Water is a critical asset that shapes global sustainability, economic stability and public health, and significant investment is required to bridge the widening supply-demand gap in this vital resource.

An estimated 2.2 billion people lack access to safe drinking water while 3.5 billion live without proper sanitation[1], with profound impacts on health and economic opportunity. By 2030, the gap between global demand and supply of fresh water is expected to reach 40%.[2] By 2050, forecasts suggest that water scarcity could reduce GDP growth by an average of 8% in high-income countries, and by much more in less developed nations.[3]

Deka today introduced the Deka STOXX Future Water ESG UCITS ETF (ISIN: DE000ETFL656), which tracks the STOXX® Future Water ESG index, to help investors gain exposure to companies leading innovation in the water sector worldwide. These are businesses involved in the sourcing and treatment of water, as well as those developing equipment, infrastructure and new technologies essential to water management. The ETF was listed on Deutsche Börse Xetra®.

Combining revenues and patents

The STOXX Future Water ESG index uses a detailed breakdown of companies’ revenues and their patent data to select, from either dataset, those most aligned with the theme and index objective.

The methodology considers companies’ revenues derived from water-related activities based on FactSet’s RBICS classification, which offers a granular and comprehensive taxonomy of companies’ business lines based on their products and services.

While revenues have traditionally been used to identify a given theme’s or sector’s largest and most important companies, using patents to detect its innovators is a more novel approach. STOXX has teamed up with EconSight, whose comprehensive patents database and classification system help source companies through their intellectual property in cutting-edge technologies linked to investable themes.

Patents are forward-looking, processable documents that are key to identifying companies that are innovating — and potentially becoming tomorrow’s leaders — in fields strongly impacted by technological advances. Significant growth in the water sector is projected to come from digital technologies, including AI, Internet connectivity and predictive analytics, as well as from water reuse, smart infrastructure and advanced treatment solutions.[4]

“The STOXX Future Water ESG Index demonstrates how STOXX leverages advanced datasets and cutting-edge technology to capture innovation within investable themes,” said Axel Lomholt, General Manager at STOXX. “In this case, it helps investors identify companies with the potential to make a meaningful impact on global water sustainability.”

“Water is one of the most valuable and scarce resources of our time,” said Thomas Pohlmann, Head of ETF Product Management at Deka. “With the Deka STOXX Future Water ESG UCITS ETF, we enable investors to participate in the opportunities offered by this future-oriented theme while also taking sustainable investment criteria into account.”

Index methodology

The index’s starting investment universe is the STOXX® Developed World All Cap index, to which size and liquidity filters are applied, as are sustainability screens to remove candidates in breach of social norms, scoring low in ESG metrics, those with high carbon emissions intensity and those involved in controversial activities.[5] Thereafter, eligible companies make it into the index if they meet at least one of the following criteria:

Revenue-based selection

- Companies that generate 25% or more of their revenues from 17 water-related RBICS L6 sectors are selected.

