DWS’ Xtrackers has adopted the recently launched STOXX® Europe Total Market Leaders index to overhaul the investment objective of one of its funds.

The fund has been renamed Xtrackers Stoxx European Market Leaders UCITS ETF[1]. The new strategy seeks to select companies with a dominant market position, competitive business advantage and superior profitability relative to peers.

The underlying methodology stands out for selecting and allocating weight to companies’ fundamental factors that have shown the potential to generate above-average investment returns.

New index methodology

From the starting universe of the STOXX® Global Total Market index excluding REITS[2], all securities are screened for minimum size and liquidity. Each company is evaluated for its market share across all segments (RBICS Level 6) in which it operates in.

Companies must meet the following criteria to enter the STOXX Europe Total Market Leaders:

- Market leadership: Companies must have a market share of 40% or higher and be at least two standard deviations above the global sector peer average.[3]

- Competitive advantage: Companies must rank in the top 50% within their subtheme group in R&D Expense/Book Value, or top 50% in Intangible Assets Value/Book Value.

- Profitability: Companies must be either Profitability Leaders or Profitability Growers, defined as ranking in the top 25% of their group in several profitability metrics.

- European membership: Companies must be part of the STOXX® Europe Total Market index

From all remaining constituents, the 40 largest companies by free-float market capitalization are selected.

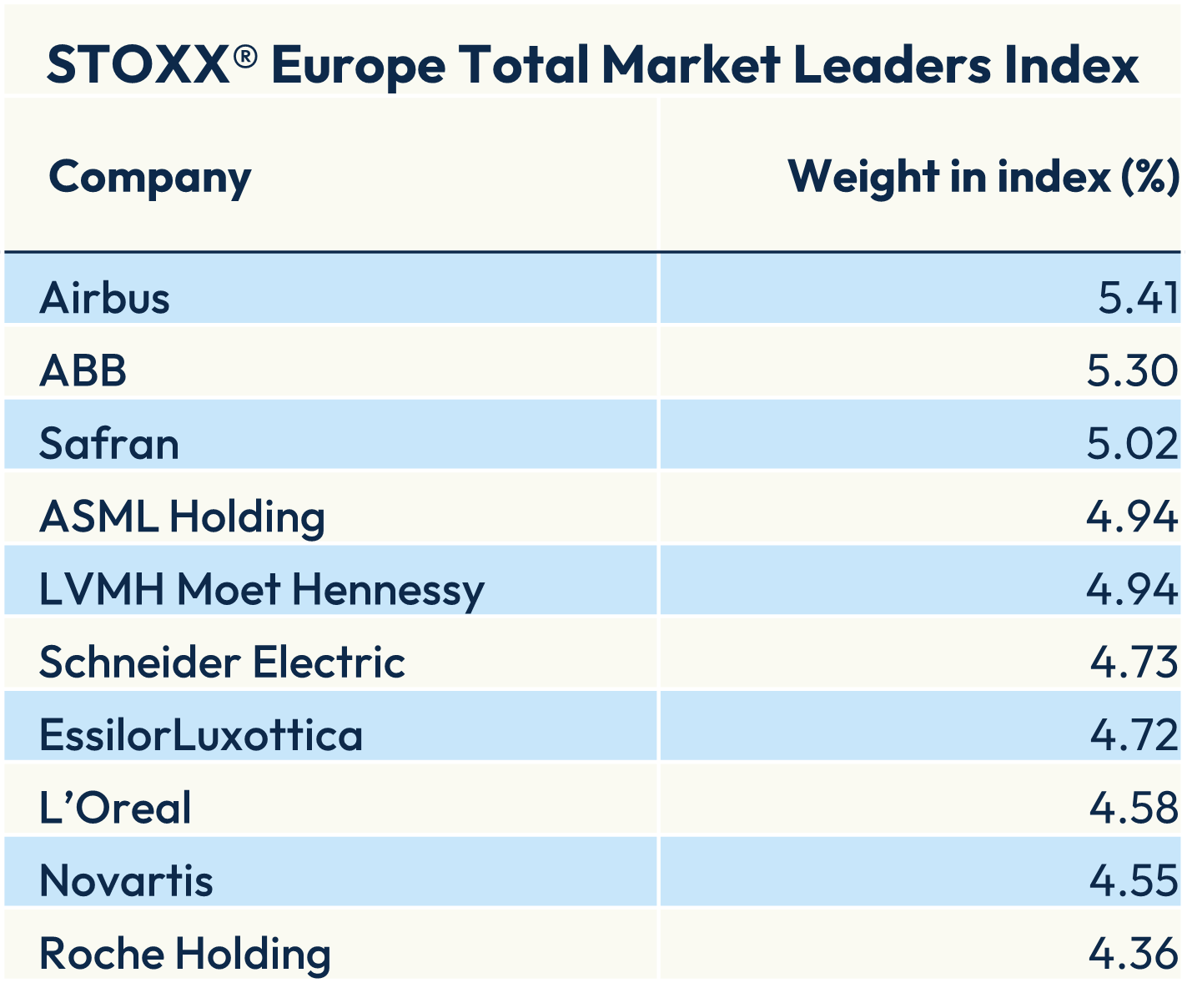

Figure 1 shows the STOXX Europe Total Market Leaders’ top 10 components, out of 40 in total.

