In October last year, Qontigo introduced the STOXX® Global Digital Entertainment and Education Index (GDEE Index), the latest addition to its family of thematic strategies. The index, which underlies a new iShares ETF from BlackRock, aims to track the beneficiaries of two accelerating structural trends of our modern society, as the public changes the way it consumes media and accesses learning.

In a new white paper1, we have looked at the composition and profile of the index for investors interested in understanding the portfolio’s return drivers.

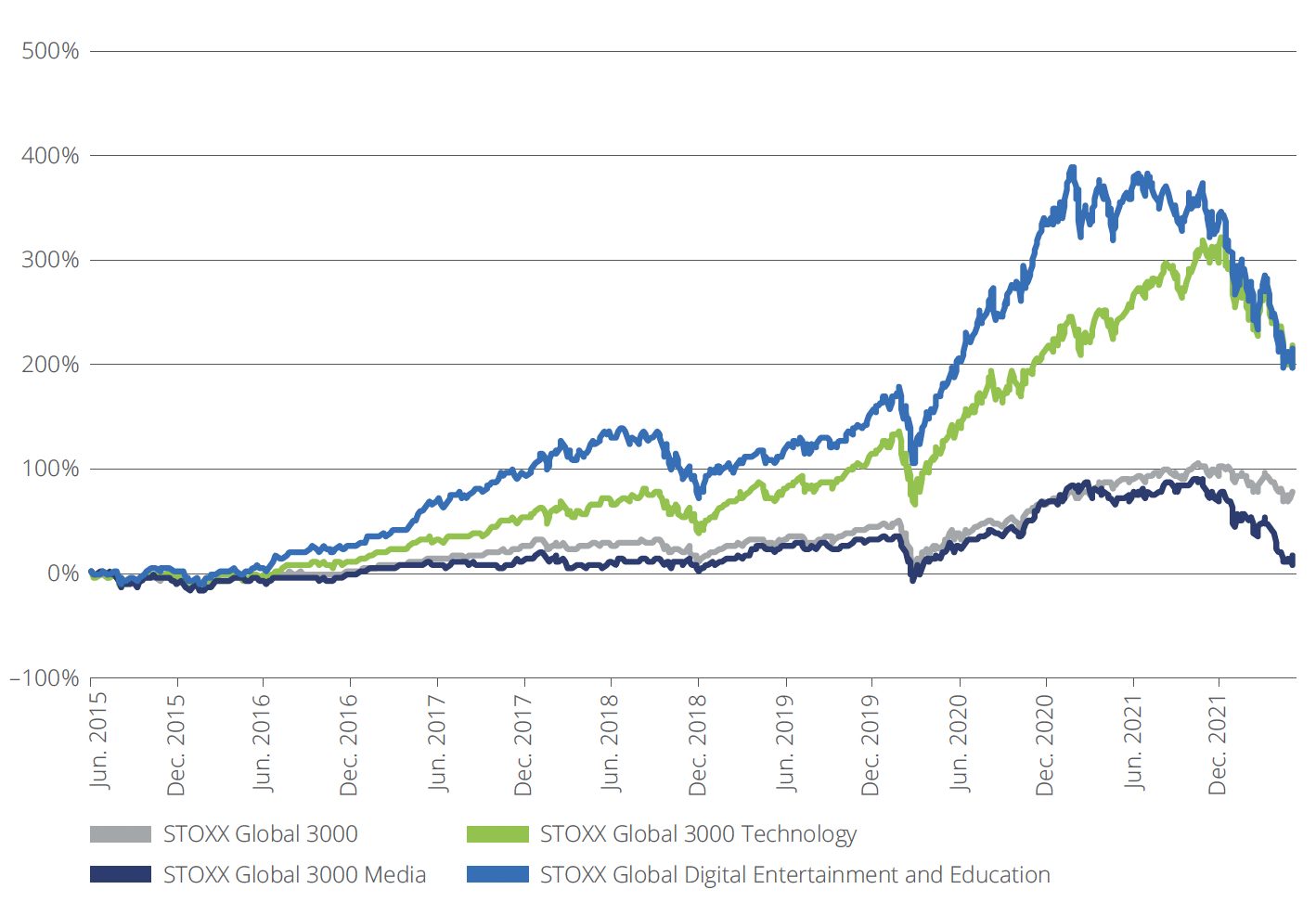

Between 2015 and 20222, the GDEE strongly outperformed both the broad STOXX® Global 3000 Index and the STOXX® Global 3000 Media Index (Global Media) (Figure 1). Meanwhile, it showed a similar performance to the STOXX® Global 3000 Technology Index (Global Tech), although with different return drivers.

Figure 1: Cumulative returns Jun 2015 – May 2022

Drivers of performance

Among drivers of returns, we have analyzed the factor contribution to each index’s performance over the past seven years as measured by the Axioma Worldwide Fundamental Medium-horizon Risk Model.

The Market factor lifted all indices over the seven years analyzed, which is not surprising given the multi-year rally in US equities. Yet the specific stock allocation in the GDEE is what sets it apart: within all four indices, the GDEE saw the biggest positive contribution to returns from the Specific factor, which captures the idiosyncratic characteristics of the assets in the index. Moreover, the individual stocks in the GDEE generated higher returns than would be accounted for by its Market, Industry, Country, Currency and Style exposures alone.

This is what we would expect to see in a thematic index that focuses on selecting stocks which are deriving revenues from theme-relevant sub-industries rather than selecting traditional industries.

The study also examines the performance attributable to Style factors including Dividend Yield, Value and Volatility.

Market conditions since index launch

Finally, we have analyzed index performance since the GDEE’s launch on October 13, 2021, to account for this year’s market volatility. Between index inception and the end of May 2022, the index outpaced Global Media by 9 percentage points but underperformed Global Tech by 13 points. All three indices trailed the broader STOXX Global 3000 as equity markets — and, in particular, technology stocks — faltered this year.

Unsurprisingly, the GDEE has been hurt by the recent fall in global equity markets in an environment of rising rates. However, it should be borne in mind that thematic indices are, by definition, built to capture long-term structural changes. Looking forward, the index is well positioned to capitalize on the innovation trends surrounding the transformation of education and entertainment to a more digital world.

The study also looks at the market, style, country, industry and currency allocations of the STOXX Global Digital Entertainment and Education Index, for those interested in a clear comparison against other indices.

We invite you to download the white paper and read more about the new thematic index.

* Diana R. Baechle is part of Qontigo’s Applied Research team.

1 Baechle, D. R., ‘The future of school and play: STOXX Global Digital Entertainment and Education Index,’ Qontigo, June 2022.

2 The period June 22, 2015 – October 12, 2021 covers backtest data, while the period October 13, 2021 – May 31, 2022 covers live index data. The GDEE was launched on October 13, 2021.