Patent-based selection

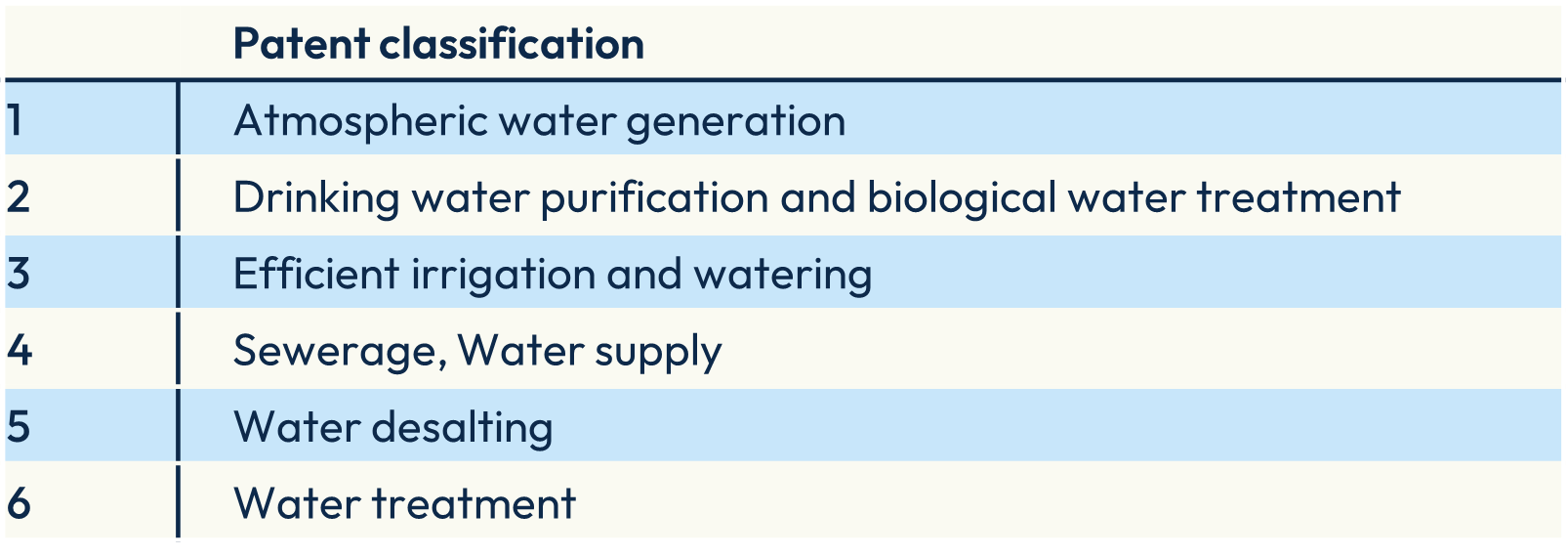

- The top 10% of companies by number of high-quality patents in six defined water technologies (Figure 1), or companies with the highest degree of specialization in the field (at least 30% of their patents are in the technologies), are selected. Companies with less than 10 active relevant patents are not eligible for patent-based selection.[6]

