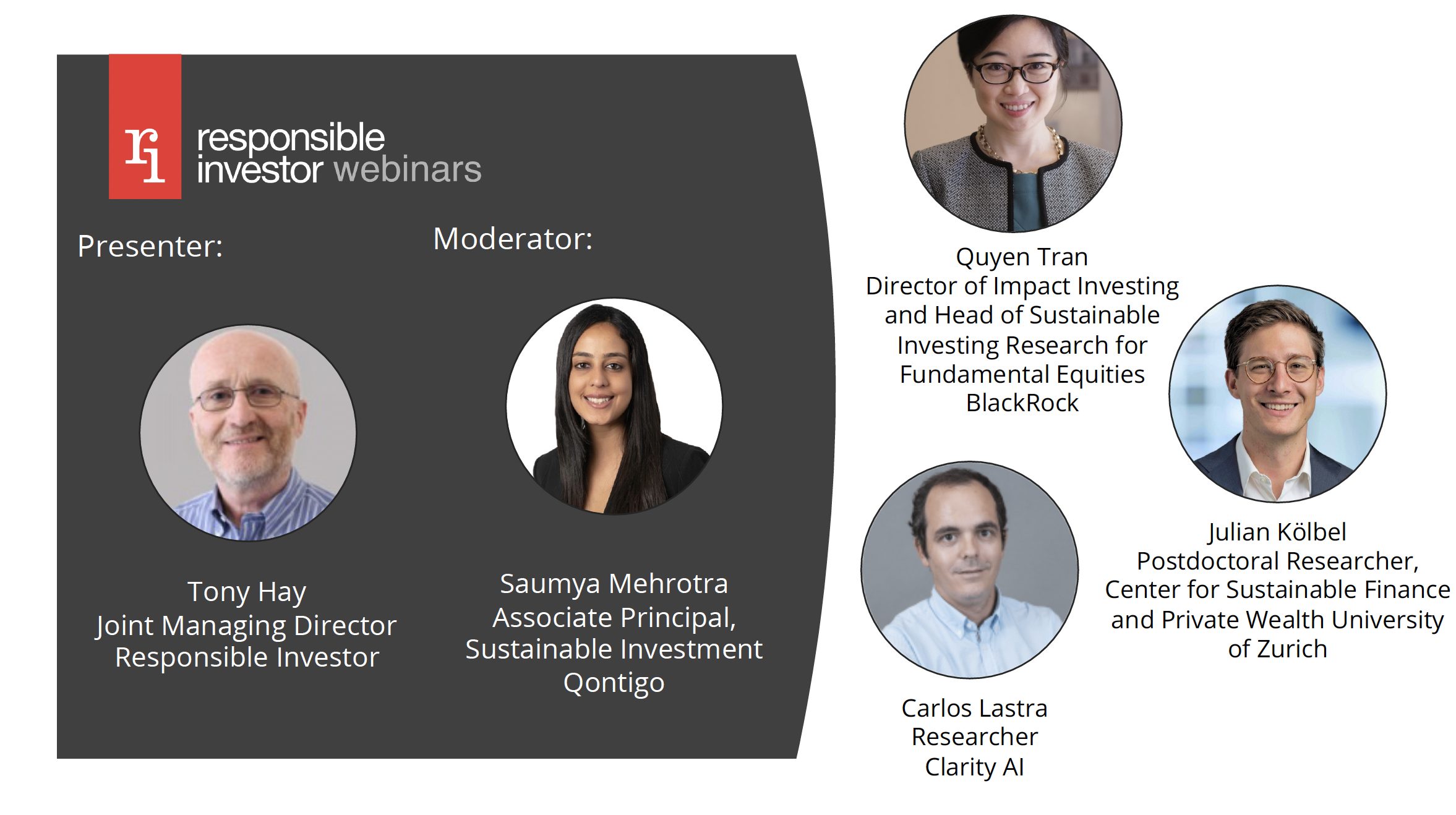

A webinar panel organized by Responsible Investor and Qontigo on November 24 brought together the view on impact investing from experts in academia and financial services.

The debate focused on the challenges of implementing impact strategies, and more specifically how to define and measure this segment of responsible investing that is growing at a fast pace.

Saumya Mehrotra, Associate Principal at Qontigo’s Sustainable Investment team, moderated the discussion and began the session by sharing the findings from a recent Qontigo study focused on impact investment1. The study reviews prominent impact management and measurement frameworks to derive a baseline of what counts as investor impact, and assesses existing impact-branded investment practices vis-à-vis the baseline to gauge the level of alignment between theory and practice. As part of the study, the authors also examine the challenges to integrating impact in investment strategies.

