Last September, Eurex introduced total-return futures (TRFs) on the STOXX® Europe 600, expanding an increasingly popular type of exchange-traded derivatives to a broad pan-European benchmark for the first time.

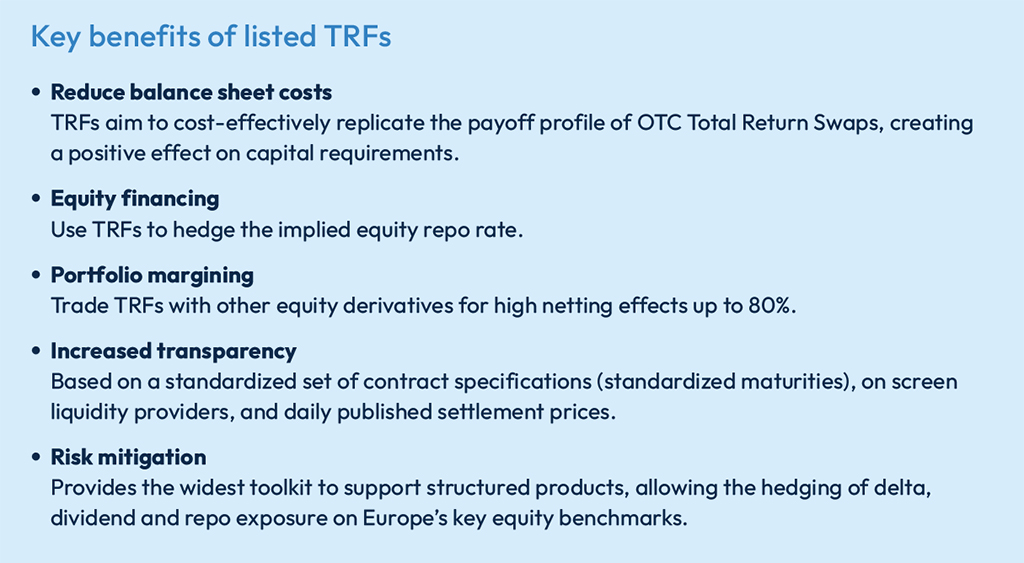

The new contracts came amid record trading in products tracking the index, which include futures, options, ETFs and structured products. TRFs are growing in volumes as they allow traders and fund managers to hedge risk, improve capital margin obligations and, overall, manage portfolios and balance sheets more efficiently.

TRF volumes saw a significant uptick following the Trump administration’s April 2 announcement of reciprocal trade tariffs. In the following six days, average daily volumes in the EURO STOXX® 50 TRFs exceeded 100,000, according to Eurex.

As the first STOXX Europe 600 TRF contracts have exchanged hands, we caught up with Stuart Heath, Product R&D for Equity and Index at Eurex, to ask him what the products add to investors’ toolkit.

Stuart, what was the objective behind the launch of the STOXX Europe 600 TRFs?

“The STOXX Europe 600’s ecosystem continues to grow because the index is seen as a very good, broad-based representation of Europe, covering all major national markets and the largest stocks in the region. As options volumes on the index have grown, the dividend and repo exposures of those positions have become more relevant for traders.

Banks that provide bespoke investable solutions need a hedging instrument. The STOXX Europe 600 is a very good alternative because its broad coverage lends itself to multiple strategies — thematic, sector-based, etc. As issuers select different constituents to construct those portfolios, at the end of the day they are likely to hedge their exposures with a STOXX Europe 600 TRF.

There is hedging demand for TRFs, not necessarily from the users of STOXX Europe 600 products at Eurex, but also from buyers of STOXX Europe 600 constituents, particularly in the QIS[1] and custom index spaces. Those products will have some sort of financing and dividend exposure, which can be hedged with a STOXX Europe 600 TRF.

Our view at Eurex, then, was that the STOXX Europe 600 product suite would be completed by a TRF.”

Can you walk us through the main use of a TRF?