Figure 1: Patent definitions

A look at patents

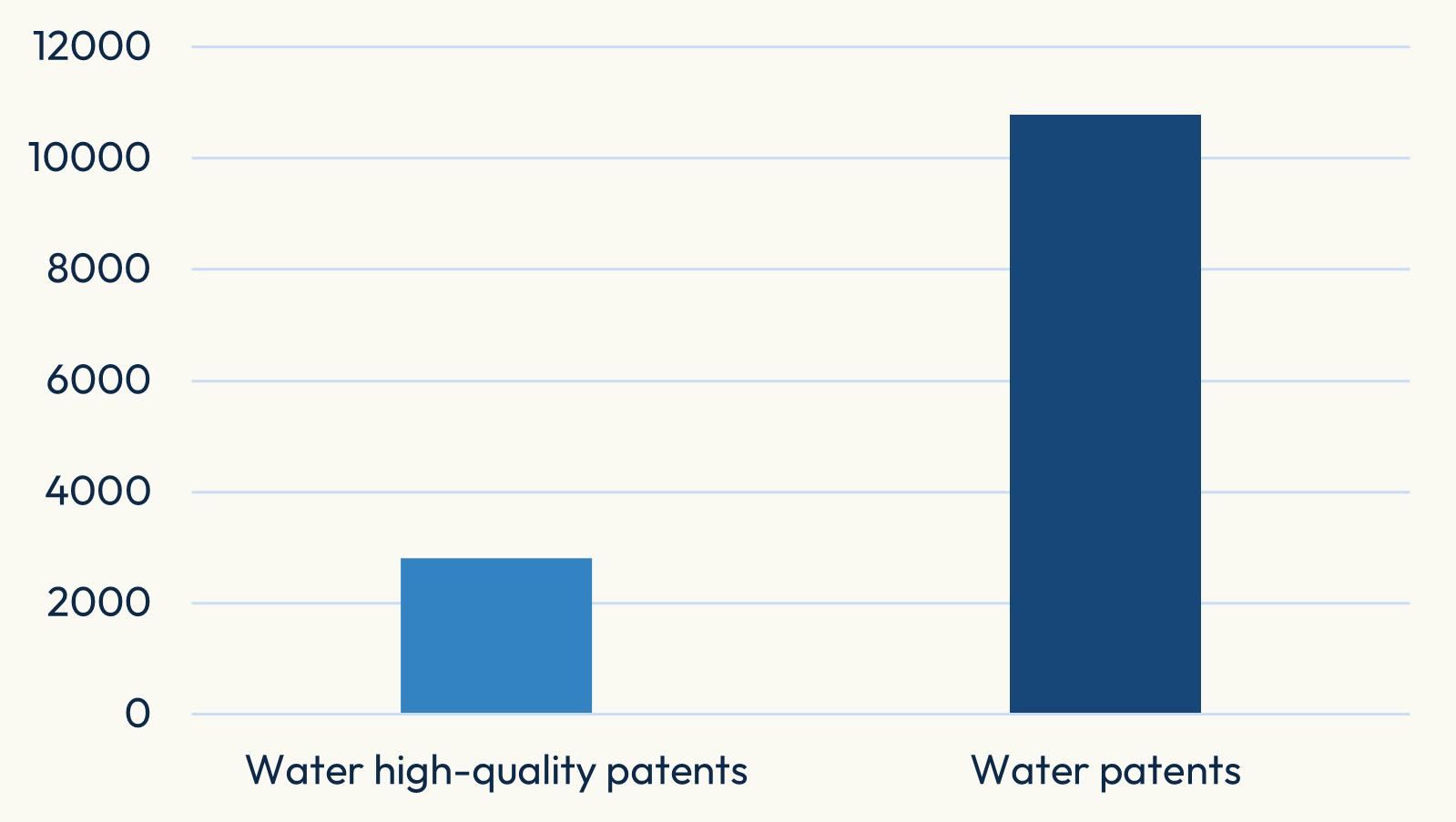

As of the latest index annual review in June 2025, EconSight identified 10,789 water-related patents in the constitution process of the index, of which 2,810 were deemed high-quality filings.

