‘Buffer’ or ‘defined outcome’ ETFs may not be familiar names for investors, but they are based on a well-known risk-management practice and are attracting significant inflows.

A buffer ETF provides a targeted level of protection against market sell-offs over a specific outcome period, along with participation in market gains up to a cap. According to Morningstar, there were USD 50 billion invested in buffer ETFs at the end of 2024.

The strategy involves holding an asset such as stocks, writing a call option on that asset — generating a premium but capping the underlying’s potential appreciation — and using the proceed to fund portfolio protection through a put option.[1] Historically, such structures were implemented directly or synthetically by sophisticated investors. Today, they can also be set up as systematic, index-based methodologies, thanks to advances in index construction.

A new whitepaper[2] from Ying-Lin Chen, Vice President of Index Product Innovation at STOXX, offers an in-depth analysis of buffer strategies and their simulated performance in Europe — particularly in comparison to alternatives such as a protective put, put spread, low-risk (or low-volatility) equity indices or the traditional 60/40 stock-bond allocation.

Performance

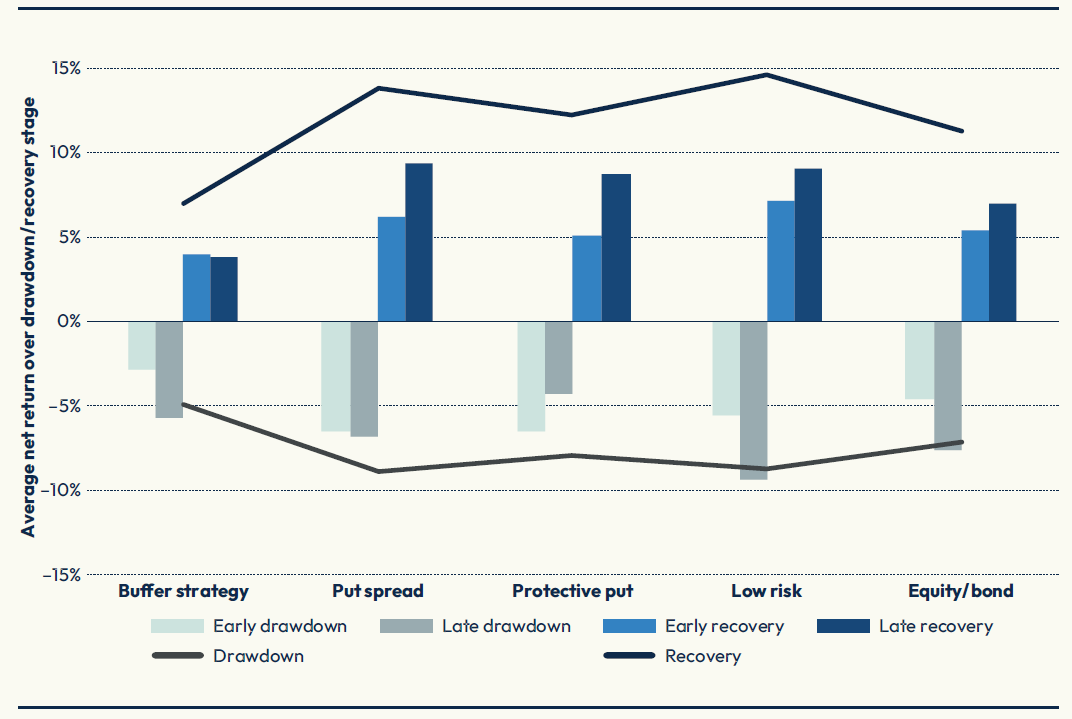

These protective alternatives each come with their own benefits, drawbacks and trade-offs. As Ying-Lin notes, their effectiveness can vary depending on the type of market drawdown and the strength and duration of the subsequent rebound.

To explore the environments in which buffer strategies might outperform, the author first identified the market sell-offs and recoveries in the period from June 17, 2016, to April 16, 2025. In total, she identified 19 drawdowns followed by 18 recoveries. Seven downturns evolved into late-stage drawdowns, while more than half of the rebounds developed into late-stage recoveries — resulting in four distinct market stages.[3]

Figure 1, from the whitepaper, shows the net return of five protective strategies over those market stages. The buffer strategy consists of the EURO STOXX 50®, the Eurozone’s equities benchmark, as underlying asset, plus a bear put spread and a call. The strategy is built to protect against a 15% loss after the first 5% drop, over a quarterly outcome[4]. Details about each portfolio can be found in the study.

As can be seen, the buffer strategy offered the most effective overall downside protection (black line) in simulated data, especially during early-stage drawdowns, but resulted in underperformance during recoveries.

