In a post last month, we reviewed Qontigo’s expanded STOXX sustainability index solutions, a toolbox that has grown to help investors meet diverse levels and types of ESG objectives.

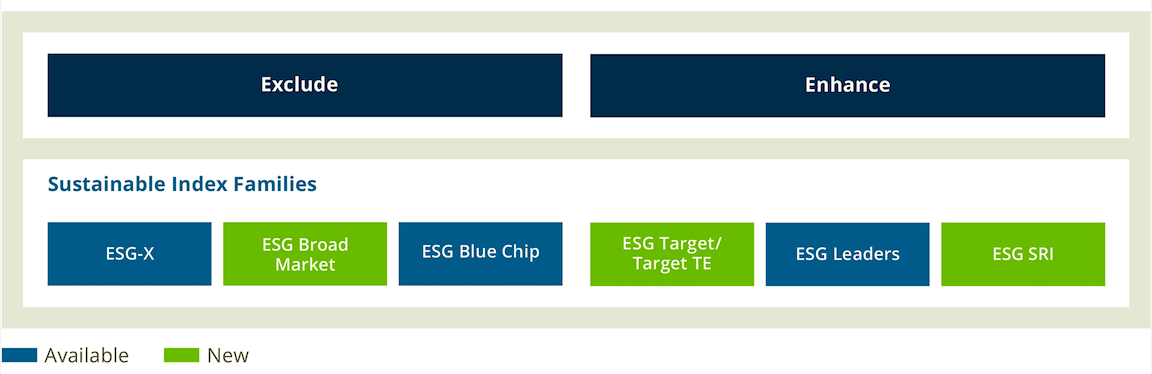

We followed up in another post with a deep dive into the first of two categories in the solutions framework — the ‘Exclude’ pillar (Figure 1). Today, we look at the indices that make up a second ESG category: ‘Enhance.’

Figure 1 – The two STOXX ESG categories

If the Exclude category is a starting point in responsible engagement and risk mitigation, our Enhance category aims to raise the sustainability profile of portfolios further.

> STOXX and DAX ESG Target Indices

Incorporating ESG criteria into a benchmark requires a necessary tradeoff in regard to benchmark tracking error and ESG score. The STOXX ESG Target Indices were introduced to directly address this issue, optimizing said tradeoff via transparent quantitative techniques.

These indices follow a similar initial selection methodology as the STOXX ESG Broad Market Indices, which apply a set of compliance, product involvement and ESG performance exclusionary screens until only the 80% top ESG-rated constituents from the starting universe remain.1 From that selection pool, the STOXX ESG Target Indices implement an optimization process to maximize the overall ESG score of the portfolio subject to a number of constraints.

Those constraints include ex-ante tracking error, a maximum cap on quarterly turnover, and limits to active country and industry exposures. The methodology relies on Axioma’s risk model and optimizer to construct the indices.

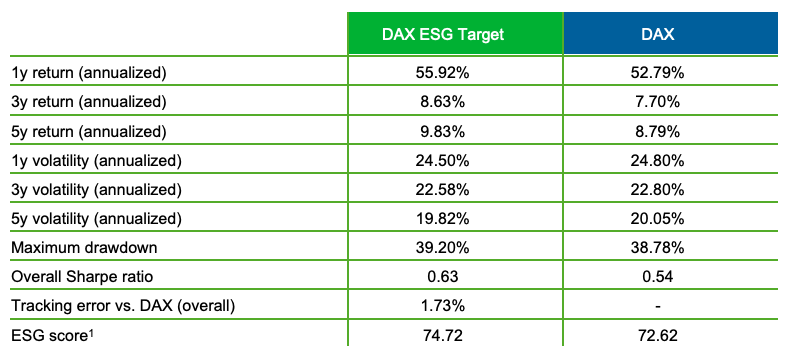

Part of this family, the DAX® ESG Target Index is an index based on Germany’s flagship DAX that additionally reduces the portfolio’s carbon intensity by at least 30% relative to the benchmark.

“We are proud to combine the vast capabilities of Qontigo across analytics and indices to bring sustainable ESG index solutions to market that respond to investors’ needs for choice,” said Hamish Seegopaul, Managing Director, Research & Development for ESG and Quantitative Indices at Qontigo. “For example, the DAX ESG Target index has been designed to track the DAX closely but with an enhanced ESG score, meeting fast-growing demand for responsible investing in Europe’s largest economy.”

The DAX ESG Target index excludes companies in violation of international norms and standards, as well as those involved with controversial weapons, thermal coal, tobacco, nuclear power, military contracting, small arms and oil sands.2

Figure 2 – DAX ESG Target Index risk and return characteristics

> STOXX ESG Target TE Indices

The STOXX ESG Target TE (Tracking Error) Indices follow a similar overall approach to the ESG target Indices, but the optimization’s objective function is to minimize tracking error to the benchmark, while imposing a constraint on ESG profile improvement.

By optimizing index construction to reduce tracking error and improve ESG scoring, the indices aim to further help investors who seek to substantially enhance their portfolios’ sustainable profile while maintaining benchmark exposure.

> STOXX ESG Leaders Indices

Separately, the STOXX ESG Leaders indices are made up of the best-in-class stocks in terms of E, S and G criteria based on specific indicators.3 The indices were introduced in 2011 and have earned a large following from investors seeking targeted sustainable returns.

