In June 2022, BlackRock and STOXX teamed up as the asset manager enhanced its global suite of multifactor ETFs with a balanced and modern style factor approach.

That collaboration has now expanded to ten iShares ETFs listed in the US, Australia and Europe. The funds have amassed a combined USD 8 billion in assets to date.[1]

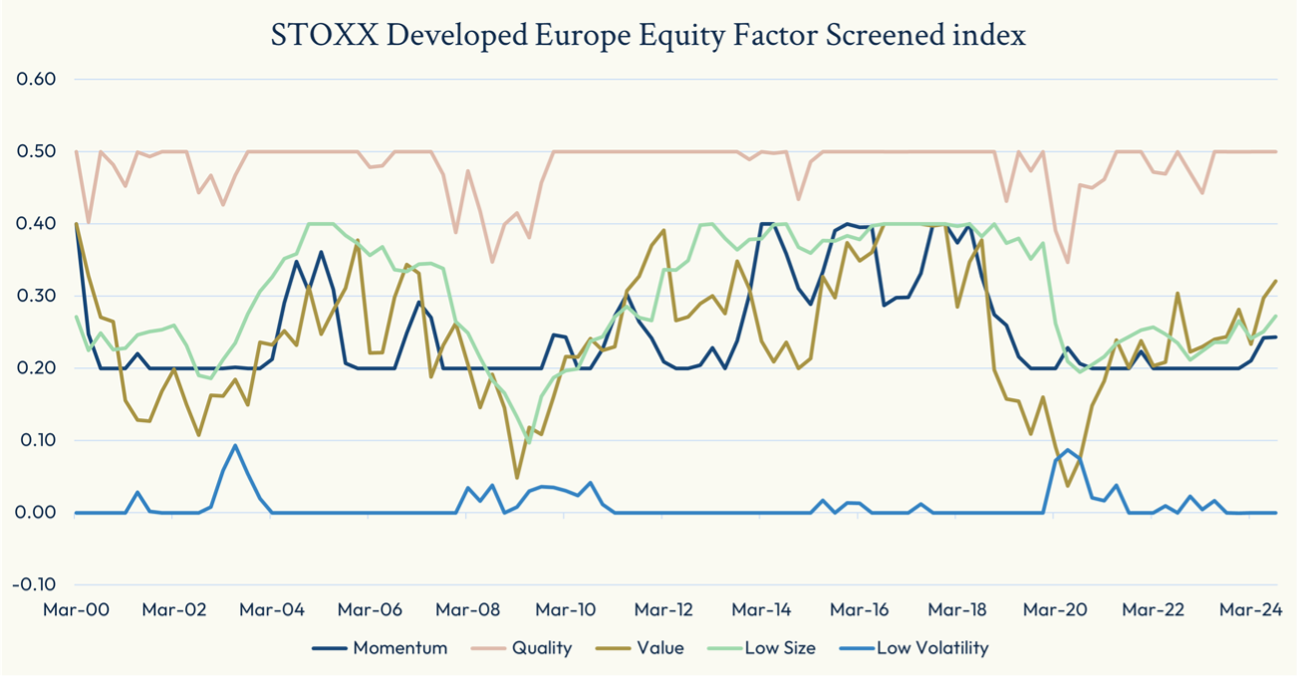

The STOXX Equity Factor indices were designed as core equity solutions that deliver above-average exposure to five factors, while being mindful of diversification considerations, unintended stock-specific risks and tracking error. The multifactor alpha signal is created by combining the following factors and weights: 36% Quality, 27% Momentum, 27% Value, 5% Low Volatility and 5% Low (Small) Size.

The STOXX Equity Factor Screened indices additionally incorporate exclusions and ensure the greenhouse gas (GHG) intensity is less than that of the parent index.

A 2024 article called “How Do Low Tracking Error, Multifactor ETFs Fit into the Factor Investment Landscape?” published in The Journal of Beta Investment Strategies discussed the indices and their optimized strategy with low levels of active risk in more detail.

We recently caught up with Jamie Forbes, Director for EMEA Equity Factor Product Strategy at BlackRock, who gave us an insightful overview of factor investing these days, as well as a description of the methodology behind the ETFs. Below is our exchange.

Jamie, what’s the background and origin of factor investing?

“Factor investing started by looking at alternative ways of capturing the market exposure, be it weighting companies based on their fundamentals or looking to achieve a portfolio that would optimize risk-adjusted returns. As those approaches became more widely used, there was a growing recognition that investors were indirectly incorporating factor exposures, and that, therefore, they could have more control over the outcomes of portfolios by more directly targeting those factors. For example, an equal-weighted portfolio is a roundabout way of getting a small-cap bias. We think that the explicit targeting of factors in a multifactor portfolio is a sensible evolution of multifactor investing.

Now, there are a lot of really thoughtful active decisions that go into constructing a multifactor portfolio, ranging from how to define the factors, how to combine them in a meaningful way, and what kind of risk controls you can put around that portfolio. In that sense, there’s been an evolution in multifactor investing that has continued to improve the types of considerations that go into index methodologies.”

