In 2023, BlackRock’s iShares introduced an ETF tracking the EURO STOXX 50® ESG, the sustainable version of the Eurozone’s flagship equities benchmark.

The EURO STOXX 50 ESG’s methodology is simple: it excludes companies in controversial activities and up to 20% of the least sustainable constituents from the EURO STOXX 50® benchmark, reducing reputational and idiosyncratic risks.[1],[2] Replacements are drawn from the broader EURO STOXX® index, selecting companies with the largest market capitalization adjusted by ESG score from the same ICB Supersector as excluded securities.

We recently caught up with Sophie Thurner, ETF Product Strategist at BlackRock, to hear from her how the iShares EURO STOXX 50 ESG ETF fits in investors’ portfolios and how the underlying index has adapted to evolving regulation.

Sophie, what was the driver for the launch of the iShares EURO STOXX 50 ESG ETF more than two years ago?

“The launch of the iShares EURO STOXX 50 ESG ETF was driven by a very clear shift in client demand. Investors were increasingly asking for sustainable core solutions — products that could serve as long-term portfolio building blocks while closely tracking the standard benchmarks they were designed to replace. This interest was initially strongest among retail clients, but we also observed a steady and meaningful shift among institutional investors looking for ESG-aligned exposures without introducing additional risk or tracking error.

At the same time, it was important to offer a sustainable alternative to a benchmark that is widely used, well understood and deeply embedded in asset-allocation frameworks. Such an ESG index allows clients to maintain exposure to a familiar market reference while screening out the controversial business activities they want to avoid.

BlackRock has been committed for years now to giving investors choice. Our sustainable product offering has expanded significantly in recent years as clients have come to define sustainability in different, more nuanced ways. Today, investing sustainably often means integrating ESG considerations into traditional exposures in a measured, pragmatic way — and this ETF was designed precisely with that in mind.”

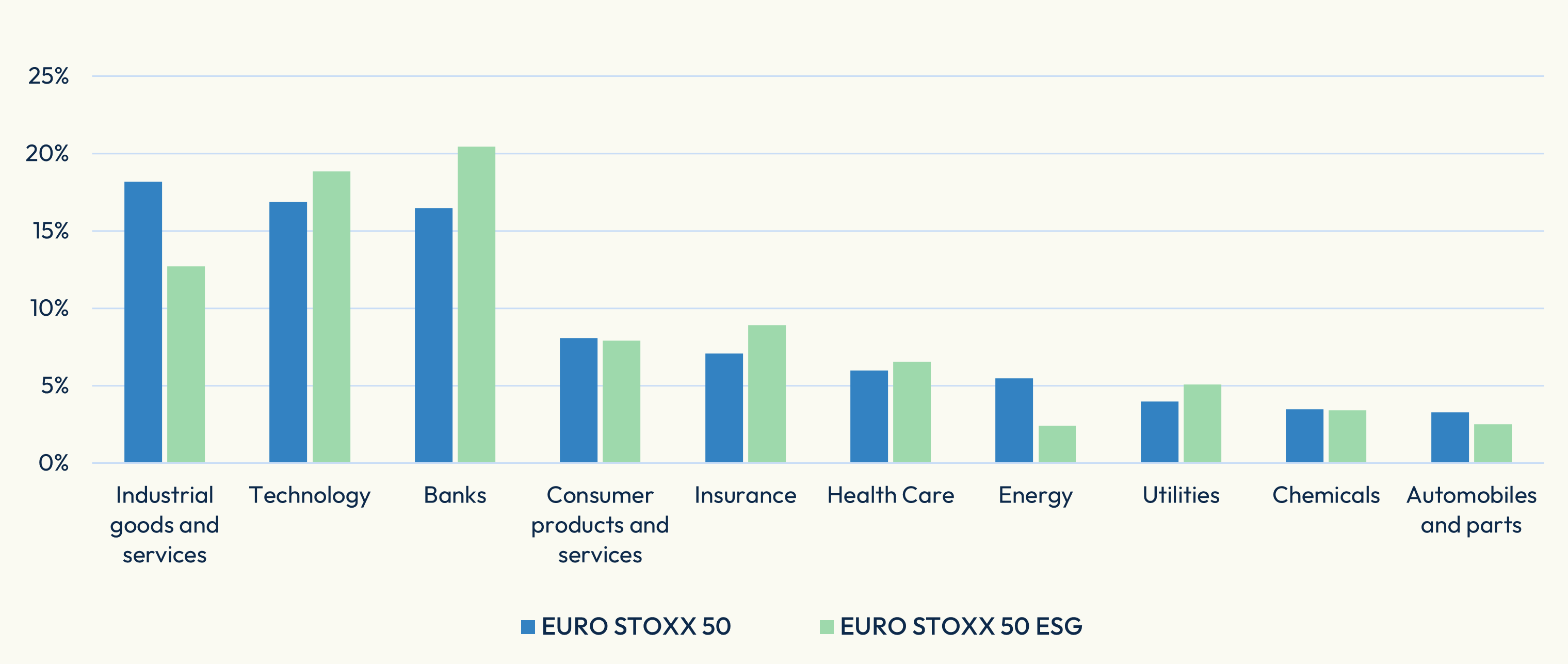

Figure 1: Supersector weightings (top 10 of benchmark)

What makes the iShares EURO STOXX 50 ESG ETF attractive for both retail and institutional investors?

