It’s springtime in Europe, and that means dividend season has started.

The period will also bring increased spotlight on one of the most active corners of the derivatives market: that of index dividend futures and options.

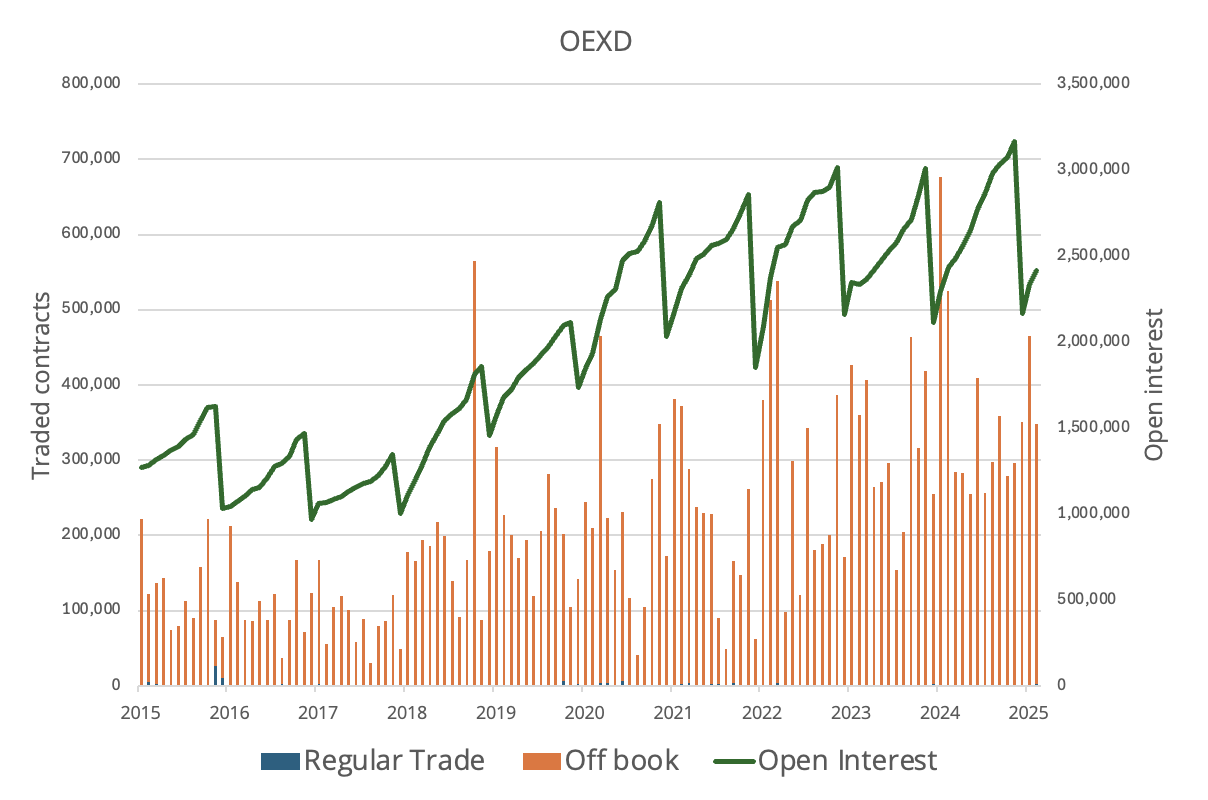

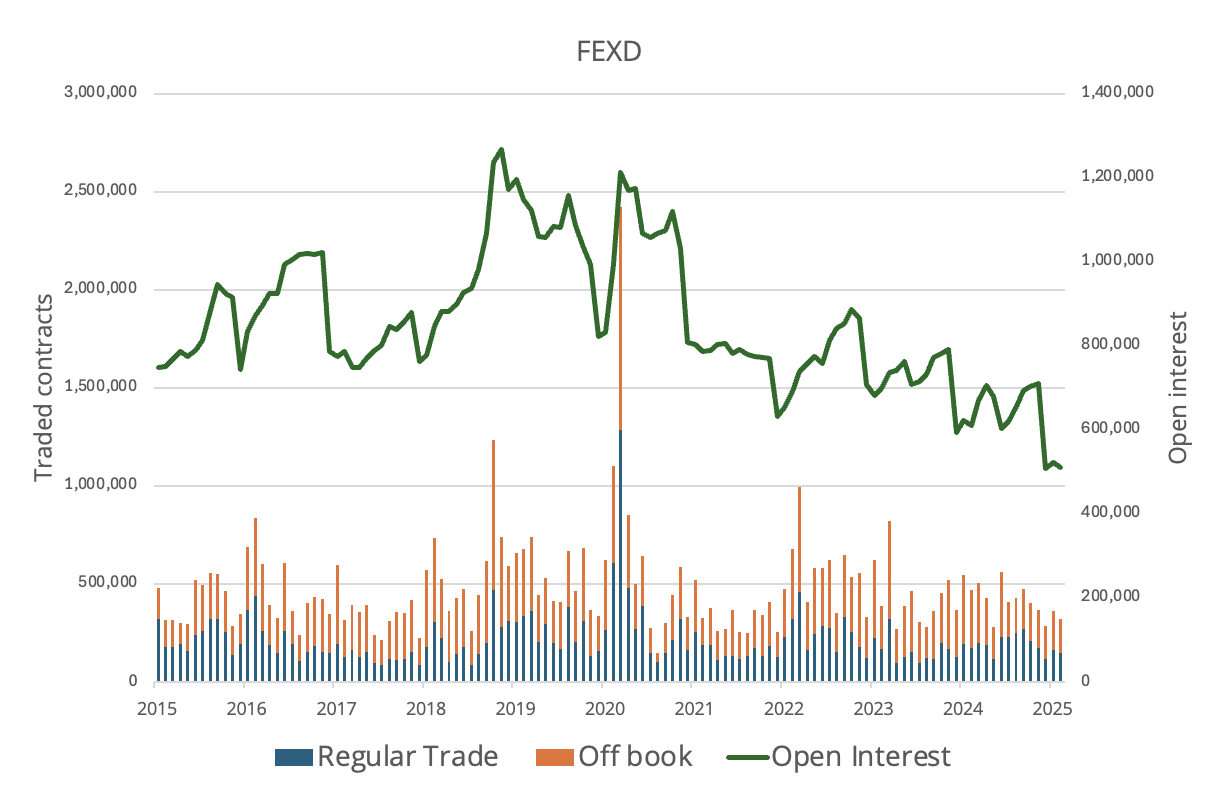

One defining feature of the trading calendar in the aftermath of the COVID-19 pandemic has been increased demand for options (OEXD) on EURO STOXX 50® Index Dividend Futures, rather than for the futures (FEXD) themselves.

Figure 1: Trading and open interest in EURO STOXX 50 Index Dividend Options

Figure 2: Trading and open interest in EURO STOXX 50 Index Dividend Futures

Lorena Dishnica, from Eurex’s Product Design team for equity and index, says higher visibility and lower volatility over company payments in the last couple of years has helped narrow the valuation gap that typically exists between index dividend futures and actual dividend payments from companies. Options, on the other hand, are a less risky and cheaper tool to position for possible market moves.

“With futures you need an entry point to get in, where you see either potential valuation upside or downside,” said Lorena. “The market is telling us that all of the good news is fully priced in, no-one is expecting any directional move outside of a shock event. Traders are probably hedging with puts on the downside, and on the upside they’d rather pay a premium for calls rather than buying the product outright.”

