The launch of the STOXX® ESG-X Factor Indices last week provides another opportunity to examine the impact of implementing both sustainability principles and risk-premia considerations into portfolios.

In a post last week, we showed that the STOXX ESG-X Factor Indices track the standard STOXX® Factor Indices closely in terms of target factor exposure and performance.

Same Strategy, Different Universe

To recap, the new index family mirrors the methodology behind the STOXX Factor Indices, introduced in January, but in this instance applied on the STOXX® ESG-X Indices.1 The STOXX ESG-X Indices are environmental, social and governance (ESG)-compliant versions of STOXX benchmarks that remove companies deemed in breach of sustainability practices or activities.

The STOXX Factor Indices, on the other hand, are based on flagship STOXX market-capitalization-weighted indices (Exhibit 1). So while the primary difference between our two factor index suites is in the benchmark universe, the difference in the number of holdings tends not to be big.

Exhibit 1

One feature of the ESG-X Indices is that their return and risk characteristics are not materially different from those of their parent benchmarks, and that the tracking error between them is small. More about this can be read in our post from last week.

Five signals covering proven sources of risk and return

Both the standard Factor and ESG-X Factor families include five single-factor indices — covering Value, Quality, Momentum, Low Risk and Size — and a Multi-Factor index combining all five signals, for the Europe, Asia/Pacific, US, Japan and Global markets.3

Both factor families offer robust factor definitions, explicitly targeted exposures and tradability, and seek to reduce exposure to all sources of portfolio risk except the desired factor. Factor definitions are the same as those used by Axioma Factor Risk Models, and portfolios are built and evaluated using Axioma’s portfolio construction tools: the Axioma Portfolio OptimizerTM and Axioma Portfolio AnalyticsTM.

ESG-X vs. standard factor indices

As reviewed in our post last week, the target factor exposures for both multi-factor and single-factor indices in the STOXX ESG-X Factor Indices and the standard STOXX Factor Indices are not very dissimilar.

