STOXX Ltd. has introduced the STOXX® Emerging Markets 800 LO Minimum Variance Index (STOXX EM 800 LO MinVar), expanding its suite of rules-based minimum variance strategies to the universe of developing nations.

The new index is derived from the STOXX® Emerging Markets 800 LO (Liquidity Optimized), which guarantees broad yet liquid access to the asset class. The STOXX Emerging Markets 800 LO is itself compiled from the STOXX® Emerging Markets 1500 Index and covers about 80% of emerging markets’ free-float equity value.

The STOXX EM 800 LO Index is weighted by free-float market capitalization, but, additionally, its methodology ensures that constituents that are illiquid relative to their size are underweighte d.

As such, investors gain access to an easily tradable emerging-markets strategy that seeks relative downside protection through its stock selection. The index launch comes at a time when emerging markets’ strong outlook has been shaken by geopolitical and macroeconomic concerns.

An optimized approach with reduced correlation risk

STOXX’s minimum variance index family is designed to provide full exposure to various equity markets, with the lowest possible level of volatility. But they are also constructed around the premise that an efficient minimum-variance approach should take correlation risk into account, avoiding crowding allocations in few sectors that display the lowest volatility.

The suite of indices employs a multi-factor risk model implemented by STOXX’s partner Axioma that estimates a covariance matrix for stocks based on factors such as leverage, liquidity and momentum.

The minimum-variance approach is then optimized through a series of constraints to enforce diversification and limit deviations from the benchmark. These constraints include: a maximum tracking error, a minimum number of constituents, a quarterly one-way turnover of less than 5% of the portfolio, as well as caps on active country, industry and style exposures.

For more on the construction of the STOXX Minimum Variance Indices, you can read our research paper on the topic.

Testing the performance of a minimum variance portfolio

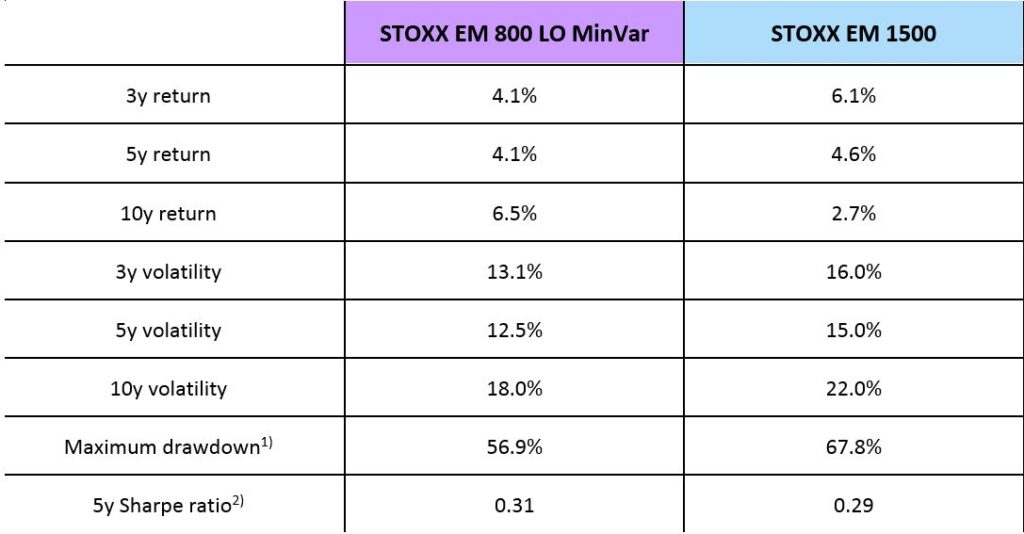

Table 1 compares the risk and return profiles of the STOXX EM 800 LO MinVar Index – currently composed of 199 constituents – and the STOXX Emerging Markets 1500 Index.

Table 1

1) From Mar. 18, 2005 to May 11, 2018.

2) Uses USDLIBOR as riskless rate.

The minimum variance strategy has underperformed in the last five years as markets rallied sharply. However, going back ten years, a period that covers part of the global financial crisis, the minimum variance portfolio produced higher returns as it avoided major drawdowns. The minimum variance index has recorded lower levels of volatility throughout its data history.

As with other regional minimum variance portfolios, the STOXX EM 800 LO MinVar Index proves its advantage in times of market pullbacks by showing consistent outperformance and risk reduction in backtested data.

Chart 1 shows the performance of the two indices since data starts in 2005. The period was deliberately chosen to cover the financial crisis and to showcase the power of risk management.

Chart 1

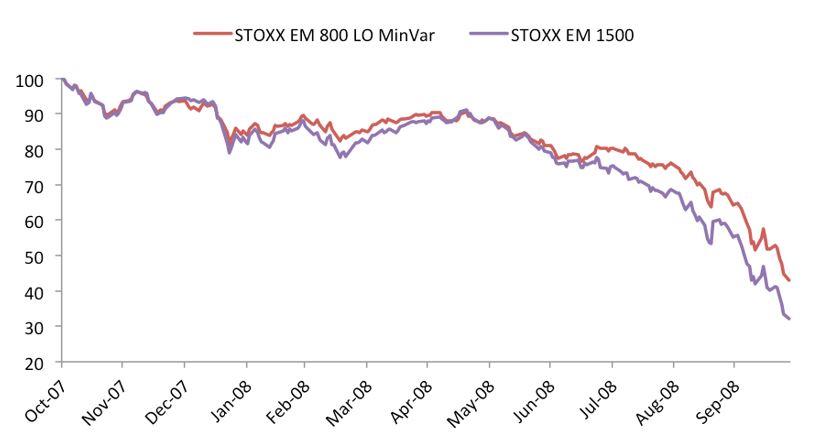

Chart 2 zooms in on the financial crisis period. In the year starting October 2007, the STOXX EM 800 LO MinVar Index declined 57%, less than the 67.8% retreat for the Emerging Markets 1500 Index.

Chart 2

The minimum variance strategy also produced better returns during episodes of volatility within the broader uptrend of the past five years. The STOXX EM 800 LO MinVar Index outperformed by 127 basis points (-14.7% vs. -16%)1 between May and June 2013 as markets were rattled by the Federal Reserve’s announcement that it would start undoing quantitative easing. It outperformed by 320 basis points (-27.9% vs. -31.1%) between April 2015 and January 2016 amid concern about an economic slowdown in China.

More recently, since markets peaked this year on Jan. 26, the STOXX EM 800 LO MinVar Index has outperformed by 240 basis points (-9.1% vs. -11.5%).2

A core tool in the asset-allocation menu

Minimum variance is not just a downside hedge or an investment that takes an active bet on volatility. It is rather increasingly found as part of an overall asset-allocation strategy for investors seeking better risk-adjusted returns over full market cycles.

The STOXX EM 800 LO MinVar Index is designed to be easily replicated by passive investment products such as exchange-traded funds, as well as for institutional mandates.

With this launch, investors obtain access to a sophisticated, passive minimum-variance strategy for emerging markets, an asset class known for its higher-risk profile.

Featured indices

STOXX® Emerging Markets 800 LO Minimum Variance Index

STOXX® Emerging Markets 800 LO Index

STOXX® Emerging Markets 1500 Index

1 All returns in USD including dividends after taxes.

2 Jan. 26, 2018 – May 31, 2018.