In environmental, social and governance (ESG) investing, many investors start with strategies that remove undesired holdings, but soon find themselves seeking a deeper sustainability engagement.

Their goal is to integrate ESG data into portfolio analysis in order to enhance risk management from a sustainability perspective and elevate its sustainable profile — all while maintaining the economic objective of their benchmarks.

To benchmark such active strategies of incorporating ESG factors positively, Qontigo has introduced in recent years STOXX ESG indices derived from some of the world’s most iconic benchmarks. They form a second pillar in the company’s sustainability-focus ecosystem, sitting right between our ESG-X indices (which incorporate negative product- and norm-based exclusions) and an upcoming suite of SRI indices.

| Exclusion | Inclusion | Sustainable Responsible Investment |

| STOXX ESG-X Indices 80 indices covering regional, country, blue-chip and factor-based strategies | EURO STOXX 50 ESG; DAX 50 ESG | Coming soon |

For more on the ESG ecosystem and the ESG-X range, visit our recent articles here and here.

ESG indices: from exclusion to active integration strategies

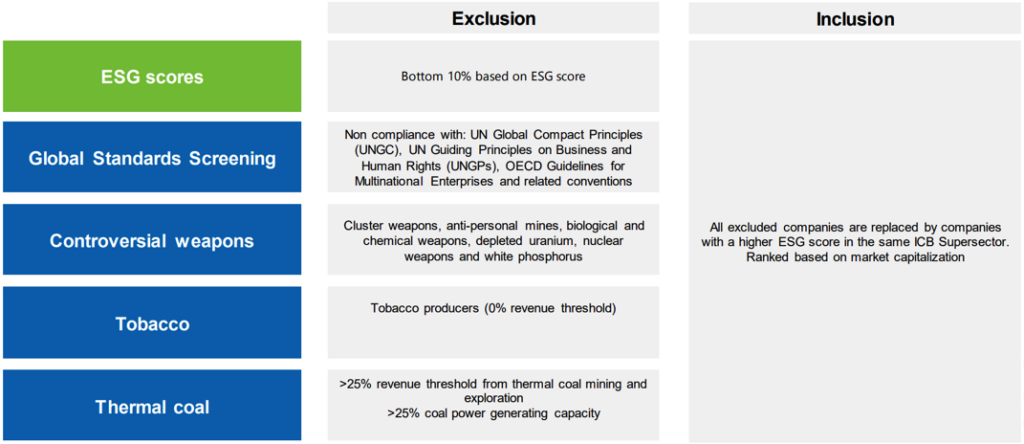

The STOXX ESG indices exclude companies that are involved in business activities shunned by the responsible policies of leading asset owners, as well as those deemed in breach of global norms. Additionally, the indices select or overweight companies with the highest ESG scores within some of the world’s most followed benchmarks, while removing or underweighting the laggards.

ESG version of Europe’s most traded benchmark

Two indices currently form the core of this strategy within Qontigo’s ESG space. The first one is the EURO STOXX 50® ESG Index, an ESG version of the well-known EURO STOXX 50® Index. The EURO STOXX 50 ESG excludes, firstly, the 10% least sustainable components from the benchmark based on Sustainalytics’ ESG score, and secondly those companies involved in controversial activities1, in favor of more sustainable peers from the same supersector.

As of Jun. 30 2020, seven stocks in the flagship EURO STOXX 50 Index were replaced in the ESG version of the benchmark.

ESG leaders can add to returns

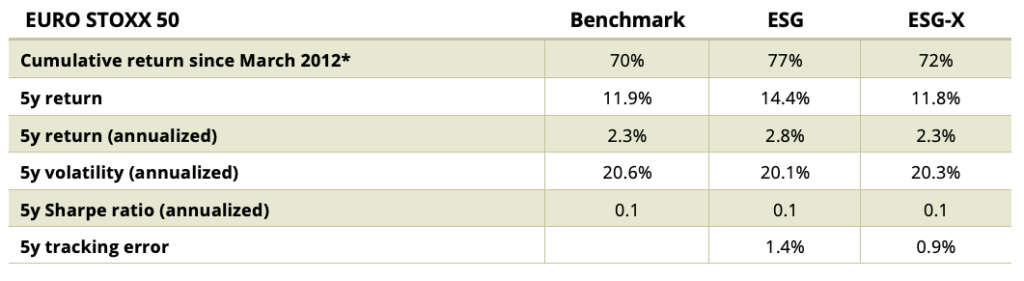

Figure 2 looks at the returns of the EURO STOXX 50 ESG against its benchmark, and against a version of the benchmark that only incorporates negative exclusions but does not integrate ESG scoring into selection (EURO STOXX 50® ESG-X Index). All three lines overlap in what are highly correlated performances.

