With the launch of futures on the STOXX® USA 500 ESG-X Index this month, we took the opportunity to revisit the effect of environmental, social and governance (ESG) exclusions on portfolio performance following on from our study in August 2019.

STOXX’s ESG-X Indices are ESG-compliant versions of established STOXX benchmarks that aim to meet investors’ need for market-capitalization-weighted benchmarks that are in line with their responsible-investing policies.

The STOXX USA 500 ESG-X Index futures are the first listed derivatives covering the US market that implement a screening for thermal-coal mining and coal-fired power plants. The index also excludes companies involved in controversial weapons and tobacco, as well as those deemed in breach of United Nations Global Compact principles. The new futures follow on from the successful introduction of futures on the STOXX® Europe 600 ESG-X Index a year ago.

Effects of exclusions

What are then the effects, cost and benefits of implementing these negative screens vis-à-vis a benchmark?

In a new research study2 published today, available here, we ran data on the STOXX USA 500 ESG-X Index since 2012 to try and answer those questions. One first finding is that the various exclusions have resulted in an average of 35 securities being removed from the benchmark STOXX® USA 500 Index (500 constituents) over the period (Figure 1). These accounted for an average weight of 9.2% of the benchmark.

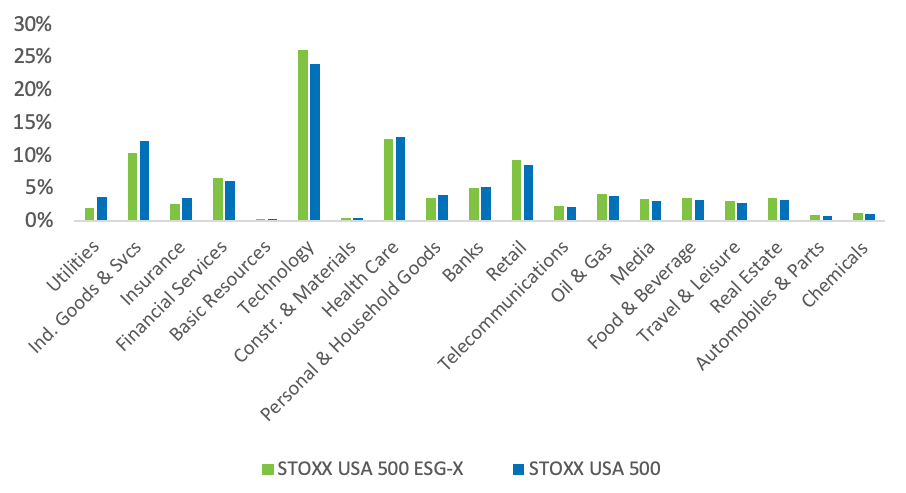

When looking at the effect on industry composition (Figure 2), the data show that tobacco-related exclusions have resulted in an underweight to the Personal & Household Goods ICB supersector. Similarly, the removal of stocks linked to controversial weapons has diminished the weight of the Industrial Goods & Services supersector, while the coal exclusions have reduced the exposure to Utilities.

Elsewhere, breaches to the UN Global Compact principles have resulted in underweights to the Banks and Health Care supersectors.

Outperformance despite drag from controversial weapons exclusion

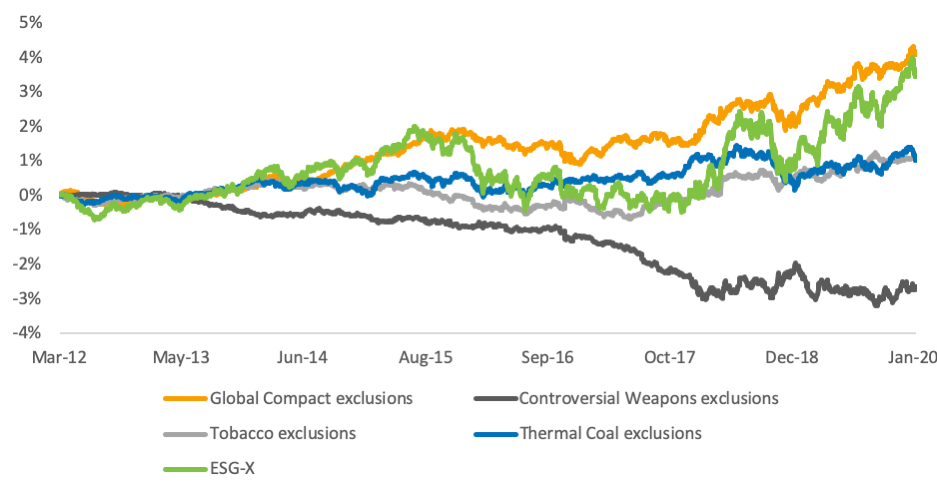

Overall, the exclusions have enhanced total returns. Between Mar. 16, 2012 and Jan. 31, 2020, the STOXX USA 500 ESG-X Index outperformed the benchmark by 3.45 percentage points in cumulative returns.3

However, not all exclusions were accretive to returns. The removal of securities involved in controversial weapons resulted in a drag on the index, whereas the other three exclusions resulted in a positive contribution (Figure 3). The biggest boost came from applying the UN Global Compact principles screen, which added over 4 percentage points to returns over the entire period.

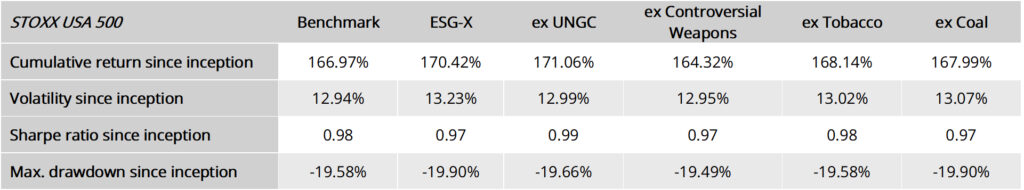

Figure 4 displays a summarized version of a more detailed analysis we ran in the report. Here, we focused on the effect on risk and returns of implementing the four ESG-X exclusions on the STOXX USA 500. Data show that the exclusions increased volatility relative to the benchmark, although did so only marginally. The Sharpe ratio and maximum drawdowns for the benchmark, ESG-X index and individual exclusions were broadly in line.

We invite you to read more about the STOXX USA 500 ESG-X Index’s methodology, constituency, performance and returns attribution in our study.

Growing implementation of ESG strategies

Sustainable investing has gathered extraordinary pace in recent years, and many asset owners and investors must now comply with responsible principles in their asset allocation.

However, this doesn’t need to come at a cost to performance. The STOXX ESG-X Indices deliver risk-return profiles that are not materially different to their benchmarks. Their straightforward and transparent methodology means that they can be easily adopted to underlie financial products and to benchmark portfolios. Additionally, the availability of a futures market further helps the construction of an ESG portfolio by providing hedging and liquidity tools that meet responsible principles, and lowering trading costs.

Featured indices

STOXX® USA 500 ESG-X Index

STOXX® USA 500 Index

1 Anand Venkataraman, CFA, is Head of Product Management and Ladi Williams is Product Manager at Qontigo’s index provider STOXX.

2 STOXX, ‘STOXX® USA 500 ESG-X INDEX,’ Venkataraman, A., Williams, L., February 2020.

3 Gross returns in dollars.