Europe-domiciled ETFs investing in European equities grew 43% to EUR 406 billion in assets in 2025, as investors poured over EUR 62.3 billion in net inflows. STOXX- and DAX-linked funds attracted 44.6% of that capital, or EUR 27.8 billion, a ten-fold increase from 2024 and the highest annual tally on record.

Inflows of 35.1 billion euros and rising share prices lifted the assets under management in all STOXX-linked ETFs, including all markets and regions, to EUR 189 billion, 51% higher than at the end of 2024. While growth was led by a wide range of exposures — including sectors, size and factor strategies — benchmark indices received the most purchases.

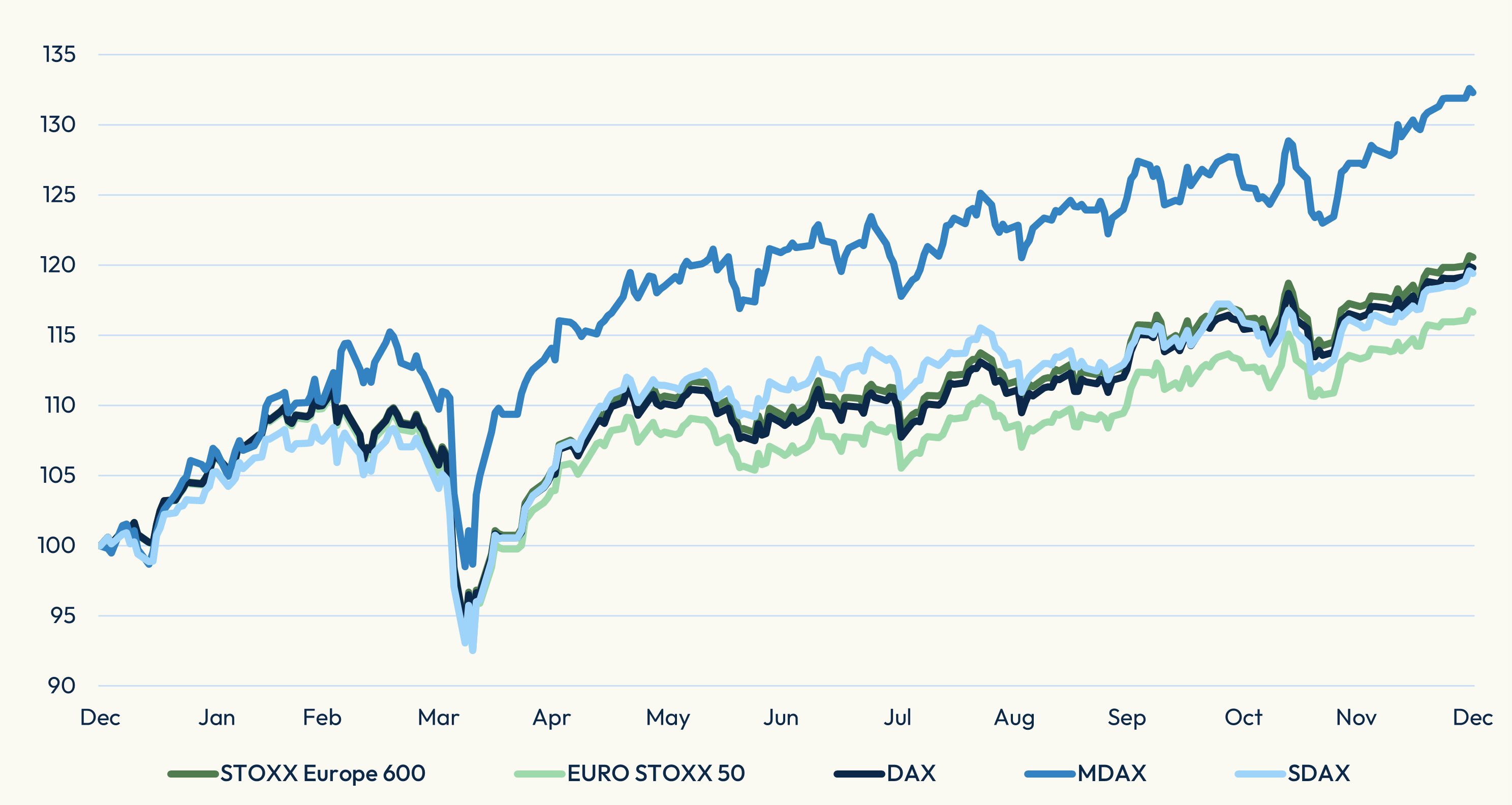

Optimism that structural reforms in Europe may help the economy shake off years of malaise drew investors to a region offering low valuations, sector diversification and some of the world’s best-known brands. The Eurozone’s EURO STOXX 50® benchmark gained 22.1% in 2025, its third consecutive year of double-digit growth, while Germany’s DAX advanced 23%, its best annual showing in six years.[1] The broader STOXX® Europe 600 climbed 20.6%.

