An improving economic and market backdrop has lifted the price of copper this year, boosting expectations for higher profits in the mining industry.

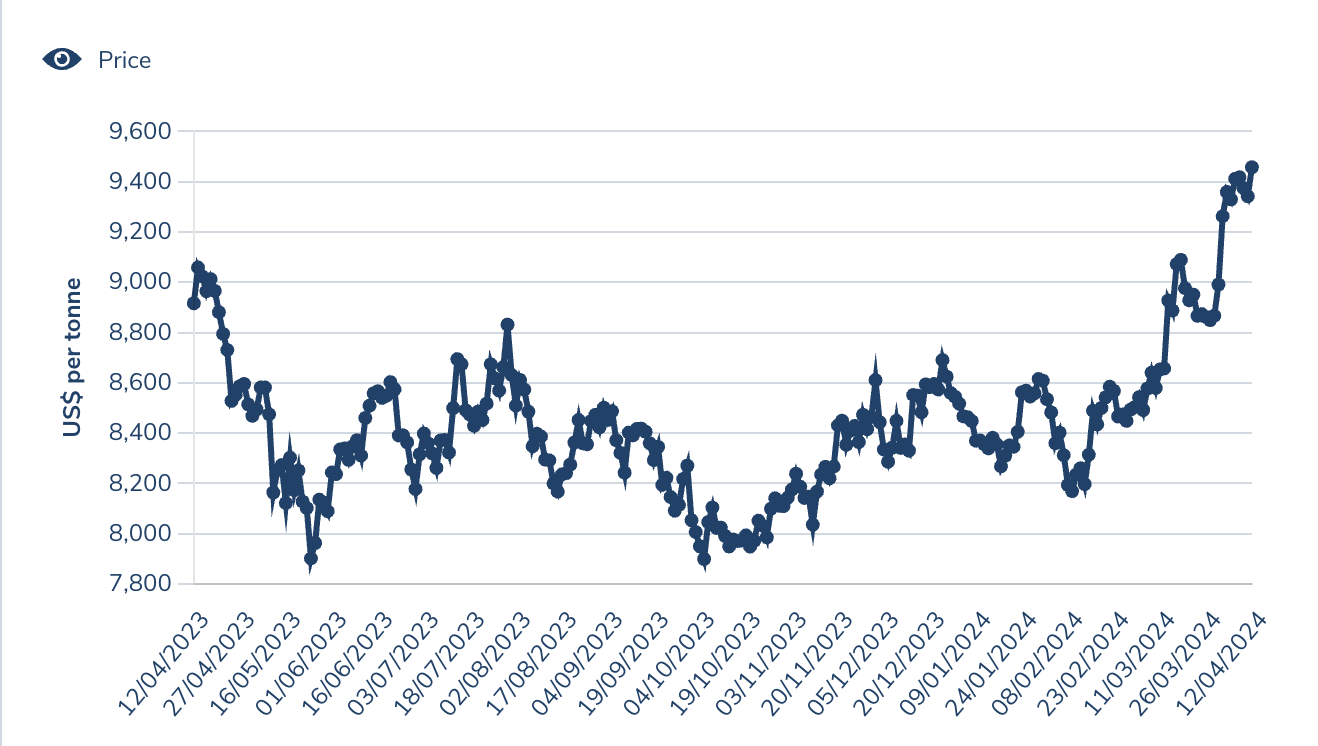

Benchmark three-month copper prices on the London Metal Exchange have risen 10.5% in 2024 to the highest since June 2022, and are up nearly 20% since a low in October last year.[1] Several drivers have this year led to forecasts for tighter supply and increased demand — from mining shortages, to stronger Chinese consumption and reduced output, faster-than-expected US inflation and a new embargo on exchange trading of Russian copper.

Figure 1: Copper price in London

More broadly, the copper market has reacted to increasing expectations that the global economy has avoided a “hard landing” recession, bolstering the outlook for a commodity that’s key in factories, energy, data centers and in the rollout of electric vehicles. Analysts predict the red metal has entered a “secular bull market” that may lift its price to a record, from USD 9,402/ton on April 12.[2]

