They may not be as sexy as the “Magnificent Seven”[1] in the US, but the “GRANOLAS” are having an equally strong pull in European equity markets.

The name, coined by Goldman Sachs in 2020, is an acronym for a group of 11 companies that stand out for strong earnings growth, low volatility, high and stable profit margins, and solid balance sheets, according to the investment bank (Figure 1). They account for a combined 21% of the STOXX® Europe 600[2] but were responsible for 60% of the benchmark’s gains in the past year,[3] and have even beaten the Magnificent Seven on a risk-adjusted basis. Their characteristics are likely to predominate in the current economic cycle, the investment bank’s strategists say.

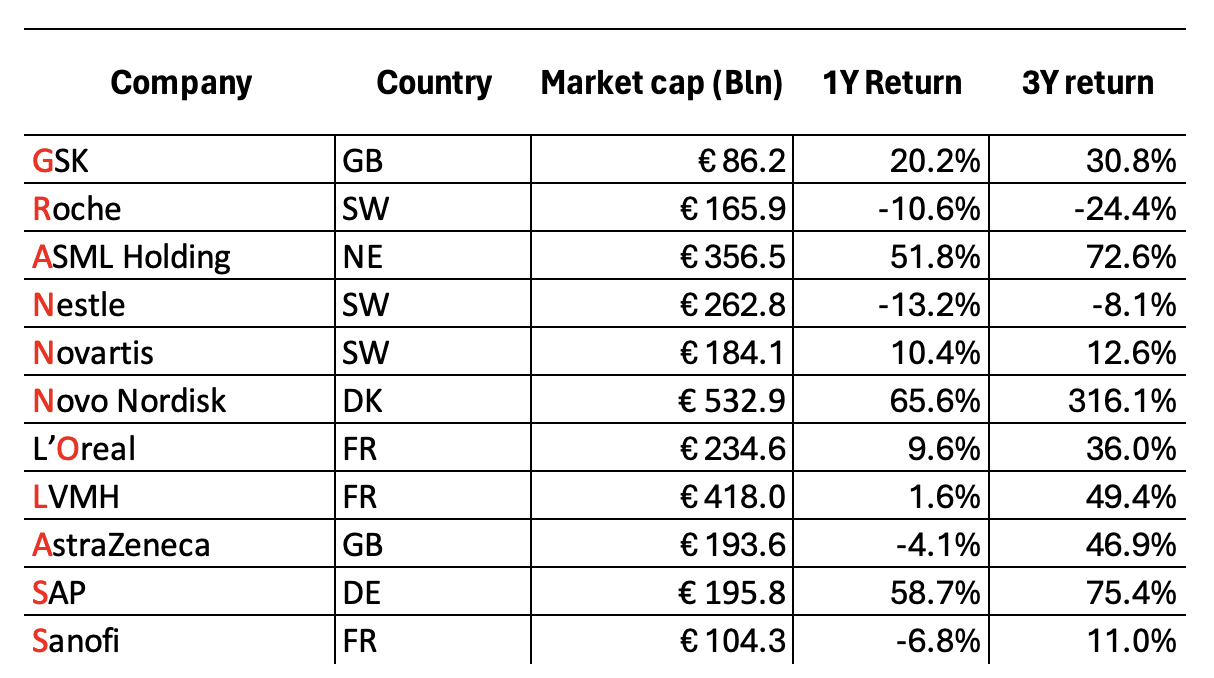

Figure 1: The GRANOLAS

Their average market capitalization is approximately EUR 250 billion. Unlike the Magnificent Seven, they are a diversified cohort, drawn from the Healthcare, Technology, Consumer Staples and Consumer Discretionary ICB Industries. The Magnificent Seven are mostly Technology stocks, except for Amazon and Tesla, which are Consumer Discretionary.