Figure 2: Number of water patents identified for STOXX Future Water ESG index

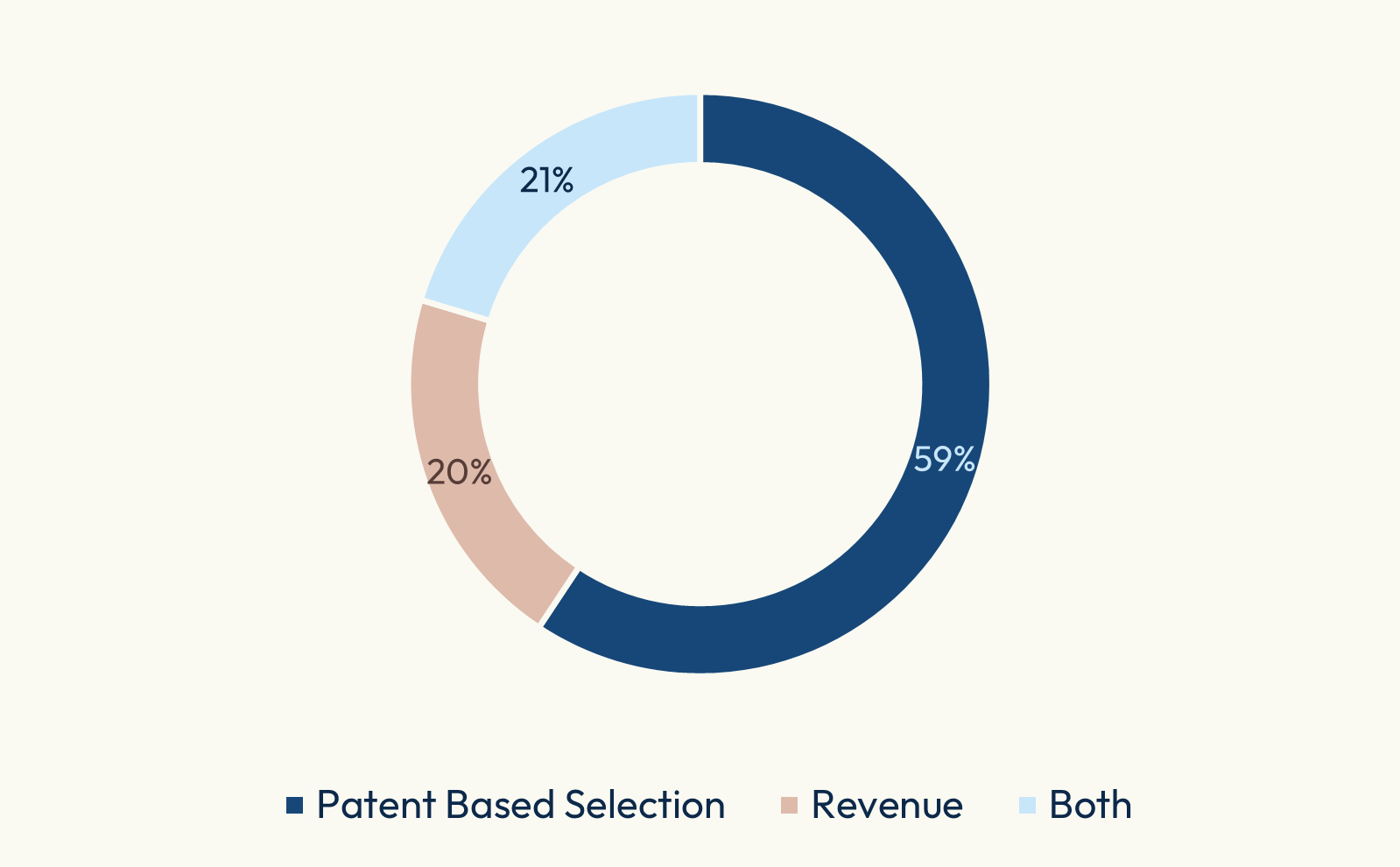

In the latest index composition, patents determined over half of stock selection, enabling the inclusion of more unique companies operating in the targeted space.

