Emerging markets have been strong performers in recent years. Their momentum, however, has hit a snag in 2018, first on geopolitics and more recently on macroeconomic concerns.

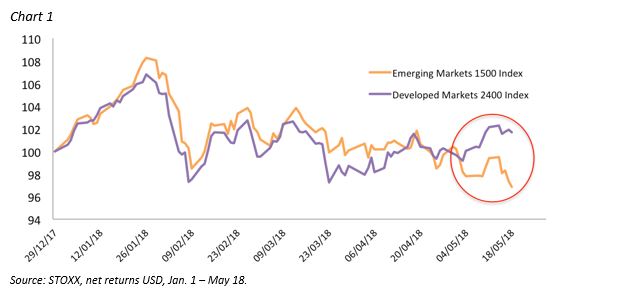

Chart 1 shows the performance of the STOXX® Emerging Markets 1500 Index against the STOXX® Developed Markets Index this year.1 The indices have diverged since the start of May, as marked by the red circle. Emerging markets are accumulating a year-to-date loss of 4.2%, compared with a gain of 1.1% for the developed-markets gauge.2

Country total market indices

Yet the emerging-market category is an array of economies with diverse fundamentals. And the broad index performance masks different national outcomes.

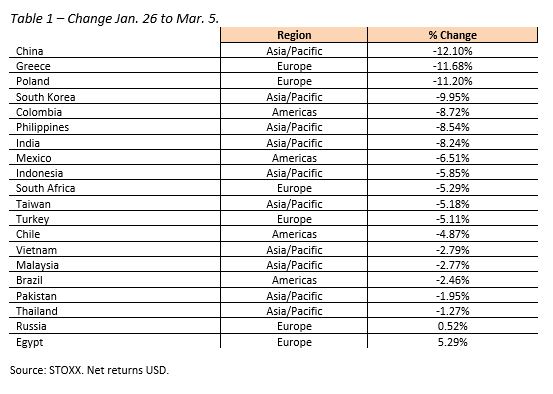

While an initial leg down at the end of January was caused by concern that US interest rates will rise further, the losses resumed in early March after the US administration said it would impose tariffs on imports of aluminum and steel.

In this initial period, the heavily export-dependent economies of China and South Korea helped pace the retreat. Table 1 shows the performance – from worst to best – of the emerging-market universe tracked by STOXX’s Country Total Market indices between Jan. 26 and Mar. 5.

Weaker budgets, weaker markets

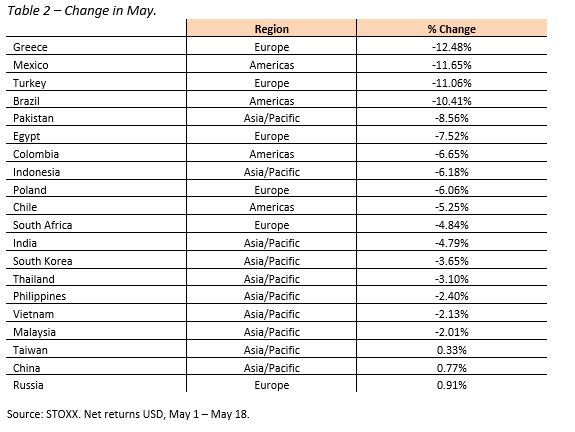

The more recent downturn for emerging markets, on the other hand, has reportedly been driven by the strengthening of the US dollar and by rising US Treasury yields. Those economies deemed to have the weakest national accounts saw the biggest drop in their currencies and stock markets, as a stronger dollar and high interest rates make it harder for them to service the debt they need to maintain spending.

As such, selling was focused on the Latin American markets of Mexico and Brazil, as well as on Greece and Turkey. Many Asian markets, by comparison, outperformed and even posted a positive return.

Table 2 displays the performance of STOXX’s Country Total Market indices for the emerging-market universe for the month of May.

Month-to-date, Asia/Pacific markets occupy all but one of the top nine slots by performance.

Interestingly, the average current account deficit for the worst five performers is -2.9%, according to International Monetary Fund (IMF) data. The five best performers, on the other hand, have an average current account surplus of 4.9%. Also worth pointing out: the worst performer, Greece, has the group’s highest government debt level relative to its gross domestic product (GDP), according to the IMF. Russia, the best performer, has the lowest debt-to-GDP ratio in the group.

In summary, not all emerging markets are equal. The recent performance may help investors determine which markets could outperform as political and economic headlines break throughout the rest of the year.

Featured indices

1 All performances are in dollars, inclusive of dividends after taxes.

2 Through May 18.