“The ETF’s methodology offers activity exclusions that meet the industry’s standard, while also integrating sustainability parameters positively. The replacement process ensures two things: it increases the portfolio’s sustainability profile — potentially benefitting its risk-return profile vis-a-vis the benchmark — and it preserves sector diversification and a similar industry profile to the benchmark.

While not part of its objective, the EURO STOXX 50 ESG index has also provided higher returns than the benchmark over recent periods.

For many institutional investors who have stricter parameters on how to allocate their capital, the liquid ecosystem around the underlying index, which is supported by the availability of EURO STOXX 50 ESG futures on Eurex, is of high value. This ecosystem allows them to manage and hedge their portfolios in an efficient way and without incurring breaches to their ESG mandates.”

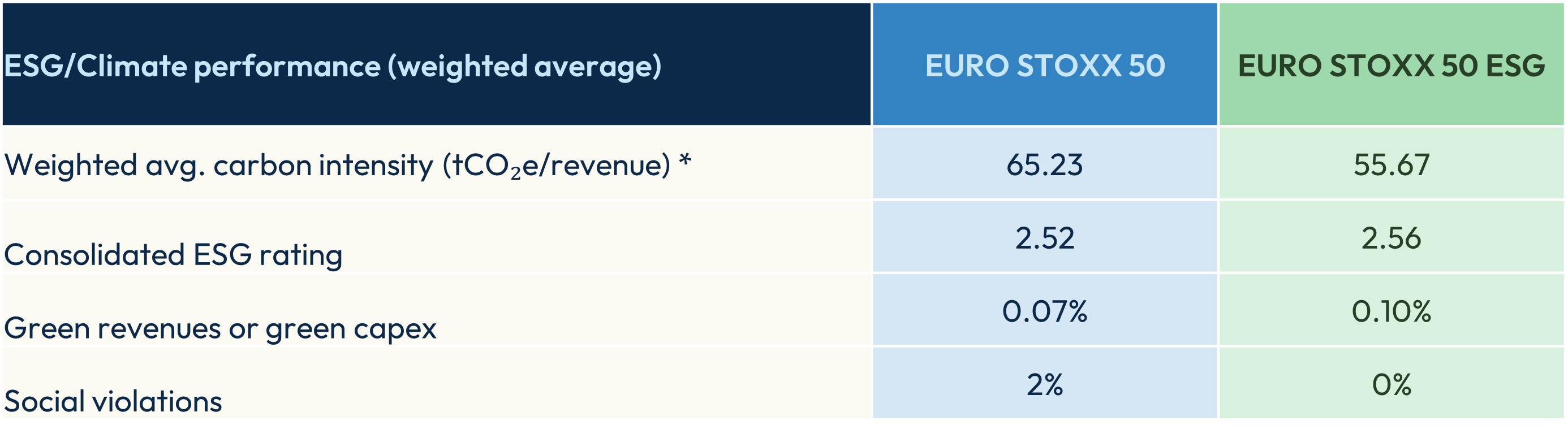

When looking at the sustainability profile, how does the EURO STOXX 50 ESG index compare against its benchmark?

“It’s important to note here that the starting universe is composed of very large, established companies, many of which already operate within highly sustainable standards after years of investments and progress in the field. That said, the EURO STOXX 50 ESG still achieves an improvement in the sustainability profile of a benchmark portfolio across several measures.

The most noticeable factor is the exclusion of controversial activities, which by their own nature can impact the environmental and social standing of the portfolio. A clear example here is the removal of fossil-fuel companies and their replacement by companies exposed to renewable energy. We see an improvement in the portfolio’s carbon emissions and the avoidance of social violations (Figure 2).

The ESG rating is also improved but, as mentioned, it already starts from a high base.”