Figure 1: Index top 10 components

Performance

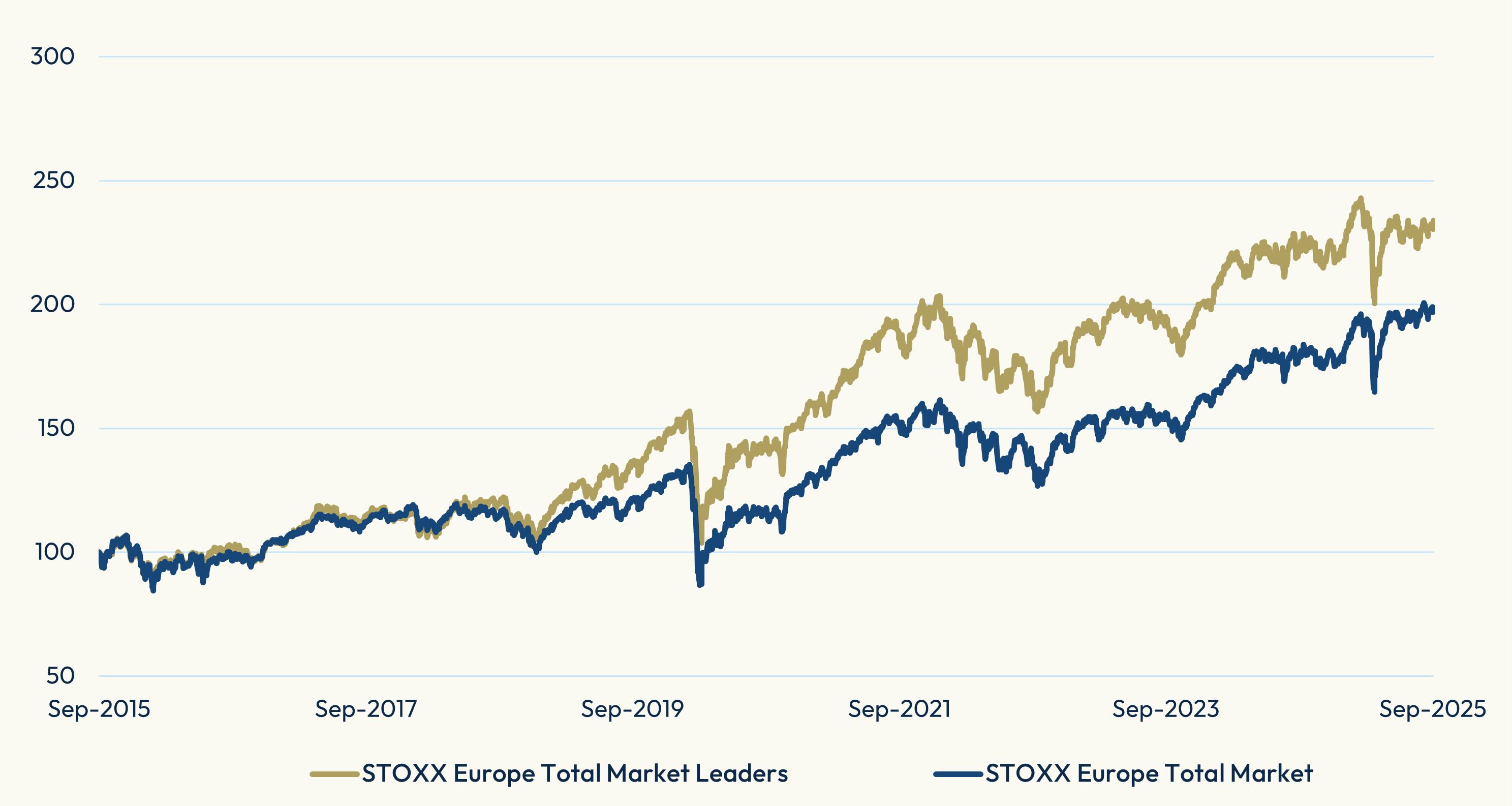

In the past ten years, the STOXX Europe Total Market Leaders index has beaten the STOXX Europe Total Market benchmark by a cumulative 35 percentage points (Figure 2).

Figure 2: Index performance

STOXX and Xtrackers by DWS have now collaborated in the design of more than 15 ETFs. This latest launch deepens that collaboration and illustrates the customization capabilities in index building.

[1] Previous name was Xtrackers MSCI Europe Consumer Discretionary Screened UCITS.

[2] Real Estate Investment Trusts.

[3] For current components, the thresholds are lowered to 35% and at least 1.5 standard deviation above the sector peer average, respectively. Revere Revenue dataset allows detailed breakdown of the revenue sources of the eligible companies.