Qontigo has expanded its family of sustainability solutions with the DAX® 50 ESG Index, a benchmark for German equities that excludes companies engaged in controversial activities and integrates environmental, social and governance (ESG) scoring into stock selection.

The index is a liquid representation of the German market that enhances the sustainable profile of the resulting portfolio while maintaining risk-return characteristics that are not too dissimilar to those of the flagship blue-chip DAX® Index.

The DAX 50 ESG Index was designed as a new standard for the growing pool of investors embracing sustainable principles in Europe’s largest economy and looking for a German ESG benchmark. The index combines the two most popular sustainable approaches for equity investing: negative screening and ESG integration.

Focus on sustainability and tradeability

The selection universe for the DAX 50 ESG Index is the HDAX® Index, which groups all equities that belong to either the DAX, MDAX® or TecDAX® indices. The HDAX index currently consists of 99 components.

From the universe, a set of filters are applied to exclude companies deemed to be non-compliant with the Global Standards Screening assessment,1 as well as those involved in controversial weapons,2 tobacco, thermal coal (extraction and power generation), nuclear power and military contracting.

The remaining securities are screened for their individual ESG scores, as calculated by Sustainalytics’ transparent ESG performance rating model.

The DAX 50 ESG Index is composed of all remaining stocks with the highest rank in three parameters: order book volume, free-float market capitalization and ESG score. For a description of the selection methodology and the review calendar, please click here.

Liquid stocks with a large-cap tilt

Feedback from market participants indicated that a flagship sustainable index should be liquid and diversified, and include an ESG strategy element that incorporates ESG screens that are commonly used in the German market.

Selected index components’ weights are capped at 7%. This not only allows for increased diversification but is also intended at overcoming the market-related challenges around the market capitalization and liquidity of companies in the available universe.

The design of the index was iterated a few times over to conclude that 50 was the optimum number of securities. This number ensures that the resulting portfolio has a sufficiently large investment capacity while offering replicability from a tradability and liquidity perspective.

The result is an index of liquid stocks with a large-cap tilt and whose overall performance doesn’t deviate too much from that of the DAX (Chart 1).

Chart 1 – Returns

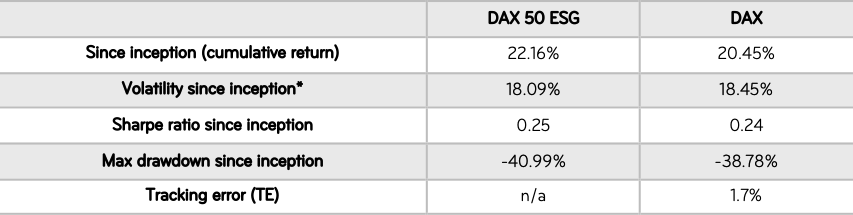

Since data starts in September 2012, the DAX 50 ESG Index has returned 22.16% on a cumulative basis and has outperformed the DAX by 1.71 percentage points, while lowering volatility by 0.36 percentage points (Table 1).

Table 1

Sector allocation

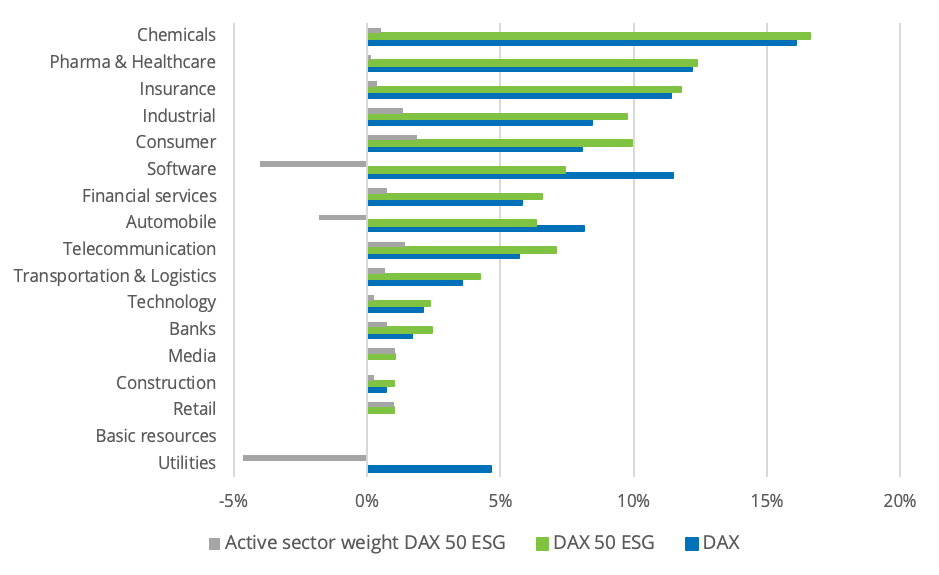

A new research paper3 from Qontigo, accessible here, examines the industry composition of the DAX 50 ESG and DAX indices (Chart 2).

Chart 2 – Sector allocation in DAX 50 ESG and DAX

The ESG index overweights the consumer, telecommunications, industrial, media and retail sectors, among others. It has, on the other hand, a smaller representation of software and automobile stocks than the benchmark. Unlike the DAX, the ESG index includes no utilities.

Accompanying the transition to responsible portfolios

The DAX 50 ESG Index provides investors with a more sustainable version of the flagship DAX benchmark. The index has a robust framework and transparent methodology, and is suitable as an underlying for derivatives, structured products and exchange-traded funds.

Just as the DAX is the undisputed benchmark for German stocks, the DAX 50 ESG Index is born with the ambition to become the go-to benchmark for sustainable equity investments in Germany.

Featured indices

DAX® 50 ESG Index

Featured study

DAX® 50 ESG – The New Standard in German ESG Investments

1 Global Standards Screening identifies companies that violate or are at risk of violating commonly accepted international norms and standards, enshrined in the United Nations Global Compact (UNGC) Principles, the Organisation for Economic Co-operation and Development (OECD) Guidelines for Multinational Enterprises, the UN Guiding Principles on Business and Human Rights (UNGPs), and their underlying conventions.

2 The following weapons are considered controversial: anti-personnel mines, biological and chemical weapons, cluster weapons, depleted uranium, nuclear weapons and white phosphorus weapons.

3 Williams, L., Venkataraman, A., ‘DAX® 50 ESG – The New Standard in German ESG Investing,’ Qontigo, April 2020.