In June 2020, STOXX introduced indices complying with the European Union Climate Benchmarks regulation, a suite that has since coexisted with changing investor goals, shifting portfolio developments and evolving climate datasets.

The indices were constructed to follow the ‘EU Climate Transition Benchmark’ (CTB) and ‘EU Paris-aligned Benchmark’ (PAB) requirements, embedded in the European Benchmark Regulation legal framework. The EU classification was devised to bring harmonization and transparency in climate-aware investments, foster climate-friendly investments and avoid ‘greenwashing.’

Different decarbonization paths

CTB and PAB rules set holdings requirements and specific emission objectives for financial indices tracking low-carbon strategies. The two benchmark types work towards keeping global warming between 1.50C and 20C above pre-industrial levels[1], but differ in their level of restrictiveness and ambition:

- CTBs allow for more diversification while forming a portfolio that is on a decarbonization trajectory.

- PABs significantly limit exposure to fossil fuels and incorporate more stringent carbon limitations.

The STOXX CTB and PAB suite covers a selection of benchmark universes, including indices based on the STOXX® Europe 600 Index and EURO STOXX® Index. Globally, ETFs with around USD 125 billion in assets track CTB and PAB indices, according to Morningstar Direct.

For a full description of the CTB and PAB criteria and methodology, visit our blog from July 2020.

From targets to realities

Climate goals remain a standard for the world’s largest asset owners. Yet during the early years of implementation, many adjusted their objectives to reflect practical portfolio considerations, improved datasets and a reassessment of the feasibility of their initial targets. Some financial institutions have even withdrawn from public decarbonization pledges. Still, the value of investments in climate-aligned strategies has not diminished.

The total AuM invested in climate solutions by members of the Net-Zero Asset Owner Alliance grew to USD 743 billion at the end of 2024, from USD 555 billion in 2023[2]. The share of climate solutions relative to total AuM grew to 8% from 6% over the period.

STOXX has acknowledged that the climate investing landscape has evolved in recent years. A market consultation in September 2025 sought to reflect and capture the new rules, realities and preferences, proposing changes to enhance regulatory alignment and improve data precision.

“Our clients’ dedication to climate-focused investment solutions remains unwavering,” said Antonio Celeste, Director and Head of Sustainability & Factors, Index Product Management at STOXX. “Equipped with continually updated insights and guidelines, they consistently refine their strategies to align with evolving realities and pursue their targeted risk-return objectives. The STOXX indices are designed to support and accompany them throughout that journey.”

