In June this year, BlackRock and STOXX celebrated the third anniversary of a partnership devised to enhance the asset manager’s global suite of multifactor ETFs with a modern and balanced approach to factor investing.

The collaboration resulted in six US-listed iShares funds, which track STOXX indices and seek to deliver above-average and optimized exposure to five factors constructed with the latest academic research, while controlling for risk. The ETFs offer some of the lowest management fees in the industry and have amassed over USD 10 billion in assets to date,[1] attracting a combined USD 3.4 billion in net inflows in 2024 and 2025.[2]

The strategy has since expanded to an additional seven funds listed in Europe and Australia.

We recently caught up with Priya Panse, CFA, lead strategist for BlackRock’s US Factor ETFs business. We asked her about the current state of factor investing, what defines a modern factor strategy, and what the collaboration with STOXX has brought to the iShares offering. Below is our exchange.

Priya, factor investing has evolved in recent years. How have BlackRock’s factor strategies changed?

“Factor investing, of course, has been around for decades. But the definition of factors — and how we think about them — has evolved.

One major driver of this evolution is the incorporation of more nuanced and unique signals alongside traditional factor concepts in order to better capture the essence of each factor. The way we view markets has changed, as have companies themselves. By leveraging richer and deeper datasets and our research partnerships with STOXX and across BlackRock, we’re ensuring that the signals driving our factor ETFs adapt with the market and remain relevant to investors.

Another important development is the recognition — through years of data — that factors go through cycles, and that they interact with each other. With that knowledge and empirical evidence at hand, we can now measure and control risk more effectively, both at the individual factor and portfolio levels.”

Let’s focus on your first point: the evolution of factor definitions. Can you provide one or two examples to illustrate this?

“Most factor definitions have evolved on the back of improved datasets and a better understanding with time of how different metrics interact with each other.

