Nomura Asset Management has launched two currency-hedged ETFs in Japan that track, respectively, the EURO STOXX 50® and DAX® indices, giving domestic investors direct exposure to Europe’s blue-chip equity segment.

Read the Japanese version of this post >

Japan’s largest ETF issuer listed the products on the Tokyo Stock Exchange on Sept. 2. The funds replicate the EURO STOXX 50® Monthly Hedged JPY TTM and DAX® Monthly Hedged JPY TTM, and enable local investors to buy and sell the portfolios outside of European trading hours. The listing marks the first DAX ETF available in Japan.

The EURO STOXX 50 and DAX indices have been the undisputed benchmarks for the Eurozone and Germany for decades. They are at the center of a complete ecosystem of ETFs, mutual funds, derivatives and structured products, which rely on objective and transparent methodologies, as well as index criteria that ensure replicability and tradability. More recently, Qontigo has introduced a suite of ESG versions of the indices.

“We are proud to have launched these ETFs with Qontigo,” said Osamu Okuyama, Head of ETF Business Department at Nomura Asset Management. “Our products enable Japanese investors to invest in Eurozone companies and contribute to international diversification. We will continue to strive to expand the ETF market.”

“We are very pleased to work with the Nomura team to provide access to these market segments through two of our most recognized and iconic benchmarks,” said Axel Lomholt, Chief Product Officer, Indices & Benchmarks at Qontigo. “The EURO STOXX 50 and DAX are well-known globally for offering an accurate representation of the underlying capital markets and economic dynamics of the Eurozone and German economies and also serve as underlying for a wide range of highly liquid financial products.”

Tactical and structural

For overseas investors, the European market presents a tactical opportunity following years of underperformance. In the five years through 2021, the EURO STOXX 50 had a total return of 53%, compared with a gain of 137% for the STOXX® USA 500.1 While the yen has plunged against the US dollar in the past five years, it has held broadly flat against the euro over the period, making European assets relatively more attractive than American ones for Japanese investors seeking to diversify geographically.

On a more structural trend, Japanese investors have increased their holdings of overseas assets in recent years, narrowing a long-held home bias. Last July, they owned the biggest value in overseas equities since at least 2005, according to Japan’s Ministry of Finance.2

A large-cap focus and liquidity filters

The EURO STOXX 50 provides a representation of industry leaders in the Eurozone, currently drawing constituents from eight countries. It selects the largest stocks in each one of 20 Supersectors, resulting in a diversified portfolio (Exhibit 1). Its components are worth a combined EUR 2.7 trillion in market capitalization, or approximately 55% of the Eurozone’s total stock market capitalization.

DAX, introduced in 1988, reflects the performance of the 40 largest companies by market capitalization listed on the Frankfurt Stock Exchange (FSE) that fulfill certain minimum quality and profitability requirements. The EURO STOXX 50 and DAX indices additionally filter stocks through a minimum liquidity threshold.

The composition of both indices is determined by a clear and well-publicized criterion — market capitalization — offering index trackers stability and visibility into changes. There are no discretionary decisions in the index construction and regular reviews, only established rules.

