DAX® closed above 20,000 on December 3 for the first time in the German benchmark’s 36-year history, as its constituents’ overseas sales of everything from AI software to industrial parts helped offset economic stagnation at home.

The blue-chip index has gained 19% in 20241, with its 40 companies adding EUR 214 billion in market value. While Germany’s economy may post little to no growth in 2024 for a second straight year,2 DAX companies are smashing earnings estimates.

Figure 1: DAX evolution in 2024

Source: STOXX. Based on uncapped stock values.

DAX’s performance this year surpasses the 10.7% return, including dividends, for both the STOXX® Europe 600 and EURO STOXX 50®. The German benchmark has also beaten the 9.3% advance for the EURO STOXX® index.

Stock drivers

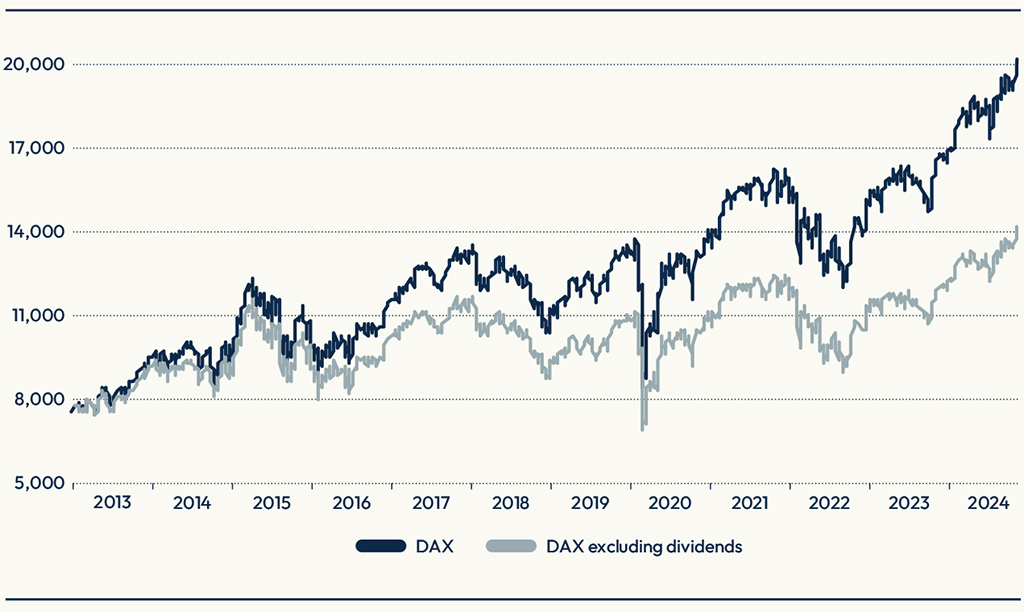

SAP SE, Europe’s largest software maker and now the DAX’s largest constituent, has been the biggest contributor to index gains this year, according to Axioma data. Just over 40% of gains in the index were driven by SAP, whose weight in the DAX is 16.2%.3 Deutsche Telekom AG and Siemens Energy AG have been, respectively, the second- and third-largest contributors to DAX returns (Figure 2).

On October 10, SAP raised its full-year revenue and profit outlook as the company benefits from demand for artificial intelligence and its cloud-computing services.4 SAP shares are up 66% in 2024.5

Deutsche Telekom, Europe’s largest telecommunications operator, last month reported earnings that beat analysts’ estimates thanks partly to strong subscriber growth in its US unit.

Siemens Energy on November 13 lifted a profitability forecast as it sells more gas turbines and power transformers.6

Figure 2: Top 15 largest contributors in DAX returns in 2024

Source: Axioma. Total portfolio returns may not equate that of the index. Period: January 2, 2024, to November 29, 2024. Daily Frequency.

This year’s rally hasn’t changed the composition at the top of the index. Figure 3 shows the five largest DAX companies at the end of 2023 and on December 2 this year.

Figure 3: DAX’s five largest constituents

Source: STOXX. Note: SAP shares were capped at 10% in December 2023 and at 15% in September 2024.

Export powerhouse

Germany’s gross domestic product fell 0.2% in the third quarter of 2024 compared with the year-earlier quarter, according to the Federal Statistical Office, when adjusted for price and calendar factors. As such, the economy has underperformed other large nations in the European Union and is significantly lagging the US.

