The following article was published on ETF Stream.

As thematic investing continues to grow in popularity, recurrent questions from investors evolve around the selection of a theme, as well as the best time and approach to capture it.

To learn more about these aspects, we caught up with Ladi Williams, Head of Thematics and Strategy Index Product Management at STOXX. We asked him how the index provider tackles the identification of investable themes and how it defines the right investment strategy for each case.

With over three dozen thematic indices covering the broad categories of future technology, the environment and socio-demographics, STOXX is a leader in index-based thematic investing and thematic research. Currently, more than USD 10 billion is invested in funds tracking STOXX’s thematic indices.

Identifying and capturing a theme

Thematic investing aims to capture the winners of seismic shifts disrupting our modern world — known as megatrends — that are durable and longer-term in nature. That is, identifying companies that stand to benefit as these themes transform politics, economics and consumer behavior. Thematic portfolios cut across traditional sector classifications, as the latter typically provide less flexibility when it comes to accurately grasp the complexity and reach of a theme.

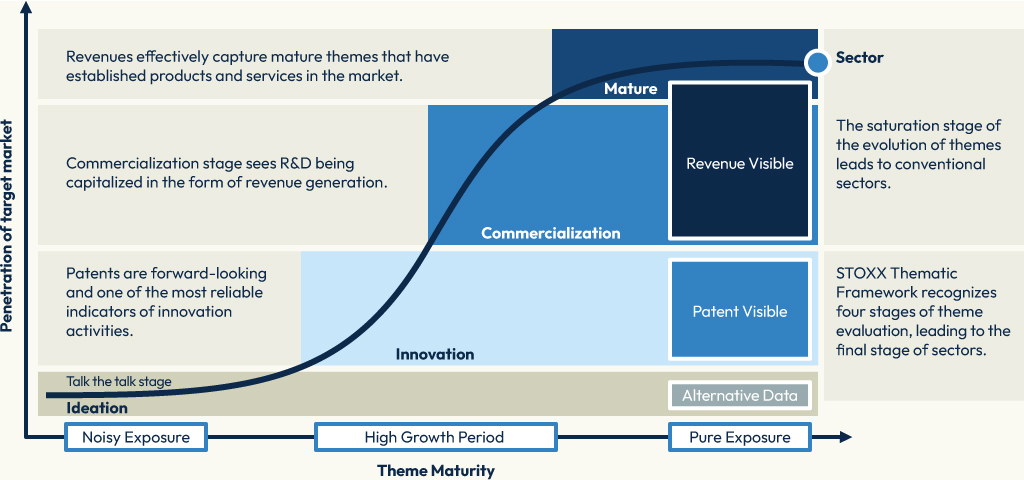

As Ladi explains, STOXX uses a lifecycle framework to identify investable themes based on their conceptual and business evolution (Figure 1). This framework draws from the diffusion of innovations concept[1], which attempts to explain how a specific technology or concept permeates within a society.

Figure 1: STOXX Thematic Framework – Mapping a theme’s evolution

The framework recognizes there are four stages in the development of a thematic concept: ideation, innovation, commercialization and maturity. As the cycle evolves, the level of conviction in a theme grows from low to high. At its core, thematic investing uses indicators to identify companies that, at each stage of the evolution cycle, are most likely to be the main contributors or beneficiaries of a given theme.

- Stage 1: Ideation

The ideation stage is where a theme is just a concept, and companies have yet to commit resources towards the idea. New themes for development can be identified via inputs from qualitative data such as earnings transcripts. At this stage, exposure to the theme is very noisy – it is hard to get a reliable signal in terms of which companies will eventually develop a product and do so successfully.

- Stage 2: Innovation

In the innovation stage, companies have started investing money into an idea, mostly in research. This may not translate into marketable products and services, but this stage presents an early window into identifying the potential leaders of tomorrow within a specific field.

To identify these early movers, the best tool at hand is to analyze patents, which are forward-looking IP documents that can be processed in a systematic manner.

