As populations get greyer, economic growth is likely to stay sluggish. But demographics also spell opportunities.

Demographics have caused famous investors like Bill Gross to warn of a headwind to markets, with slower economic growth becoming the ‘new normal’ just as much as grey hairs come with age.

The U.S. is expected to grow just 2.2% this year and 2.3% in 2018, trailing annual rates well above 3% in the late 1990s boom.

This year, the United Nations estimated there would be an additional 1 billion people on the planet by 2030, with the population aged 60 or over growing faster than all younger age groups.1 By 2050, the number of those 60 and over will have more than doubled from today, the UN estimates. And the age distribution will be very different then: in Europe, 25% of the population today is aged 60 or more; by 2050, it will be 35%.

Opportunities in change

Beyond the headline number, the shift in the composition of populations will bring about radical social and economic changes. As Baby Boomers retire, a new landscape emerges with production and consumption dynamics that are very different to what we have known. For investors, this means specific opportunities to be captured.

Some of the sectors associated with a growing elderly population include healthcare, insurance, asset management and tourism. To cite one example of the transformative force of an ageing population, Japan estimates that the national healthcare bill will rise more than 50% between 2012 and 2026, to 60 trillion yen (467 billion euros), even as the overall population shrinks.2 In the UK, the share of national wealth of those over 55 climbed to about 65% percent in 2014, while the share held by 16-44 year olds steadily shrunk after 2008.3

However, the weight of the ‘grey dollar’ is likely to be felt as well in unexpected places, making it vital for companies to have the right strategy in place or risk missing their targets. A study by KPMG last year estimated, perhaps counterintuitevely, that people aged 65 and over outspent those aged 16 to 24 on clothing.4

Rules-based universe of changing demographics

The iSTOXX FactSet Thematic Indices are a way for investors to zero in on the long-term beneficiaries of such seismic changes through a passive investment approach, while spending less than they would on active fund management.

The iSTOXX® FactSet Ageing Population index is one of four of these thematic indices, which cover global, disruptive and modern megatrends defining the digital era. The index is compiled on a rules-based methodology and best-in-class database from FactSet Revere, whose granular analysis selects companies that derive more than 50% of their revenue from business activities linked to the megatrend in question.

For the Ageing Population index, FactSet singles out companies active in 54 sectors: from High-Net Advisory Finance to Private Wealth Managers; from Boat Makers to Golf Equipment; and from Cardiology Surgical Devices to Drug Lead Discovery.

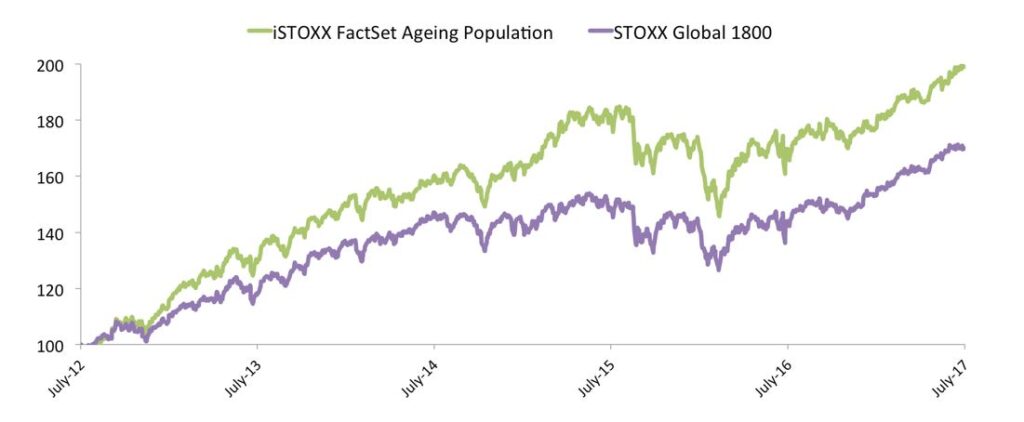

The iSTOXX® FactSet Ageing Population index is derived from the STOXX® Global 1800 Index, which it has beaten in the past five years (Chart1).

Chart 1

An accurate analysis of megatrend exposure

The equal-weighted thematic indices can help investors diversify their stock portfolio, but can also offer more effective exposure to a trend. For example, the iSTOXX FactSet Ageing Population index offers fine-tuned exposure to a theme that may have been accessed in the past through a generic healthcare sector index or fund, giving less precise exposure.

From dialysis to motorcycles

The iSTOXX FactSet Ageing Population index is currently made up of 245 stocks.

Members include Clovis Oncology in the US, whose specific therapies target ovarian and lung cancers; and Australia’s Sirtex Medical, which produces treatments for liver cancer. Also included: Germany’s Fresenius, supplier of dialysis services for kidney failure.

Demographics are also likely to see differentiation between financial stocks. With investment banks’ fortunes tied to the economy, some global firms are moving away from trading to focus on wealth management, betting that clients will seek more advice on preserving savings for the next generation and on tax efficiency when they retire.

That’s the specific strategy of UBS. The Swiss bank and local peer Julius Baer are both present in the Ageing Population index.

It’s not all worrying about the future for retirees. Many are likely to have active lives for years longer than any previous generation, and they also benefit from pension pots and house-price gains their descendants envy: that means they have cash to burn on leisure.

The iSTOXX® FactSet Ageing Population index targets this with stocks like Britain’s Saga, a conglomerate focusing on the over-50s that offers both vacations and insurance. Its 2015 takeover of a motorcycle insurer was specifically aimed at capturing the growing ranks of middle-aged buyers of Triumphs, Ducatis and Harleys.

Accessing megatrends through listed and transparent passive products

The iSTOXX FactSet Thematic Indices became in 2016 the underlying for four exchange-traded funds (ETFs) managed by BlackRock’s iShares and listed in London.

Index-based thematic investing brings the benefits of passive investing to a realm that was previously the domain of active investments. This means there is now a low-cost and rules-based alternative to capture powerful and transformative trends that promise to change the global economy.

More on investment megatrends

Featured indices

1 “World Population Prospects,” United Nations, 2017.

2 “Tokyo Bureaucrats Turn Stock Peddlers With List Nobody’s Buying,” Bloomberg, Mar. 18, 2015.

3 “Mind the Generation Gap,” Brewin Dolphin, Nov. 2016.

4 “Millennials vs. Grey Pound – Who holds the key to future retail success?” KPMG, May 25, 2016.