Nvidia Corp. on June 18 overtook Microsoft Corp. as the world’s most valuable company amid a rush to invest in the beneficiaries of the Artificial Intelligence boom.[1]

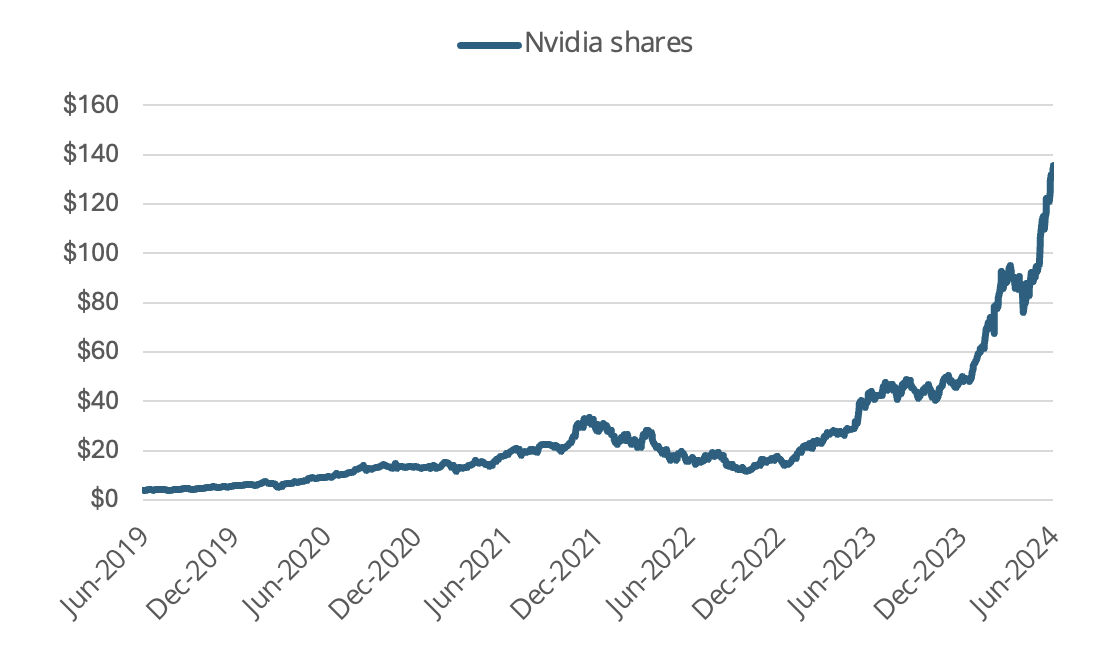

The chipmaker’s shares have nearly trebled in 2024 as it continues to beat revenue forecasts thanks to sales of semiconductors powering the AI revolution. As the Wall Street Journal reported, Nvidia’s 3.5% jump on June 18 meant that for the first time since 2019 a business other than Microsoft or Apple Inc. is the world’s No. 1 listed company by value. The California-based company is now worth USD 3.34 trillion.

Figure 1: 5-year performance

Gaining exposure to Nvidia via ETFs and indices

The shares’ rally means investors in broad-market indices now get more exposure to the company than to any other in those portfolios. Nvidia shares account for 7.3% of the STOXX® USA 500 and 4.5% in the STOXX® World AC, the benchmarks’ largest holding.

For those seeking an even larger investment in the stock, thematic ETFs may offer a targeted alternative. STOXX is a leader in thematic indices, with almost three dozen solutions covering the Future Technology, Environment and Socio-demographics categories.