“In the early stages of a theme, the only true way of capturing companies operating in that segment is through what they talk about in earnings transcripts, filings,” said Ladi. “Yet, talk is cheap, but patents are not. That is where patents — one of the most robust and reliable innovation indicators — play a role.”

A company with significant patent activity in a certain technology will likely develop and monetize a product in the coming years. Conversely, a company without patents is unlikely to play an active role in the specific activity in the future. As such, patent-based datasets are integral to unlocking the next phase of thematic investing and capitalizing on the growth of disruptive trends.

- Stage 3: Commercialization

Further along the adoption curve, the commercialization stage is where companies have translated their earlier research and development efforts into tangible products and services. Revenues start to grow and sales broaden out to a larger market. In this phase, revenues appear to be the most reliable signal for identifying key companies. This is the stage that most of the STOXX Thematic indices currently target.

- Stage 4: Maturity

In the mature stage, a theme is well established and defined, and related products and services are widely available. If the theme becomes sufficiently pervasive and significant, it may lead to the formation of a new sector within existing industries. Revenues remain the key signal to select companies.

However, maturity does not necessarily mean the theme’s upside is limited. While growth has been priced in to a certain extent, subthemes or theme components continue to emerge, offering new sources of economic upside.

Risk-reward

The adoption curve also reflects the profile of a theme in terms of risk and reward, with the earliest stages offering the biggest potential returns but also the highest volatility. The “sweet spot,” according to Ladi, may be at the steep part of the curve between innovation and commercialization. That is, where products are being launched.

“It is important to have a flexible approach that allows you to harness a theme across the different phases of the adoption curve,” Ladi said. “And to target all the diversified players within one theme that do not focus on one area. Here, you want to be able to identify both the established companies as well as those that will come to the market with exciting ideas.”

This may require a combination of revenue-based and patent-based approaches, Ladi added. One example is the STOXX® Global Lithium and Battery Producers index. In it, STOXX uses FactSet’s Revere (RBICS) granular data for a detailed breakdown of the revenue sources of the eligible companies, to select those most exposed to the theme. Additionally, EconSight’s patent data is used to identify innovators in a set of technologies linked to the theme.

It is interesting to note that themes will not necessarily move from one stage to another in a linear manner. One example is Artificial Intelligence, where sub-themes such as Cloud Computing or Semiconductors are mature, but some specific segments such as Neuro-Symbolic AI or AI Simulation are still in their infancy. Effectively, a theme can have a head in one stage and a tail in another.

Cryptocurrencies as theme and asset class

One of the most disruptive technologies to emerge in recent years and a popular investment theme has been that of blockchain.

“In a way, the growth in index-based thematic investing and higher demand for cryptos have coincided,” Ladi said. “Investors have sought to target the transformation that blockchain technology is bringing to the market, and thematic investing has been one way of integrating that potential growth into equity portfolios.”

In 2018, STOXX launched the STOXX® Global Fintech, a revenue-based thematic index that offers exposure to companies involved in blockchain technology and cryptocurrency mining, as well as to the more traditional sectors of electronic payment processing and money transfer services.

With clearer regulation, however, cryptocurrencies have become a new asset class in themselves. In December 2023, STOXX introduced the STOXX® Digital Asset Blue Chip index, which aims to track high-quality assets that represent the crypto universe today. STOXX recently expanded the offering with the launch of single-token indices tracking Bitcoin, Ethereum, Solana, Cardano and Ripple.

Index construction

In summary, disruptive technologies and services are laying the ground for a growing and evolving set of investable themes. Knowing when and how to invest in them is crucial for an effective strategy. Indices offer a low-cost and transparent vehicle to integrate the latest research and most efficient tools into the process, in a way that can be customized to meet investors’ particular objectives but that adheres to a systematic, coherent and rules-based methodology.

[1] The Diffusion of Innovations is a theory by Professor Everett Rogers.