BlackRock and STOXX have expanded their collaboration in thematic investing with two new ETFs that target specific segments in the rollout of Artificial Intelligence (AI).

The launch of respective iShares ETFs tracking the STOXX® Global AI Infrastructure and STOXX® Global AI Adopters and Applications thematic indices allow investors fine-tuned exposure to companies in different stages and involvement in a technology that promises to be far-reaching and disruptive.

The two indices are part of the STOXX Artificial Intelligence Suite, a growing family of thematic indices that track stocks across the full AI value chain. Index construction leverages the STOXX Thematics Framework, which uses revenue and/or patent-based approaches to capture a diverse range of companies at various stages of AI adoption.

“AI is transforming the investment landscape, offering unprecedented potential growth and innovation opportunities,” said Manuela Sperandeo, Head of Europe and Middle East, iShares Product, at BlackRock. “We are committed to empowering investors with the choice to access AI through the convenience of the ETF wrapper. ETFs have become an increasingly critical part of European portfolios, with one in five investors now holding them, a 19% relative increase in ETF investors in Europe since 2022.”[1]

BlackRock Investment Institute analysts consider AI a mega force[2] that will drive unprecedented investment and will disrupt productivity worldwide, potentially triggering a major shift of economies and markets.[3] While forecasting the economic impact of AI is a difficult task, they say the technology will generate new revenue streams and investment opportunities across the “tech stack” and beyond.

STOXX Thematics framework

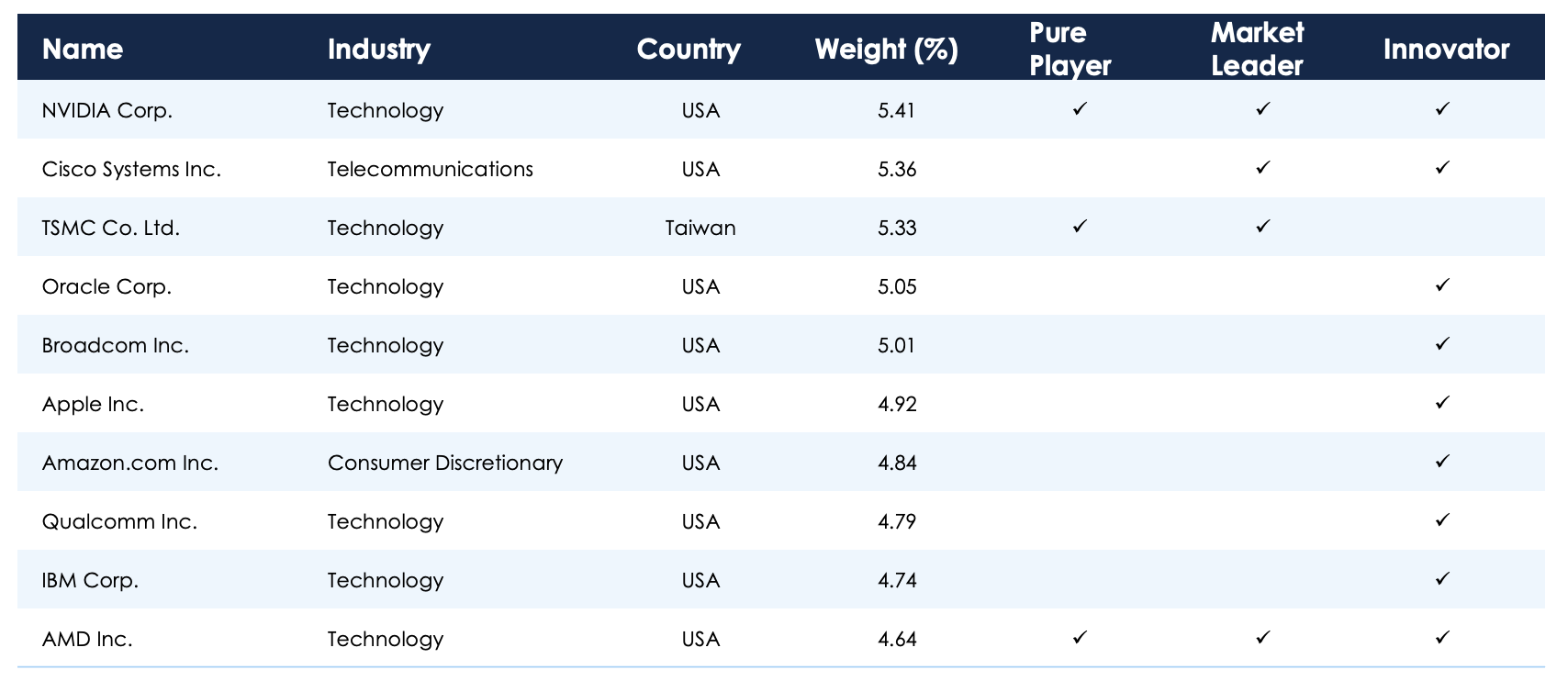

The dual revenue/patent approach allows the indices to spot innovators and market leaders in fields at the center of the respective themes. The STOXX Global AI Infrastructure index also targets so-called pure players, or companies that already generate a majority of their revenue from AI infrastructure products and services.

