As investors focus on when Bitcoin reaches the headline-grabbing USD 100,000-mark, the post US-election rally has been widespread in the crypto world.

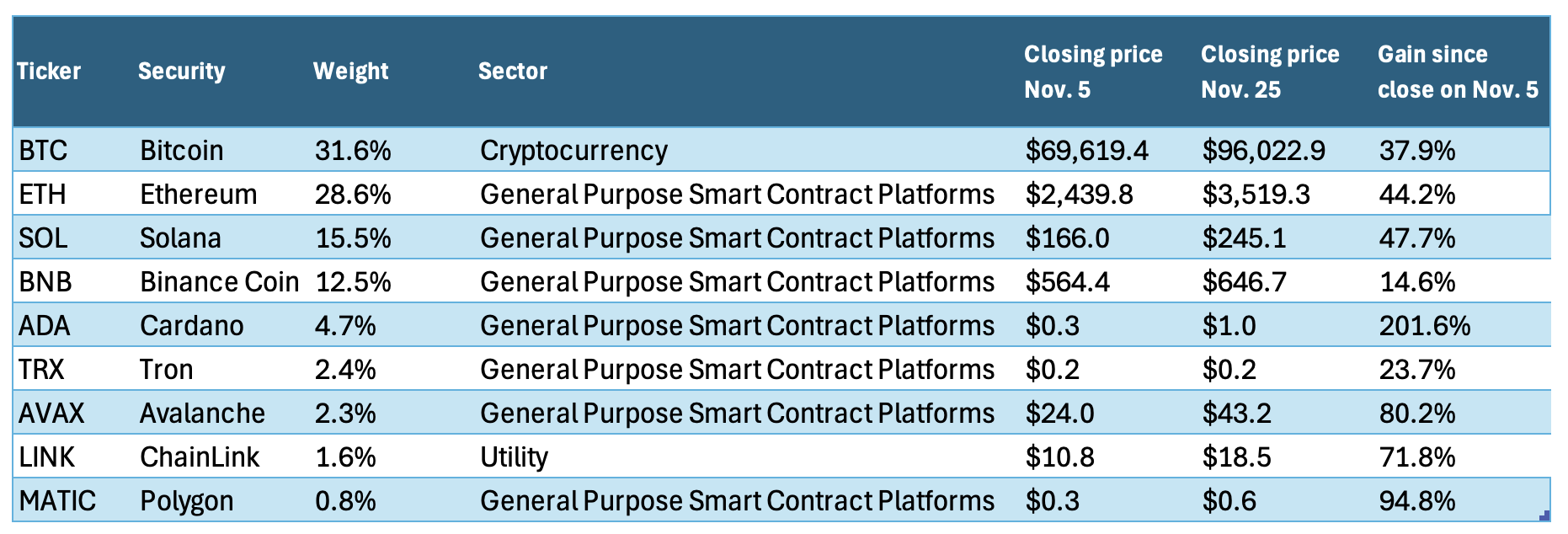

The STOXX® Digital Asset Blue Chip index has gained 42% since November 5[1], when Donald Trump clinched a second term as US president. While Bitcoin has advanced 35% to USD 91,431 over the period, other index constituents including Ethereum and Solana have outperformed (Figure 1).

Figure 1: STOXX Digital Asset Blue Chip – Holdings and returns

‘Anti-crypto crusade’

Investors and traders have snapped up digital assets on expectations that a second Trump presidency heralds an era of lighter regulation in the sector, as well as speculation that the new government may scrap a capital gains tax on cryptocurrencies issued by American companies.[2]

During his campaign, Trump promised to make the US the “crypto capital of the planet” and to have the federal government hold on to its Bitcoin holdings.[3] Speaking at an industry event in July, he promised to dismantle the “anti-crypto crusade” of President Joe Biden and Vice President Kamala Harris.[4]

Securities and Exchange Commission Chair Gary Gensler, under whose tenure the US markets watchdog led an enforcement campaign against crypto companies, is leaving his post upon Trump’s appointment.[5]

A benchmark for digital assets

The STOXX Digital Asset Blue Chip index aims to track high-quality assets that represent the crypto universe today. A blue-chip focus means the new index does not just select the largest crypto assets by market capitalization, as is customary with other indices, but instead considers crypto-native metrics including the scope of adoption, the size of the developer community, the fees paid by users and the age of the protocol.

The index serves as an important tool for investors and the broader market to understand, measure and participate in the evolving crypto landscape. An index contributes to the development of a more mature and transparent market.

The list of eligible digital assets for the STOXX Digital Asset Blue Chip index is derived from all assets classified under the Bitcoin Suisse Index Reference Classification List (xRCL).

Bitcoin Suisse implements thorough exchange vetting, which includes due diligence, exchange scoring, comparing trading volumes and time-decay analysis. These measures are employed to select two principal exchanges for each asset at any given time.[6] Averaging the most recent traded asset prices across these two sources ensures the most reliable, up-to-date and representative price.

Market expects further gains

As for Bitcoin, the market is expecting the world’s largest cryptocurrency to surpass USD 100,000 very soon, according to Kalshi.[7] Odds on the prediction platform show an 85% chance that Bitcoin will reach that price milestone this year, while the median forecast calls for a level of USD 125,000 by the new year.

STOXX® Bitcoin is a single-token index that tracks the cryptocurrency. The index has climbed 125% in 2024, and touched a record high on November 22.

Figure 2: STOXX Bitcoin index

[1] USD price returns, data through November 25.

[2] TheStreet, “Trump’s Bold Move Could Make Crypto Gains Tax-Free: The 3 U.S. Tokens Set to Skyrocket,” November 18, 2024.

[3] CNBC, “Trump proposes strategic national crypto stockpile: ‘Never sell your bitcoin’,” July 27, 2024.

[4] CNBC, “Trump proposes strategic national crypto stockpile: ‘Never sell your bitcoin’,” July 27, 2024.

[5] WSJ, “Gensler Says He Won’t Leave SEC Until Trump Takes Office,” November 25, 2024.

[6] Assets must have an active market on a minimum of two exchanges.

[7] Cointelegraph, “Bitcoin ‘wild’ odds see 85% chance of BTC price above $100K by New Year,” November 23, 2024.