Global X ETFs Europe has launched the first ETF tracking an “at-the-money” (ATM) covered call strategy on the DAX® benchmark, offering low-cost and systematic exposure to a portfolio of German equities that also generates income from selling options.

The Global X DAX Covered Call UCITS ETF tracks the DAX Covered Call ATM index, designed to reflect a hypothetical strategy in which an investor buys the DAX and simultaneously sells a DAX ATM call traded at Eurex.1

The launch expands the collaboration between STOXX, which administers the DAX, and Global X ETFs Europe, a specialist in thematics, alternative income and other strategies with more than EUR 4 billion in assets under management.

A hedging strategy

Covered call strategies provide extra income to holders of the underlying asset from the proceeds of writing the option, offering an alternative risk premia from the monetization of volatility. The strategy forfeits stock gains if the price moves above the option’s strike price, resulting in underperformance in bull markets but usually outperforming in slightly up and rangebound markets. The strategies have become attractive to many investors in view of geopolitical and economic headwinds, persistent inflation and stretched valuations in some markets.

As of October 15, 2025, there was EUR 4.6 billion invested in European-based covered call ETFs.2 Global X ETFs Europe oversees around EUR 700 million in its covered call product suite.

“Covered call strategies give investors the chance to earn additional income beyond dividends and capital appreciation, which is especially valuable in today’s environment of higher rates, slower global growth and general uncertainty,” said Hasham Niazi, Regional Director for Germany and Austria at Global X ETFs Europe. “DYLD will give investors the opportunity to stay exposed to German equities while potentially generating steady income in a challenging market environment.”

Other benefits of covered call strategies may include correlation reduction, diversification, risk mitigation and regular income distributions.

Hedge against drawdowns

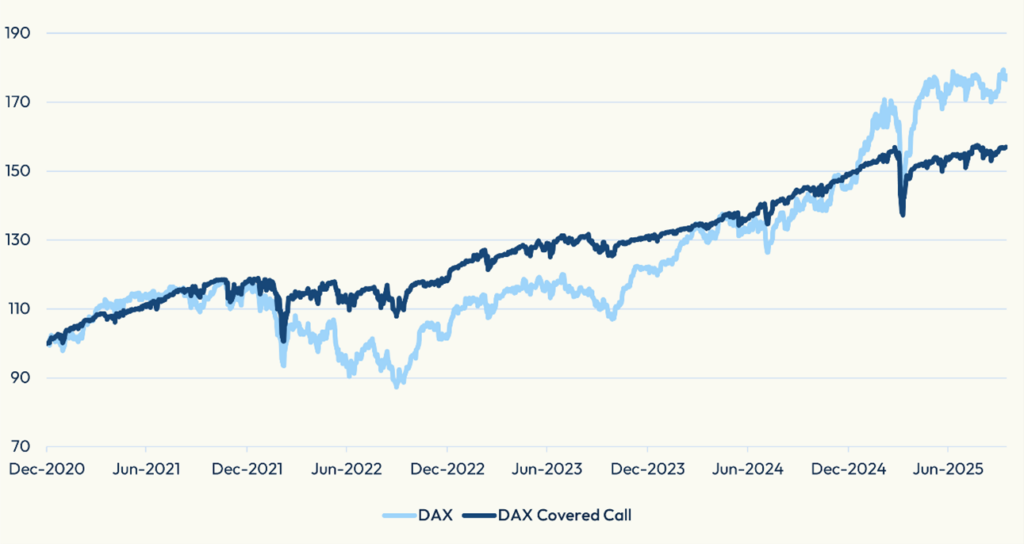

Figure 1 shows the performance of the DAX and DAX Covered Call ATM indices since the start of 2021. The latter avoided the worst of a 2022 market slump, allowing it to keep an edge over the benchmark until late 2024/early 2025, when a rallying market lifted the DAX at a faster pace.

In market rallies, the upside potential of a call seller is capped in the event that the underlying appreciates beyond the option strike price. In downturns, the covered call position is protected up to the value of the premium received. Option premiums tend to increase during volatile markets, offering a potential risk management component.

Figure 1: Indices performance

Source: STOXX. Covered call strategy is represented by the DAX Covered Call ATM index. Gross returns in EUR, normalized at 100 on December 31, 2020.

DAX gains

The ETF launch comes amid strong performance in the DAX, which has gained an annual average of 20% in the past three years.3 Reasons for the gains include loosened fiscal policy in the country, national plans to invest in infrastructure and defense, and relatively low equity valuations.

The DAX was introduced in 1988. The index underlies some of the world’s most popular listed derivatives and currently commands EUR 23 billion invested in linked ETFs.4

1 The long DAX Index component and the short call option component are held in equal notional amounts, i.e., the short position in the call option is “covered” by the long DAX Index component.

2 Source: ETFBook.

3 Total return in euros, period includes start of 2023 through September 2025.

4 Source: STOXX. Data as of November 10, 2025.