Source: Qontigo, Mar. 19, 2012 – Jun. 30, 2020. Gross returns in euros

Table 2 displays returns since data begins in March 2012 in more detail and puts the focus on the past five years, a period that wasn’t very buoyant for Eurozone equities. The ESG index lifted returns relative to the benchmark and the exclusions-only index, and did so with a similar level of volatility, suggesting that a higher ESG score need not mean taking on more risk.

Source: STOXX index data, Mar. 19, 2012 – Jun. 30, 2020. Returns and volatilities are annualized except where indicated with *. Returns in EUR gross. Sharpe ratios based on Euribor 1m.

Selecting stocks on metrics in addition to the traditional market-capitalization criteria means that returns may diverge from standard benchmarks more compared to only applying a number of exclusions. Offsetting these concerns, however, there is empirical proof that companies with higher sustainable records tend to outperform in the long run. Many relate this outperformance to companies’ better management and hedging of reputational and idiosyncratic risks and to more efficient operations.

Since the early 1970s, around 2,250 academic research studies have been published on the link between ESG and corporate financial performance, according to a paper by DWS.2 Two thirds of the studies have found a positive correlation between the two variables, with only 8% finding a negative correlation.

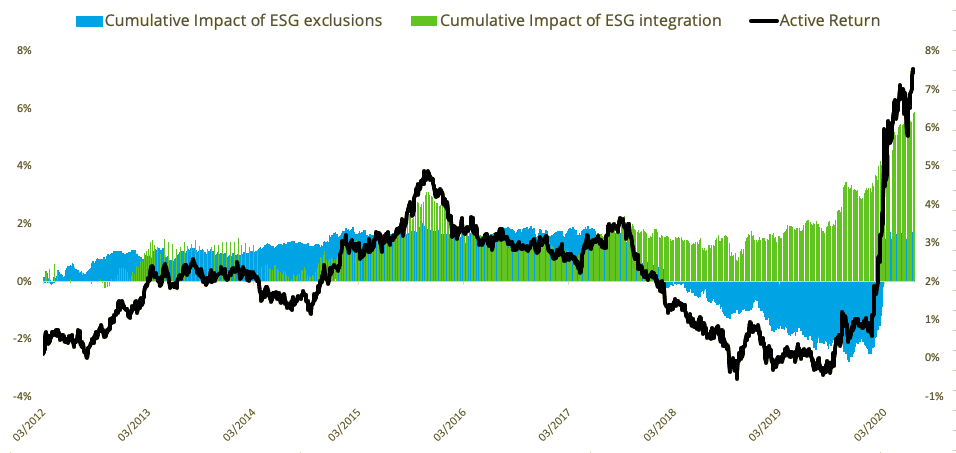

Figure 3 shows the cumulative impact of applying exclusions (ESG-X) and ESG positive integration (ESG) on the EURO STOXX 50. ESG integration has contributed more than the exclusions to the net overall active outperformance (black line).

Source: Qontigo, Mar. 20, 2012 – Jun. 30, 2020. Gross returns in euros

For a complete analysis of the impact of ESG integration on index constitution and performance in the EURO STOXX 50 ESG, please visit a recent research study here.

DAX 50 ESG – Germany’s ESG benchmark

The DAX® 50 ESG Index is another one of Qontigo’s ESG solutions. The index tracks the performance of the 50 largest, most liquid German stocks that have comparably good performance based on ESG criteria.3 The stocks must also pass a screening for global norms, and not be involved in controversial weapons, tobacco production, thermal coal (production and power generation capacity), nuclear power or military contracting. As is the case with the EURO STOXX 50 ESG Index, exclusions and ESG scores are based on information sourced from Sustainalytics.

The DAX 50 ESG is derived from the HDAX® Index, which comprises the entire set of companies included in DAX®, MDAX® and TecDAX® indices. Figure 4 exhibits the index’s constituency selection process.

The methodology and number of index constituents in the DAX 50 ESG Index means the resulting portfolio has a sufficiently large investment capacity while offering replicability from a tradability and liquidity perspective.

