Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

New product launches

Most Recent New product launches

Index | Listed Derivatives

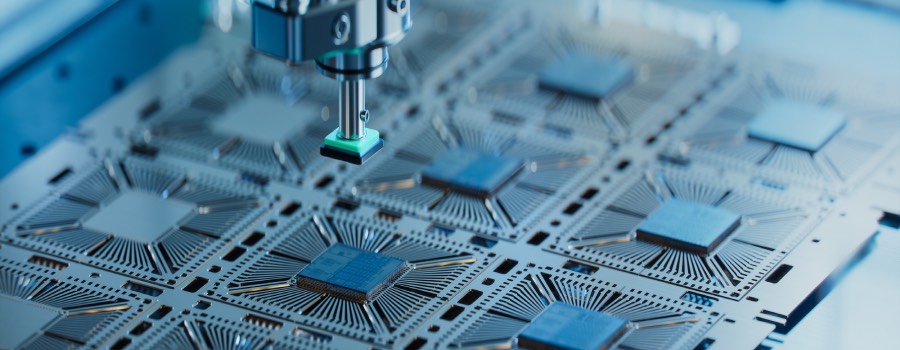

Q&A: New Eurex futures on STOXX Semiconductor 30 index as investment vehicle into dynamic sector

Eurex’s Mezhgan Qabool explains how demand to invest in chipmakers drove the launch of the STOXX Semiconductor 30 index futures in March, and what the new product offers for portfolios.

Weekly expirations allow market participants to finetune hedging and accurately implement strategies around specific events such as economic data releases. The new options further expand a comprehensive derivatives ecosystem around the STOXX Europe 600.

The investment product has been listed on the Frankfurt Stock Exchange. The underlying index follows a best-in-sector selection methodology and has a unique blue-chip focus that selects assets based on specific crypto-market criteria for quality.

Index | New product launches

STOXX licences first crypto Blue Chip Index, co-developed with Bitcoin Suisse, to Valour Inc.

STOXX Ltd., part of the ISS STOXX GmbH group of companies and a leading provider of benchmark and custom index solutions to global institutional investors, has licensed the STOXX Digital Asset Blue Chip Index to Valour Inc. The index, which marks STOXX’s entry into the digital asset space, will serve as an underlying for an exchange traded product (ETP) listed on Xetra, a leading trading venue for ETFs & ETPs in Europe. The index was developed in partnership with crypto-financial services provider Bitcoin Suisse.

The products offer market participants liquid exposure to an industry whose sales are booming on demand from artificial intelligence, mobile gadgets and electronic vehicles.

The DAX 30 ESG index is the latest introduction to a family of German ESG benchmarks. It tracks the country’s large-caps with the highest ESG scores determined by ISS ESG.

Index | ESG & Sustainability

Expert view: Unpacking the new Xtrackers biodiversity ETFs and their ISS STOXX indices

As DWS launched the Xtrackers Biodiversity Focus SRI UCITS ETFs, we sat down with experts from Xtrackers, ISS ESG and STOXX to explore what’s driving investor interest in biodiversity strategies and how they can comprehensively integrate natural-world data and considerations into portfolios.

Index | Listed Derivatives

Eurex introduces options on EURO STOXX 50 index dividend futures, expanding popular derivatives offering

Mid-curve options on dividend futures give market participants a more targeted instrument, with quarterly expirations, to gain exposure on the direction of European dividend payments.

Index | ESG & Sustainability

Q&A with BlackRock’s Moufti: Capturing the upside from essential metals miners

Omar Moufti, Thematics and Sectors Product strategist at BlackRock, says the transition to a low-carbon economy is just one of the forces propelling the copper and lithium industries, and explains why investing in the miners’ stocks may be an attractive long-term proposition for investors.

Index | Listed Derivatives

New STOXX Europe 600 SRI futures on Eurex broaden sustainable derivatives offering for investors

Eurex will launch futures on the STOXX Europe 600 SRI (Socially Responsible Investing), an index with extended exclusions as well as emissions and best-in-class ESG filters. The offering follows the successful adoption of similar contracts on the STOXX EUROPE 600 ESG-X, launched in 2019.

Daily expirations allow market participants to finetune hedging and accurately implement strategies around specific events such as economic data releases. More than 670,000 EURO STOXX 50 daily options have traded since their August listing.

Index | ESG & Sustainability

DWS launches biodiversity-focused Xtrackers ETFs integrating comprehensive ISS STOXX impact framework

The ETFs allow investors to consider the risks and opportunities presented by rising biodiversity-related liabilities. The core strategies are based on a multi-step framework designed by ISS ESG and STOXX, which not only applies screens to exclude companies that negatively impact biodiversity but also provides increased exposure to those more aligned with the preservation of the world’s natural capital.