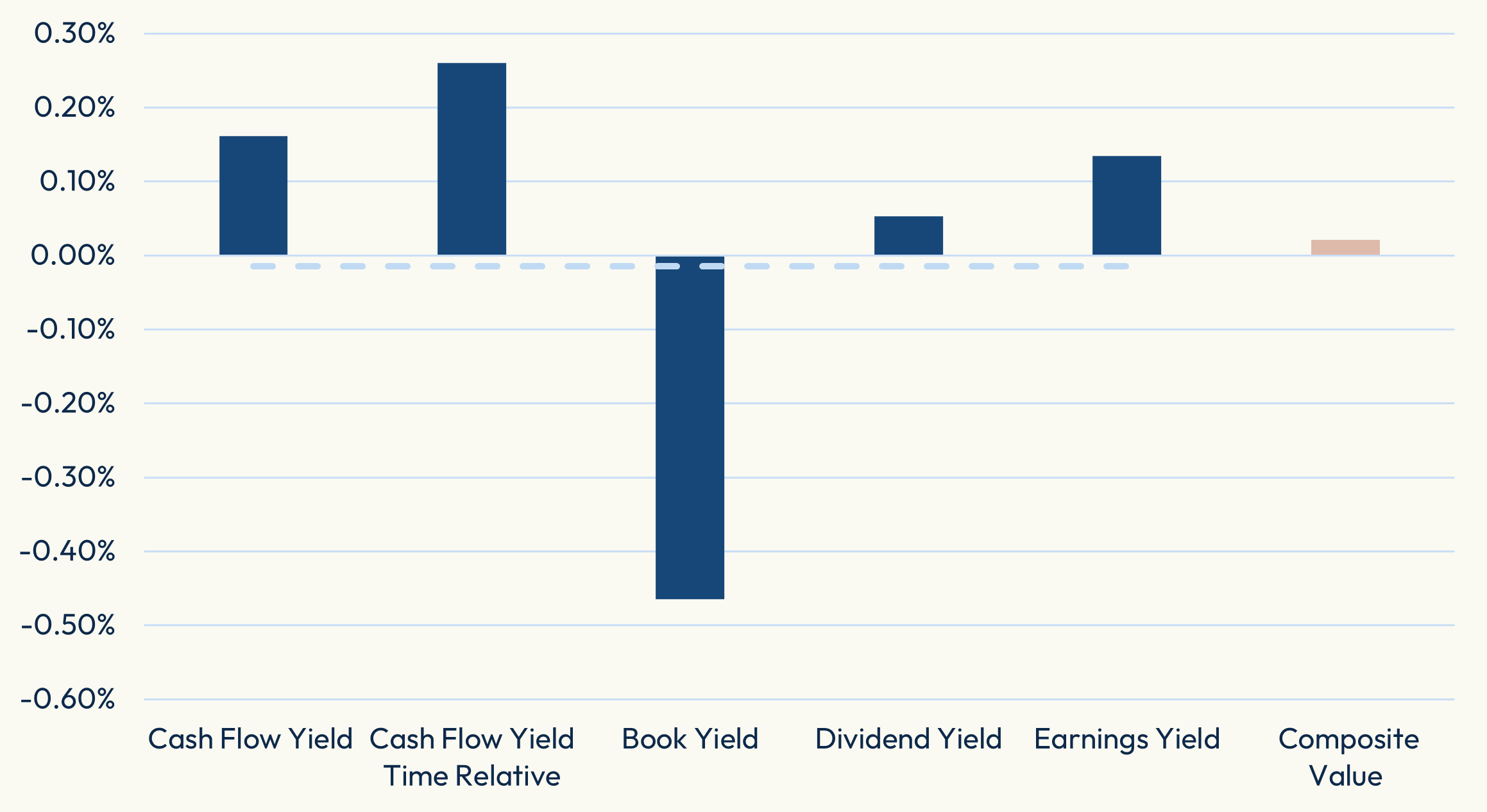

A clear example is Value, where the shift in measurement has been especially significant. The classic definition – price-to-book – was built in an era when tangible assets largely drove corporate value. This metric has underperformed relative to other value metrics (Figure 1). Today, especially in developed markets, intangible assets like R&D, intellectual property, brand equity and human capital are often left off the balance sheet. That’s why, in the iShares Core Multifactor ETF range, we use a composite Value signal that includes price-to-earnings, price-to-sales and enterprise-value-to-cash-flow, among others. This multi-signal approach avoids the overreliance on any single distorted metric that can negatively impact returns.”