Figure 1: Downside protection and recovery by strategy

Buffer ETFs, however, have a practical advantage over put strategies due to their wrapper nature. The single-fund structure offers a one-ticker solution accessible to most investors, avoiding complex derivatives trades.[5]

Tactical buffer trades

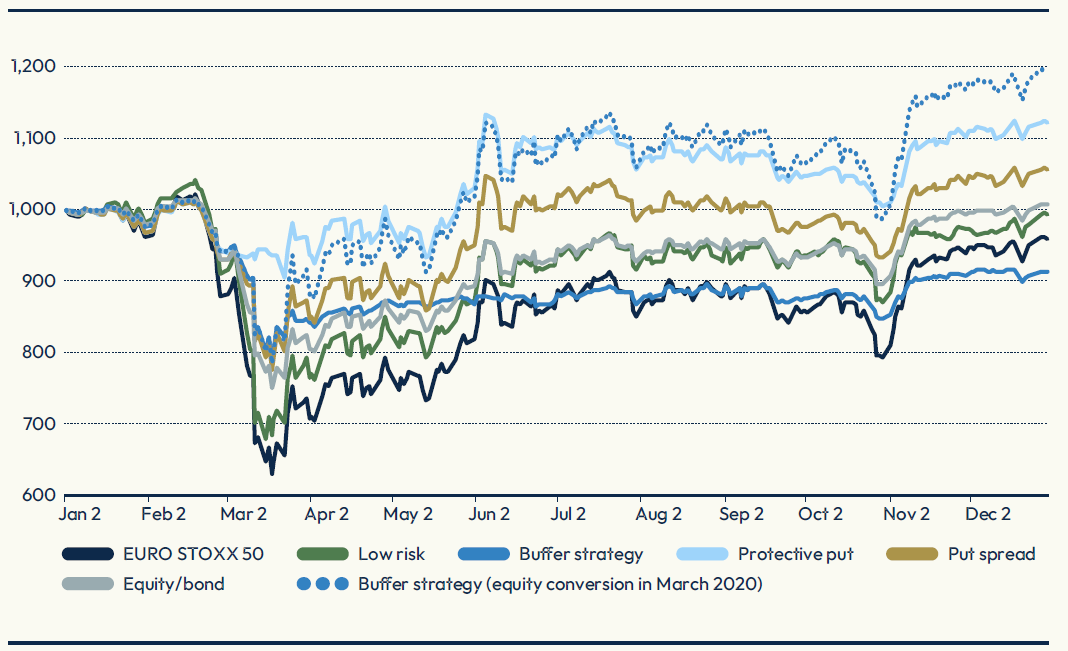

The strong performance of buffer strategies during the early stages of a downturn naturally raises a question: what if an investor used the strategy to manage a specific, expected drawdown, then switched to equities to capture the market recovery?

Such a move paid off during the 2020 COVID-19 sell-off, Ying-Lin writes. The market trough in March 2020 roughly coincided with the end of the outcome horizon. A switch to the underlying equities index at that point would have boosted returns, benefiting from the market rebound over the final three quarters of the year (Figure 2). Keeping the buffer strategy through year-end would have been the worst alternative of all five, the chart shows.

Figure 2: Simulated total return performance in 2020

Ying-Lin also looked at the market performance in 2022, a year in which the EURO STOXX 50 index fell 9.5%[6]. The buffer strategy analyzed performed the best among all defensive strategies that year, as a protracted drawdown had only subdued interim recoveries.

Long-term perspective

Due to the market’s long-term upward trend, buffer strategies underperformed both put spread and protective put strategies over longer periods, even if the latter had higher upfront costs. This suggests buffer strategies might not strike the optimal balance between cost and upside potential, Ying-Lin argues.

“For those who believe that consistent discipline is the key to successful long-term investing, strategically implementing buffer strategies may yield benefits by reducing panic selling during volatile periods and allowing investors to stay invested to capture any eventual gains, even if partial,” Ying-Lin writes. “However, as shown previously, buffer strategies can underperform the market during strong market rallies. In this context, it is important to understand their long-term implications.”

“What is often overlooked in the discussions is perhaps the most difficult thing of all to measure: the strongest appeal of buffer strategies may be investors’ perceived sense of certainty, especially in uncertain times,” the author adds. “Whether or not it justifies the upside potential that investors forgo in the long term, is a trade-off that investors should make consciously, as with any other investment decision.”

We invite you to download the whitepaper and explore in more detail the findings around buffer ETFs.

[1] Unlike structured products, buffer ETFs do not have product maturities but are instead structured in such a way that the outcome conditions are reset for the predetermined horizon.

[2] STOXX, ‘Buffer strategies for downside protection? A short-term and long-term perspective,’ Chen, Y., July 2025.

[3] The study distinguishes between an early and late stage for each drawdown (or recovery) by assigning a cutoff threshold for the date on which the cumulative return exceeded –10% or 10% for the first time. If the cumulative return of the drawdown/recovery is less than –10%/10%, the entire period is considered to be early stage. It is therefore possible for an entire drawdown or recovery to be considered only as an early stage and not to evolve into a late stage.

[4] There is no STOXX buffer index currently available. The strategy has been simulated for the whitepaper.

[5] Where the strategy is implemented as an index, portfolio rebalancing follows a predetermined schedule that falls on the quarterly expiration Fridays so as to target the outcome profile. The expiring options are rolled into the new ones on each rebalancing day, at which point the outcome conditions are also reset and a new outcome period starts.

[6] Net return in euros.