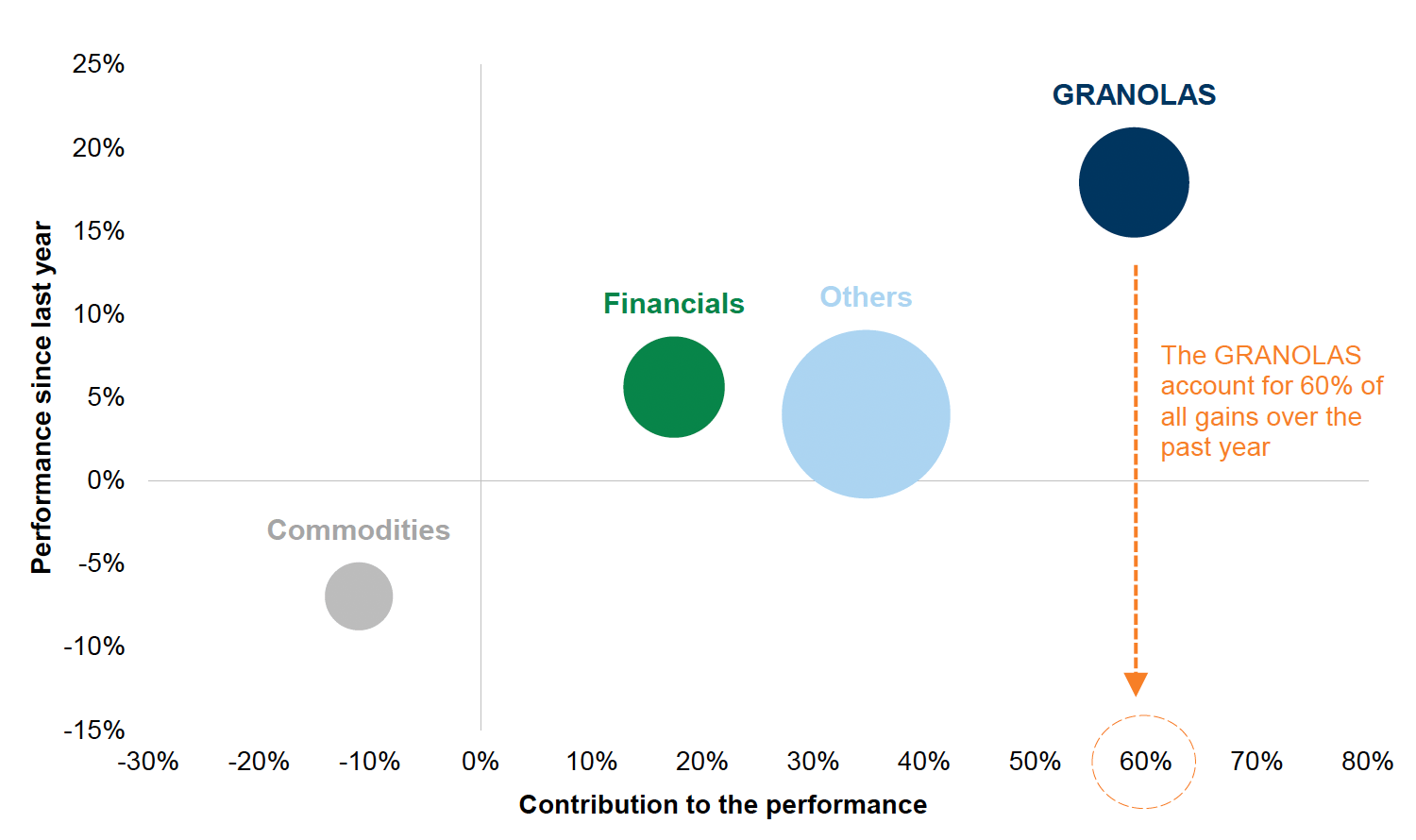

Figure 2: Group performance in past year and contribution to STOXX Europe 600 returns

