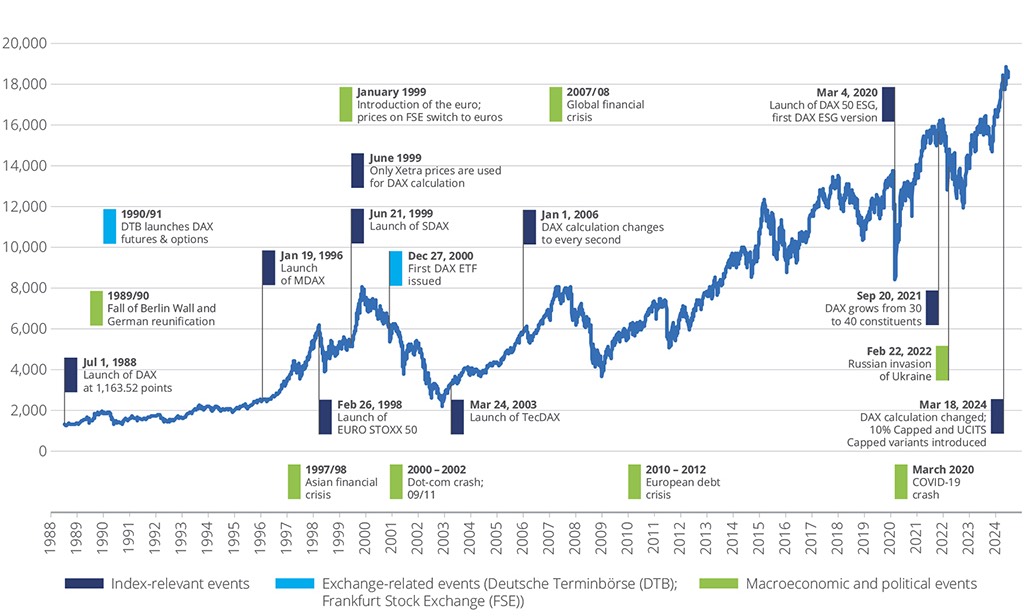

The DAX® index was introduced on July 1, 1988, and throughout the past 36 years it has acted as a barometer of Germany’s equity market, impacted by both domestic and global events.

The benchmark for the largest German public companies has yielded a compound annual return of 8% including dividends since inception — a total of 1,575%![1] It has also spun over that period a comprehensive family of sub-indices and derived strategies, and has become the underlying for one of the world’s widest ecosystems of financial products — including listed derivatives, ETFs and structured products.

Figure 1: DAX and events timeline

The most important development in Germany in the past 36 years, the country’s reunification in October 1990, preceded a decade of equity gains. The index rose nearly six-fold between then and its March 2000 peak, and had in 1997 its best year ever (+47%).

With large exposures to the cyclical Supersectors of Industrial Goods & Services and Technology, the index was impacted by the global financial and economic crises of 2000, 2008 and 2020.

DAX tumbled 73% between March 2000 and March 2003 as the dot-com bust put an end to the rolling 90s. The German benchmark lost 55% between July 2007 and March 2009 amid the fallout from the global banking crisis, and fell 39% in less than one month during the COVID-19 crash in February/March 2020.

Those instances of turbulence were eventually left behind, and the DAX index has powered ahead each time.

Different landscape, familiar names

The evolution of the index has also coincided with a deep transformation of Europe’s financial landscape — from the expansion of electronic trading to the introduction of the euro, the ETFs boom and the advent of sustainable investing.

As an illustration of that progress, in 2006 DAX began to be calculated every second, compared to once every minute when launched. The benchmark’s predecessor, the Börsen-Zeitung Index, was calculated once daily.

In spite of the market’s twists and turns, and the fast globalization of the past three decades, the German benchmark still shows a remarkably stable composition. Eleven of the original DAX components in 1988 have remained, with no interruption, index members as of today. That includes world-famous brands such as BASF, Bayer, BMW, Daimler, Deutsche Bank, Siemens and Volkswagen.

Methodology changes

Recent years have brought important changes to the methodology behind DAX, following market consultations. In September 2021, the index expanded from 30 to 40 constituents, concluding the biggest reform in the benchmark’s history, an overhaul that also raised the profitability and financial reporting requirements on index components. In March 2024, the maximum weighting cap of individual stocks was lifted to 15% from 10%.

Market capitalization remains the key criterion for selection into the index, with liquidity, free-float, quality and profitability filters considered. For a full methodology guide, click here.

With its finger on the German market’s pulse, liquid composition and transparent methodology, the DAX index has cemented its position as the country’s undisputed benchmark after 36 years.

[1] Total return in euros between July 1, 1988, and June 24, 2024.