Stocks plunged by the most in over eight years during February, as a fast and widely spreading Coronavirus stoked concerns the global economy will suffer a slowdown.

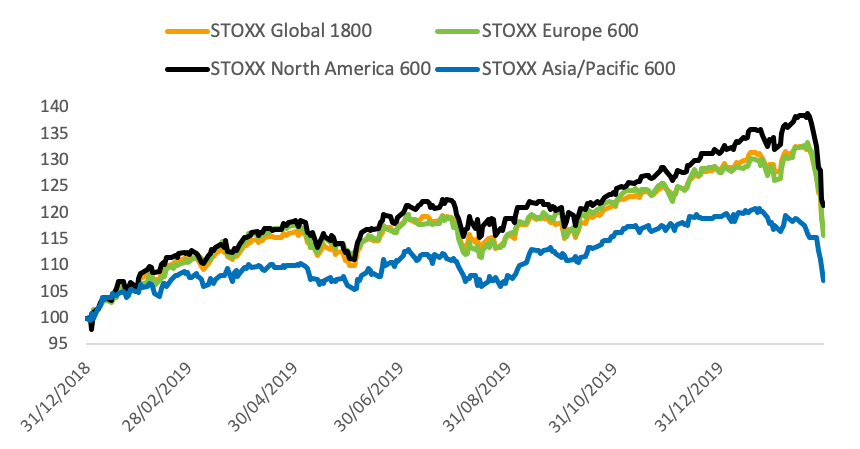

The STOXX® Global 1800 Index slid 8.4% in dollar terms1 during the month, with all losses concentrated in the month’s last seven trading sessions. The global benchmark tumbled 11.8% between Feb. 20 and Feb. 28, the steepest drop in such a time frame since August 2011, falling in each of the seven sessions. The index is now down 9% for 2020.

Correction territory

The pan-European STOXX® Europe 600 Index fell 8.3% when measured in euros, its worst monthly performance since August 2011, and the Eurozone’s EURO STOXX 50® Index lost 8.4%. The STOXX® North America 600 Index shed 8.1% in dollars, its fifth-worst month since data begins in 2004. The STOXX® Asia/Pacific 600 Index fell 8.8% and erased all of its gains for the past 12 months.

All four indices entered a so-called correction, defined as a drop of 10% from a recent high.

Chart 1 – Benchmarks’ performance since 2019

Heading towards a recession?

With virus cases quickly spreading across Asia and Europe at the end of last month, governments, companies and consumers rushed to cancel public outings and limit contagion. Economists have made significant cuts to growth forecasts for this year as a result, including predicting now that some nations are likely to fall into a recession. Speaking at a public event, former Federal Reserve Chair Janet Yellen said the US could be one of those countries.2

Losses across sectors and countries

All 25 developed markets tracked by STOXX fell during February when measured in dollars. The STOXX® Developed Markets 2400 Index declined 8.5% in dollars and 7.7% in euro terms, as the common currency weakened 0.9% against the greenback. All but one of 21 developing-nations indices retreated, with the exception being the STOXX® China Total Market Index. The STOXX® Emerging Markets 1500 Index dropped 7.2% in dollars.

All 19 supersectors in the STOXX Global 1800 Index fell under the selling pressure. For a second consecutive month, the STOXX® Global 1800 Oil & Gas Index was the worst performer, shedding 13.7%, amid a rout in energy prices. The STOXX® Global 1800 Telecommunications Index’s 6.3% decline marked the best performance among all industries.

Thematics outperform

While they didn’t escape February’s sell-off, 16 of 18 revenue-based STOXX® Thematic Indices outperformed the STOXX Global 1800 Index. Most of them, however, registered higher levels of volatility than did the benchmark.

The iSTOXX® FactSet Breakthrough Healthcare Index had the group’s best performance during the month – a 4.4% decline. The STOXX® Global Electric Vehicles and Driving Technology Index, meanwhile, fared the worst with a 9.4% drop.

Two of the three STOXX artificial-intelligence-driven thematic indices outperformed their benchmark during February. These are the STOXX® AI Global Artificial Intelligence Index and the STOXX® AI Global Artificial Intelligence ADTV5 Index. Both indices track companies that are investing the most in research and development of artificial-intelligence technologies.

The iSTOXX® Yewno Developed Markets Blockchain Index underperformed the STOXX Global 1800 Index by 17 basis points.

Minimum variance fails in the US

Minimum variance strategies had diverse performances during the month amid a spike in volatility.

The STOXX® Global 1800 Minimum Variance Index topped the STOXX Global 1800 by 15 basis points. The STOXX® Global 1800 Minimum Variance Unconstrained Index outperformed by 84 basis points. There were similar relative performances with the minimum variance indices tracking the STOXX Europe 600.

In the US market, however, STOXX’s Minimum Variance indices failed to deliver on their objective during February. Both the constrained and unconstrained versions of the STOXX® USA 900 Minimum Variance Index trailed their benchmark by more than 30 basis points.

ESG, Climate, Low Carbon

Among STOXX’s ESG and Sustainability indices, the STOXX® Global ESG Impact Index underperformed the STOXX Global 1800 Index by 35 basis points, while the STOXX® USA ESG Impact Index lagged the STOXX® USA 900 Index by 31 basis points. The two indices select stocks based on key sustainable performance indicators.

The EURO STOXX 50® ESG Index, which incorporates negative exclusions and ESG scoring into stock selection, outperformed the EURO STOXX 50 by more than one percentage point.

STOXX’s Climate Indices performed largely in line with benchmarks during February. The STOXX® Global Climate Change Leaders Index, however, underperformed the STOXX Global 1800 Index by 25 basis points. The index selects corporate leaders that are publicly committed to reducing their carbon footprint.

Most STOXX Low Carbon Indices showed February returns that weren’t far off from those of the respective benchmarks. The EURO STOXX® 50 Low Carbon Index trailed the flagship EURO STOXX 50 Index by 24 basis points.

Value style lags

Factor-based strategies outperformed the market during February as measured by the EURO STOXX® Multi Premia® and Single Premium Indices.

Six of eight indices – including those tracking the size, quality and momentum factors – came ahead of their benchmark, the EURO STOXX® Index, which fell 7.8% in euros during the month. The EURO STOXX® Reversal Premium Index and the EURO STOXX® Value Premium Index trailed the benchmark but did so by less than 20 basis points each.

Featured indices

- STOXX® Global 1800 Index

- EURO STOXX 50® Index

- STOXX® Europe 600 Index

- STOXX® North America 600 Index

- STOXX® Asia/Pacific 600 Index

- STOXX® Developed Markets 2400 Index

- STOXX® Emerging Markets 1500 Index

- STOXX® Global 1800 Minimum Variance Index

- EURO STOXX® Multi Premia® and Single Premium Indices

- STOXX Low Carbon Indices

- EURO STOXX® 50 Low Carbon Index

- STOXX® Global Climate Change Leaders Index

- EURO STOXX 50® ESG Index

- STOXX® Thematic Indices

- STOXX® Global ESG Impact Index

- STOXX® USA ESG Impact Index