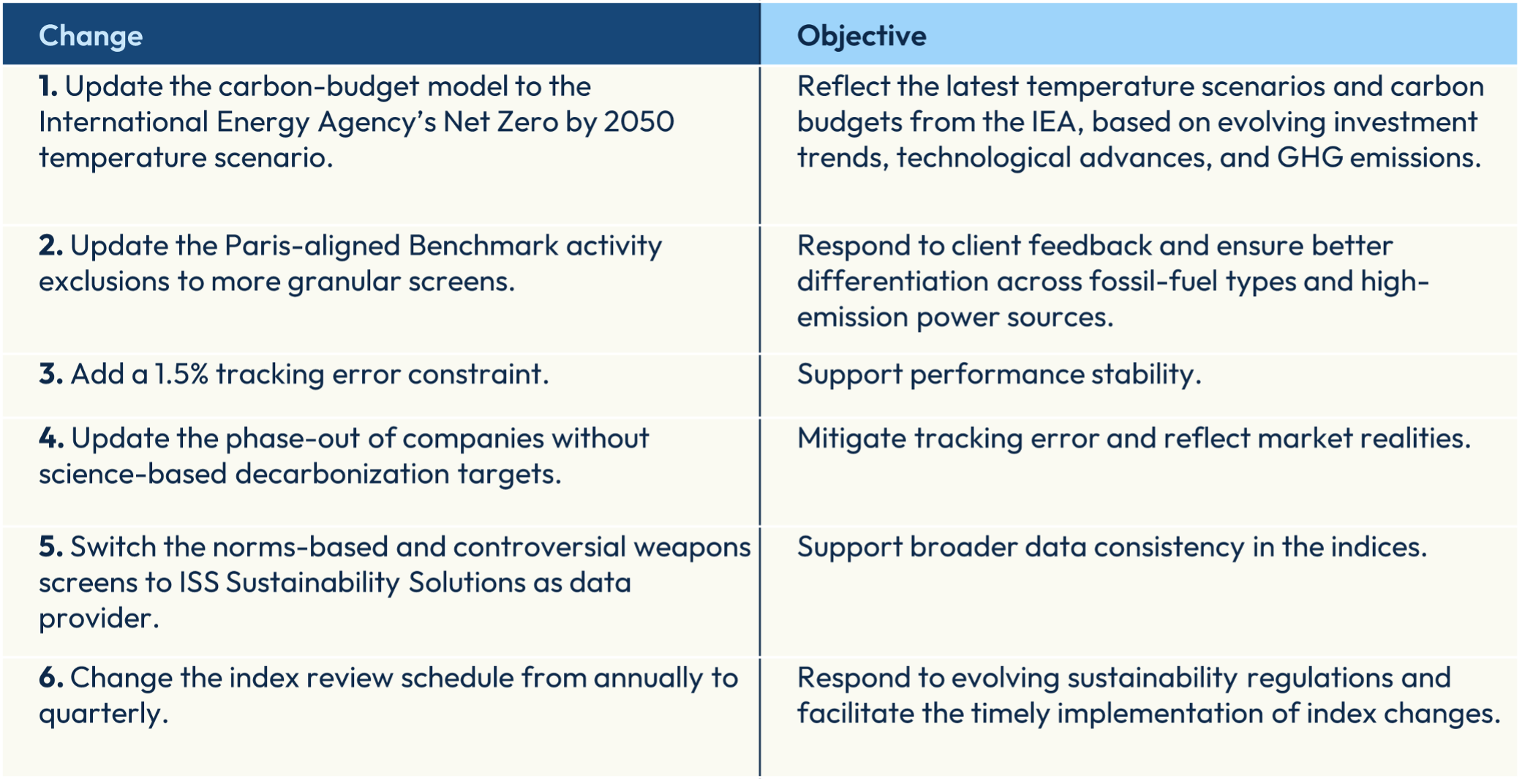

The proposals outlined in the recent market consultation on the CTB and PAB methodologies are shown in Figure 1.

Figure 1: Changes to CTB and PAB indices’ methodology

The results of the market consultation were published in October 2025, and all proposed changes were accepted by a majority of respondents. Below is a more detailed explanation of changes:

- The IEA Net Zero Emissions by 2050 Scenario updates previous scenarios to reflect real-world trends and delays in emissions reductions. The cumulative projected emissions of a STOXX CTB and PAB index, based on the companies’ GHG reduction targets, must now be below their carbon budget for the IEA Net Zero by 2050 temperature scenario for the current year and for 2050.

- Enhanced data now allows for a more focused analysis of activities deemed potentially harmful to the climate transition as well as those considered detrimental to the UN Sustainable Development Goals (SDGs). As a result, PAB indices have introduced more detailed exclusionary screens on activities, with more granular definitions covering fossil fuel extraction, refining and distribution. New thresholds have also been added for mining, processing and marketing of coal, as well as for power generation.

- A 1.5% tracking-error constraint was integrated into the index optimization to allow CTBs and PABs to track their benchmarks more closely. This is an important consideration in supporting the use of the indices as ‘core’ investment products within portfolios.

- The phase-out of companies without science-based targets was replaced by low-exposure thresholds, reflecting the challenges some industries face in achieving a decarbonization trajectory. Previously, securities with no commitments or no SBTi-approved targets were subjected to incremental underweighting and were not eligible for selection starting in 2025 and 2030, respectively.

- The switch to ISS Sustainability Solutions reflects the use of new datasets and enables consistency across STOXX indices. ISS and STOXX joined forces in 2023 to form a unified platform offering high-quality data, analytics and indices, underpinned by a leading governance franchise.

- A more frequent review better captures the evolution of data and regulation.

Separately, the EU in May 2025 mandated that index administrators shall include as of January 2026 the acronyms ‘CTB’ in the name of Climate Transition Benchmarks and ‘PAB’ in the name of Paris-aligned Benchmarks. The change seeks to generate visibility for index-related products, and avoid misleading or ambiguous ESG claims.

The current situation

Through indices, investors can integrate climate goals in a systematic, transparent and objective manner — one that leverages the latest capabilities in indexing and carbon data. Indices are also used as customization tools to implement preferences and nuanced views of the climate transition.

The STOXX CTB and PAB indices follow — and often exceed — the EU provisions on decarbonization trajectories, activity exclusions and sector-exposure constraints. They also incorporate climate analysis that evaluates how companies are addressing the challenges, and opportunities, of climate change.

The commitment to increase decarbonization efforts and reduce exposure to climate-related financial risks has not slowed. However, the criteria for achieving those goals continue to evolve in the face of new realities. STOXX constantly monitors market developments, in collaboration with clients and partners, to ensure its indices reflect changing preferences.

Fit for purpose

Together with existing low-carbon indices, the CTBs and PABs help channel capital flows and build momentum behind a climate agenda that is fundamental to global development. The indices have succeeded in raising awareness of climate-aligned investing and have generated significant attention across the industry, according to STOXX’s Celeste.

“Keeping up to date with the changing backdrop and rules will ensure that the indices remain relevant, usable and fit for purpose,” he said.

[1] For example, the overall greenhouse gas (GHG) emission intensity reduction relative to their underlying investment universe or parent index is set at more than 40% at index level for CTBs and at least 60% for PAB.

[2] NZAOA 2025 Progress Report.