STOXX has introduced the DAX® 30 ESG index, a benchmark of Germany’s large-caps with the highest ESG scores.

Index selection starts with the universe of the HDAX®[1](around 100 stocks), and companies that fail the ISS ESG Norms Based Screening assessment[2] are ineligible for inclusion. Exclusion filters are also applied for involvement in Controversial Weapons, Tobacco, Thermal Coal, Unconventional Oil & Gas, Civilian Firearms, Nuclear Power and Military Equipment.

From the remaining companies, the top 60 by free-float market capitalization are pre-selected. Thereafter, the 30 securities with the highest ESG Performance Score from ISS ESG are finally included in the DAX 30 ESG.

ISS ESG’s Corporate Rating system allows investors to evaluate companies’ ESG-related risks, opportunities, and impact along their value chain. The ESG Performance Score enables cross-industry comparisons using a standardized best-in-class threshold.

The ESG scoring system draws from a pool of about 700 indicators, of which approximately 90% are industry-specific, and identifies key sustainability issues for each industry, upon which companies can be examined according to their performance.

Composition and returns

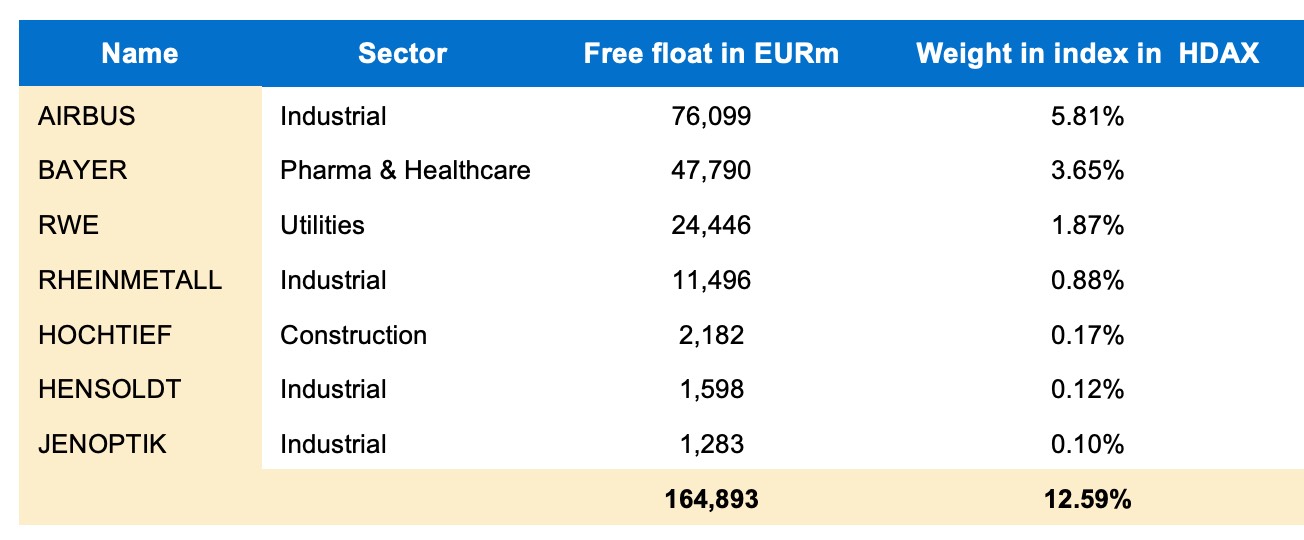

Seven stocks were ineligible for the DAX 30 ESG as they failed to pass the methodology screens (Figure 1).