Figure 2: Sustainability metrics comparison

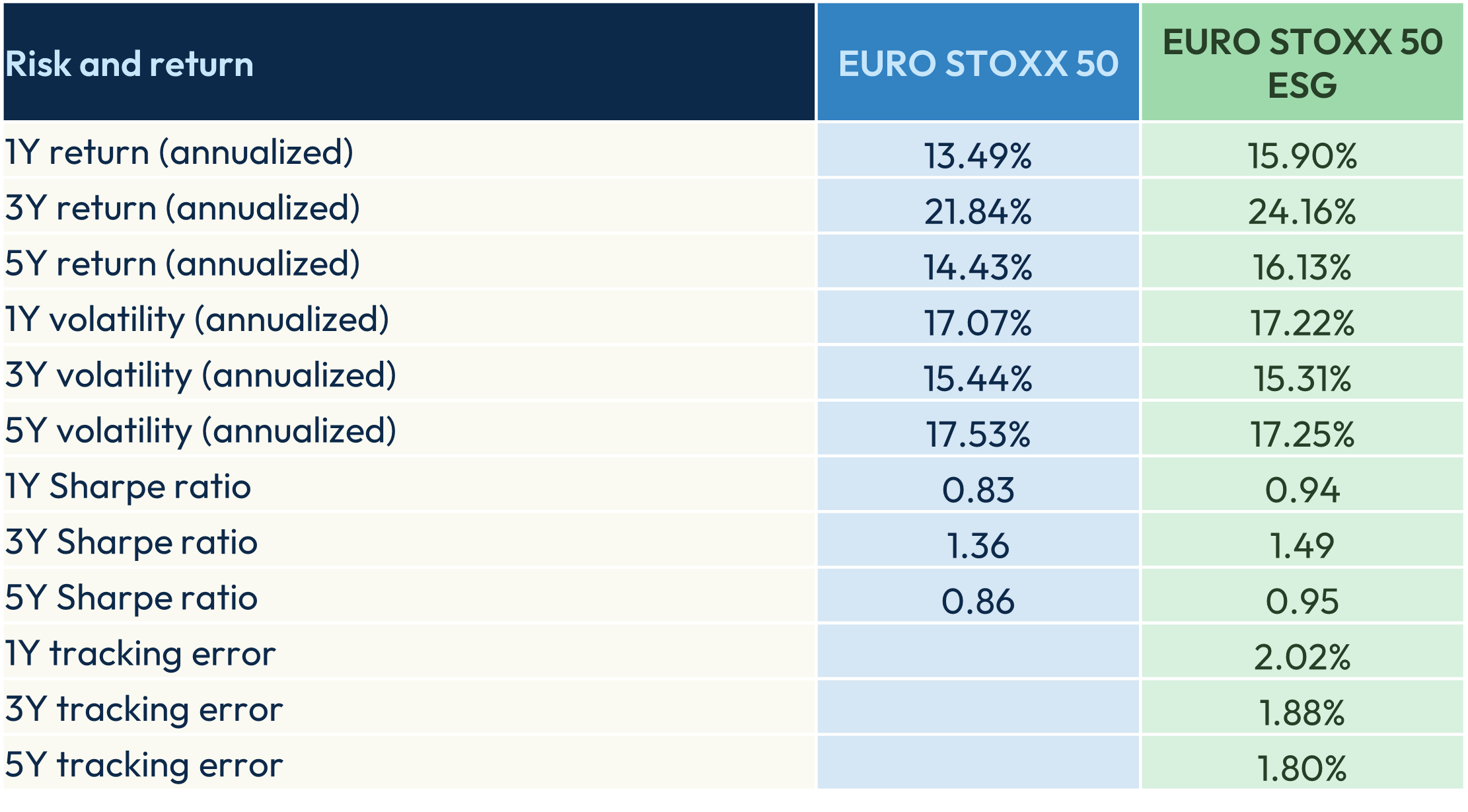

And what about performance?

“The EURO STOXX 50 ESG index has beaten the benchmark over the past 1-, 3- and 5-year periods, while volatility appears slightly lower in the long term (Figure 3). This outperformance has been driven partly by an overweight to financials and information technology, and an underweight to energy and industrials.”

Figure 3: Risk and returns

With evolving regulation and changing investor needs, how do BlackRock and STOXX ensure the EURO STOXX 50 ESG remains aligned with those dynamics?

“Regulation and practices around sustainability have evolved in recent years as the topic becomes more widely accepted and integrated into investment portfolios. In that sense, there is constant dialogue between us, investors and index provider to adapt and make sure we are aligned with shifting investor needs and evolving rules.

STOXX has updated the methodology of the EURO STOXX 50 ESG index a couple of times, implementing changes that meet investors’ preferences and standard practices as reflected on market consultations.

Among such changes, the index methodology was recently updated to apply stricter rules and align with new regulation such as the Sustainable Finance Disclosure Regulation (SFDR), the Markets in Financial Instruments Directive II (MiFID II) and ESMA’s new guidelines on funds’ names using sustainability-related terms. This allows ETF issuers to remain competitive and, importantly, follow best practice.”

Finally, how do you see demand for sustainability products such as the iShares EURO STOXX 50 ESG ETF evolving?

“We expect demand for sustainable products to continue rising as investors’ fiduciary responsibilities expand and as new regulations come into force. Investing with a sustainable focus is here to stay — at BlackRock we share the notion with many clients that financing our world’s future responsibly is a key long-term investment theme.

ETFs will remain central to this shift thanks to their trading efficiency, low cost and ability to implement sustainability-driven strategies in a transparent and scalable way.

At BlackRock, we are pleased to provide clients with the right vehicles to support this transition.”

[1] Removals happen in two steps: first, exclusionary screens are applied. Thereafter, companies with the lowest ESG scores are excluded until a total of 20% of holdings of the initial EURO STOXX 50 components (included those removed as part of exclusionary screens) are removed.

[2] Screenings use data from ISS Sustainability.