What are some of those considerations?

“Firstly, the investment thesis of multifactor investing is that in recognition that factors go through periods of cyclicality, not every factor will be expected to outperform the market at any given time, but that, individually, factors can be expected to have better risk-adjusted returns over the long term. So, to help diversify the exposure to the factors over time and to mitigate some of that cyclicality, that’s where the attractiveness of a multifactor approach comes in. The beauty of the investment thesis is that it should smooth out that short-term market cyclicality by combining the factors.

Secondly, you also need to have the appropriate definition of those factors and the right portfolio construction to achieve the desired outcome.

Finally, you want to control for the active risk relative to the benchmark and broader market yet offer consistent factor exposure in order to extract the factor premia. In the STOXX Equity Factor indices, an optimization process incorporates constraints around sector, countries, individual companies and single-factor exposures, and controls for turnover, beta and tracking error relative to the broad market.”

Can you give some examples of those risk controls?

“For example, the indices target a 2% ex-ante tracking error as a way to mitigate the unwanted risk of factors left unconstrained, or uncompensated bets, that potentially erode returns when certain factors are out of favor. Many investors look to incorporate a multifactor approach within the core part of their portfolio, so there is likely to be little appetite for very wide deviations from the benchmark over time. We also find that it is a really important aspect to ensure that the performance of the multifactor portfolio is driven primarily by the factors and not by idiosyncratic, stock-specific risk.

I’ll give you an example. In the last couple of years, as we know, market returns have been largely driven by a very small number of tech stocks that exhibit certain Quality and maybe some Momentum characteristics. But certainly no Value characteristics. So, if the Value part in your multifactor approach is not holding any of these stocks, if that is left unconstrained or unchecked from a total risk perspective, you potentially have a situation leading to sustained underperformance. So that risk control is a really important mechanism to prevent those biases from sneaking in.”

How has factor research evolved in recent years, and how has the definition of factors changed?

“We recognize that the body of research in factors is constantly evolving. BlackRock has a seasoned factor research group that constantly looks at improving the industry’s insights. We stay ahead of new developments in factor insights, evaluating and ensuring that they are additive to our high standards of explaining factor return drivers. I would describe recent factor advancements as evolutionary rather than revolutionary.

We utilize many of the traditional factor metrics that are commonly known and understood in academic literature, and work to enhance the factor definitions that we’re using. I guess we could call these evolved insights.

I’ll give you a couple of examples. One of the classic factors that we know and that investors love is Value, which at its core definition is stocks that are undervalued relative to some measure of their fundamental worth. Traditionally, we’ve looked at metrics like price-to-book, or price relative to cash flows or earnings. One of the insights that we’ve brought into the Value factor definition is looking at, over time, how overvalued or undervalued a company is relative to its own history, and not just relative to its peers.

Another really interesting insight comes from analyzing carbon emissions data alongside factors, now that we have access to more comprehensive data in this field, to give us information that we can incorporate within our definition of Quality — which are companies that are relatively efficient at managing their capital, and are profitable with stable earnings. For example, integrating data on the carbon emissions intensity of companies, can signal a company’s overall efficiency in managing resources. That’s, therefore, another indicator of the future quality of that company. That’s just one example of how research can help capture Quality with a slightly more forward-looking metric, and how environmental data points can play a role in harnessing the factor more effectively.”

Within a multifactor strategy, how do you allocate your capital to each one of the signals?

“That’s a key question as it touches upon one of the most important active decisions in the multifactor strategy.

Traditionally, a lot of multifactor strategies have had an equal allocation to each of the targeted factors. But it is important to recognize that factors themselves have unique risk and return characteristics, and an allocation should reflect those to achieve a balanced portfolio.

The Quality factor is relatively steady over time and doesn’t tend to deviate too far from the broader market. It brings more resilience to the portfolio and offers that little bit lower risk profile. As such, the STOXX Equity Factor indices upweight Quality.

Value and Momentum are natural pairs, and so they have the same weight relative to each other.

The Small Size factor, for its part, is a high beta, pro-cyclical factor, relative to the Low Volatility factor, which is low beta and a much more defensive factor. Those are opposing factors pulling in opposite directions. And so, they each have a 5% weight so that we’re not moving too far away from the core.”

Figure 1: Targeted factors — active exposure over time

What does an index-based methodology add to factor investing?

“An index-based methodology brings obvious cost advantages, but, very importantly, it brings transparency. There is visibility and predictability in the process. Having a rules-based strategy with clear allocations allows for a robust and transparent way of demonstrating how the factors contribute to the portfolio’s performance and outcome. That transparency and understanding of what’s driving returns is really important for investors.”

Finally, what is the benefit of collaborating with an index provider like STOXX?

“We appreciate STOXX’s flexibility in terms of sourcing the right underlying data that is needed to build indices. And in terms of customization, STOXX also has the expertise to incorporate this data into their risk models. For this strategy in particular, the integration of sustainability considerations highlights competence and possibility. That’s been an asset that STOXX has brought to the table.”

[1] STOXX calculations. Data as of February 13, 2025.