Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

New product launches

Most Recent New product launches

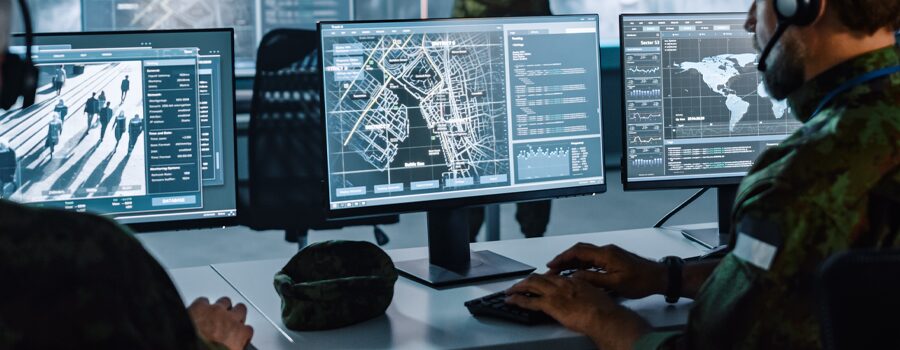

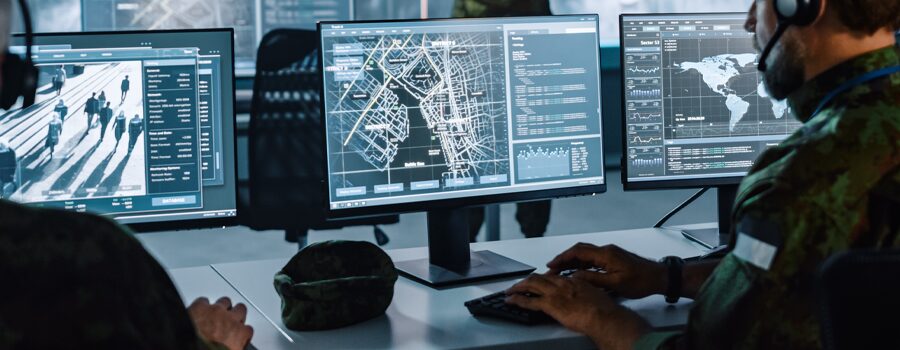

STOXX Ltd., part of the ISS STOXX group of companies, today announced its expanding collaboration with DWS, with DWS’ launch of its Xtrackers Europe Defence Technologies UCITS ETF tracking the STOXX® Europe Total Market Defence Space and Cybersecurity Innovation index, as the continent undertakes a historic upgrade of its military capabilities.

Index | New product launches

New ETF from Xtrackers by DWS tracks STOXX Europe Total Market Defence Space and Cybersecurity Innovation index

The underlying index combines revenues- and patent-based stock selection methodologies, capturing companies across the spectrum and life cycle of the targeted themes.

Index | New index launches

Xtrackers by DWS ETF switches to new STOXX Europe Total Market Leaders index

The asset manager has updated the objective of an existing ETF to track an index focused on European companies with significant share in their respective market segments, competitive business advantage and superior profitability.

Factor Investing

STOXX and L&G collaborate on launch of three L&G developed world factor-based index funds

STOXX Ltd. today announced its expanding collaboration with L&G, with L&G’s launch of three developed world factor-based index funds tracking customized iSTOXX indices.

Ladi Williams, Head of Thematics and Alternative Strategies at STOXX, explains in an article on ETF Stream how we have catered to the specific needs and objectives of ETF managers in devising a series of indices targeting the defense sector.

Index | Thematic Investing

Q&A with BlackRock’s Moufti: AI as driver for ‘picks and shovels’ and copper

The world is in immediate need of vast amounts of data centers, chips and energy. Omar Moufti, Thematics & Sectors Product Strategist at BlackRock’s iShares, explains how to harness the upside from the infrastructure supporting the AI revolution.

The TRFs were listed in September last year, expanding the pan-European benchmark’s trading ecosystem. TRFs have seen strong demand from market participants as a hedge against the long-term financing and dividend risks of equity positions.

Index / ETFs

Sparinvest and STOXX collaborate on Sparinvest’s launch of fund tracking iSTOXX Enhanced Defense index

Sparinvest and STOXX Ltd. today announced Sparinvest’s launch of an Exchange Traded Mutual Fund (the Fund) tracking the newly developed iSTOXX Europe Total Market Defense Enhanced Index.

The new iShares fund offers precise exposure to European companies expected to benefit from the region’s historic ramp-up in military investments. The launch marks another collaboration in thematic ETFs between BlackRock and STOXX.

Index / ETFs

BlackRock and STOXX collaborate to launch BlackRock’s European Defence ETF for European investors

STOXX Ltd. today announced its expanding collaboration with BlackRock, with BlackRock’s launch of the iShares Europe Defence UCITS ETF (DFEU), which tracks the STOXX® Europe Targeted Defence index.

Index | Thematic Investing

Amundi ETF, Eurex launch products tracking STOXX Europe Total Market Defense Capped index

The index selects European companies from ICB’s Aerospace and Defense Sector that have revenues from specific defense activities, seeking a focused strategy on the military re-equipment theme.

Index / ETFs

Triodos Investment Management and STOXX collaborate to launch iSTOXX Triodos Developed Markets Impact Index

Triodos Investment Management (Triodos IM) and STOXX Ltd., part of the ISS STOXX group of companies, today announced the launch of the iSTOXX Triodos Developed Markets Impact Index.