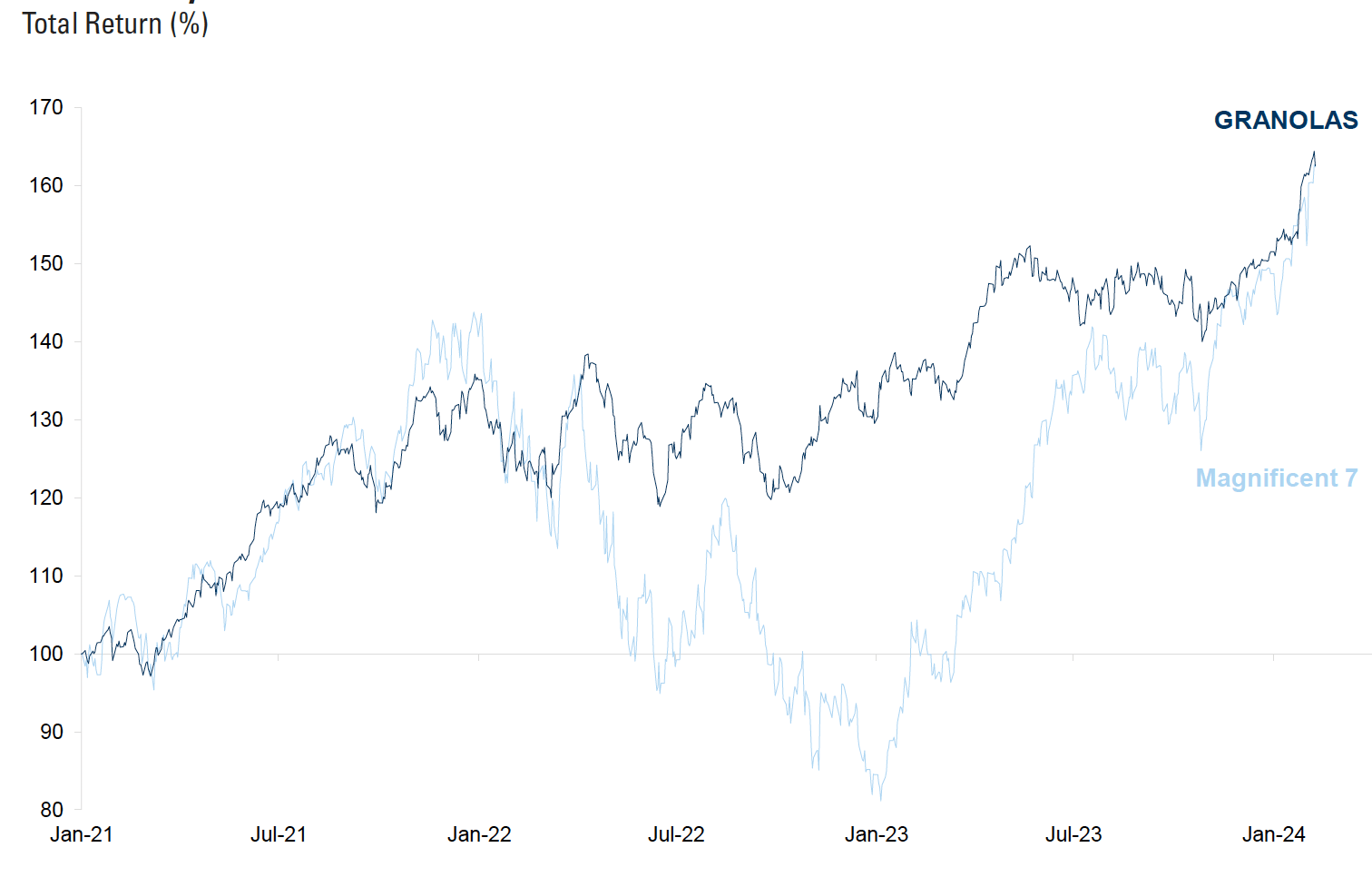

The GRANOLAS have jumped more than 60% as a group since January 2021, matching the performance of the Magnificent Seven, Goldman Sachs’ calculations show. However, they accomplished this with lower volatility. Unlike their US counterparts, the European group avoided the sharp sell-off of 2022, when investors fretted about quickly rising interest rates (Figure 2).

Figure 3: Steady rise

“From a portfolio construction point of view, the GRANOLAS can help to boost the Sharpe ratio and mitigate risks as volatility picks up,” a team of Goldman Sachs strategists including Guillaume Jaisson and Sharon Bell wrote in a report on February 12, 2024.[4] “If we were to enter a high vol regime, we believe the GRANOLAS would be well insulated relative to the market, as they have been in the recent past.”

The realized volatility of the GRANOLAS is on average twice lower than that of the Magnificent Seven, according to Goldman Sachs.

Thanks to their large share of overseas earnings, the GRANOLAS were the main reason why the STOXX Europe 600 posted double-digit gains in 2023 despite lackluster economic growth in the region.

