The Sustainable Development Investments Asset Owner Platform (SDI AOP) provides investors with a groundbreaking tool to assess companies based on their contribution to the UN’s Sustainable Development Goals (SDGs). The resulting SDI AOP standard and dataset support and align portfolios with the SDGs through asset allocation, stewardship and engagement, and for analytical and reporting purposes.

A webinar organized by IPE1 on January 13 offered attendees a chance to hear about those capabilities and learn how SDGs integration has emerged as one of the fastest-growing segments in responsible investing (RI).

As a strand of RI, SDG investing is different from ESG and climate, the webinar panel, made up of experts from BlackRock, APG Asset Management and Qontigo, explained. While ESG and climate are typically associated with risk mitigation, SDG investing is more aligned with impact and outcome — a more solution-driven element of RI.

One standout topic during the discussion evolved around the advancement in data technology within indexing, which has played a key role in the growth of SDI. An open-architecture approach that brings together different data sources, for example combining SDG with carbon and company conduct analysis, is especially vital to develop a comprehensive SDI strategy, the panelists said.

A tailored proposition for all investors

Claudia Kruse, the SDI AOP’s Chair of the Board, kicked off the presentations and explained how the platform was born to develop a global standard translated into a rules-based and auditable dataset to identify and measure companies’ revenue lines that contribute to the SDGs. The platform founders (APG, AustralianSuper, British Columbia Investment Management Corporation and PGGM), themselves driven in the initiative by their and their clients’ responsible investment commitments, have since the beginning aimed to build it as a global impact and performance standard for investors.

“The standard that we are developing has to enable us to make better investment decisions and to choose the right kind of investments that contribute to the SDGs, as well as meet our risk-return requirements,” Kruse, who is also Managing Director, Global Responsible Investment & Governance, at APG Asset Management of the Netherlands, said. “We would like to offer something that every investor can use and integrate into a tailored proposition for their clients and ultimate beneficiaries.”

As Kruse explained, the SDI AOP is continuously expanding in scope, and also improving through machine learning provided by Entis.

