BlackRock is switching the underlying index for the iShares STOXX Europe 50 UCITS ETF (DE) to the STOXX® Europe 600 Top 20, offering exposure to a smaller number of mega-caps in the broad European region.

The fund, which has until now tracked the STOXX® Europe 50, will be renamed iShares STOXX Europe 600 Top 20 UCITS ETF (DE).

The Germany-listed ETF was one of the first ETFs to be launched in Europe a quarter-century ago. The fund was listed in December 2000, only months after the Ireland-listed iShares STOXX Europe 50 UCITS ETF EUR Dist. inaugurated Europe’s ETF industry in April of that year. The latter, which holds nearly EUR 600 million in assets[1], also tracks the STOXX Europe 50 index and will continue to do so.

The index

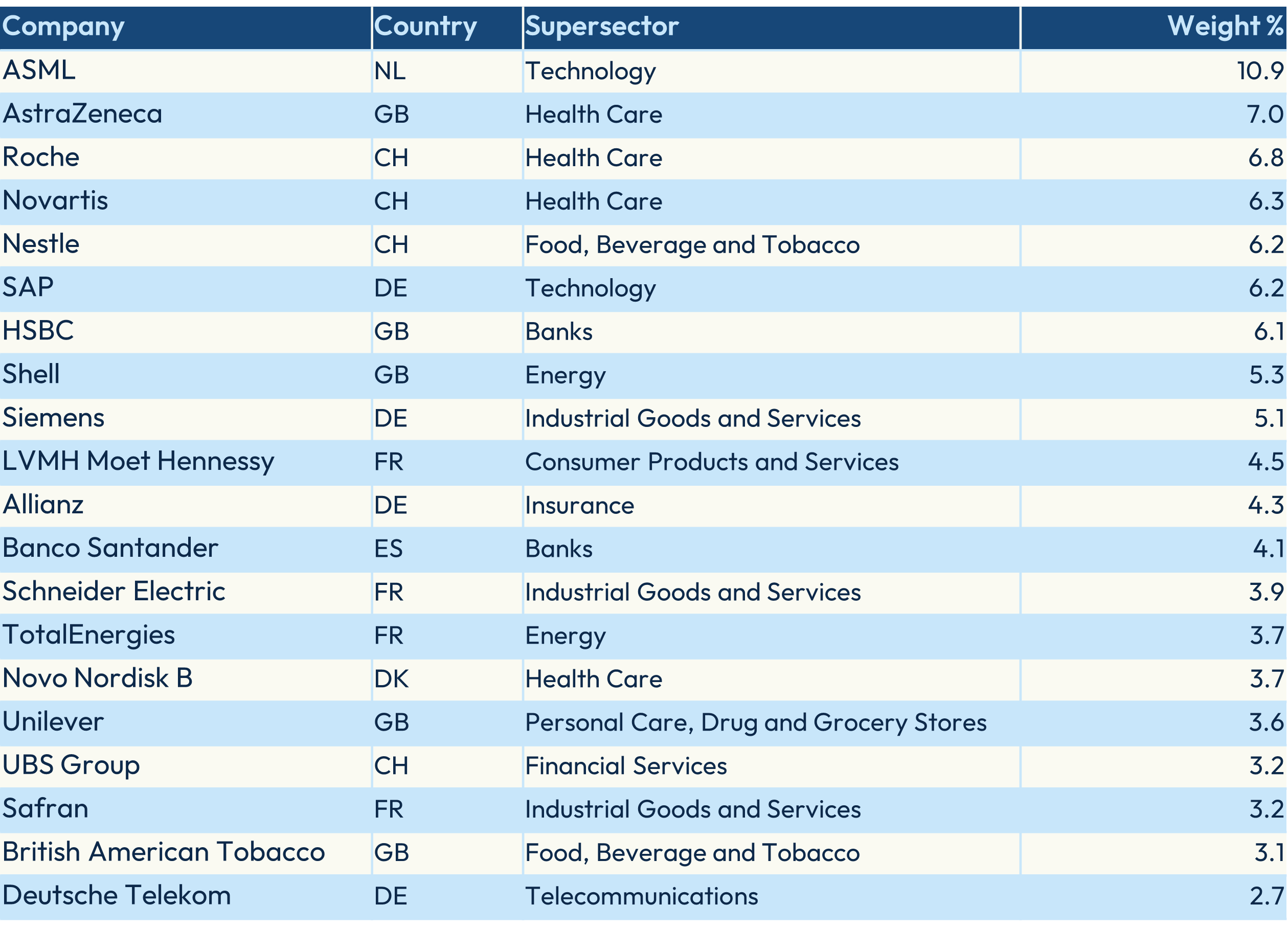

The STOXX Europe 600 Top 20 is derived from the STOXX® Europe 600 benchmark, which covers 17 developed European markets, and selects the 20 largest constituents in the parent index by free-float market capitalization at each quarterly review. Figure 1 shows its current holdings.

Figure 1: Index constituents

The revamped ETF will expand the range of choices for European investors at a time of rising interest in the region’s equities. A total of EUR 25.3 billion has flowed into EMEA-based European equity-focused ETFs in 2025.[2] Currently 79 BlackRock ETFs track a STOXX or DAX index, with total assets under management of EUR 85 billion.[3]

1 Data from BlackRock on December 17, 2025.

2,3 Source: STOXX. Data through November 2025.