The June annual review and rebalancing of eight STOXX Thematic indices underlying ETFs in Europe brought changes to their stock composition, and to the selected business sectors in six of them.

The review, conducted on June 24, 2024, assessed the entire RBICS[1] sector classification for each index, ensuring they accurately reflect the targeted themes. The eight indices, listed below, underlie ETFs managed by BlackRock’s iShares.

Figure 1: Rebalanced indices and related ETFs

| Index | ETF | ETF ticker |

|---|---|---|

| STOXX® Global Ageing Population | iShares Ageing Population UCITS ETF | AGED |

| STOXX® Global Automation & Robotics | iShares Automation & Robotics UCITS ETF | RBOT |

| STOXX® Global Breakthrough Healthcare | iShares Healthcare Innovation UCITS ETF | HEAL |

| STOXX® Global Digitalisation | iShares Digitalisation UCITS ETF | DGIT |

| STOXX® Global Digital Security | iShares Digital Security UCITS ETF | LOCK |

| STOXX® Global Digital Entertainment and Education | iShares Digital Entertainment and Education UCITS ETF | PLAY |

| STOXX® Global Electric Vehicles & Driving Technology | iShares Electric Vehicles and Driving Technology UCITS ETF | ECAR |

| STOXX® Global Smart City Infrastructure | iShares Smart City Infrastructure UCITS ETF | CITY |

“Themes evolve, and thematic strategies must stay current,” said Omar Moufti, Head of Sector, Thematic & Commodity Product Strategy at BlackRock, “Our themes, especially technological and social ones, have underlying driving forces that are changing fast. Reviewing periodically the revenue exposure of a thematic portfolio to maintain its purity is key to a successful investment strategy.”

High purity maintained

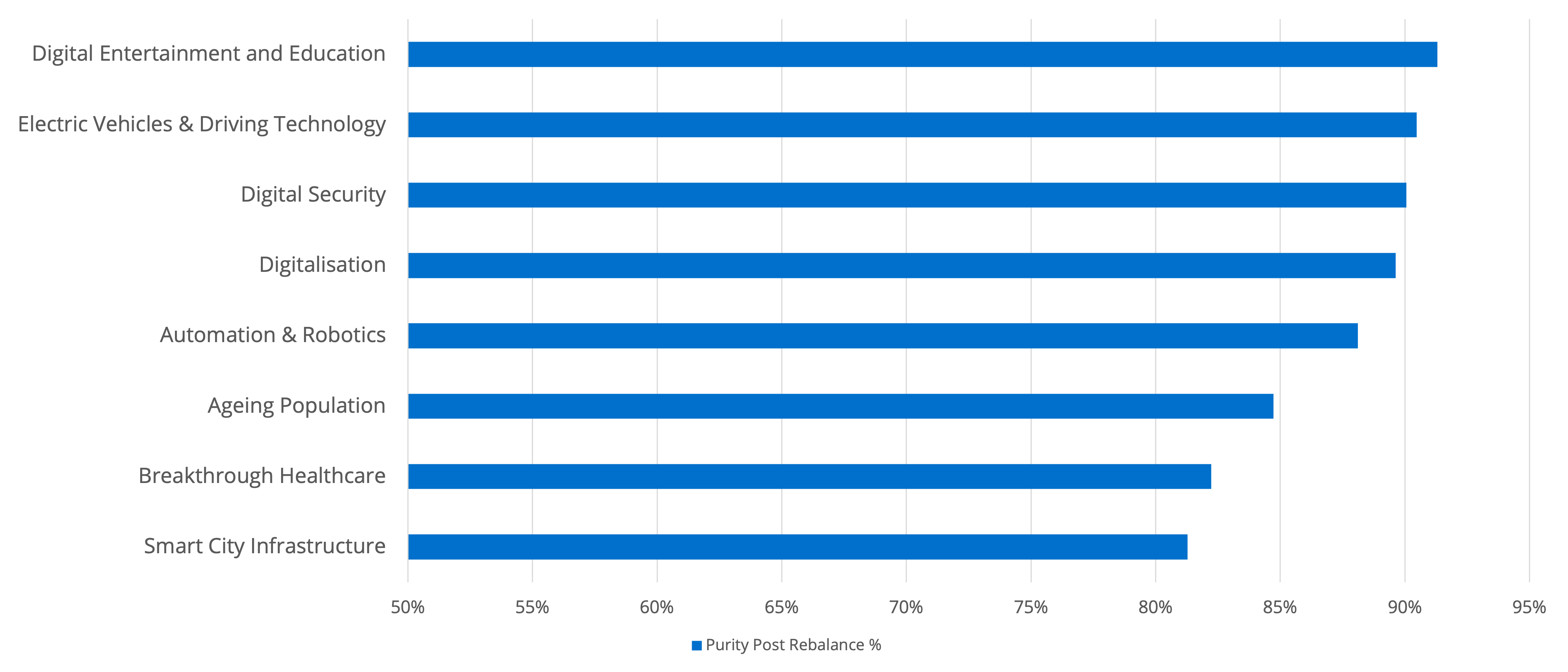

As a result of the composition changes, the eight indices’ revenue exposure to their targeted theme, or “purity” ratio, ranged between 81% and 91% (Figure 2). The ratio reflects the weighted average of theme-related revenue exposure. The indices’ review turnover averaged 22%.

Figure 2: Index revenue exposure to targeted themes (“purity”)

Changes to Electric Vehicles & Driving Technology composition

The STOXX Global Electric Vehicles & Driving Technology index underwent the largest change in number of targeted sectors. This followed a market consultation to update the index’s methodology and better capture the evolution of the targeted theme six years after the index’s launch.

A total of 12 RBICS sectors were removed from the index’s methodology, including Conventional Engine Car Manufacturers and Diversified Consumer Vehicle Manufacturing. Two sectors, Embedded Automotive Software and Automotive Industry Software, were added.

Sustainable investing commitment

Since September 2023, a Sustainable Investment (“SI”) commitment has been integrated into the index methodology of the thematic indices. This ensures a minimum level of environmental and social contribution of the theme. The SI commitment for the eight indices underlying iShares ETFs ranges between 5% and 50% and is considered in the weighting scheme for the annual review and quarterly rebalances.

[1] RBICS stands for FactSet Revere Business and Industry Classification System.