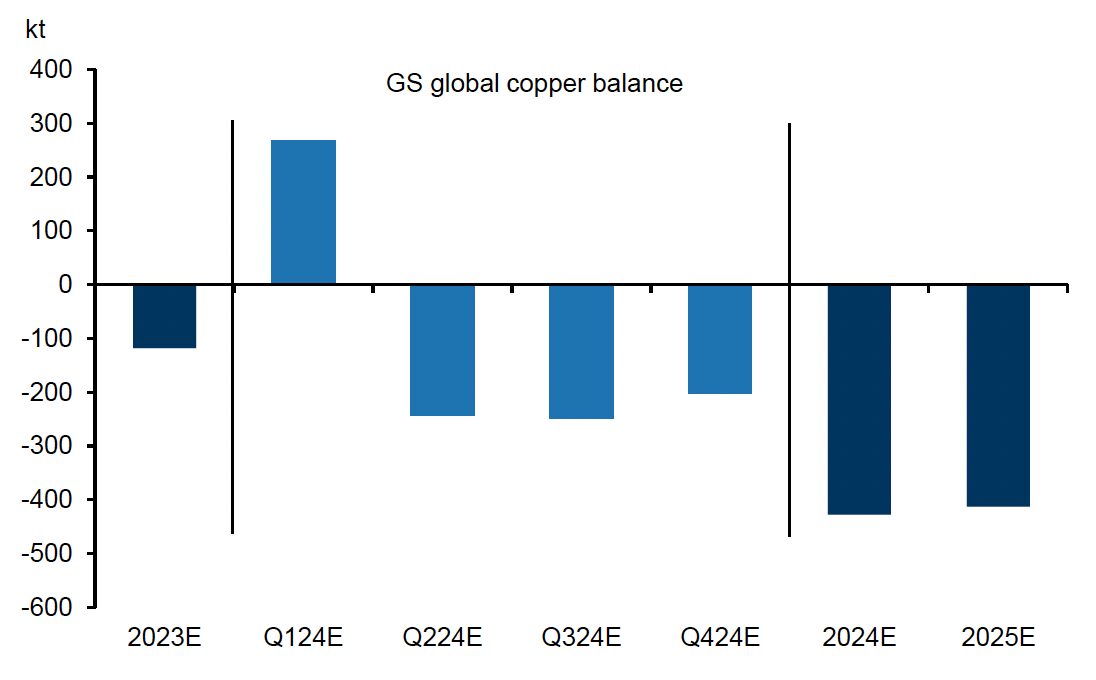

“The strong performance of the industrial metals complex over the year so far is a trend we expect to gather momentum ahead,” Goldman Sachs analysts Nicholas Snowdon and Lavinia Forcellese wrote in a research note on April 15.[3] “This view particularly resonates with copper and aluminium, given the unprecedented fundamental shortfalls facing both metals over the next three years.”

“While the apparent troughing in the global industrial cycle presents a broadly supportive demand factor, it is only for copper and aluminium that fundamentals present a structural extension in bull market, tied to a combination of high green transition demand leverage, underinvested predominantly long-cycle supply dynamics, and already extremely low inventory cover,” the analysts added.

Goldman Sachs expects copper prices to reach USD 12,000/ton in 12 months, underpinned by “a significant deficit phase from Q2 onwards until year-end.”

Figure 2: Quarterly and yearly copper balance (Goldman Sachs)