Figure 1: Active returns – USA Value factor

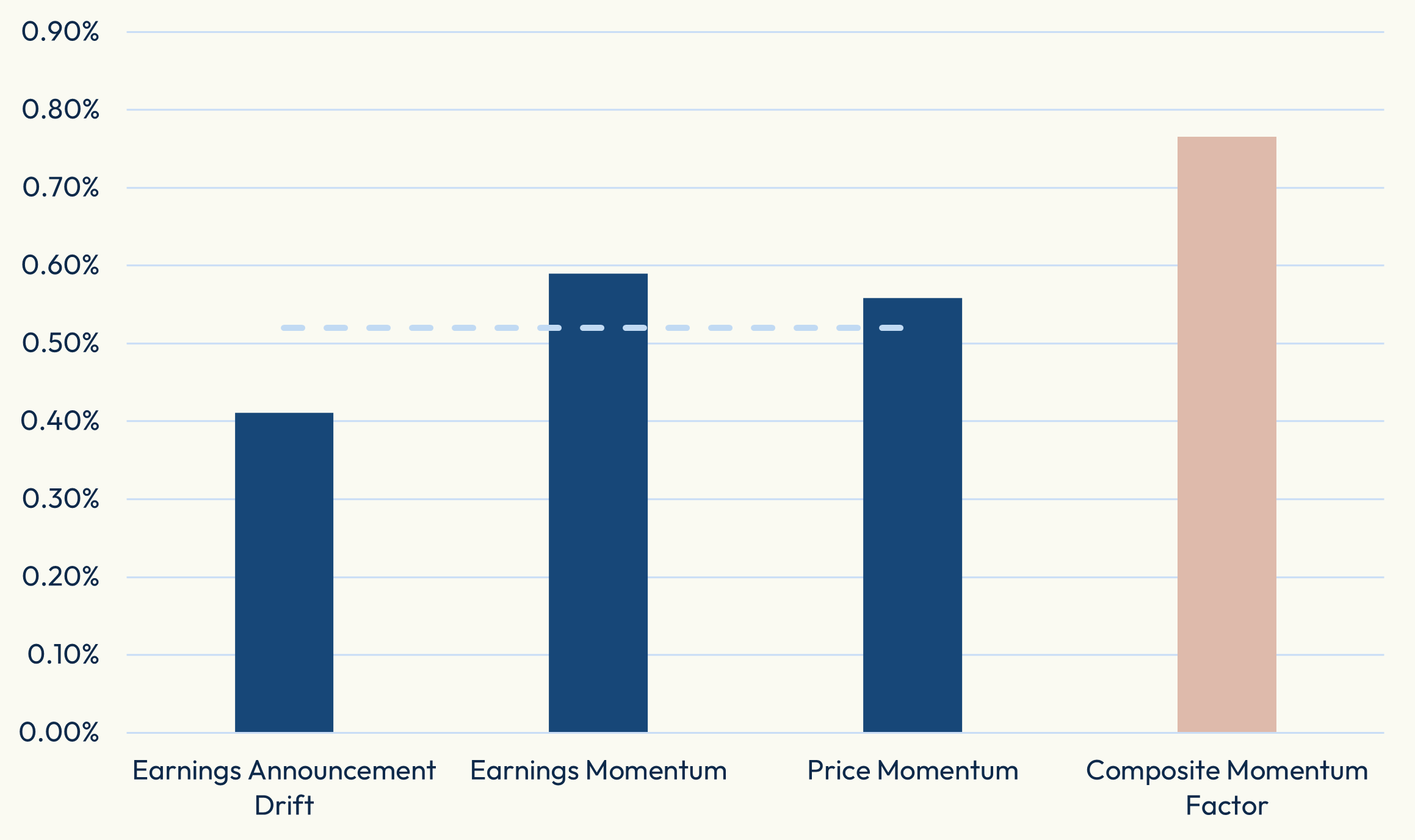

“Momentum is another compelling example. Traditionally, it’s been defined using a stock’s simple, 12-month share-price appreciation, excluding the most recent month to avoid short-term reversal effects. But today’s markets are faster, flooded with information and more prone to short-term noise. Our research has shown that combining Momentum signals across both price and fundamentals — such as earnings momentum or earnings momentum drift — enhances signal strength (Figure 2). This approach helps us avoid simplistic exposures and better reflect what Momentum truly represents: a behavioral phenomenon rooted in investor underreaction, and not just a statistical artifact.”

Figure 2: Active returns – USA Momentum factor

“It’s worth emphasizing here that innovating in factor design does not mean neglecting traditional factor definitions, but rather building on them to create more robust signals.”

You also mentioned the inherent risk embedded in factors. How should a modern factor portfolio take that into consideration?

“It’s important to recognize that not all factors carry the same systematic risk, and that has direct implications for portfolio construction. While we may intuitively want to ‘equally weight’ across the five target factors in the iShares Core Multifactor ETF range — Value, Quality, Momentum, Size and Minimum Volatility — that approach can lead to unintended concentrations of risk, especially when some factors are more volatile or more correlated with each other.

Instead, we take a risk-aware approach, allocating factor exposures in a way that balances their contribution to the overall portfolio risk, rather than weighting them equally based on raw signal strength. For example, Momentum tends to have higher volatility and turnover than Quality. If we naively equal-weighted it, it could overwhelm the contribution of other, more stable, signals and introduce an excessive tracking error.

That’s why, in our Core Multifactor ETFs, we use an optimization framework, developed in partnership with Axioma and STOXX, that explicitly accounts for factor volatilities and correlations. We aim to maximize the multifactor exposure subject to risk and also cost constraints, not equal exposure for its own sake. Our typical tracking error target of 1–2% helps ensure that the portfolio stays suitable for core allocations, while still aiming to deliver a persistent factor premium.

In other words, it’s not about giving each factor the same weight — but rather giving them the appropriate risk budget within a diversified, long-term investment solution.”

Can you briefly describe, in that context, how you build the multifactor portfolio?

“We start by defining the targeted factors based on decades of academic research and validated across economic cycles. For each factor, we use diversified multi-signal definitions as described earlier to improve the robustness of the factor capture.

Once we’ve defined our factors, we apply an optimized portfolio construction process that:

- Maximizes the multifactor exposure across stocks

- Constrains tracking error to maintain market-core characteristics

- Controls sector and stock-specific risk and ensures minimum levels of factor risk

Multifactor strategies also offer an advantage in managing market cyclicality. Single factors can go out of favor — sometimes for years. By combining complementary factors — like Momentum, which thrives in trending markets, and Value, which often rebounds in reversals — we can mitigate drawdowns and aim for a more balanced return profile over time.

Ultimately, the approach in our systematic multifactor construction process reflects the same principles we bring to institutional portfolios: robust signal design, disciplined risk management and cost-efficient implementation. The latter is a main focus in this ETF suite. By almost halving costs relative to other factor strategies, we ensure the products are in line with traditional core solutions.”

What does a systematic, index-based methodology add to factor investing? And what is the benefit of collaborating with an index provider like STOXX?

“A systematic, index-based approach brings transparency, consistency and cost efficiency — hallmarks of modern factor investing. By clearly defining, weighting and rebalancing factors, this methodology ensures repeatability and discipline over time.

Our collaboration with STOXX strengthens this foundation. They contribute deep index design expertise, while integrating insights from BlackRock and third-party research to keep the index client-aligned and forward-looking. This partnership allows us to deliver institutional-quality multifactor strategies in an ETF wrapper — with the efficiency and scale that investors expect.”

Where does a multifactor strategy like this one fit in a portfolio?

“We see multifactor strategies like LRGF[3] and INTF[4] as ‘enhanced core’: a way to move beyond simple market-cap weighting without introducing excessive complexity or cost.

