Volatility has become a common asset class in many professional portfolios thanks to its multiple strategy uses and the large suite of investable products to access it.

Two of the most popular volatility indices in the world are the VSTOXX® (EURO STOXX 50® Volatility) and the VIX® Index, which gauge, respectively, the implied volatility in the Eurozone and US equity markets.

To review the current state of volatility in both markets, we caught up with Matthew Koren, Equity and Index Derivatives Sales for the Americas at Eurex, and with Thomas Shuttlewood, Associate Vice President for Product Research and Development at STOXX. We asked them how both indices track market sentiment and what they are telling us about “market fear” right now.

Matthew Koren, Eurex

Thomas Shuttlewood, STOXX

Thomas, let’s start with an introduction of what VSTOXX measures and how the index is calculated.

“The VSTOXX aims to reflect the market expectation of volatility over a given time period, with the main VSTOXX index covering 30 days. It does so by measuring the market’s implied volatility, which is intrinsically forward-looking when compared to realized volatility.

Implied volatility is captured by calculating the implied variance of EURO STOXX 50 options portfolios, with options’ expiry dates bracketing the constant 30-day period targeted by the VSTOXX index. Calculation is done via interpolation (or extrapolation if necessary) of two options portfolios, one with an expiry shorter than 30 days, and one with an expiry longer than 30 days.”

Matthew, many of our American readers will be more familiar with the VIX. Is it an equivalent index to VSTOXX for the US?

“VIX and VSTOXX are extremely similar indices. Ignoring some technical differences in the final settlement process (VIX uses an auction, whereas VSTOXX settles through a so-called time-weighted average price, or TWAP), the biggest difference is the underlying volatility that each index captures. VSTOXX tracks 30-day forward volatility on the EURO STOXX 50, the Eurozone’s premier equity benchmark, whereas VIX tracks 30-day forward volatility on the S&P 500.

Where traders will see a notable distinction is in the derivatives that are listed on each index. VSTOXX futures have a multiplier that is a tenth the size of the standard VIX futures. We believe this smaller contract size enables more nimble trading and allows for participation by those with less capital to deploy to a given strategy.

The options space is also noticeably different. For over seven years, VSTOXX options have been structured as options on futures, allowing for participation by communities that might be prohibited from trading cash-settled options.

Both volatility markets are highly liquid during most of the trading day. First- and second-month VSTOXX futures are generally quoted on screens just one tick wide. Eurex has seen the depth of the futures book effectively double after we tweaked our liquidity provisioning scheme in September, giving traders the ability to trade more size with little impact on the market.

Screen markets for VSTOXX options, meanwhile, have never been as deep, tight or liquid. Most strikes are quoted just a few ticks wide, and in some cases there’s over 5,000 contracts being posted on the bid/ask.”

Thomas, with different economic realities and monetary policy in the two markets, what are volatility indices telling us today?

“The VSTOXX and VIX are currently quoted at around 17 and 15 index points respectively. This is lower than the average value across the lifetimes of these two indices and represents a sense of calming markets after the uncertainty brought about by the US elections.