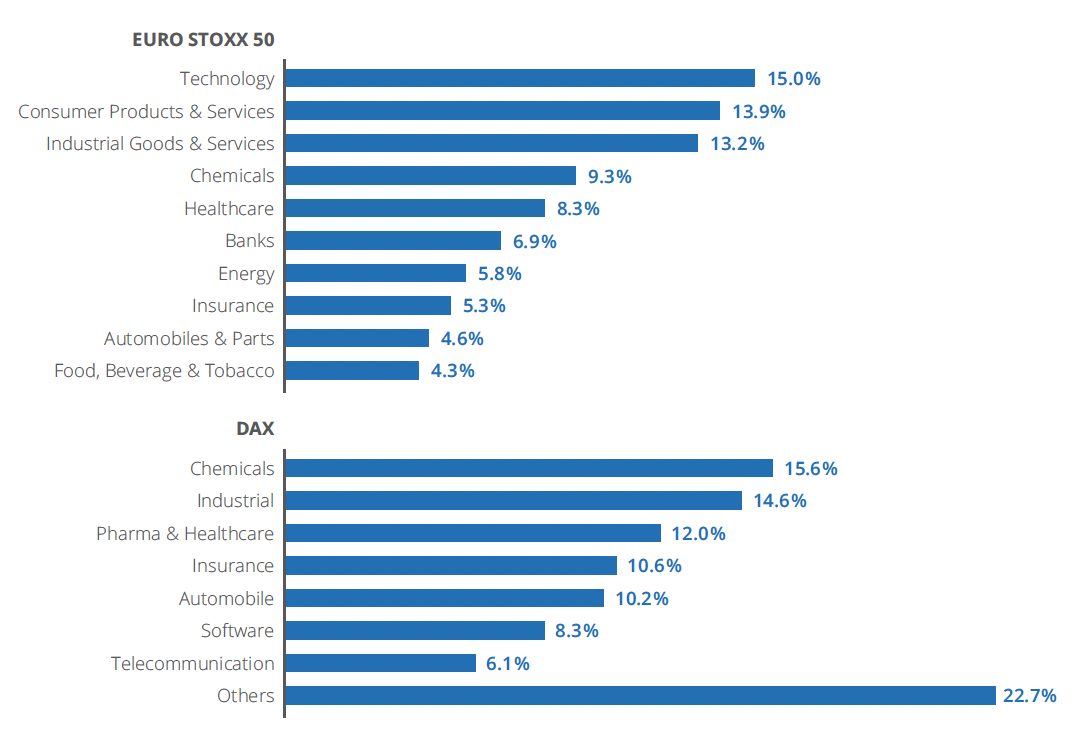

Exhibit 1 – Sector allocation

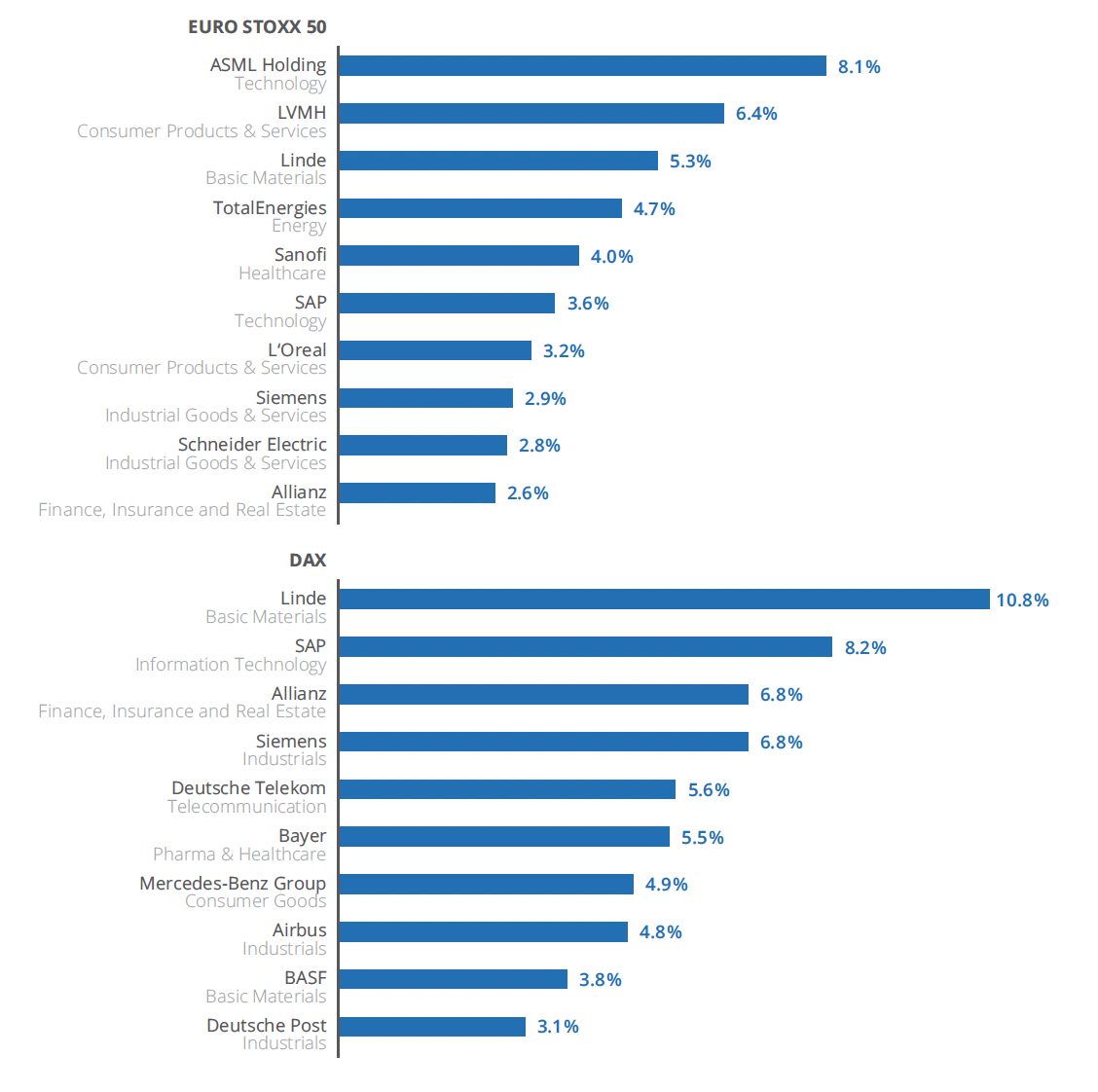

Exhibit 2 – Top ten holdings

Currency-hedged versions

A currency-hedged index is designed to represent the index investment returns protected against currency risk (with a rolling investment into foreign-exchange forward contracts). Investors thus eliminate the risk of exchange-rate fluctuations at the cost of potential currency gains. In the monthly hedged version, the forward hedge is set up once a month and remains unchanged until the next reset.

The EURO STOXX 50 Monthly Hedged JPY TTM and DAX Monthly Hedged JPY TTM Index use the TTM (Telegraphic Transfer Middle rate) spot and forward rates from MUFG Bank, Ltd., as the exchange rate.

Liquid representation

Blue-chip indices represent a simple and highly liquid way for investors to obtain comprehensive exposure to the world’s equity regions. The listing of EURO STOXX 50 and DAX ETFs in Tokyo will offer local investors low-cost market access to two of the world’s most important economies.

1 Source: Qontigo. Total returns in EUR for the EURO STOXX 50 and in USD for the STOXX USA 500.

2 Reuters, ‘Japanese investors were big buyers of foreign equities in July,’ Aug. 8, 2022.