This month’s announcement that two vaccines appear effective in combating COVID-19 has fueled a sharp rally in equity markets, shifting the leadership away from stocks that have done best this year and onto the laggards.

Our colleague Melissa Brown last week analyzed the poor performance of Momentum stocks since Nov. 9 through the lens of the Axioma Fundamental Risk Models. Using these portfolio analytics tools tells us how the shift in sentiment, which led to a wide dispersion in daily returns, impacted style preferences.

In this article, we’ll aim to extend the analysis using the STOXX Factor Indices as a way to measure the scope of the recent market rotation.

The STOXX Factor Indices deliver accurate insight and transparency to target institutionally tested factors covering five styles: value, quality, momentum, low risk and size. The indices manage exposure, liquidity and risk characteristics to provide an efficient approach to factor investing.

Market gains

Our analysis starts on Nov. 9, the day when Pfizer Inc. and BioNTech SE announced that the vaccine they are developing has prevented more than 90% of COVID infections in their trial. One week later, Moderna Inc. reported similarly positive results from its own compound. In the six sessions to Nov. 16, the STOXX® Global 1800 Index rose 3.7%, with markedly different returns within stocks and sectors.

While the market’s positive tone started a few days earlier following the US elections results, the news from the drugs companies was arguably a more important driver for shares. A vaccine may ease, if not end, the virus woes that have weighed on markets all year. The pandemic has lifted some equity sectors (most notably technology and some health-related shares), while others have slumped (transport, consumer-related shares, hotels). Returns after Nov. 9 reflect a dramatic flip from those pandemic-related views,

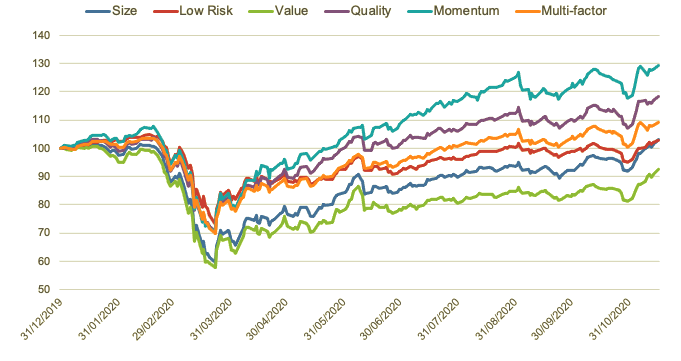

Figure 1 shows the outperformance of the STOXX® Global 1800 Ax Value Index, which jumped 6.2% in the six days through Nov. 16. At the other end, the STOXX® Global 1800 Ax Momentum Index was little changed. Value’s outperformance must be put in context: the Momentum index has jumped 29.2% in 2020, compared with a 7.5% loss for the Value Index (Figure 2).

Figure 1 – Returns for the STOXX Global Factor Indices, Nov. 9 – Nov. 16

Figure 2 – 2020 returns for the STOXX Global Factor Indices

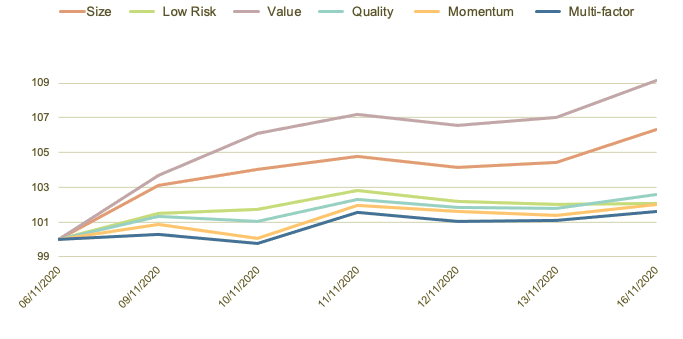

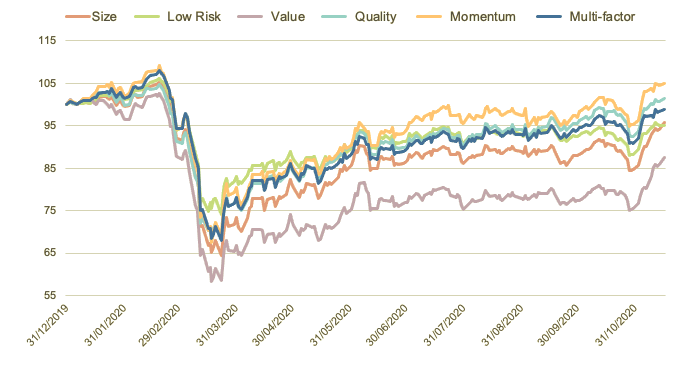

Figure 3 and 4 show the same analysis, this time for the Factor Index family for Europe, which is derived from the STOXX® Europe 600 Index. Here, Value returned 7 percentage points more than Momentum in the six-day period.

Figure 3 – Returns for the STOXX Europe Factor Indices, Nov. 9 – Nov. 16

Figure 4 – 2020 returns for the STOXX Europe Factor Indices

Sector performance

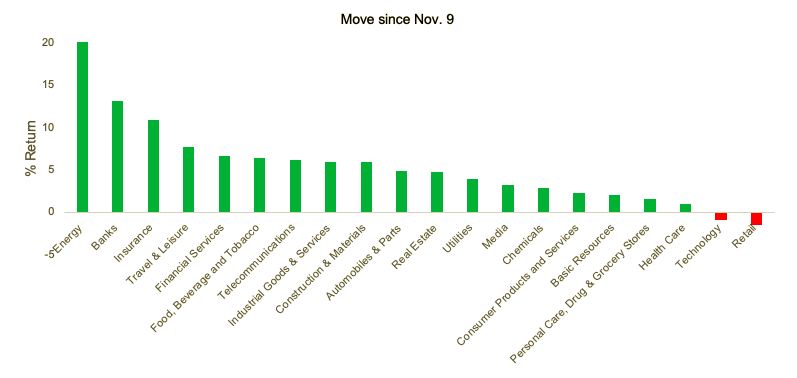

Turning to the behavior of sectors in the latest period, Figure 5 shows the performance since Nov. 9 of 21 Supersectors in the STOXX Global 1800 Index.

Figure 5 – Return of STOXX Global 1800 Supersector Indices, Nov. 9 – Nov. 16

The Supersector performance points to a strong rebound of cyclical businesses most affected by activity lockdowns: oil companies, banks and transport stocks. At the other end, technology components of the global index, among this year’s darlings, have fallen in the recent rotation. Retail is the worst-performing Supersector, as investors took profits in the group’s largest stock – Amazon.com Inc.

Conclusion

The divergence seen in markets in recent days has been noteworthy, a sudden and short snap-back from this year’s gap between the winners and those stocks that have been completely out of favor.

The timing and duration of such rotations are famously hard to call. Should prospects for a successful distribution of COVID vaccines eclipse shorter-term concerns about the economy, the recent market shift could continue, favoring those sectors that have been most depressed this year.