Investing along sustainability principles has become the mainstream position for many asset owners and investment managers. According to estimates, assets managed under ESG strategies more than doubled in value in four years to over 40 trillion dollars.1

Prompted by client demand, risk management and the demands for a sustainable future, ESG considerations have become a key third perspective of investment, sitting next to risk and returns. As the world celebrates the 51st Earth Day today, we can take a moment to gauge the progress made in embedding responsible-investing principles within the asset-management industry.

As more investors adopt sustainability mandates, they bring their own, specific needs and expectations — themselves driven by a myriad of performance, disclosure, materiality and fiduciary duty variables. All this, therefore, calls for solutions that fit each individual case and that can meet diverse ambitions and levels of sustainability commitment.

With this in mind, Qontigo’s STOXX index unit has this year expanded its flexible framework of innovative sustainability solutions that aims to support investors along their entire ESG adoption journey. This comprehensive range combines the transparent and rules-based methodology of STOXX indices, thoughtfully selected data from leading partners, and Qontigo’s state-of-the-art Axioma portfolio construction capabilities. With the right solution and your own differentiated approach, we can help you optimize your investment impact.

“When it comes to ESG investing, there can’t be a one-size-fits-all approach,” said Rodolphe Bocquet, global head of sustainable investment at Qontigo. “We need to reflect key investors’ preferences while providing high liquidity solutions.”

An open and curated index and analytics architecture

Our ESG framework offers access to curated databases that allow for cutting-edge index creation. Through our open architecture, we select and integrate best-in-breed, third-party data from leading providers including Sustainalytics, ISS ESG and CDP.