Index dividend futures settle to the annual value of the EURO STOXX 50® DVP (Dividend Points) Index, which calculates the gross cash dividends paid out by constituents during the annual period. EURO STOXX 50 Index Dividend Futures expiring in December traded at 165.8 on March 17, implying a 3.1% increase in underlying payments relative to 2024.

Product evolution

Listed dividend derivatives were born over a decade ago out of traders’ and structured-product issuers’ need to hedge dividend risk, and have become an established market since then.

Over 5 million EURO STOXX 50 Index Dividend Futures traded at Eurex in 2024, slightly less than a year earlier, according to data from the exchange. A total of 4.3 million EURO STOXX 50 Index Dividend Options exchanged hands last year, 11% more than in 2023 and 25% higher than in 2022. Volumes so far in January and February this year suggest growth in annual numbers may continue.

Eurex last year launched mid-curve options on the EURO STOXX 50 index dividends futures. The options have quarterly expiries over the next five years, allowing participants to fine-tune dividend risk management or anticipate changes in dividend expectations. The new, shorter maturities are also aligned with an increasing trend from companies to pay interim dividends.

| Available at Eurex |

|---|

| Index dividend futures EURO STOXX 50 Index Dividend Futures (FEXD) EURO STOXX Banks Index Dividend Futures (FEBD) EURO STOXX Sector Index Dividend futures Options on index dividend futures EURO STOXX 50 Index Dividend Options (OEXD) 1-Year FEXD mid-curve options (OED1) 2-year FEXD mid-curve options (OED2) 3-year FEXD mid-curve options (OED3) 4-year FEXD mid-curve options (OED4) 5-year FEXD mid-curve options (OED5) |