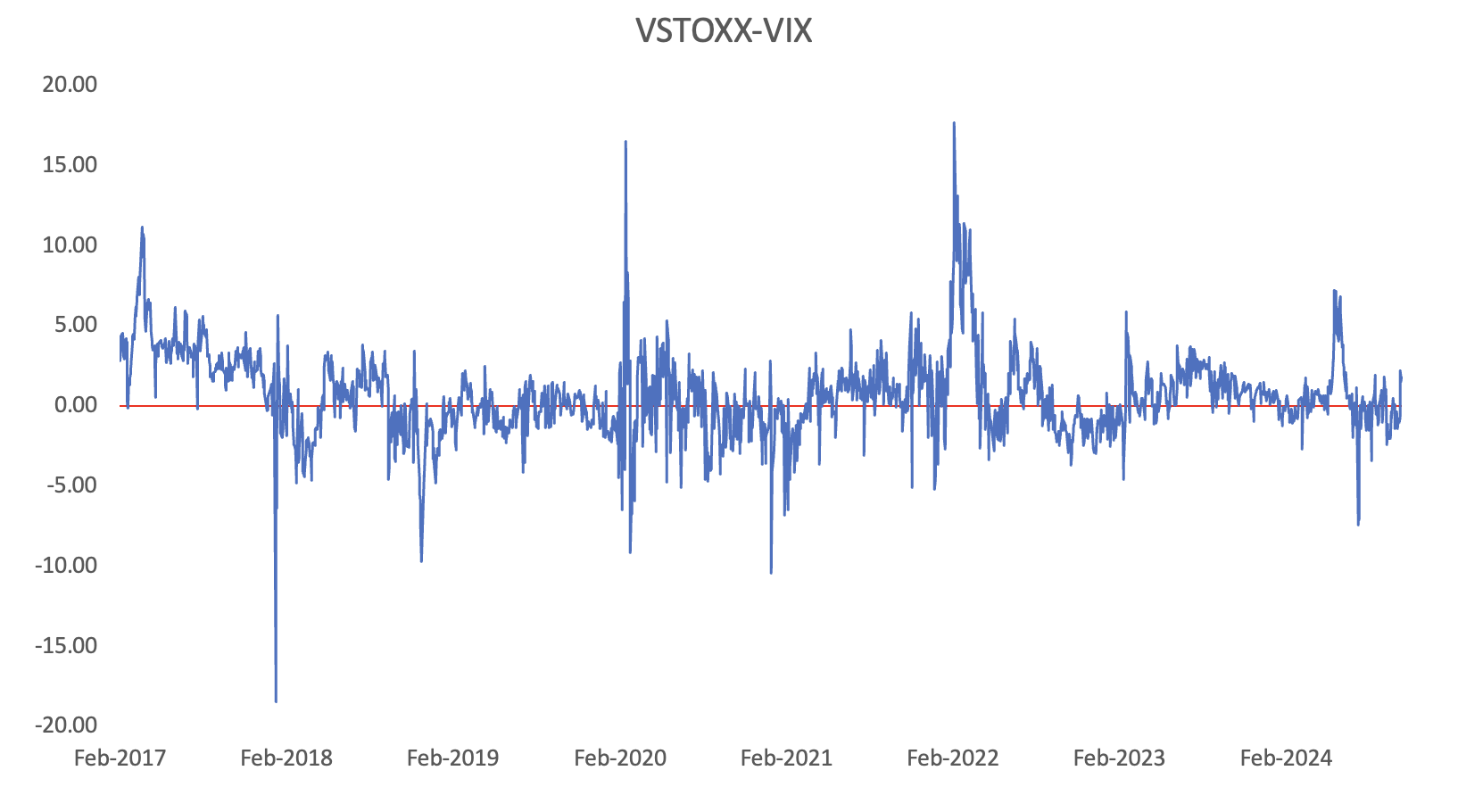

The indices have been pretty strongly correlated this year, with the exception of the EU election period in June, which saw markedly higher volatility in the VSTOXX. The August 2024 market shock, driven by US recession fears and the unwinding of yen carry trades, saw both indices rise sharply. The effects were clearly greater in the US, where the VIX hit intraday levels not seen since the COVID-19 pandemic. This year actually gives a good summation of the relationship between the two indices: there is usually general alignment in trend, but more localized market events cause spikes in one index that aren’t always seen as strongly in the other.”

Figure 1: Volatility comparison – Eurozone vs. US

Matthew, what spread-trading strategies exist within volatility?

“Spread strategies are quite common within the volatility space. I like to view these strategies in two ways: cross-asset and intra-volatility. From a cross-asset standpoint, statistical arbitrage is probably the most popular use case for VSTOXX futures, but that’s not a tradable strategy for the average investor. Intra-volatility plays are easier to conceptualize and trade. These strategies come in many flavors and variations, which can be as simple as term structure plays (for example, buying the Oct. 2024 VSTOXX futures to capture 30-day volatility over US election day and selling the Nov. 2024 contract), or relative value (buying Dec. 2024 VSTOXX options and selling Dec. 2024 VIX options). The VIX-VSTOXX futures spread tends to capture investor interest over geopolitical events, such as the snap French elections this summer.”