Stock rally

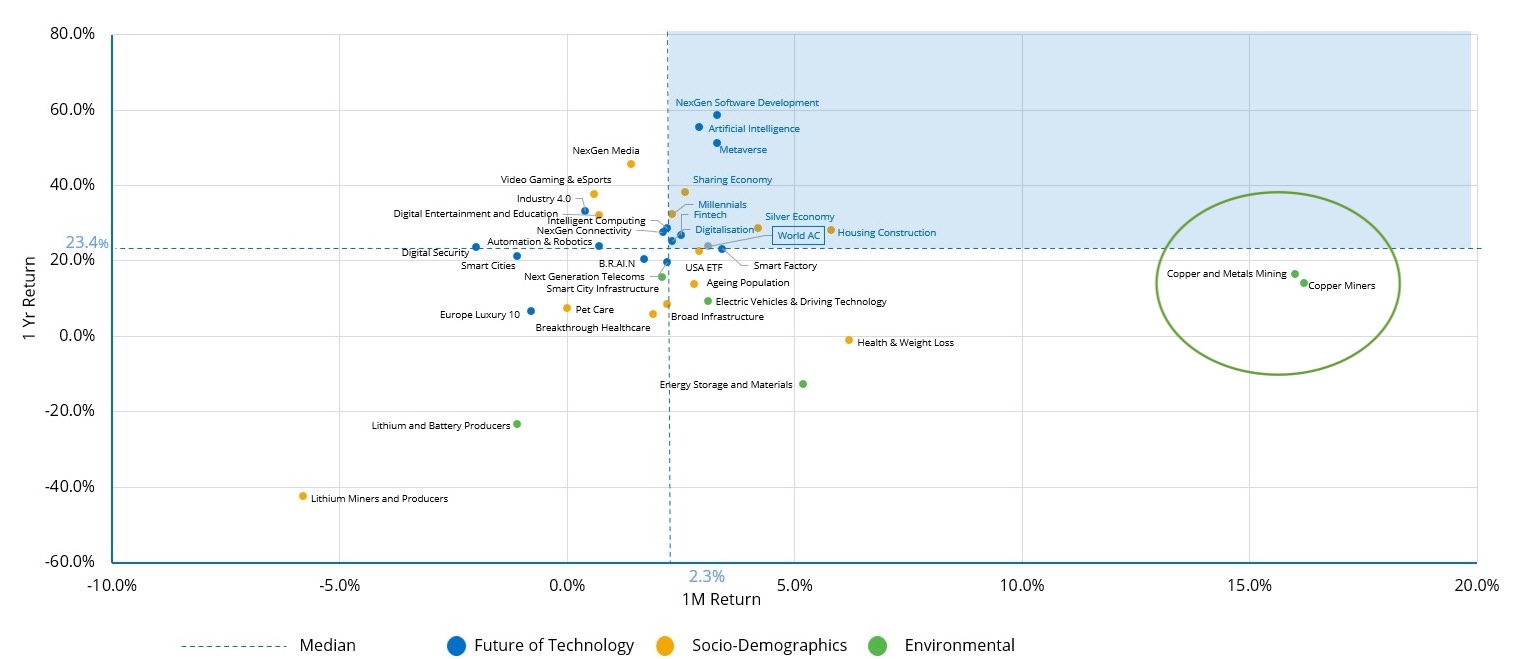

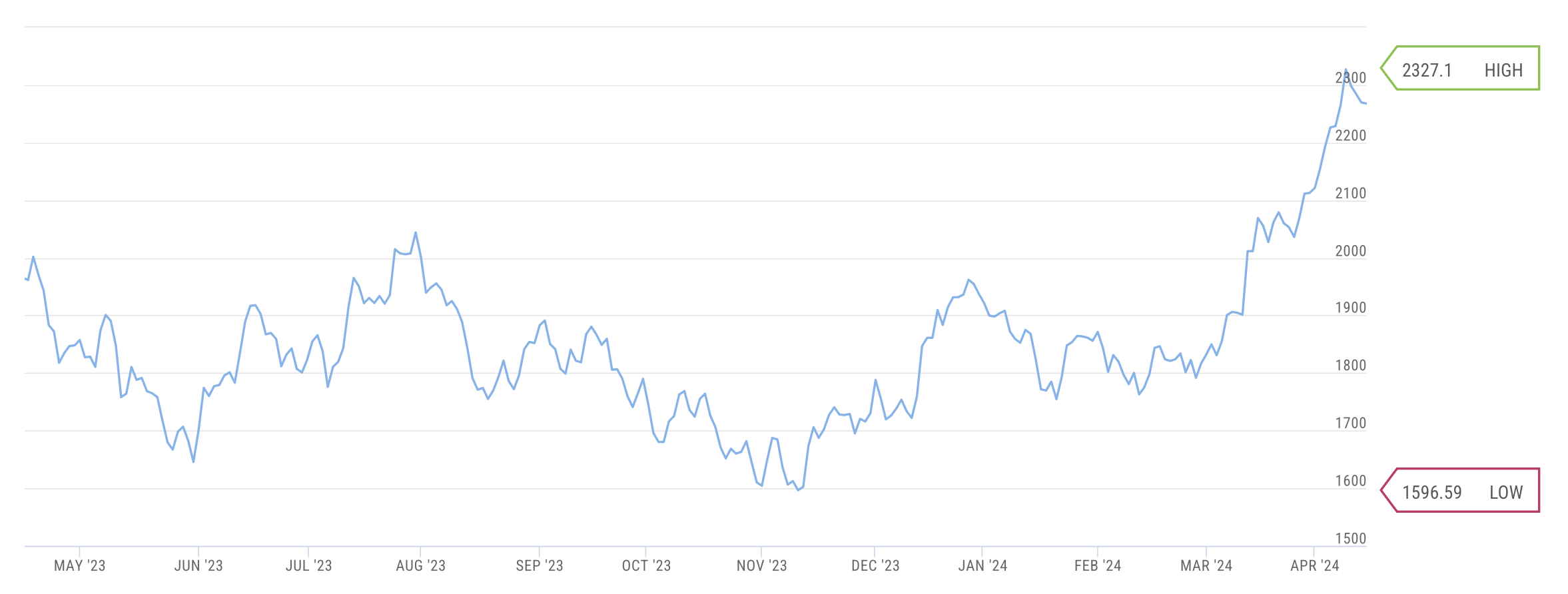

Investors have responded to rising metal prices by snapping up the shares of copper miners. The STOXX® Global Copper Miners index rose 16.3% in March,[4] its strongest monthly showing in three years and the highest return among 35 STOXX Thematic indices (Figure 3). In the past year, the gauge has gained 14%.