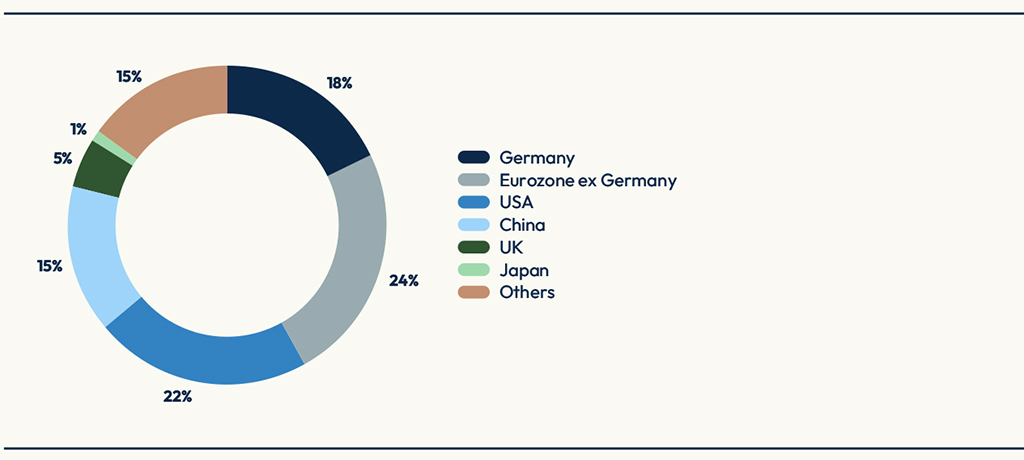

As some of the world’s biggest exporters, DAX companies are however largely dependent on overseas revenues. According to a 2023 analysis from Deutsche Bank, only 18% of DAX components’ sales are generated in Germany (Figure 4).7 Germany is the world’s third-largest exporter8, led by sales of automobiles, machinery, chemicals and electronics.

Figure 4: DAX revenue exposure

Source: Deutsche Bank Research, May 2023.

Also according to Deutsche Bank, DAX performance shows a higher correlation to global GDP growth (0.41) than to Germany’s (0.33).

The power of dividends

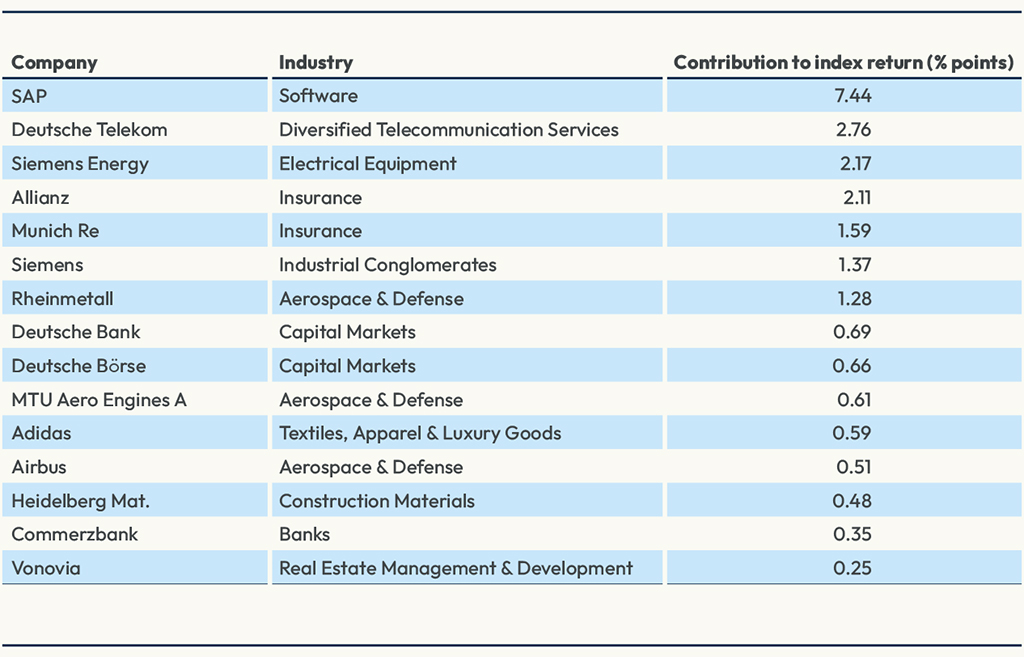

DAX is one of the few major benchmarks in the world that is principally quoted on its total-return basis, or including dividends gross of tax. The inclusion of company payments in the index calculation has boosted the compound growth of the benchmark, as shown in Figure 5. Since the start of 2013, the total-return DAX has yielded 75 percentage points more than its price-only (excluding dividends) version.

Figure 5: Performance comparison

Source: STOXX. Data through December 4, 2024.

DAX underlies a large suite of ETFs, listed derivatives and structured products, while many active funds are benchmarked against the index. Overseas investors have, in particular, been active buyers of the investment products.

A barometer for global trade

As a true representation of the German corporate landscape, DAX has become more a barometer for the strength in global trade than for the pulse of the German economy. Given this year’s performance, DAX investors have reasons to cheer for that.

1 Data through December 2, on a total-return basis.

2 Source: IMF, “World Economic Outlook,” July 2024.

3 Weight data is from December 2, 2024.

4 WSJ, “SAP Gains Over $17 Billion in Market Value After Guidance Upgrade,” October 22, 2024.

5 Data through December 2.

6 FT, “ Siemens Energy posts €1.3bn profit as turbine crisis eases,” November 13, 2024.

7 Deutsche Bank, “Made in Germany – The sore athlete of Europe,” September 2023.

8 CIA, The World Factbook data, 2023 estimates.