Thomas, could you quickly walk us through which volatility strategies can be implemented with indices?

“STOXX has a suite of indices based on the VSTOXX, each with its own investment rationale. We have a number of indices based upon VSTOXX futures, short- and mid-term, with replicated long and short exposure.

We also combine the index with our equity benchmarks. The EURO STOXX 50® Volatility-Balanced index combines a base investment in the EURO STOXX 50 with a variable allocation to the VSTOXX® Short-Term Futures index. The Balanced strategy dynamically allocates weight away from equities and into volatility futures in times of market stress, with each asset’s weight determined by the prevailing volatility environment.

The VSTOXX is even used as a calculation input, for example as a risk indicator, for our EURO STOXX 50 Risk Control indices.

Investors can also resort to the VDAX®, which measures the volatility of the German equity market based on options on the benchmark DAX®.”

Matthew, what other factors should traders bear in mind when comparing or trading volatility indices?

“It’s important to understand what you’re trading, both in terms of the derivative product and its underlying index. While certain US indices and related derivatives are highly liquid, in most cases they are not a “one-size-fits-all” proxy for global volatility. Take VIX for example. With VIX futures and options you’re trading forward S&P volatility. Using VIX to hedge Eurozone volatility exposure becomes quite painful when regional volatility flares up, as was seen in events like the Russian invasion of Ukraine, or the 2024 French elections. Germany, the third-largest economy in the world, is poised to hold federal elections in February 2025. No matter how liquid US markets are, I would not want to hedge my Eurozone-related election risk with anything other than VSTOXX.”

Thomas, volatility indices have crept higher this year, albeit not by a large margin. Is that compatible with the equity rally we’ve seen in Europe and the US?

“It’s true that the equity rally, especially in the US, has been strong this year. Volatility and stock returns are known to be negatively correlated, so the slight overall increase in volatility may seem counterintuitive. However, even though we’ve seen an important market upturn this year, it has not been without its shocks. Significant market downturns in August and September increased volatility in both Europe and the US and those effects may still be shown in volatility terms. Volatility itself is characterized by very sharp increases, followed by a gradual return to the equilibrium over a longer time period. The slightly higher levels today, and in particular the higher levels seen before the US elections, also highlight the forward-looking nature of implied volatility. The inherent uncertainty surrounding the vote would have been effectively priced into option contracts, thus increasing the implied volatility measured by the indices.”

Finally, Matthew, with less than two months to go until 2025, what do you see in store on the volatility front next year?

“I, unfortunately, don’t have a crystal ball, but the three themes I foresee being front and center next year are geopolitics, the general trend towards short-dated volatility trading, and near 24-hour trading sessions.

Let’s look at geopolitics first. Some events on the calendar could be extremely impactful on the global political stage. The German federal elections are the big one and will take place earlier than expected. A second term from President Trump could greatly impact the trajectory of US-EU trade relationships, aid to Ukraine and the brewing conflict in the Middle East. These issues can flare up on a moment’s notice, with tariff announcements potentially just a tweet away. I personally expect the VSTOXX-VIX spread to be a bit jumpy throughout the course of 2025.

Moving on to shorter-dated options, I think it’s unlikely we will see investors curb their appetite for short-dated volatility. As liquidity continues to build in these products (index, ETFs and single stocks), investors have very little reason to play events using longer-dated options when shorter-dated contracts are as liquid as they are. The global volatility ecosystem will have to adapt to this. US markets recently got options on VIX futures, which sets the table for 0DTE[1] VIX contracts. ETFs continue to see massive flows into covered call strategies and defined outcome funds. I see no real scenario where the trend towards shorter-dated options slows.

Lastly, near 24-hour weekday trading will likely become an even bigger global phenomenon in 2025 as more exchanges extend hours. The real question is how liquidity adapts to these longer hours. Will liquidity providers be able to absorb massive trades at all hours of the day, or will volatility events like those that occurred in the morning hours of August 5 reoccur more often? Ensuring the listed marketplace is well collateralized will be critical until liquidity becomes robust throughout the course of the entire trading day.”

[1] Zero-days-to-expiration.