Figure 3: Stock selection by type

Index constituents

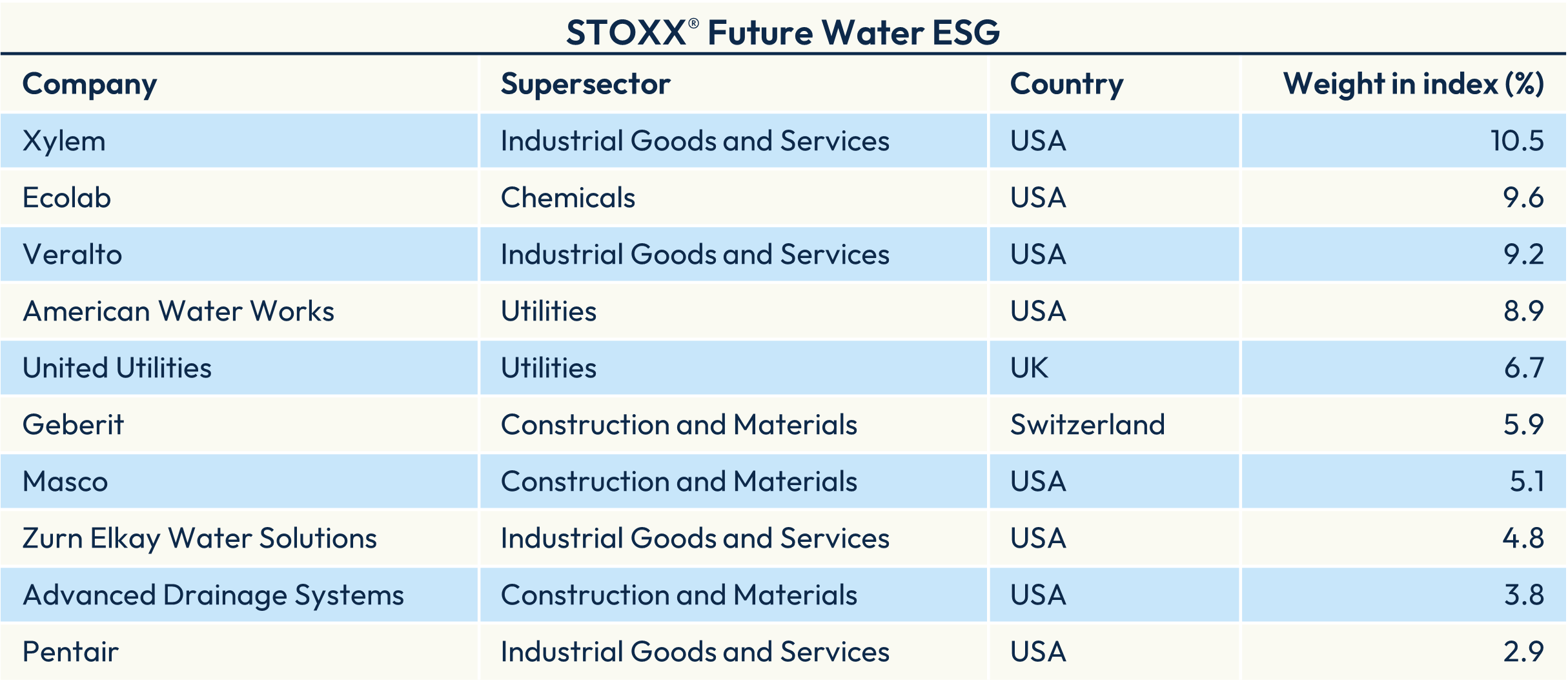

Companies’ weights in the index are based on their free-float market capitalization and their water exposure (water revenue and water patent specialization). This weighting methodology tilts the portfolio towards businesses with a larger water focus, increasing the thematic purity.

As of December 31, the largest companies in the index were Xylem Inc., which helps operate water reuse projects to cool data centers, and Ecolab Inc., whose products range from cooling water treatment solutions to tools to efficiently analyze, evaluate and treat wastewater.

Figure 4 shows the top 10 of a total of 59 constituents in the index.

Figure 4: Index top 10 holdings

Securing the future of water

Water stress poses a serious threat to human health and development, and to economic growth, in what has been called “potentially the most complex and costly sustainability issue”[7] the world is facing today. Population growth, industrialization and climate change are exacerbating the problem.

As global attention turns to addressing this challenge, companies that help provide secure, sustainable and affordable water have a crucial role to play — and so will investments in their solutions. The STOXX Future Water ESG index enables investors to focus on these innovators and key suppliers in a field that is set to grow in importance in the coming years.

[1] United Nations, ‘The Sustainable Development Goals Report,’ 2024. Data corresponds to 2022.

[2] Morgan Stanley, ‘A Deep Dive on the Water Crisis,’ February 14, 2022.

[3] Global Commission on the Economics of Water, ‘The Economics of Water.’

[4] For a complete overview of emerging water technologies, visit Xylem, ‘Water Technology Trends,’ 2025.

[5] ESG screens include norms-based screening, human rights controversies, environmental protection controversies, controversial weapons, carbon intensity, energy consumption intensity, ESG corporate rating, ESG SDG 6 impact rating, and the following product involvement: tobacco, coal, unconventional oil and gas, fossil fuels, nuclear power, civilian firearms and military equipment. Screens are provided by ISS Sustainability.

[6] Companies’ weights are based on their free-float market capitalization and their water exposure. Water exposure is based on companies’ revenue share coming from the water RBICS L6 sectors, and companies’ patent specialization in the defined water technologies. A 10% single-stock capping is applied. The index is reviewed annually in June. ESG criteria will be reviewed on a quarterly basis.

[7] Morgan Stanley, ‘A Deep Dive on the Water Crisis,’ February 14, 2022.