STOXX’s European equity indices provide access to Europe’s dynamic economy, covering key sectors and leading companies, while always being rules-based, transparent, and representative of the underlying market.

Key benefits

Market capitalization based

The indices are weighted according to free-float market capitalization

Transparency

Index calculation and changes to the index composition follow publicly available transparent rules

Track record

STOXX Benchmark indices are established as underlyings for derivatives, ETFs, index funds and structured products

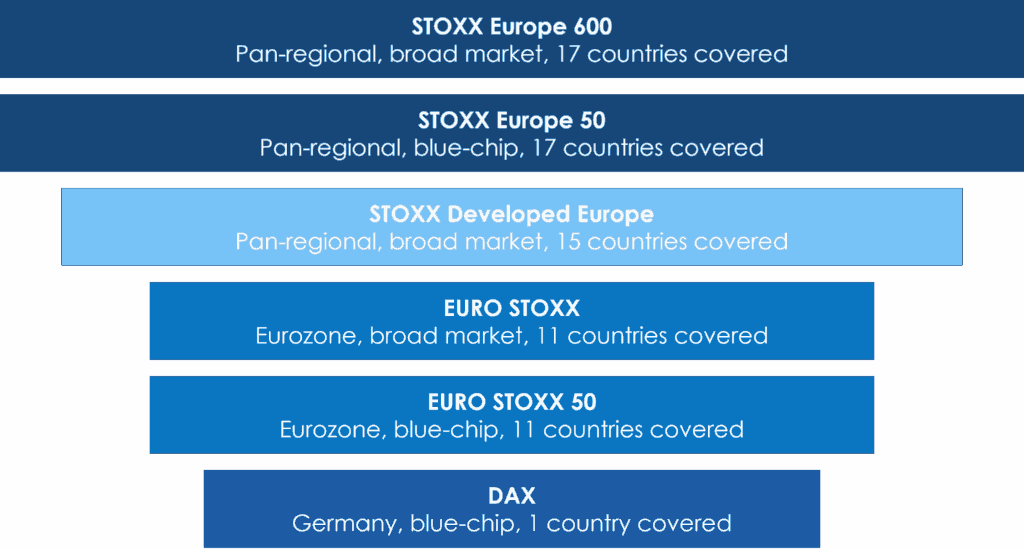

Benchmark indices

EURO STOXX 50

The EURO STOXX 50 is the most-followed benchmark for European equities. The index tracks the Eurozone’s Supersector leaders, offering a distinctive and diversified business exposure, and covers 11 national markets.

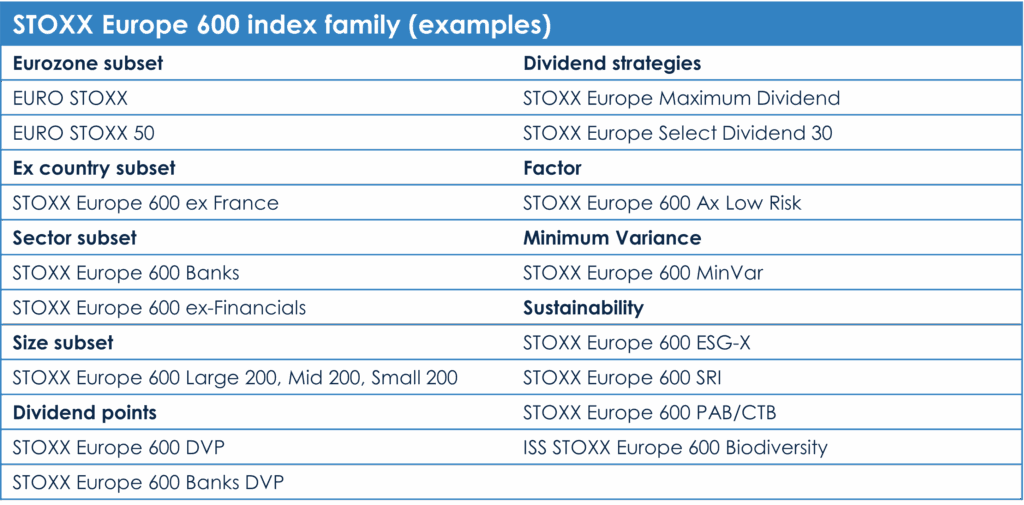

STOXX Europe 600

With a fixed number of 600 components, the benchmark represents large-, mid- and small-capitalization companies across 17 countries – the widest coverage among flagship European benchmarks in the industry in terms of market capitalization and number of components.

Established benchmarks

For over 25 years, STOXX has provided the most popular benchmarks for Europe’s equity markets, forming a liquid investment ecosystem that continues to grow in size and scope.

Evolving landscape

STOXX’s European equity indices have seen widespread adoption since their inception in June 1998, providing investable exposure to the region. As the nature of index-based investing continues to change, benchmarks are now used as a toolbox with which to build customized strategies. The family of indices derived from our flagship indices and the trading vehicles around them will continue to grow as STOXX caters to the increasingly tailored needs of investors.

Incorporating responsible investing policies

Increasing demand for responsible policies has defined institutional investing in recent years. Amid that trend, sustainable versions of STOXX’s European equity indices have gained traction with investors and issuers and will continue to do so as regulators and asset owners raise the bar on issues from climate to biodiversity and social inclusion.

Key European equity indices

Related news & research

Get in touch

Whether you are looking for benchmark solutions, implement strategic investment decisions, or developing custom solutions, STOXX is your partner in indexing excellence. Contact us today to learn more about how we can help you achieve your investment goals.