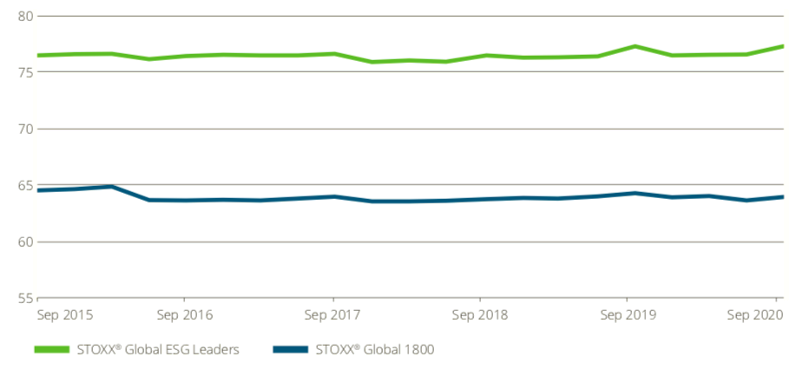

The STOXX® Global ESG Leaders Index, for example, represents nearly a quarter of the benchmark STOXX® Global 1800 Index by weight.4 The ESG index has consistently had a higher average ESG score than has the benchmark (Figure 3).

Figure 3 – Historical ESG Scores for the STOXX Global ESG Leaders Index and the STOXX Global 1800 Index

| Download the ‘STOXX Global ESG Leaders 2020 Annual Index Review Analysis’ whitepaper here. |

> STOXX SRI Indices

Finally, the STOXX SRI (Socially Responsible Investing) indices apply a rigorous set of carbon emission intensity, compliance and involvement screens, and track the best ESG performers in each industry group within a selection of STOXX benchmarks.5 The SRI indices, which were introduced in April this year, target holding only a third of the parent benchmark’s constituents.

“The new SRI Indices use a wide variety of screening criteria, before selecting top ESG-ranking securities, in order to achieve a true best-in class approach for ESG investors,” said Helen Tesfaldet, Associate Principal, Research & Development for ESG Indices at Qontigo.

The new efficient frontier

All indices in the families that compose our Enhance category cover the world’s major markets.

“Overall, our new sustainability suite offers investors a flexible menu to address their different needs,” said Seegopaul. “With the appropriate solution, we aim to help them reach the optimal spot on their new efficient frontier of impact, risk and returns.”

Our DNA and philosophy

Qontigo’s ESG framework offers access to curated databases that allow for cutting-edge index creation. Through our open architecture, we select and integrate best-of-breed, third-party data from leading providers including Sustainalytics, ISS ESG and CDP.

All indices in the STOXX and DAX ESG families are guided by the principles of transparency, simplicity, liquidity and tradability. They are product-focused, versatile and ready for business, be it for benchmarking or to underlie products, with our APIs supporting the interoperability with clients and partners.

Optimizing impact

As investors around the world continue to incorporate responsible considerations into portfolios, we aim to help them navigate the transition with solutions that are as innovative as they are effective and simple to use. Qontigo’s sustainability solutions toolbox has been designed to satisfy every situation and need in the diverse sustainability uptake. We hope to share the journey towards optimizing your impact.

1 For the STOXX ESG Broad Market Indices, companies that are non-compliant based on the Sustainalytics Global Standards Screening assessment or are involved in controversial weapons are not eligible for selection. Additional exclusion filters are applied, screening companies for involvement in tobacco production, thermal coal and military contracting. The remaining securities are ranked in descending order of their ESG scores within each of the 11 ICB Industry groups. The STOXX ESG Broad Market Indices select the top-ranking securities in each of the ICB Industries until the number of selected securities reaches 80% of the number of securities in the underlying index. The STOXX ESG Target and Target TE Indices additionally exclude tobacco suppliers/distributers, and involvement in small arms and oil sands extraction, before selecting 80% of the securities.

2 Baseline exclusions for the DAX ESG Target Index include the Global Standards Screening and controversial weapons. Product Involvement exclusions include tobacco production (0%), tobacco suppliers/distributers (5%), thermal coal extraction (5%), thermal coal power generation (5%), military contracting weapons (5%), weapons-related products and services (5%), small arms (0%), small arms retail/distribution (5%), nuclear power generation and distribution (5%), nuclear power supporting products and services (5%) and oil sands extraction (5%).

3 The ESG Leaders indices also incorporate exclusion screens for controversial weapons and global standards.

4 The STOXX Global ESG Leaders Index is built up from the specialized E, S and G indices through a weighted sum of the component weights. A score ranging from 0 to 100 is assigned to each indicator that counts towards each one of the E, S and G categories. The ESG criteria ratings are defined as the weighted sum of the indicator scores, where the weighting scheme and the set of indicators used depend on the industry the company is classified into.

5 The SRI indices exclude companies that are part of the highest 10% carbon emitters within their region. Companies that are not compliant based on Sustainalytics’ Global Standards Screening assessment, or are involved in Controversial Weapons, are neither eligible for selection. Moreover, product involvement screens are applied for tobacco, alcohol, adult entertainment, gambling, weapons, thermal coal, oil & gas and nuclear power. The remaining securities are ranked in descending order of their ESG scores within each of the 11 ICB Industry groups. The STOXX SRI Indices select the top-ranking securities until the number of selected securities reaches a third of the number of securities in the underlying index.