In March 2024, the single-stock weight cap in the DAX® benchmark was raised from 10% to 15%, a move devised to keep the German blue-chip index diversified and representative of the underlying economy. The change was backed by a wide range of stakeholders in a market consultation and was aligned with international practices.

For the first time since the cap increase, an index constituent surpassed the single-stock weight limit in last September’s quarterly review and may do so again in December as things stand. SAP, the software provider based in Baden-Württemberg, gained 57% in 2024 through October 24, taking its total market capitalization to nearly EUR 270 billion, Europe’s most valuable technology company[1]. The rally has lifted SAP’s stock to a weight of 15.7% in the DAX[2], exceeding the maximum cap allowed by 0.7 percentage points.

We’ve taken this opportunity to analyze the impact that selling from ETFs and other funds closely tracking the DAX may have on SAP shares, should the cap be applied again in the next quarterly review.

Passive money

According to ETFBook, there are ten ETFs listed in Europe that track the DAX. They manage total assets of just above EUR 16 billion,[3] or 1.16% of the free-float market capitalization of the DAX. An additional EUR 1.87 billion (or 0.13% of the DAX) is invested in other DAX-linked funds, such as the DAX ESG indices.

In the ten years through 2023[4], SAP shares have posted a median outperformance to the DAX ex-SAP of 1.2 percentage points in between quarterly reviews.

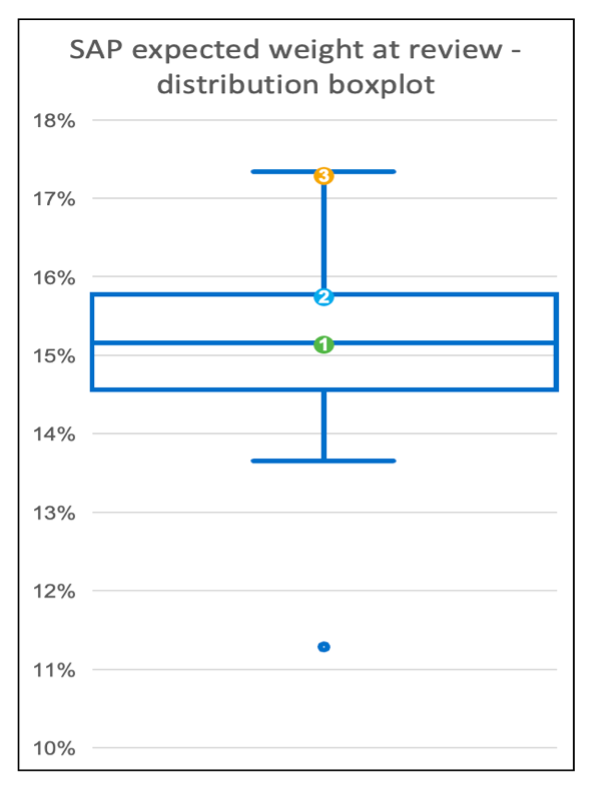

Such a return in the current quarter would take the company’s weight in the DAX by the time of the December review to 15.16% (Figure 1, green dot).

In a more bullish scenario, where SAP shares mirror the performance in the upper third quartile of their quarterly returns in the past decade, its weight in the DAX would rise to 15.78% by December (Figure 1, light blue dot).

Figure 1: Distribution boxplot

Source: STOXX

An extreme event where the stock matches its best relative performance quarter in ten years (fourth quarter of 2015) would lift SAP’s weight in the benchmark to 17.34% (Figure 1, orange dot).