Qontigo’s sustainability index framework

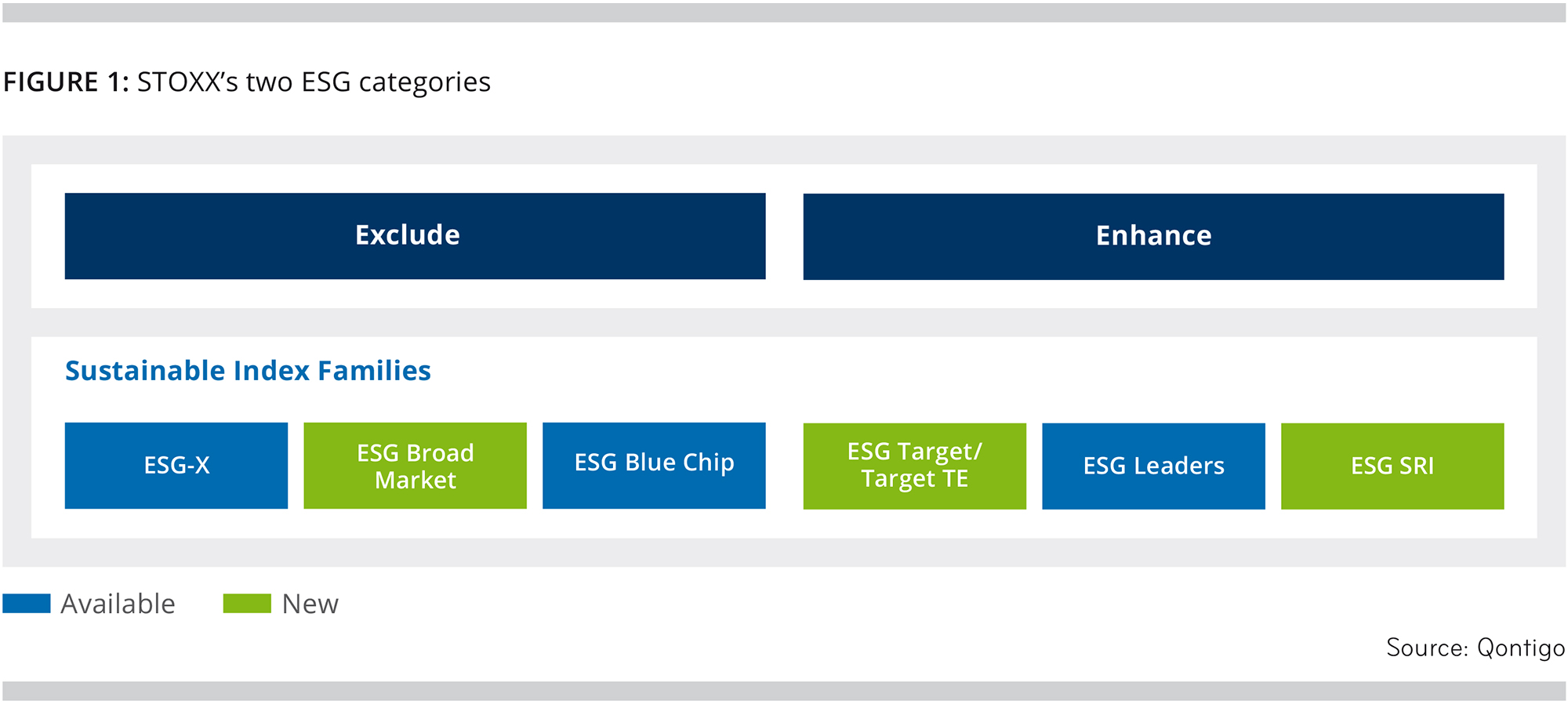

We have thought of our offering as a toolbox containing two categorization buckets, each one channeling a different level of sustainability penetration. We call these buckets ‘Exclude’ and ‘Enhance.’ Let’s review them.

Figure 1 – STOXX’s two ESG buckets

‘Exclude’ strategies – an efficient starting base

The first category is a starting point in responsible engagement and risk mitigation. It includes the STOXX ESG-X indices, which implement standard negative exclusions that remove companies in activities deemed undesirable from a responsible standpoint.2 Our latest innovation introduces the STOXX ESG Broad Market Indices. These exclude 20% of the parent index, through a combination of negative exclusions and the removal of the poorest-scoring securities in terms of ESG criteria.

Finally, our growing family of ESG blue-chip indices within the ‘Exclude’ category are derived from some of the world’s most iconic benchmarks. They combine negative exclusions with the positive integration of ESG scoring into stock selection, removing companies with the lowest ESG grades and replacing them with better-ranked peers. The EURO STOXX 50® ESG Index3 and the DAX® 50 ESG Index4 belong in this bucket.

‘Enhance ESG’: optimizing sustainable investing

Our ‘Enhance’ bucket has been designed for investors who wish to pursue ESG opportunities while maintaining benchmark exposure.

Within this segment, the new ESG Target Indices aim to reflect the benchmark’s performance and, at the same time, maximize the portfolio’s ESG score. The weighting of each constituent security is determined through an optimization process that ensures diversification and relies on Axioma’s risk modelling for tracking-error calibration. The ESG Target TE Indices use a similar configuration, but have the objective of minimizing tracking error.

“We are proud to combine the vast capabilities of Qontigo across analytics and indices to bring sustainable ESG index solutions to market that meet investors’ needs for choice,” said Hamish Seegopaul, Managing Director for Product Research & Development, ESG and Quantitative Indices at Qontigo. “For example, the DAX® ESG Target Index takes the industry-leading DAX®, Germany’s market benchmark, while maximizing its ESG score and reducing its carbon intensity by at least 30%.”

Separately, the STOXX ESG Leaders indices are made up of the best-in-class stocks in terms of E, S and G criteria based on specific indicators. The indices were introduced in 2011 and have earned a large following from investors seeking targeted sustainable returns.

Finally, the STOXX ESG SRI (Socially Responsible Investing) indices track the best ESG performers within each industry group within a selection of STOXX benchmarks, and additionally apply a set of carbon emission intensity, compliance and involvement screens. The SRI indices were also introduced in April this year.5

Visit this blog in coming days as we will delve deeper into the characteristics of these two ESG index clusters.