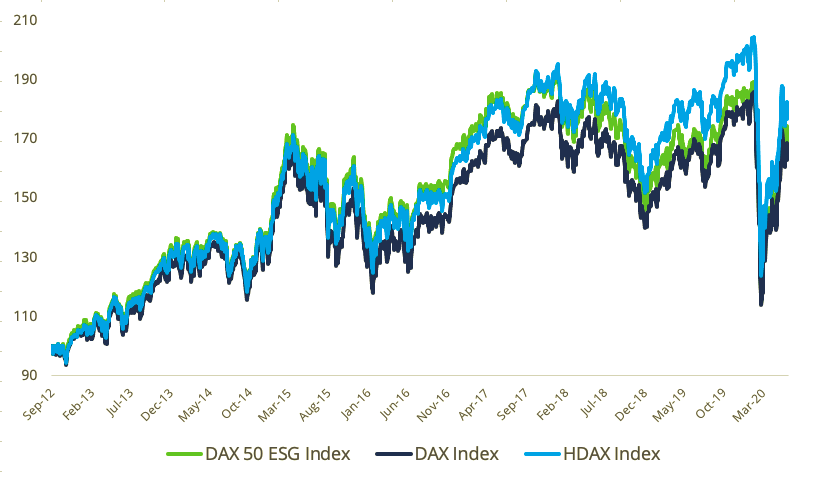

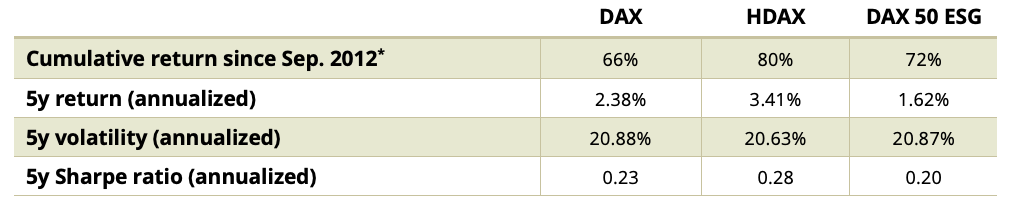

Since data begins in September 2012, the DAX 50 ESG has outperformed the blue-chip DAX but has lagged its universe index, the HDAX (Figure 5).

Source: Qontigo, Sep. 24, 2012 – Jun. 30, 2020. Gross returns in euros

Source: Qontigo. Data as of Jun. 30, 2020. Returns and volatilities are annualized except where indicated with*. Returns in EUR. Eonia rates are used as proxy for riskless returns

The DAX 50 ESG has outperformed the DAX by 5.5 percentage points in backtested data between Sep. 24, 2012 and Jun. 30, 2020, although it has lagged in the last five years. For a recent research study analyzing the risk and returns of the DAX 50 ESG Index in more depth, please click here.

Fast exit for sustainability breaches

Both the EURO STOXX 50 ESG index and DAX 50 ESG Index include a ‘fast-exit rule’ to act in case of an important conduct breach from a company. If an index constituent increases its ESG Controversy Rating to Category 5 in the Sustainalytics risk scale and becomes non-compliant based on the Sustainalytics Global Standards Screening assessment, the respective constituent will be deleted from the index.

Such a case took place in 2015, when German automaker Volkswagen admitted to have lied about its cars’ nitrogen oxide emissions. The event triggered the fast-exit rule and STOXX was the first index provider to remove Volkswagen’s shares from indices such as the STOXX® Global ESG Leaders Index.

The journey to more sustainable investing

The ESG indices are guided by the same key design criteria that govern all other STOXX offerings: transparency and simplicity, liquidity and tradability, state-of-the-art data quality, and ongoing alignment with changing investor preferences. They are suitable to benchmark mandates and as underlying for exchange-traded funds, listed derivatives, structured products and certificates.

Qontigo’s family of ESG indices is set to expand in the near future as demand grows for ESG integration strategies across regions. We are excited to engage with asset owners and asset managers as we travel together on the journey to a more sustainable world.

Featured indices

EURO STOXX 50® ESG Index

DAX® 50 ESG Index

1 Exclusions in the EURO STOXX 50 ESG are based on Sustainalytics’ Global Standards Screening and on the activities of controversial weapons, thermal coal (extraction or exploration, and utilization for power generation) and tobacco production.

2 DWS, ‘ESG & Corporate Financial Performance: Mapping the global landscape,’ December 2015.

3 The DAX 50 ESG Index selects the 50 largest and most liquid securities that rank highest in the quantitative criteria of free float market capitalization, order book volume and ESG score. For more information on the selection methodology, visit the Guide to the DAX Equity Indices, page 37.