Indexing use of SDGs data

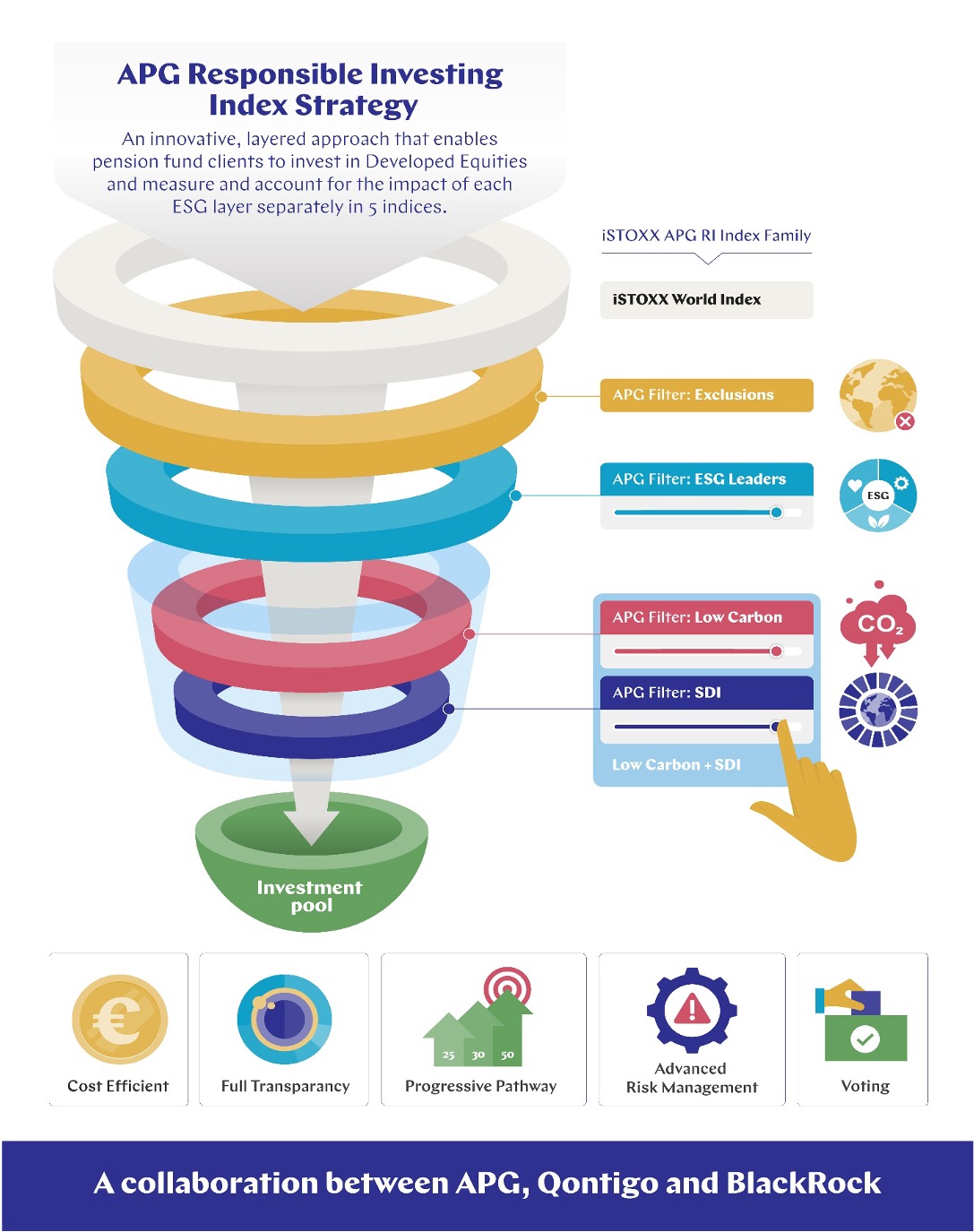

The SDI AOP data was first used for a passive strategy with the introduction last year of the iSTOXX APG World Responsible Investment Indices (iSTOXX APG RI index family). The indices follow multiple sustainability objectives: baseline exclusions, non-leader exclusions, a low-carbon tilt and, finally, SDI. All are combined in a stepwise approach that layers in one sustainability element at a time to get to a final portfolio that invests with all criteria, including the SDGs (Figure 1).

Figure 1 – iSTOXX APG RI index family

The trade-off between impact and tracking error

Hamish Seegopaul, Head of Index R&D at Qontigo, explained during the panel that one overall aim of the iSTOXX APG RI indices is to minimize the tracking error to the benchmark, a key consideration for benchmark-focused investors.

“There is a trade-off that needs to be made, in terms of how much you can align your portfolio with SDGs, or with any sustainable element, and how much you deviate” from the benchmark, Seegopaul told the audience. “We are really looking to make efficient use of every bit of deviation from the benchmark and manage that trade-off.”

In that balance between impact and tracking error, indices can be constructed to intuitively find the ideal frontier for each investor, Seegopaul explained. In building an SDI portfolio, stock selection can be done through ever-more intelligent data sources, but an optimization-based portfolio approach that can control for outcomes and limit unintended exposures can be attractive for benchmark-focused investors. Qontigo’s suite of Axioma portfolio solutions was used to build the iSTOXX APG RI indices, optimizing for tracking error while constraining for tradability and sector, regional and factor biases.

“At Qontigo we believe that sustainability is not a one-size-fits-all solution,” he added, “so how you calibrate that exposure is really important to get the end outcomes you are seeking with any index.”

‘Tectonic shift’

Because of performance deviations, transparency about the strategy’s construction is of paramount importance for investors adopting sustainability principles, Manuela Sperandeo, BlackRock’s Head of Sustainability Indexing in EMEA, said during the webinar. Sperandeo defined the growth in index-based investing as a “tectonic shift,” with flows into sustainability mandates forming its core driver.

“Investors use benchmarks because they are systematic and the rules are publicly available; and, so, the minute you move away from widely accepted index constructs, investors do require the transparency on what is driving risk and returns,” she said.

BlackRock manages a fund tracking the iSTOXX® APG World Responsible Low-Carbon SDI Index, in which APG last year allocated approximately EUR 1 billion. A second time that SDI AOP data was used to build investable indices came with the launch of the iSTOXX® PFF Responsible SDG Index, which was selected by Philips Pensioenfonds to align a EUR 4.5-billion developed markets equity portfolio managed by BlackRock.

SDGs are becoming universal, both as an investment objective as well as a portfolio measurement tool, said Sperandeo. Increasingly, the goals serve as an overarching classification framework, which “is becoming more and more relevant” in light of recent regulations such as the European Union’s Sustainable Finance Disclosure Regulation (SFDR), she said.

“If you think of SFDR, many asset managers have looked at SDGs alignment as a way to also classify their investment solutions,” she said. “In the context of the data that we can use, not only to build but also to classify solutions, makes it a particularly interesting field.” BlackRock, the world’s largest asset manager, has over USD 500 billion of assets under management in sustainable strategies.

According to Sperandeo, the rise of sustainability has challenged several key tenets of index investing: standardization, measurement and comparability, transparency, and implementation. Managers are successfully overcoming those challenges, she said, with efforts around ESG data breadth and robustness, greater collaboration with index providers, and, in the case of BlackRock, with an enhanced understanding of risks and great ability for analysis through its Aladdin technology platform.

Nascent and growing

Impact investing was defined during the event as a nascent field in terms of sustainable investing, but is one where some of the most innovative developments are taking place. Given growing client demand and regulatory requirements, the SDGs and SDI are set to carve out a larger share of the responsible investing pie, the panel concluded. The impact market may already be worth USD 715 billion.2

The debate brought enlightening viewpoints and demonstrated how asset owners, managers and index providers can come together to design responsible investment strategies and measurement frameworks that are aligned with the UN SDGs. With impact investing gaining in prevalence among responsible-investing pioneers, the experience of the SDI AOP can show the way for others seeking to construct portfolios that contribute to a sustainable future.

The Sustainable Development Investments Asset Owner Platform (SDI AOP) is responsible for the development and maintenance of the SDI taxonomy and guidance, SDI definitions and SDI classification methodology (www.sdi-aop.org). The SDI AOP consists of asset owners who invest in solutions which contribute to the UN Sustainable Development Goals. The SDI AOP uses revenues associated with a company’s products and services as starting points to classify which companies qualify as SDI.

1 ‘Beyond Reporting: UN SDGs for the Investment Case,’ IPE webinar, January 13, 2021.

2 Data from the Global Impact Investing Network (GIIN).