Additional strategies

Qontigo’s ESG framework is complemented by these stand-alone index families:

- Low Carbon Indices: they aim to significantly decrease the carbon footprint relative to benchmarks, employing a transparent scheme based on carbon intensity scores that determine the over- and under-weighting of stocks.

- Climate Impact/Awareness Indices: they include companies that are leading in terms of climate change as well as those that are managing the effect of climate-related issues.

- Climate Benchmarks: versions of flagship STOXX indices that comply with, and exceed, the requirements laid out in the European Union regulation establishing Climate Transition Benchmarks (CTBs) and Paris-aligned Benchmarks (PABs).

- Thematic Indices: this growing family covers concepts that are at the heart of climate action and environmental protection, including Electric Vehicles and Smart Cities.

Our DNA and philosophy

To achieve easy adoption and ensure their efficacy, all indices in the STOXX ESG families are guided by the following philosophy:

- Superior design: use accurate, tested and transparent non-financial factors fully integrated across our analytics IP.

- Experience and familiarity: resort to full-fledged ESG versions of established traditional benchmarks.

- Plug-and-play: we aim for an adaptive product delivery and versatile functionality, with our APIs supporting the interoperability with partners.

- Transparency and simplicity: a clear and easy-to-explain, rules-based framework to incorporate ESG considerations into investment processes.

- Liquidity and tradability: turnover and replicability considerations always play a crucial role in the development and composition of indices.

- Ongoing alignment with investor preferences: our methodologies allow for a rapid reaction to evolving ESG awareness and changing corporate actions.

- Product focus and ready for business: be it for benchmarking, or to underlie exchange-traded funds, derivatives or structured products, our indices can help improve costs, yield or tracking error to achieve your goals.

The sustainability journey

With a track record that dates back to 2001, Qontigo advocates sustainability as a company and in our products.6 By joining forces with our clients and partners in developing solutions, we aim to be a catalyst for transformation, and help build a more efficient and impactful path forward for a better world. We’re excited to travel this journey together, for the long run.

1 See Sophie Baker, ‘Global ESG-data driven assets hit $40.5 trillion,’ P&I, Jul. 2, 2020.

2 The norm- and product-based screenings of the ESG-X Indices are based on standard policies of leading asset owners and allow the indices to keep a similar financial risk and return profile to benchmarks, while reducing ESG-specific risks. The filters exclude companies that are non-compliant with Sustainalytics’ Global Standards Screening, or are involved in controversial weapons, tobacco, or thermal coal production or consumption.

3 The EURO STOXX 50 ESG excludes the 10% least sustainable components from the benchmark based on Sustainalytics’ ESG scoring, as well as companies in controversial activities, in favor of more sustainable peers from the same supersector.

4 The DAX 50 ESG Index tracks the performance of the 50 largest, most liquid German stocks that have comparably good performance based on ESG criteria. The stocks must also pass a screening for global norms, and not be involved in controversial weapons, tobacco production, thermal coal, nuclear power or military contracting. The DAX 50 ESG is derived from the HDAX® Index, which comprises the entire set of companies included in DAX®, MDAX® and TecDAX® indices. Constituents in the DAX 50 ESG

5 The SRI indices exclude companies that are part of the highest 10% carbon emitters within their region. Companies that are not compliant based on Sustainalytics’ Global Standards Screening assessment, or are involved in Controversial Weapons, are neither eligible for selection. Moreover, product involvement screens are applied for tobacco, alcohol, adult entertainment, gambling, weapons, thermal coal, oil & gas and nuclear power. The remaining securities are ranked in descending order of their ESG scores within each of the 11 ICB Industry groups. The STOXX SRI Indices select the top-ranking securities until the number of selected securities reaches a third of the number of securities in the underlying index.

6 Qontigo’s STOXX unit became a signatory of the UN’s Principles for Responsible Investment in 2012, while Qontigo did so in 2020.