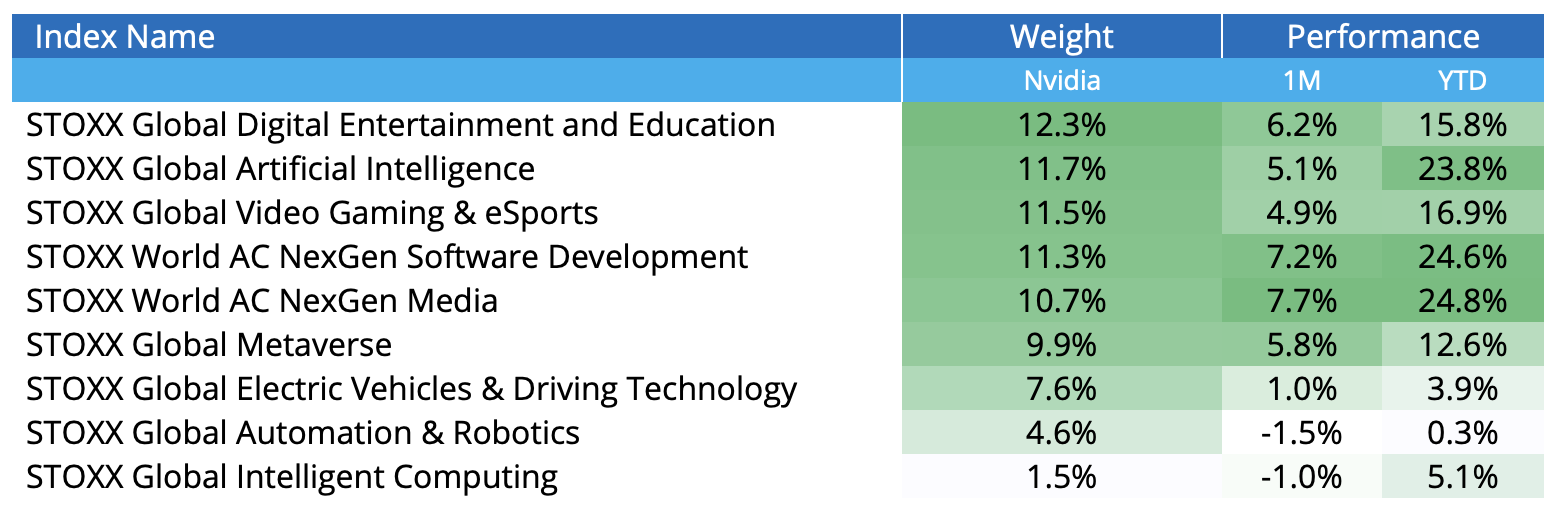

Figure 2 shows the STOXX Thematic indices with the biggest weights by Nvidia, almost all of them drawn from the Future Technology classification. As it happens, a higher presence of Nvidia has broadly coincided with a better index performance between May 20 and June 18, and year to date. The benchmark STOXX USA 500 gained 3.5% and 11% over those periods.

Figure 2: Nvidia weight in selected STOXX Thematic indices

The shares’ biggest weight among 35 STOXX Thematic indices is to be found in the STOXX® Global Digital Entertainment and Education index. The index aims to track the beneficiaries of two accelerating structural trends of our modern society, as the public changes the way it consumes media and accesses learning. Constituents are selected according to their revenues derived from more than 30 sectors associated with the targeted theme.

Nvidia also takes up the No. 1 slot in the STOXX® Global Artificial Intelligence, STOXX® Global Video Gaming & eSports, STOXX® World AC NexGen Software Development, STOXX® World AC NexGen Media, STOXX® Global Metaverse, STOXX® Global Electric Vehicles & Driving Technology and STOXX® Global Automation & Robotics indices. The weightings are testament to Nvidia’s newfound relevance but also show that investors can target the AI theme through different angles.

A nuanced alternative

Thematic indices allow a focused approach to invest in structural themes that are disrupting our world. They can track the companies with the most at stake from those themes either through their revenue exposure or alternative methods. In particular, thematic indices have proven to be a more targeted alternative than traditional sector indices as technological and business change becomes more nuanced.

[1] WSJ, ‘Nvidia Tops Microsoft to Become Largest U.S. Company,’ June 18, 2024.