Figure 1: Companies ineligible for DAX 30 ESG

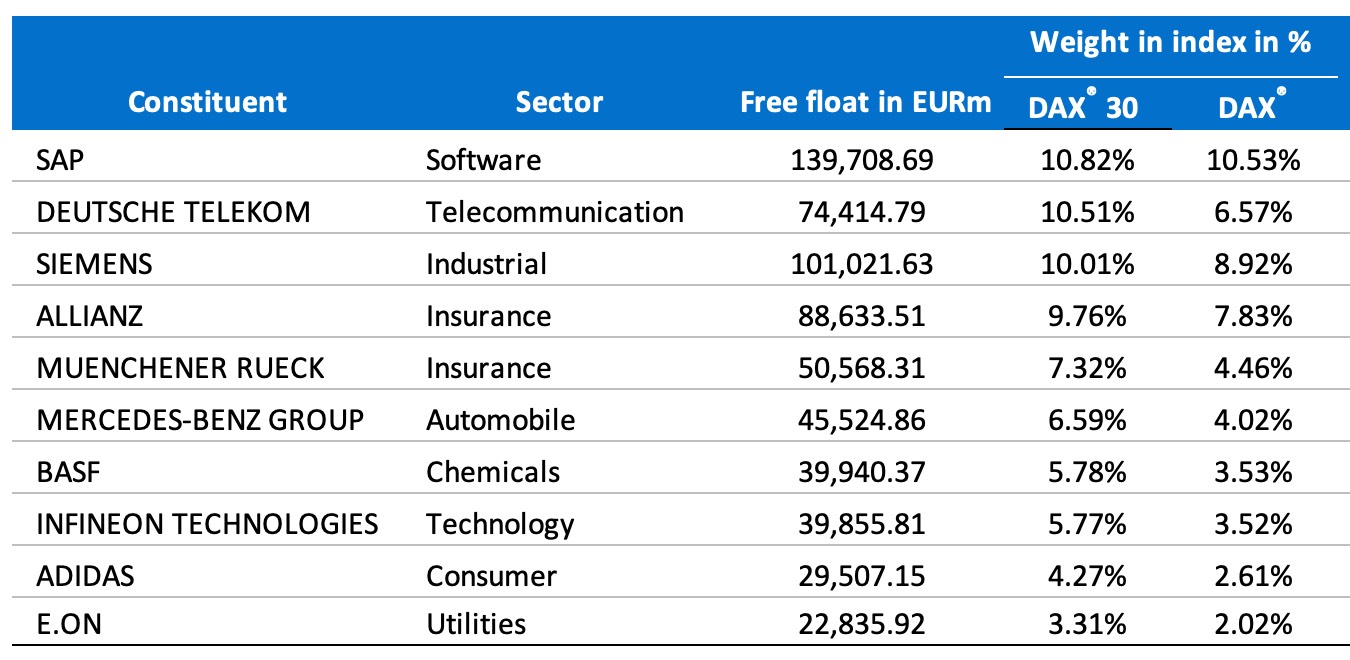

Figure 2: DAX 30 ESG top components

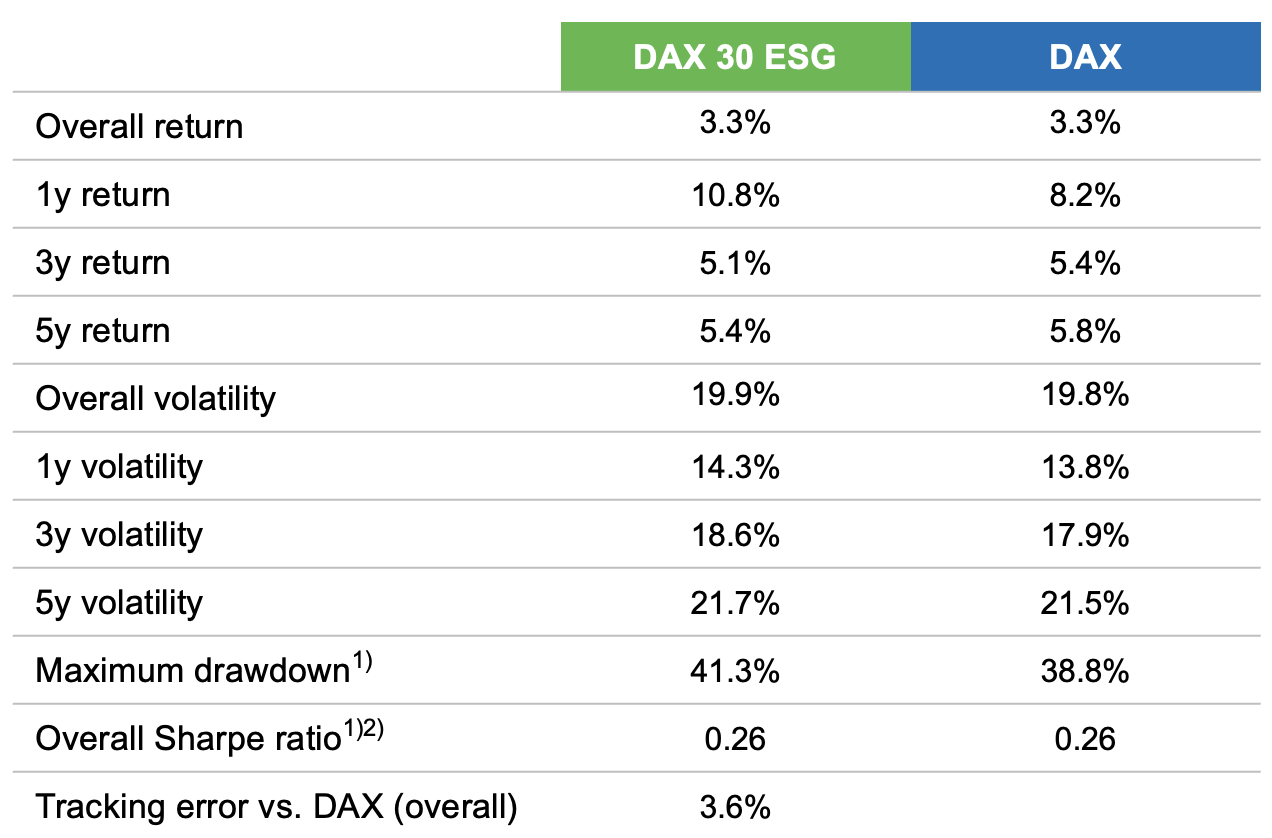

Figure 3: Risk and return characteristics

Decrement version

Together with the introduction of the DAX 30 ESG, the idDAX® 30 ESG Decrement 4.0% index was launched. The index replicates the performance of the DAX 30 ESG net return index assuming a constant 4% performance deduction per annum. Decrement indices have proved very popular with structured-product issuers as it allows them to improve the terms offered to clients.

Growth of responsible investing

As demand for sustainable investing in the German market has grown strongly in recent years, STOXX has introduced several alternatives to the benchmark DAX® that meet the specific needs of investors with diverse responsible objectives.

The indices vary in strategy, following either a negative-screening approach, combining exclusionary screening and best-in-class ESG integration, as is the case with the DAX 30 ESG, or embedding an optimization to maximize impact given a certain tracking error. The indices also have distinct characteristics in terms of starting universe and weighting processes.

While the indices differ in scope and approach, they have the transparent methodologies and liquidity considerations that are common to all DAX indices, and use the best available data for each case. Having options is a deliberate decision in a market segment where one size does not fit all.

[1] The HDAX groups all equities that belong to either the DAX, MDAX® or TecDAX® indices.

[2] Companies are assessed against their adherence to international norms on human rights, labour standards, environmental protection and anti-corruption established in the UN Global Compact and the OECD Guidelines. Companies identified as ‘Red’ are excluded. ISS ESG identifies companies are ‘Red’, if they are failing to respect established norms and where the issue remains unaddressed.