Flows into STOXX and DAX ETFs were led by investments into funds mirroring the EURO STOXX 50, STOXX Europe 600 and DAX® indices (Figure 1), all of which touched a record high in 2025.

Figure 1: Inflows and assets in STOXX-linked ETFs

Figure 2: 2025 performance – key European indices

Strong market performance is also accelerating the growth of Europe’s retail investor base. A BlackRock survey published last November[2] showed the number of individual investors in Europe climbed 69% between 2022 and October 2025 to 32.8 million. The firm estimates a further 8.7 million people — another 27% increase — could enter the market over the next year.

Bank stocks lead for second year

Within the broader EURO STOXX® benchmark, banks led gains for a second consecutive year. The EURO STOXX® Banks index, which tracks the largest lenders in the Eurozone, jumped 80.3% last year excluding dividends, its best annual performance since data going back to 1987. Utilities, energy and construction companies followed in performance.

More public spending in Germany

Germany was at the center of attention last year as the new government of Chancellor Friedrich Merz unveiled a EUR 500-billion infrastructure investment program, raised borrowing caps for federal states, and exempted defense spending from constitutionally mandated debt limits. The economy returned to modest growth in 2025 after two consecutive years of contraction.

“After many years of extreme caution, especially in Germany, the continent’s largest economy, fiscal policy has become more expansive and fresh investment initiatives are being launched,” wrote Vincenzo Vedda, Chief Investment Officer at asset manager DWS, in a note[3]. “We view these developments positively. Europe’s growth should be bolstered, and the region’s appeal enhanced.”

The European Central Bank expects the Eurozone to grow 1.2% this year and 1.4% in 2027.[4] The projections may look modest in a global comparison, but they offer some hope for a region that has oscillated between recessions and uneven recoveries.

“The coming year may see year-on-year a further U.S. growth slowdown, while in the Eurozone rising private domestic consumption supported by strong labor markets should help to lift Eurozone GDP growth, bringing it close to the U.S. level,” Vedda added.

The MDAX® of German mid-caps, which turned 30 on January 19, rose 19.7% in the year, also its best annual performance since 2019. ETFs tracking the index attracted a net EUR 1.8 billion over the year. Mid-sized companies tend to generate more of their sales domestically than DAX constituents and are often used to gain targeted exposure to the German economy.

Defense, AI data centers

Defense was a strong theme within European equities. Industrials stocks led gains in DAX, and the best-performing DAX component was Rheinmetall with a 154% advance. Germany has pledged to increase total defense outlays to 3.5% of gross domestic product by 2029, up from around 2% in recent years.

Rheinmetall was also the best-performing stock in the EURO STOXX 50 over 2025, followed by another German company: Siemens Energy. The shares jumped 139% during 2025 as the stock benefited from a cycle of building AI data centers.

Valuation discount remains

Europe’s strong gains in recent years have barely made a dent in valuations. The EURO STOXX 50 trades at 2.4 times its companies’ book value, about half the price of the STOXX® USA 500, STOXX data show. The European gauge is valued at 18.4 times its members’ trailing earnings, compared with a ratio of 30 for the US benchmark.

Should Europe’s economic momentum gather pace, it would not only mark a clear break from recent years but could also spur a realignment in global portfolio allocations, where European equities are still underrepresented. While the Eurozone accounts for around 11.5% of the world’s GDP[5], its equities represent only 8% of the STOXX® World AC index.

“The euro area has sidestepped the tech-driven highs and lows in the US and China, yet its economy’s resilience has been striking,” wrote a team of Barclays strategists in a note to investors in November.[6] “Despite a war on its doorstep, an energy crisis and trade tensions, Europe has managed to grow close to trend. Our economists expect it to do so in 2026 as well.”

[1] All gross returns in EUR.

[2] BlackRock, ‘People and Money,’ November 2025.

[3] DWS, ‘CIO View: Gateway to Europe,’ September 23, 2025.

[4] ECB Macroeconomic projections, December 2025.

[5] Source: ECB, ‘Structure of the euro area economy.’

[6] Barclays, ‘Q1 2026 Global Outlook.’