Quality growth

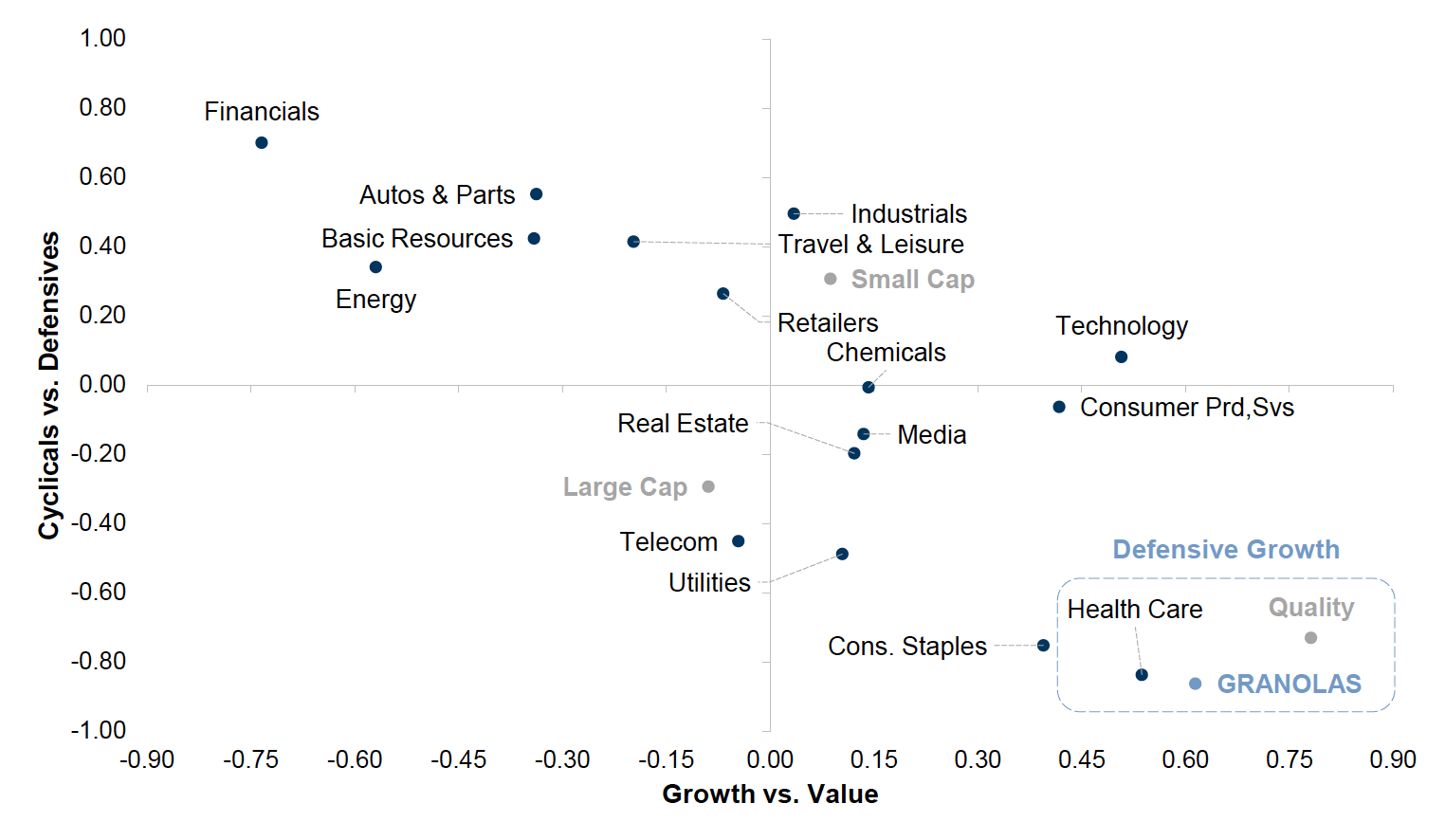

Their business characteristics make the GRANOLAS a quality and defensive trade in Europe, according to Goldman Sachs. Figure 3 shows the GRANOLAS’ positive correlation with those two styles. Quality was the second best-performing style globally in the 12 months through February, according to the STOXX Factor indices, only beaten by Momentum.

“This type of company has tended to outperform when growth slows,” the strategists wrote.

Figure 4: Correlation with Growth and Defensive styles

ASML, the Dutch company whose lithography machines are used to make chips, on January 24 reported that sales jumped 30% in 2023 from the year earlier. Booming revenue has also lifted the shares of Novo Nordisk, the company behind the Ozempic and Wegovy drugs, and LVMH, the maker of Louis Vuitton handbags and Tiffany’s jewelry. Both are now among the world’s top companies by market capitalization.

Capturing flows

Because of their size, the GRANOLAS also stand to capture the biggest share of flows amid the structural shift towards passive investment, according to Goldman Sachs. The bank’s research shows that the GRANOLAS tend to outperform when ETFs see more inflows than actively managed funds. Another benefit is that the GRANOLAS are among the most liquid companies in Europe, an attribute sought by large, US-based institutions.

Finding the right theme in the cycle

At a broad index level, European stocks may be behind the returns of other markets such as the US, dominated by uber-growth technology shares. However, Goldman’s analysis shows that an important part of the European market has similar growth characteristics, but at lower volatility levels than the popular, more cyclical stocks that dominate news headlines. That segment could provide above-average returns particularly in a market where economic growth is scarce and should volatility pick up.

[1] Amazon, Apple, Alphabet, Meta, Microsoft, Nvidia and Tesla.

[2] Data as of March 18, 2024.

[3] Source: STOXX. Price data in USD from February 9, 2023 to February 9, 2024.

[4] Goldman Sachs, “The Magnificent GRANOLAS,” February 2024.