We found there is “rampant confusion in the market about the process of impact creation through investments, which leads to mislabeling and capital misallocation,” Mehrotra told the audience. “One of the major challenges is in developing a comprehensive and holistic view of company-level impact. A second issue is the inconsistency in the underlying metrics to evaluate a company’s performance. The third thing is the lack of data verification and assurance standards.”

The Qontigo whitepaper also explores the United Nations’ Sustainable Development Goals (SDGs) as a practical framework to measure impact, as they provide a comprehensive link between larger systemic goals of society to very granular, ground-level company performance. The potential of SDGS as an impact measurement tool would be brought up at various times throughout the debate.

Measuring impact

Julian Kölbel, a postdoctoral researcher at the University of Zurich whose studies have focused on sustainable investing’s contribution to societal goals2, underscored the importance of measuring companies’ and investor impact amid a flush of capital inflows into impact strategies. The impact market has been valued at USD715 billion.3

“That must be an essential question we should address: what is the impact of all that money going in?” Kölbel said. “Five years ago, the most important question was, ‘how does (impact investing) perform compared to conventional investments?’ And I think now the question has shifted to ‘what really changes?’ You undertake some sort of activity and you want to know what changed because of that and how does that compare to what the world would look like if it hadn’t been done.”

Carlos Lastra, researcher at Clarity AI, returned to the SDGs and said they can help bridge the measurement gap. Clarity AI’s methodology maps the impact of a company’s operations, products and services to 52 out of 169 SDG targets that have been identified as relevant to investors, measurable and with an actionable timeline. The methodology calculates in monetary value the contribution that companies make to each one of the measurable targets.

“The SDGs provide a framework in which you can bring in a taxonomy of the different impacts that companies create,” said Lastra. The framework allows an assessment and “makes information accessible and comparable across companies and asset classes.”

Drivers of demand

Quyen Tran, Director of Impact Investing and Head of Sustainable Investing Research for Fundamental Equities at BlackRock, brought the asset-management industry’s perspective. Tran explained that demand for impact investing is being fed by three drivers: a new cohort of more active and conscious asset owners, the realization that generating a positive outcome does not mean giving up on returns, and the availability of more choices thanks to innovation and accessibility.

“Demand for impact has been strong and rapidly increasing,” said Tran. “Even before the pandemic, the world already had urgent needs for solutions to fundamental challenges to society as well as the environment. The pandemic has only exacerbated these challenges and urgency to solve them.”

BlackRock’s approach to defining impact, Tran explained, is gauging whether a company is an agent of change or generates ‘additionality’ in terms of societal benefits. In other words, assessing whether its products and services, or its operations, produce a specific positive outcome that would not have occurred but for their existence.

“We look to see whether the business model is not only different to competitors, providing that additionality, that edge that leads directly to impact, but also whether or not it is reaching the underserved,” Tran explained.

Fostering impact as investors

And how can investors push companies to generate a positive effect on societies and foster additionality? BlackRock’s Tran said investors can bring innovation to companies and steward them through engagement towards specific actions and practices. On the financial side, she said anchor investors can increase visibility to undervalued companies that have a positive impact, provide capital in primary equity sales, and “create a better marketplace for private companies seeking a responsible exit to go public.”

Netting off positive and negative impact

Clarity AI’s Lastra brought up the challenge of calculating the net impact of companies that may add to certain societal goals while undermining others.

“It may be that, as a company, you create lots of employment but you also pollute a lot; in fact, that may be typical,” Lastra said. “We provide information on each one of the SDGs. We aggregate across different impact types through a measure of the value that is created for society. There’s meaningful comparisons that can be done across SDGs.”

Reasons for optimism

The debate brought an enlightening exchange of ideas around a rapidly-growing segment of responsible investing that is catching the attention of investors, regulators and the business sector. There was a positive take-out shared by most of the panelists: despite confusion and difficulties in settings clear rules for impact investing, there is reason for optimism in the rising awareness from investors, and in innovation in the use of frameworks such as the SDGs to measure real-world impact.

1 Bocquet, R., Mehrotra, S., Georgieva, A., Pina, P. Coelho, R., Lastra, C., ‘On the Way to Impact Investment: Mind the Gap Between Theory and Practice,’ August/September 2021.

2 See also Heeb, F. and Kölbel, J., ‘The Investor’s Guide to Impact,’ University of Zurich.

3 Data from the Global Impact Investing Network (GIIN).