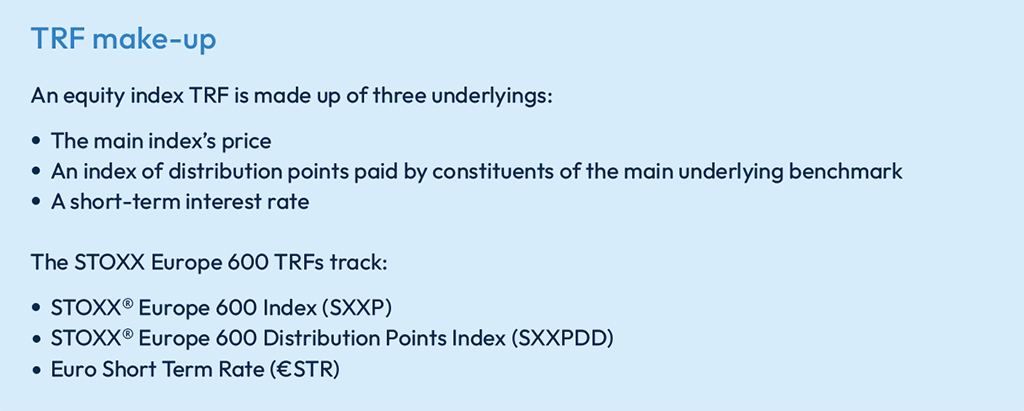

“The primary use of a TRF, or where the initial supply and demand comes from, is to manage the repo or financing risk. Regular index futures have an embedded financing cost, the standard cost of carry, which has been quite volatile recently. The TRF is used to lock in that financing rate.

However, another important use of the products is to hedge the dividend risk in the market. Particularly during the COVID-19 pandemic, there was increased awareness that normal index futures carry significant exposure to dividend fluctuations, whereas the TRF will pay out the index’s realized dividend as calculated by STOXX. In a TRF, traders don’t have to forecast and bake dividends into the calculation of forward prices – it’s done automatically. So, they have less pricing sensitivity to dividends than do price-return futures and therefore help users avoid dividend risk.”

Who are the main users of TRFs?

“Because TRFs are designed to reflect the total return of the index, they serve a different purpose than do traditional index futures. One of the key TRF user groups are sell-side issuers of long-dated structured products, which often have maturities of up to 12 years. These products create significant long-term repo and dividend risk exposure for the banks that issue them. TRFs are much better suited for longer-term position and risk hedging than standard futures, which are fantastic for liquidity but have their own issues in terms of managing repo and dividend risk along the curve.”

The STOXX Europe 600 has a larger constitution and broader market coverage than the EURO STOXX 50, whose TRFs are already popular. How do those differences impact the use of TRFs on the STOXX Europe 600?

“While much of the initial demand for EURO STOXX® 50 index TRFs came from issuers of structured products, in the case of STOXX Europe 600 TRFs demand will be more buy-side oriented, coming from investors with passive exposure to Europe. This is because of the breadth of the STOXX Europe 600 and the hedging required for all the stocks. We see demand more driven by a Europe-vs.-US exposure rather than structured-product exposure to Europe by itself. This may imply a slower uptake, because of the buy-side’s nature. Getting into the systems of the buy-side is a significantly longer task than it is for the sell-side.”

Can TRFs co-exist with regular futures, or will they take over market share?

“My view is that they are symbiotic rather than cannibalistic. If you look at the open interest in notional value terms, there has been an increase in the EURO STOXX 50 TRFs without any loss in the open interest of regular futures. The distribution is spread almost 50%-50%. The same goes for the TRFs and traditional futures we have on other indices such as the EURO STOXX® Banks and EURO STOXX® Select Dividend 30.”

How do you see demand evolving for TRFs?

“Demand will be driven mainly by underlying economics. The fastest-growing TRF story right now is in the US, simply because that is where the biggest global exposure to equities is. That focus will probably shift to Europe and maybe Asia at some point. I don’t see any great change in dynamics other than continuous, organic growth in demand.”

For more on the functioning of STOXX-linked TRFs, please visit a dedicated section on Eurex’s website.

[1] Quantitative Investment Strategies.