‘Picks and shovels’

The STOXX Global AI Infrastructure index seeks to identify companies that play a central role in the development and evolution of the building block components for AI, such as semiconductors, cloud computing and big data technologies. In other words, the ‘picks and shovels’ supporting the technology. Stock selection is conducted through a mix of companies’ revenue streams and patent exposure to the theme.

Developers involved in this infrastructure deployment may be at the front line of (and be the immediate beneficiaries of) the AI buildout race, the initial stage in the AI revolution. According to the BlackRock Investment Institute, annual investment into AI data centers and chips could surpass USD 700 billion by 2030 – or about 2% of annual US GDP.[4] BlackRock’s Fundamental Equities team estimates AI servers cost roughly 40 times more than the data centers of the past.

Organizations require infrastructure that can efficiently train AI models, handle large volumes of data, and run real-time AI inference for use cases like autonomous driving, predictive analytics, and natural language processing.

Figure 1: STOXX Global AI Infrastructure index – Top 10 constituents

AI applications transforming industries

The STOXX Global AI Adopters and Applications index, meanwhile, tracks a set of companies benefiting the most from the advancement of AI applications, selected through a systematic process involving revenues and innovation patents.

Index constituents are picked based on their patent exposure to a list of relevant technologies, and on their revenue derived from up to 104 economic sectors tied to sub-themes including healthcare; finance; energy, power and smart grid; internet and content creation; and networks and security.

UBS expects revenues from the AI applications and models segment — including AI software assistants, AI advertising, AI cloud and models, and others — to grow from USD 2.2 billion in 2022 to USD 225 billion in 2027 – a compound annual growth of 152%.[5]

Figure 2: STOXX Global AI Adopters and Applications index – Top 10 constituents

Revenue streams

FactSet RBICS data, a comprehensive and structured taxonomy based on revenues, allow detailed and accurate revenue breakdown of eligible components, and hence their exposures to a list of business sectors identified with the targeted theme.

Patent exposure

Constituents are also screened and selected for their high-quality patent exposure to a list of technologies identified to be relevant to the targeted theme.

Patents are forward-looking and one of the most reliable indicators of innovation activities. EconSight’s high-quality patents (HQP) is defined as the number of active patents that a company holds that fall in the top 10% in terms of patent quality within the defined technologies.

The two indices apply size and liquidity filters in the stock selection, and also apply negative screens to remove companies in controversial activities or in breach of global norms. The indices are weighted according to adjusted equal weights.

“The STOXX Artificial Intelligence Suite provides a flexible, diversified approach for investors, enabling them to harness the AI theme across different phases of the adoption curve, to identify both established companies as well as those bringing new innovation to the market,” said Axel Lomholt, General Manager at STOXX.

STOXX’s thematics family

With over fifty thematic indices covering the broad categories of future technology, the environment and socio-demographics, STOXX is a leader in index-based thematic investing and research. Thematic investing aims to capture the winners of seismic shifts disrupting our modern world — known as megatrends — that are durable and longer-term in nature, identifying companies that stand to benefit as these themes change businesses, economics and consumer behavior.

With this latest launch, the BlackRock-STOXX thematic collaboration includes 17 ETFs.

[1] Source: BlackRock People & Money/YouGov Plc. All figures, unless stated otherwise, are from YouGov Plc. Sample size: 36,730 adults across Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and UK (any references to Europe in this report refer to these 14 markets). Fieldwork was undertaken between 15th March – 10th May 2024. The survey was carried out online. Figures given an even weighting to produce an ‘average’ value. All calculations conducted by BlackRock. 2022 data refers to the previous ‘Next wave of ETF investors’ survey conducted by YouGov Plc between 12 August 2022 and 8 February 2023. Population figures are based on United Nations 2024 and 2022 Revisions of World Population Prospects report (18+ adults). The content and assumptions in this report are based on data derived directly from these surveys.”

[2] BlackRock strategists currently consider five “mega forces” that can guide thematic investing. They are: Digital disruption and artificial intelligence, Geopolitical fragmentation and economic competition, Future of finance, Demographic divergence and Transition to a low-carbon economy.

[3] See BlackRock Investment Institute, “Investment perspectives,” November 2024, and BlackRock, “Global Outlook Q4 update,” October 2024.

[4] BlackRock Investment Institute, “Investment perspectives,” November 2024.

[5] UBS, “TechGPT: Raising AI revenue forecast by 40%.”