Figure 3: 1-year and 1-month performance of STOXX Thematic indices

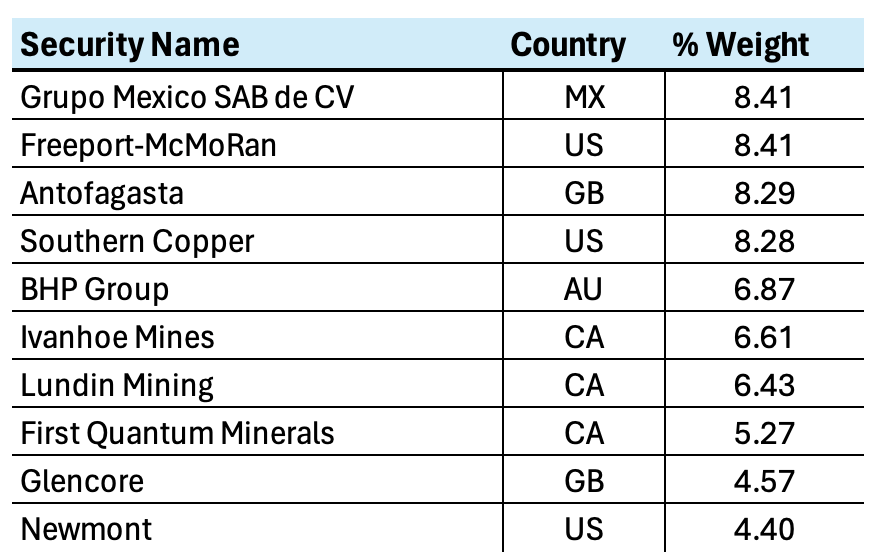

The STOXX Global Copper Miners index was introduced last year and tracks companies with the highest revenues from, and largest market share in, mining the metal.

The index underlies the iShares Copper Miners UCITS ETF from BlackRock, launched in EMEA last year, which led gains among all copper equities ETFs in the month through April 10 according to Trackinsight data.[5]

Figure 4: STOXX Global Copper Miners index 1-year return

In an interview in January this year, Omar Moufti, Thematics and Sectors Product Specialist for iShares EMEA, said the mining segment may face long-term supply shortages after multiple years of underinvestment. Besides this industry backdrop, Omar explained, there are fundamental drivers for so-called essential metals such as copper, particularly linked to the transition to a low-carbon economy and the related need for electrification.

“There are important constraints that have led or could lead to a large supply-demand gap” in copper and lithium, Omar said at the time. “If the forecasted demand for the metal increases, the limited potential for supply to follow suit paints a constructive backdrop for metal prices, and thus miners.”

BlackRock has also launched in EMEA the iShares Lithium & Battery Producers UCITS ETF, tracking the STOXX® Global Lithium Miners and Battery Producers index.

The STOXX copper and lithium indices offer focused strategies within the broader metals and mining industry segment. Still, they remain diversified: over 30 companies in the case of the copper index. They allow investors to tap growing demand for metals and the rising profitability of miners, presenting an alternative to buying the underlying commodities or their derivatives.

Figure 5: STOXX Global Copper Miners index – Top 10 holdings

Economic upside

Copper is proving its status as a proxy for global growth. China’s manufacturing activity expanded at the fastest pace in 13 months in March, while that in the US grew last month for the first time in 1-1/2 years.

According to Goldman Sachs, copper prices have historically risen 25% on average in the 12 months after a trough in global manufacturing indicators.

Given the outlook for undersupply in the market, the prospect for lower interest rates and signs of a resurgent Chinese economy, the strong performance of copper this year may be more than justified. For investors, targeting the shares of specialized miners may be an efficient way to capture the upside of a world hungry for essential metals.

[1] Data through April 12, 2024.

[2] “Bulls jump deeper into copper amid supply challenges, AI-fueled demand,” Reuters, April 15, 2024.

[3] Goldman Sachs Commodities Research, “Metals Comment: Assessing the LME Russian ban impact,” April 15, 2024.

[4] Gross returns in USD.

[5] Source: ETF Stream, “Copper shortage leads surge in mining ETFs.”