Open interest in STOXX® Europe 600 ESG-X Index (OSEG) options has climbed to near 2 billion euros ($2.4 billion), the highest-ever for a sustainability-focused derivative listed on Eurex, as more investors turn to the products to manage responsible portfolios.

The options’ open interest rose 28% to 1.96 billion euros at the end of May from a month earlier, according to data from Eurex. The number of OSEG contracts that has exchanged hands in 2021 reached 251,000 last month, already over six times the amount traded last year.

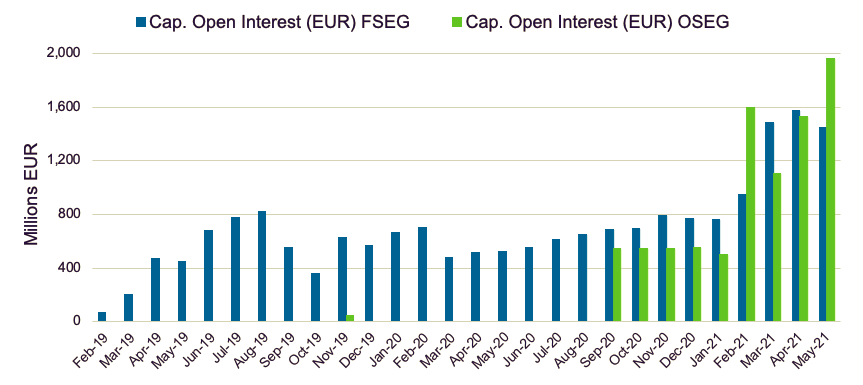

STOXX Europe 600 ESG-X Index futures (FSEG) were listed in February 2019, while options started trading in October that year. The futures attracted instant investor interest as an efficient way to replicate the underlying equity market. More recently, investors and traders have also turned their focus to options as hedging and leverage instruments. Open interest in the options overtook that of the related futures for the first time last February (Figure 1).

Figure 1 – Open interest in STOXX Europe 600 ESG-X futures and options

Benefits of ESG derivatives

ESG derivatives give investors the ability to hedge, manage portfolio positions and materially lower trading costs with instruments that are fully compliant with their sustainability principles. STOXX and Eurex have been at the world’s forefront in the rollout of the derivatives, coinciding with the rapid growth of ESG mandates in Europe.

“The listed derivatives market clearly had a need for sustainable choices, and we believe the growth trend is set to continue,” said Hamish Seegopaul, Head of R&D, ESG and Quantitative Indices at Qontigo. “For many participants, the use of futures and options that embed ESG criteria provides a cost-effective solution to comply with certain responsible principles.”

Global coverage in ESG exclusions

The STOXX ESG-X family is composed of versions of established STOXX benchmarks that apply exclusionary screens based on the responsible policies of large asset owners. The indices exclude companies in breach of Sustainability’s Global Standards Screening, as well as those involved with controversial weapons, thermal coal and tobacco.

Listed derivatives on the ESG-X family also include futures on the STOXX® USA 500 ESG-X Index, which were at the time of listing the first derivatives in Europe tracking ESG exclusions on US stocks and the first worldwide to include a screening for thermal-coal mining and coal-fired power plants.

ESG integration

Since November 2020, two Qontigo second-generation ESG indices — the EURO STOXX 50® ESG Index and DAX® 50 ESG Index1 — also underlie futures and options on Eurex. Both apply exclusionary screens for activities that are undesirable from a responsible-investing perspective, and additionally integrate sustainability parameters into stock selection.

Other available ESG derivatives include futures on the STOXX® Europe Climate Impact Ex Global Compact Controversial Weapons & Tobacco Index, EURO STOXX 50® Low Carbon Index, and futures and options on the STOXX® Europe ESG Leaders Select 30 Index.

1 Contracts track the index in its EUR price return version.