Selling on capping implementation day

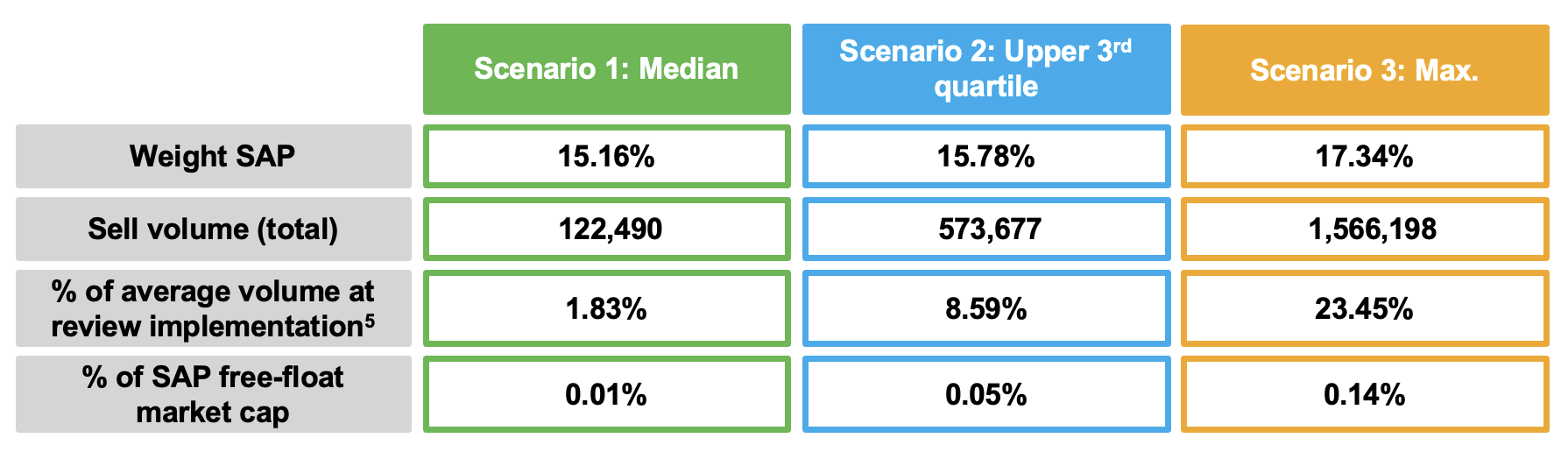

With those weights scenarios in place, we can calculate the selling volume on SAP shares from DAX ETFs and other DAX-linked funds. They are shown in Figure 2.

Figure 2: Scenario analysis of trading volume on rebalancing days

In the median scenario, the one close to an average SAP quarterly performance in recent history, the selling volume from index trackers on the day they rebalance their portfolios[5] amounts to 122,490 shares. That equates to just 1.83% of the day’s volume based on the total number of shares traded on Xetra, and 0.01% of SAP’s free-float market capitalization. In a very good quarter for SAP shares (Scenario 2), selling flows from ETFs on rebalancing day would still represent less than 9%, or 0.05% of SAP’s free float.

In the three months to the September 2024 review, SAP shares rallied 11.9%, outperforming the DAX by 10.5 percentage points. In the review that month, SAP’s weight in the DAX was capped from 15.4% to 15.2%[6], leading passive DAX trackers to sell around 160,000 shares on review implementation day (September 20, 2024), or 5.5% of the company’s traded volume, assuming 1.16% of the DAX’s free float is with DAX trackers.

Active funds

While a lot of public focus is put on the buying and selling from ETFs, active funds benchmarked to the DAX and DAX variants may have a stronger pull on individual shares. Active funds benchmarked against those benchmarks represent about 1.94% of the total free-float market capitalization of the DAX, almost 80 basis points more than do ETFs in the DAX.

Moreover, active funds have lower thresholds for maximum single-stock weights, a result of UCITS regulation that puts the cap at 10%. In practice, the funds invest less than that in single stocks to maintain a buffer. According to STOXX estimates, selling from these funds account for a total of 0.11% of SAP shares’ dealing on Xetra in a median-performance quarter.

About weight caps

DAX weight caps are implemented at each quarterly review. They were designed to avoid a single component dominating an index, and therefore improve the index’s volatility profile.

Europe’s UCITS regulation allows for no more than 10% of a fund to be invested in securities issued by one company. That threshold is upped to 20% for index-tracking UCITS funds.

A STOXX analysis of the cap limit in light of the UCITS regulation concluded that the 15% cap most appropriately allows passive investors to comply with the regulation. To continue to provide active investors with benchmarks that are aligned with the active 10% UCITS limit, STOXX this year introduced the DAX UCITS Capped index series.

For more on the automatic capping process, please see Section 5.10 of the DAX Equity Index Methodology Guide.

Conclusion

A 15% capping rule has very limited impact on trading flows, representing only a small fraction of the regular trading volume around DAX rebalancing days, even in the case of very strong quarters for a dominant stock. With respect to the free-float market capitalization of stocks, quarterly capping events appear insignificant.

A larger impact, actually, comes from European regulation that limits UCITS-based active funds from investing more than 10% in a single company, irrespective of the weights in their benchmarks.

Moreover, much of the selling from tracker funds is usually snapped up by other market participants that follow fundamental factors such as stock valuations.

As backed by recent market consultations, single-stock caps serve broader functions in indices, including stability and diversification. They are also implemented in the spirit of current market regulation, as is the case with UCITS.

[1] Data as of October 24, 2024. Universe is all constituents in the STOXX® Europe 600 Technology index.

[2] Data as of close of trading on October 24, 2024.

[3] Data as of October 23, 2024.

[4] Analysis was done between June 2013 and December 2023.

[5] Review implementation day is the third Friday of the review month.

[6] A company may not be capped to exactly 15% at review implementation, as the prices used in the capping process are fixed on the Thursday one week earlier.