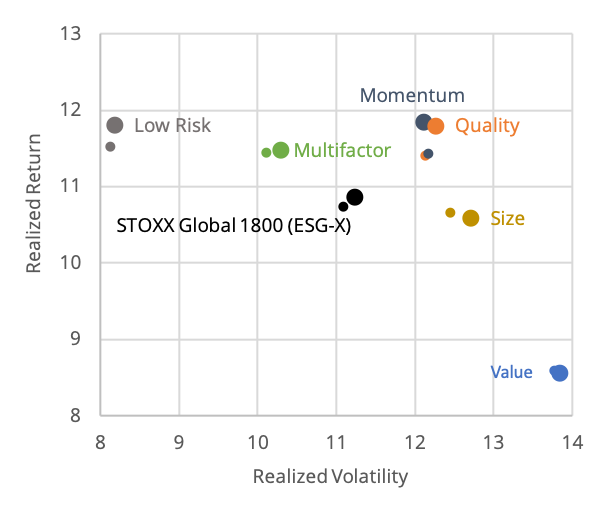

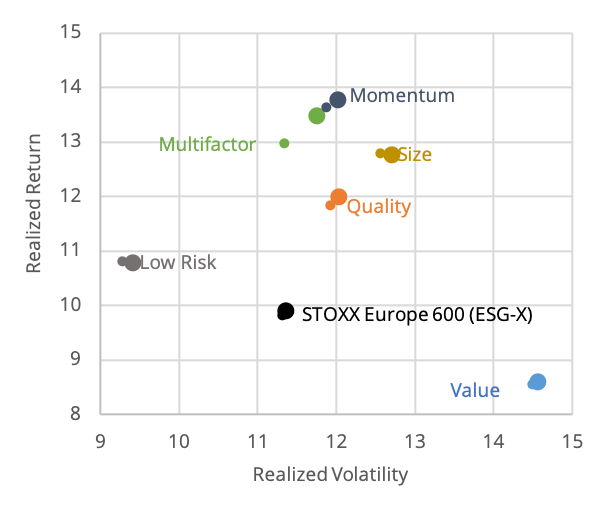

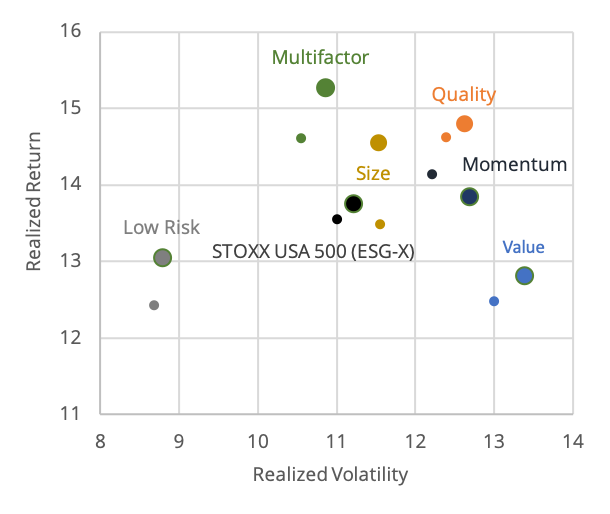

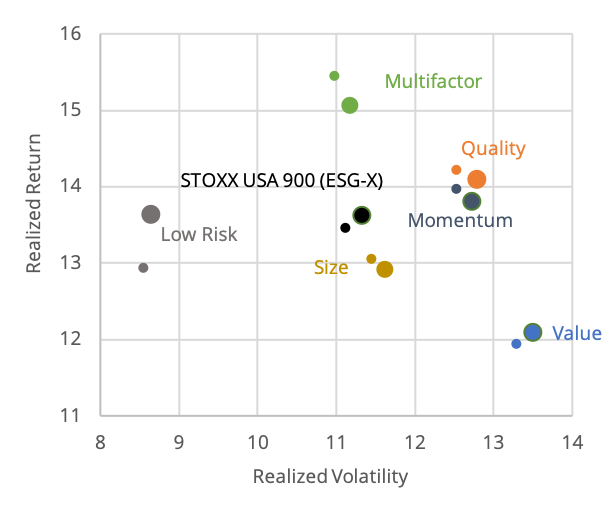

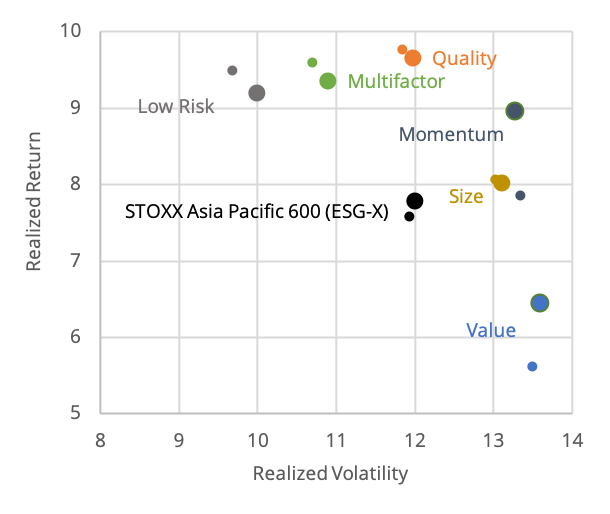

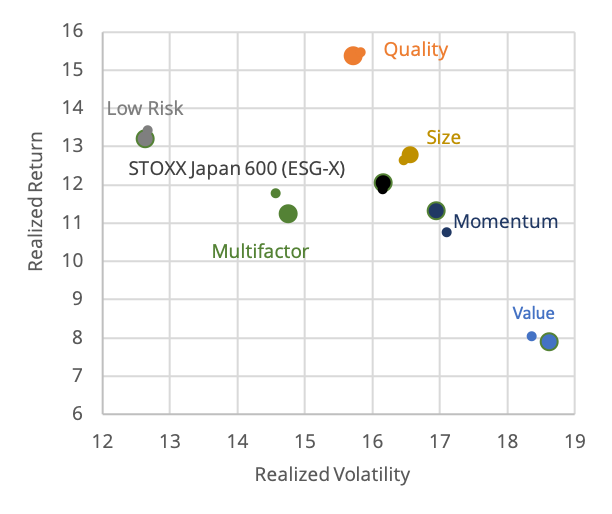

Therefore, it is not surprising that, overall, risk levels and returns among the standard Factor indices and the ESG-X equivalents are quite similar. In Exhibit 2, the latest study shows simulated returns and volatilities for the two groups from March 2012 through December 2019. The larger marker represents the ESG variant and the smaller one its standard counterpart.

Exhibit 2 - Risk and return

Global & Europe

US

Asia/Pacific & Japan

Source: Qontigo, simulated data covering March 2012 – December 2019.

Broadly speaking, risk levels and returns were quite similar for most pairs, with few exceptions showing manageable differences.

The research paper unveils some other observations:

- Whereas Multi-Factor or Momentum produced the highest returns in most ESG-X Factor portfolios (Asia/Pacific and Japan were exceptions), Low Risk portfolios generated the highest Sharpe ratios across all regions.

- In contrast, Value produced the lowest Sharpe ratios across the regions, driven by both lower return and higher volatility than the other factors. Value also lagged the market in each region, where the market was defined as the appropriate ESG-X benchmark. On a positive note, ESG Value’s returns and Sharpe ratios were roughly the same, or higher, than those for standard Value in all regions.

- Most ESG-X Factor portfolios beat their ESG market benchmarks across regions — although there were exceptions.

We invite you to learn about other findings in the research report.

Focus on strategy and methodology

The STOXX ESG-X Factor Indices complement the suite of factor-based strategies established by the standard STOXX Factor Indices in January. Both groups use well-known and extensively tested factors to provide targeted exposures, while simultaneously avoiding unwanted portfolio bets. They are also built with sufficient liquidity to avoid giving back all the potential gains in trading costs.

The ESG-compliant indices track the standard factor indices closely in terms of target factor exposure and performance. This is, firstly, because excluded stocks contribute only a small amount to the target factor exposures. Second, applying the methodology on a slightly narrower benchmark does not impede risk premia harvesting.

Investors who prefer to incorporate ESG principles into their factor-based portfolios, can do so without sacrificing returns, whether actual or risk-adjusted.

1 The STOXX ESG-X universe is a filtered version of that of the STOXX benchmarks. The exclusion criteria consist of norm-based screening (Sustainalytics’ Global Standards Screening), as well as product-involvement screening (controversial weapons, thermal coal and tobacco), based on data from Sustainalytics. The STOXX ESG-X Indices cover more than 40 geographies and were launched in 2019. For more information on them, visit a post here.

3 The STOXX Factor Indices also include Global ex US variants.