Qontigo has announced the annual review results of the STOXX® Global ESG Leaders Index, the benchmark for sustainability champions.

A total of 75 companies entered the index on Sep. 19, including Deutsche Bank AG, BlackRock Inc. and Nikon Corp. Spanish lender CaixaBank SA joined with the third-biggest weight among index constituents. Germany’s BASF AG, General Mills Inc. of the US, and France’s LVMH SE are among 44 companies that have exited.

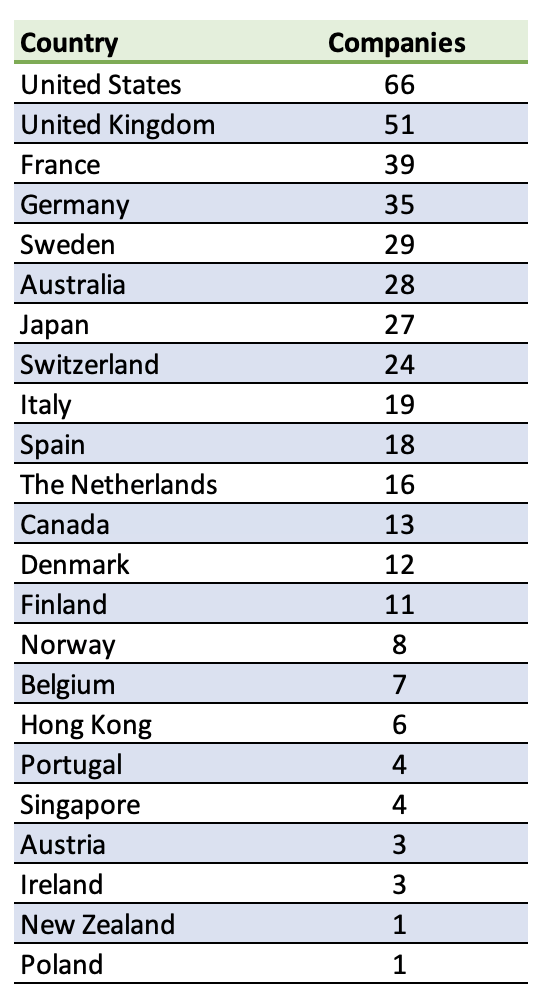

Following the review, the index comprises 425 constituents: 280 from Europe, 79 from North America and 66 from Asia/Pacific.

Best performers in each ESG category

The STOXX Global ESG Leaders Index is STOXX’s broadest benchmark tracking the highest-scoring companies in ESG criteria. The index is derived from three gauges covering each ESG category individually — STOXX® Global ESG Social Leaders Index, STOXX® Global ESG Environmental Leaders Index and STOXX® Global ESG Governance Leaders Index — with each one selecting companies that are leading in that category’s criteria and range above average in the other two. The composition of the three global specialized ESG indices was also reviewed.

The indices are compiled based on indicators from Sustainalytics, which researches companies employing internal data, media reports, and sector and public studies. Sustainalytics reviews a set of indicators for each of the three ESG categories, assigning a score ranging from 0 to 100 for each criterion. These scores are aggregated into a total company rating per ESG category using a weighted sum, where both indicators and weight are adjusted to reflect industry idiosyncrasies.

The ratings form the basis to calculate an overall ranking for each stock and finally for entry into the specialized ESG indices and the overarching STOXX Global ESG Leaders Index. The latter comprises all components eligible for at least one of the specialized indices and is weighted by stocks’ sustainability scores.

In a pre-selection step, companies deemed non-compliant with Sustainalytics’ Global Standards Screening (GSS) assessment,1 and those involved with controversial weapons, are excluded.2

For more on the methodology, please click here.

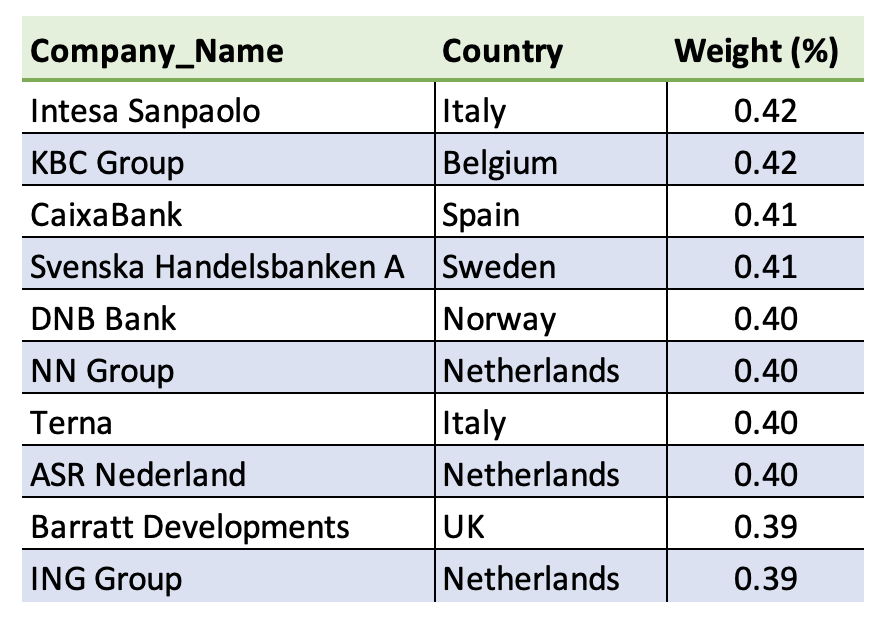

Exhibit 1 – STOXX Global ESG Leaders top 10 holdings

While US companies make up almost two-thirds of the benchmark STOXX® Global 1800 Index, they now account for just over 12% of the Global ESG Leaders.

Exhibit 2 – STOXX Global ESG Leaders current holdings per country

1 GSS identifies companies that violate or are at risk of violating commonly accepted international norms and standards, enshrined in the United Nations Global Compact (UNGC) Principles, the Organisation for Economic Co-operation and Development (OECD) Guidelines for Multinational Enterprises, the UN Guiding Principles on Business and Human Rights (UNGPs), and their underlying conventions.

2 In case a constituent increases its ESG Controversy Rating to Category 5 and becomes non-compliant based on the Sustainalytics Global Standards Screening assessment, the respective constituent will be deleted from the index.