BlackRock has switched the index underlying the iShares World Equity Factor ETF (WDMF) in Australia to the STOXX® Developed World Equity Factor to revamp the multifactor strategy.

The STOXX Equity Factor indices seek to capture the fundamental drivers of equity performance through five signals: Quality, Value, Momentum, Size (small capitalization) and Minimum Volatility. The multifactor strategy, in particular, was designed as a core equity solution to deliver above-average and diversified exposure to those five signals.

The STOXX Developed World Equity Factor Index is constructed through an optimization process that maximizes the allocation to a multifactor alpha signal, while satisfying a set of constraints intended to closely track the STOXX® Developed World benchmark. The index offers investors a unique methodology to target long-term potential outperformance while controlling for systematic risk.

Because of its full-market-cycle performance potential, many investors tend to leverage a multifactor strategy to mitigate long periods of underperformance from a given individual factor and enhance risk-adjusted returns. Controlling how much a multifactor index can be tilted toward any single factor creates diversified and consistent factor profiles and prevents the index from loading too much (or not enough) on one individual factor.

Index performance

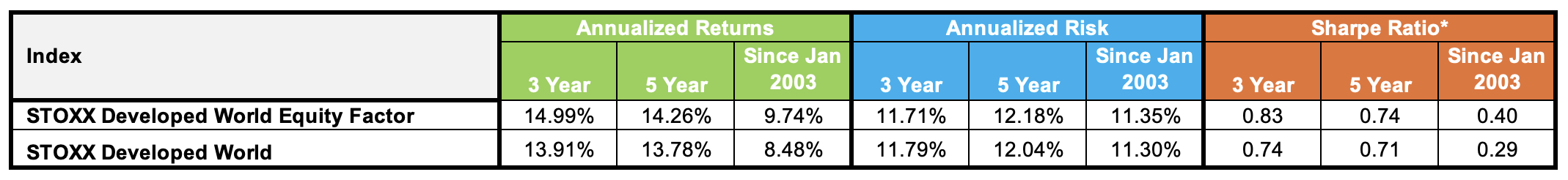

The STOXX Developed World Equity Factor index has in recent years outperformed its benchmark with similar levels of risk, resulting in stronger risk-adjusted returns as measured by the Sharpe ratio (Figure 1).

Figure 1: Risk and returns

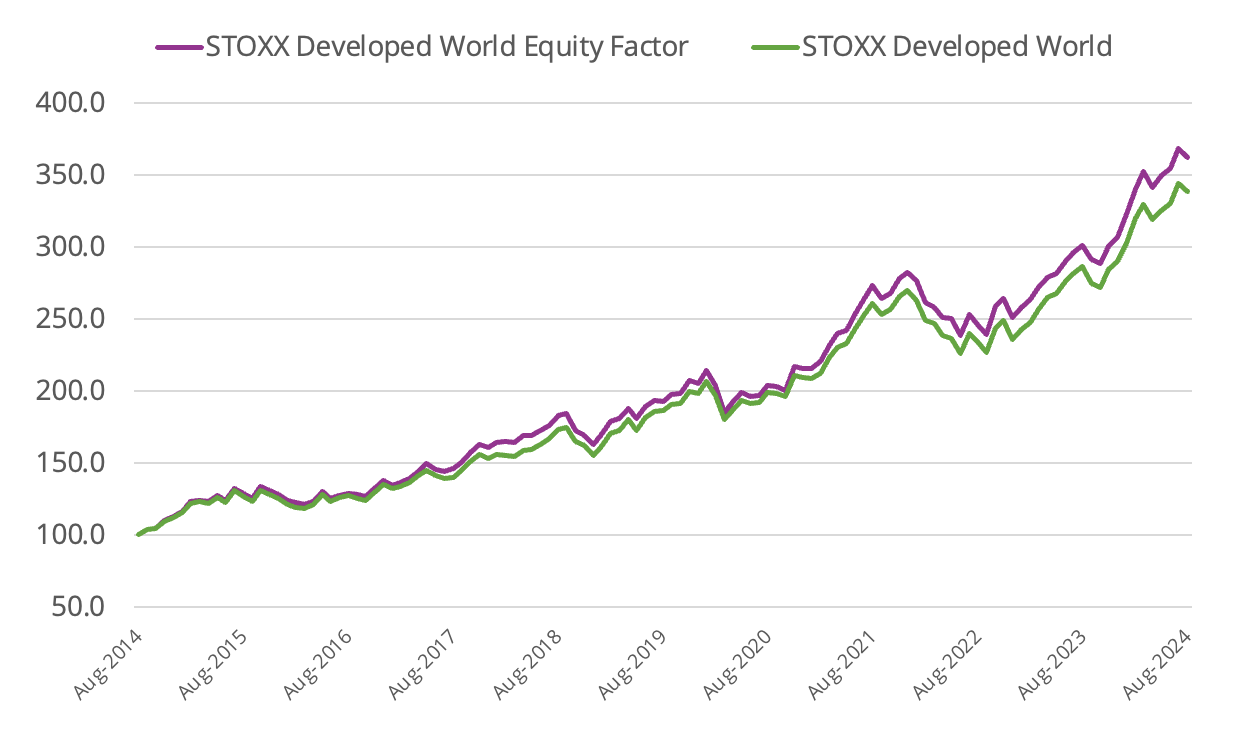

Over the past ten years, the Equity Factor index has beaten its benchmark by a cumulative 24 percentage points. Figure 2 shows the performance of the index and its benchmark in Australian dollars.

Figure 2: Performance

Ongoing collaboration

Technological advancements have in recent years allowed for improved factor portfolios that accurately hone in on the potential for long-term enhanced returns without inherent pitfalls such as unwanted biases, sustained periods of underperformance or high costs. BlackRock and STOXX have collaborated to design well-researched factor and multifactor strategies that control for risk and that have bounds over the factor exposures themselves.

The STOXX Equity Factor indices were devised to target rewarded factors, avoid unintended and uncompensated bets, and control for active risk. The construction methodology incorporates constraints around sector, countries, individual companies and single-factor exposures, and control for turnover, beta and tracking error relative to the broad market.

BlackRock in 2022 enhanced its multifactor suite in the US, adopting STOXX indices for the iShares U.S. Equity Factor ETF (LRGF) — which tracks the STOXX® U.S. Equity Factor index — and iShares International Equity Factor ETF (INTF) — which mirrors the STOXX® International Equity Factor index. In March last year, the asset manager expanded the coverage of STOXX factor strategies in adopting the following four indices to underlie respective iShares ETFs: STOXX® Global Equity Factor, STOXX® Emerging Markets Equity Factor, STOXX® U.S. Small-Cap Equity Factor and STOXX® International Small-Cap Equity Factor.

For more on the rationale and benefits of multifactor investing, read an article from 2022 on this blog.