By combining multiple rewarded factors within a single, risk-managed portfolio, we aim to provide a smoother ride across market cycles. These ETFs are designed to replace traditional core equity holdings with balanced exposures to long-term drivers of returns.”

To finish off, how has the iShares multifactor suite performed since launch three years ago?

“The past three years have been a volatile period, marked by sharp factor rotations, inflation surprises and diverging Growth and Value performance. Yet the suite held up well, demonstrating the benefits of diversification and disciplined risk controls.

In 2023, for example, Value underperformed Growth by more than 30%. But LRGF — which balances exposures to Value, Quality, Momentum, Low Volatility and Size – performed in line with the broader market. This is by design.

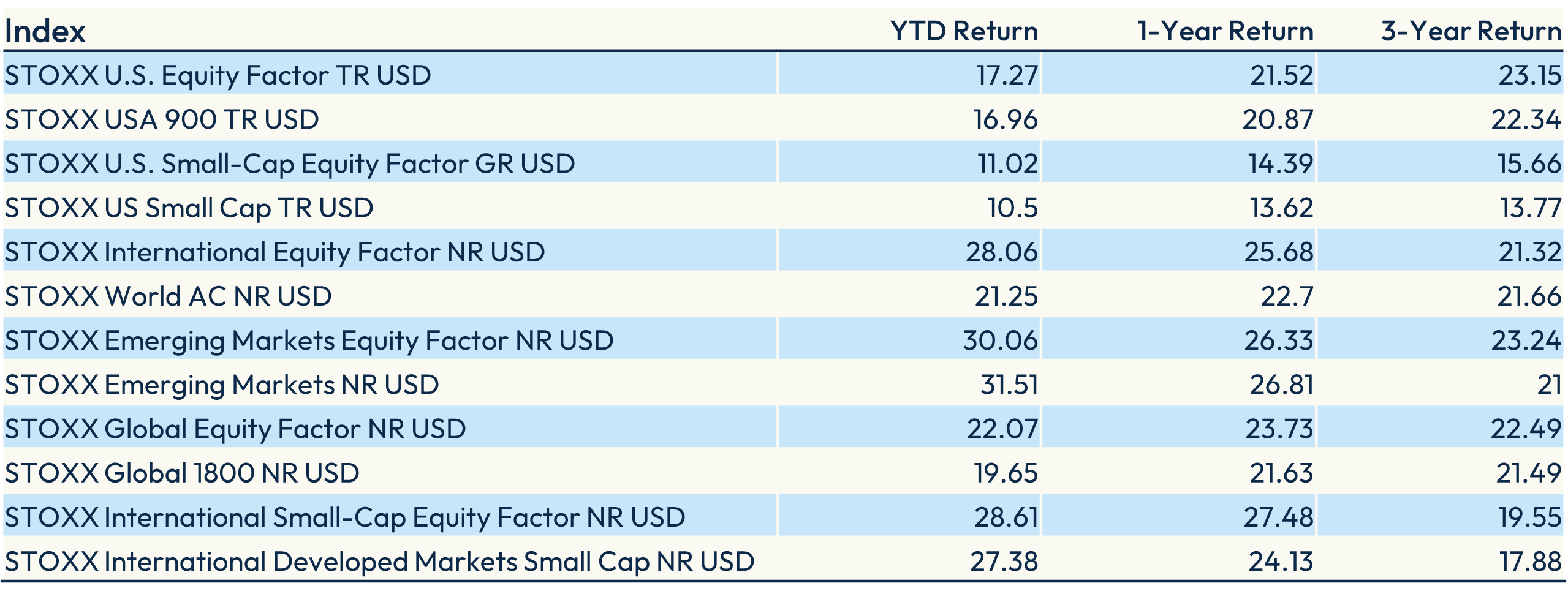

From June 2022 through June 2025, the STOXX® U.S. Equity Factor index — which underpins LRGF — delivered top-quartile performance across the 1-, 2- and 3-year periods, or 1.3% annualized active returns on a cumulative basis. That’s the power of a systematic, multifactor approach delivering resilient outcomes through cycles.

The story is even stronger in US small-caps, where SMLF[5] has been a real standout. Nearly half of the popular Russell 2000 index is unprofitable — but SMLF, which tracks the STOXX® U.S. Small-Cap Equity Factor index, tilts towards higher-quality, more profitable companies alongside other desirable factors. That discipline has driven top-decile performance across the 1- and 3-year periods.

Such performance is consistent across the suite of our multifactor ETFs.”

Figure 3: 3-year performance

[1] Data as of December 15, 2025.

[2] Source: STOXX. Data as of end of November 2025.

[3] LRGF is the iShares U.S. Equity Factor ETF.

[4] INTF is iShares International Equity Factor ETF.

[5] SMLF is LRGF is the iShares U.S. Small-Cap Equity Factor ETF.