This year marked the second anniversary of the launch of the STOXX Equity Factor indices, a Multifactor strategy suite designed in collaboration with BlackRock.

The STOXX Equity Factor indices were devised as core solutions that deliver above-average exposure to five factors — Quality, Value, Momentum, Small Size and Low Volatility — through a Multifactor signal. The indices include constraints to target diversification, remove unintended systematic exposures, guarantee liquidity and limit tracking error.

Six indices in the family underlie iShares ETFs in the US, which aim to offer among the industry’s lowest management costs. The funds have amassed a combined USD 6.3 billion in assets.1

A new STOXX whitepaper from Kartik Sivaramakrishnan, Head of Factor and Quantitative Strategies, and Gimani Vidanagamage, Product Research and Development, Factor and Quantitative Strategies, unpicks the design of the indices by looking closely at the STOXX® U.S. Equity Factor index.

Factor definitions

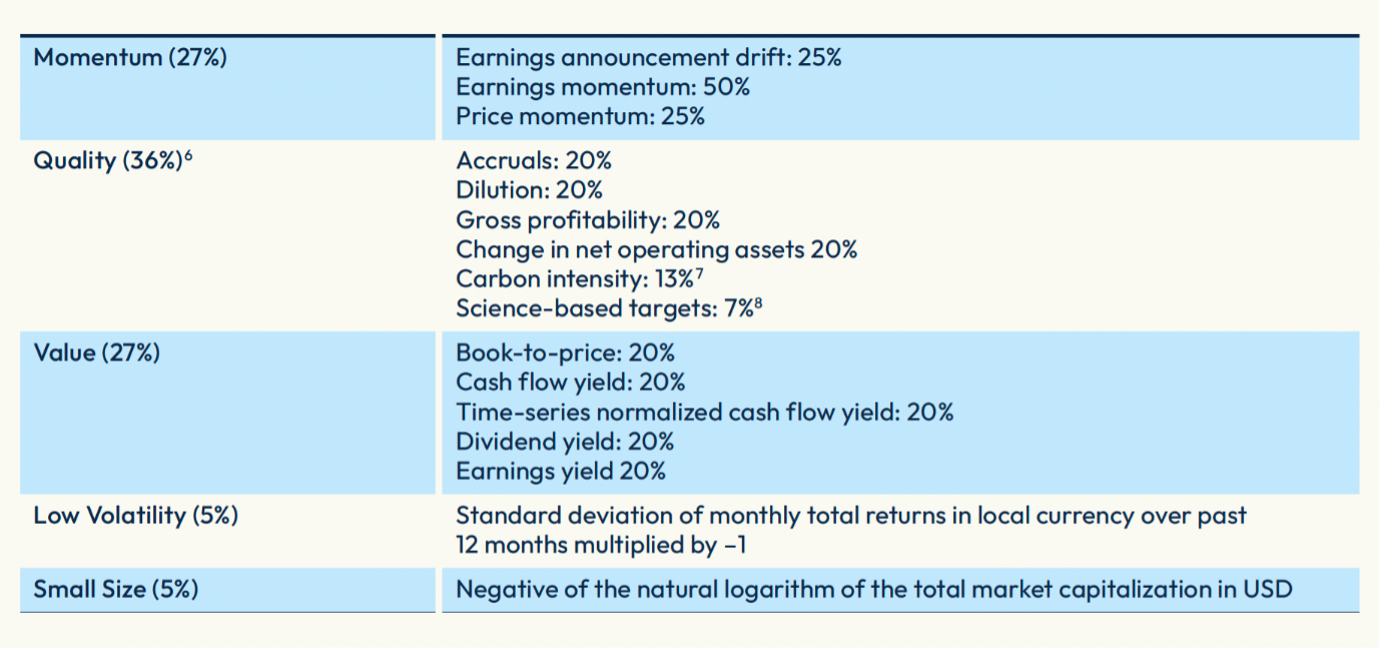

The authors first explore the composition of the Multifactor signal (Figure 1), which, as reported in previous studies, is grounded in the latest academic research. The components of each factor are described in detail, as is the cross-sectional correlation between the five single factor signals. Combining factors with low correlations to each other can offer diversification benefits and a potentially smoother investment profile over time.

Figure 1: Components of the Multifactor signal in the STOXX Equity Factor indices

Risk premium

The paper reviews the risk management, diversification and turnover constraints built into the index methodology, a process that upholds the harvesting of the factor premium in an investable and repeatable framework.

One of the key takeaways from the study is that the customized Multifactor signal behind the index has a “standalone” risk premium.

The authors performed a signal backtest, where the market capitalization-weighted portfolio in the top quartile of Multifactor scores outperformed the parent STOXX® USA 900 index by 2.2%, while the market cap-weighted portfolio in the bottom quartile of Multifactor scores underperformed the parent index by 3.3%.

Returns and attribution

When looking at returns, the authors tested the strategy by constructing an investable portfolio based on the STOXX U.S. Equity Factor index. The Multifactor portfolio outperformed the STOXX USA 900 index by an annualized 1.26% between December 2002 and June 2024, with similar volatility, the study shows. The STOXX U.S. Equity Factor index had a realized tracking error of 1.27%.

Finally, the authors ran an attribution analysis to understand what factors drove the outperformance over the period under consideration. They found that part of the active returns came from the Quality, Momentum, Value and Small Size components of the Multifactor signal, while another part came from the specific active return reflecting the improved definitions of the BlackRock factors.

We invite you to download the paper here and explore all its findings.