October’s market pullback is the type of seismic event that initiates discussions about a change in investor sentiment. In the current rally, such a change would mean a move away from the recent years’ leaders, namely growth stocks, towards the laggards: value stocks.

Value investing has its merits and followers, yet the current bull market has also shown its shortcomings: value can go through prolonged periods of underperformance that can be hard to recoup. Moreover, it is difficult to accurately time when the style will take over from growth.

STOXX has partnered with American Century Investments to develop value and growth approaches that aim to limit the problems of style investing, protecting the portfolio when either strategy falls out of favor and instead exploiting the momentum of such rotations.

A quality universe with an edge

The iSTOXX® American Century USA Quality Value Index seeks to invest in two types of high-quality companies selected from the STOXX® USA 900 Index: those with attractive valuations and those with sustainable and high dividends, resulting in a selective value tilt.

An initial screen eliminates the bottom of the universe based on quality characteristics that include profitability, earnings quality, management quality, leverage and earnings revisions. This screening takes into account supersector composition to control industry biases.

Starting with these high-quality names, the iSTOXX American Century USA Quality Value Index consists of two sub-strategies: value and income. The value sub-strategy selects stocks based on their price relative to book, earnings and cash flow. The income side, meanwhile, tracks the highest and most consistent dividend payers with low leverage and low price volatility.

The index dynamically allocates between the two sub-strategies, guided by a risk-adjusted momentum signal. The allocation to the value sub-strategy can range between 35% and 80%.

The index can thus capture the upside in value while mitigating risk when value stocks languish. The quality score and the tactical allocation between value and income moderate the exposure to the cyclicality of the value style and can help generate stronger risk-adjusted returns throughout the market cycle.

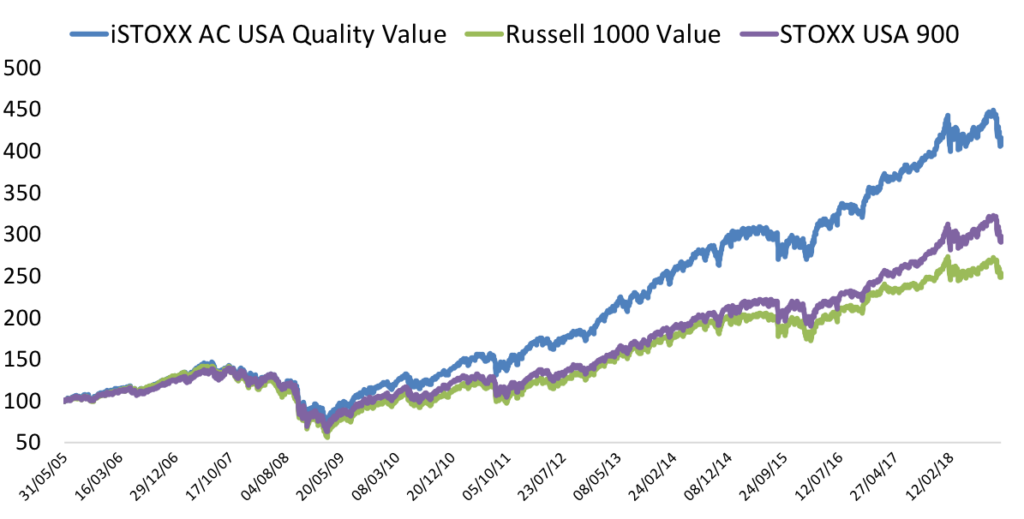

Chart 1 illustrates the attractive return profile of this approach. It shows the iSTOXX American Century USA Quality Value Index against a traditional value portfolio (as represented by the Russell 1000 Value Index) and a traditional market capitalization-weighted benchmark (as represented by the STOXX USA 900 Index).

Chart 1

As illustrated, growth stocks took off in the aftermath of the global financial crisis, possibly reflecting investors’ low conviction in the economic recovery and their preference for companies with higher earnings growth outlooks. They snubbed other stocks, even if they traded at a discount. This trend accelerated in recent years.

Between 2008 and 2009, the traditional value portfolio lost 24% while the cap-weighted portfolio dropped 20%. By contrast, the iSTOXX American Century USA Quality Value Index fell 11% in the period. During these two years, value stocks lacked momentum, so the iSTOXX American Century USA Quality Value Index had an average exposure of 62% to value stocks and 38% to income. This performance profile highlights the benefit of income as a hedge in falling markets.

In 2011, the traditional value portfolio dropped 0.4% while the cap-weighted portfolio added 1.6% and the iSTOXX American Century USA Quality Value Index jumped 13%. The latter had an average allocation of 53% to value stocks and 47% to income during the year. Moreover, the iSTOXX American Century USA Quality Value Index outperformed the traditional value portfolio every year but one since 2008, by an annual average of 4.6 percentage points.

Growth’s bull market

The iSTOXX® American Century USA Quality Growth Index similarly switches allocations between two sub-strategies: high, or pure, growth, and stable growth. The first strategy selects companies with the highest historical earnings and cash flow growth and strongest projected profit growth, while the second one tracks stocks with sustainable growth prospects and attractive valuations.

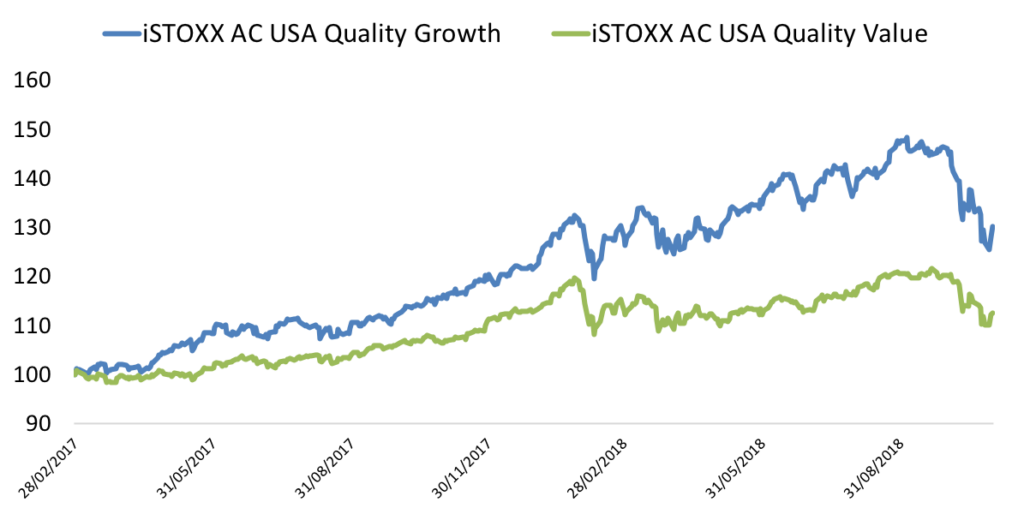

Growth has been a particularly strong performer in the recent past. Chart 2 shows the performance of both iSTOXX American Century USA Quality indices – Growth and Value – in the 20 months through Oct. 31, 2018.

Chart 2

Last month, however, growth stocks suffered the brunt of the selling. The iSTOXX American Century USA Quality Growth Index fell 11% in October. That compares to a 6.4% retreat for the iSTOXX American Century Value gauge.

With interest rates rising, trade tensions mounting, and an aging bull market, many investors could be eyeing a style strategy based on growth and value. History shows that approaching such strategies in a way that avoids value traps and volatile growth stocks, and is flexible enough to benefit from the cycle’s changing dynamics, may be a more efficient way to exploit the style rotation.