By Roberto Lazzarotto, Global Head of Sales, STOXX

As part of the expanding STOXX thematic offering, we are excited to introduce a new index tracking four technologies transforming business globally.

The iSTOXX® Developed Markets B.R.AI.N. Index is made up of companies that generate more than 50% of their revenue from biotechnology, robotics, artificial intelligence (AI) and nanotechnology. In covering these four trends, the index aims to give investors access to the economic benefits of modern industrial change.

Investor demand for single-theme indices is strong. Our iSTOXX FactSet Thematic index family, which covers ageing population, automation & robotics, breakthrough healthcare and digitalization, successfully offers already a diversified range of investment strategies. But we went one step further…

Four technologies for a world in change

The B.R.AI.N. Index is composed of pioneers and adopters of four technology themes that are disrupting the value chain across industries, generating new sources of profit growth and operating efficiency. These same technologies are likely to have a profound and lasting impact on all of our lives.

In Biotechnology, biological processes and engineering techniques are combined to develop new technologies and products that can improve lives. Biotechnology is now extensively used in the medical industry, biofuels and agribiotech.

The global Robotics market is expected to boost revenue at a compound annual growth rate of 16% between 2017 and 2025, to $154 billion.1 Lower costs and increasing output efficiency, safety and reliability are fueling demand for smart machines at factories, homes and offices. The car manufacturing industry remains a leading sector in terms of automation, but the technology is quickly becoming an integral part of the healthcare, defense and electronics industries.

AI – human-like cognitive tasks performed by machines – has taken industries by storm in past years. A recent PULSE ONLINE article featured a forecast that AI will be responsible for doubling the pace of growth in 12 developed countries between 2016 and 2035. Beneficiaries of the theme include AI users, hardware providers and big data enablers.

Finally, Nanotechnology refers to the science and engineering conducted at the nanoscale level, or at about 1 to 100 nanometers (one nanometer is a thousand-millionth of a meter). Nanoscale ingredients can perform tasks at a speed and efficiency unattainable for larger-scale counterparts, and enhance properties of final materials and products. The top applications of nanotechnology include electronics, energy, cosmetics and the biomedical industry. Revenue derived from nanotechnology is expected to grow at a compound annual rate of 17% between 2017 and 2024.2

The index composition – accurate exposure to the four themes

Following an initial liquidity filter, all stocks in the STOXX® Developed Markets Total Market Index are meticulously screened and their business analyzed to assess their exposure to each megatrend tracked by the B.R.AI.N. Index.

Companies that derive at least 50% of their revenue from the aggregate of business sectors linked to one theme are ranked by that exposure, creating four respective clusters. The top 20 stocks of each technology cluster are selected into the index.

For example, more than 60 activity sectors – from biological specimen storage to ethanol fuel manufacturing – will determine the ranking of constituents for the biotechnology theme.

The index is weighted according to each stock’s free-float market capitalization multiplied by its exposure to all themes. Weight caps are in place to ensure diversification.

Capturing the growth tilt

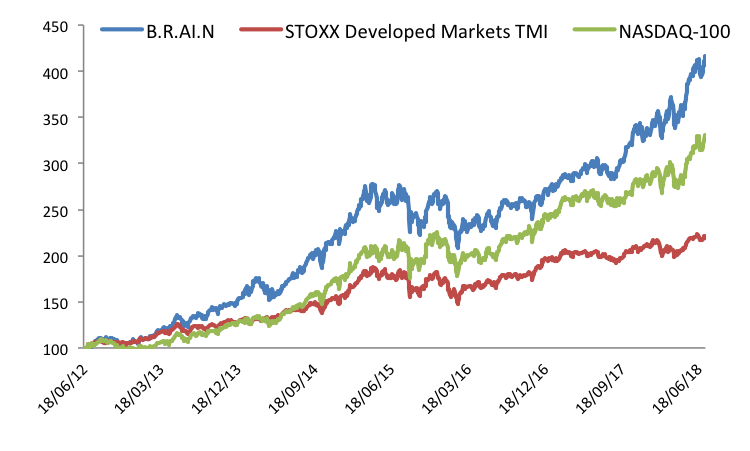

The B.R.AI.N. Index had an annualized return of 24% in the five years to Jul. 16, 2018.3 That is exactly twice the 12% annual return for the STOXX Developed Markets Total Market Index.

Chart 1 shows the performance of the B.R.AI.N. Index and its benchmark based on available data that starts on Jun. 18, 2012. The NASDAQ-100 Index, which is tilted towards technology stocks, is also featured.

Chart 1

The force of transformation

The four themes underlying the B.R.AI.N. Index are likely to be at their initial stages of development, providing investors another channel into a promising growth trajectory.

In choosing these disruptive technologies, we at STOXX aimed to capture the impulse of four strong and unique drivers. Each cluster of the B.R.AI.N. Index is revolutionary in itself; by combining them they bring a diversified while powerful access to a continued business transformation.

Featured indices

1 ‘Robotics Market,’ Transparency Market Research (TMR), October 2017.

2 RNCOS, ‘Global Nanotechnology Market Outlook 2024,’ May 2018.

3 Gross returns in euros.