Last September, Qontigo implemented the new Industry Classification Benchmark (ICB) framework across STOXX indices. The revamped ICB structure aims to reflect the evolution of the global economy and address the changing face of industry.

The reclassification included the creation of one new Industry and one new Supersector — the two top tiers in the ICB framework — and the modification of others. To read a summary of the changes, please visit our blog post here. Qontigo has introduced new sector indices and kept legacy ones to allow investors to make the transition at their own pace.

A new whitepaper1 from Diana Baechle, director of Applied Research at Qontigo, now looks into the impact of the reclassification on the STOXX® Global 1800 and STOXX® Europe 600 indices. The study places the focus on the risk-oriented perspective, revealing changes in weights and risk contribution parameters by Industry and Supersector. It also unveils variations in stock concentration among the top holdings, and changes to style factor exposure.

Sectors affected

Overall, the ICB reclassification has had little headline impact from a risk perspective for most Industries and Supersectors in the indices analyzed, the author concludes. But there are nuances and specific exceptions, particularly among Industries whose definition has changed, including Financials and the consumer-related industries.

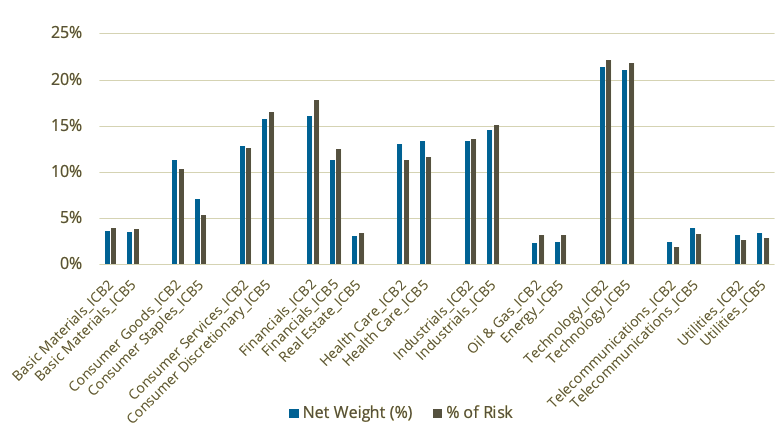

Exhibit 1, taken from the report, displays the weights and percentage of risk in the STOXX Global 1800 by Industry. The chart shows that both parameters changed when comparing the new (ICB5) classification of Consumer Discretionary and Consumer Staples relative to the old (ICB2) division between Consumer Services and Consumer Goods.2

Financials saw a decrease in both ratios as a result of the carve-out of real-estate stocks into a new stand-alone Industry. Industrials, Telecommunications and Technology saw minor adjustments in their influence.

Exhibit 1 – STOXX Global 1800’s Industry weight and contribution to benchmark risk

Stock profile

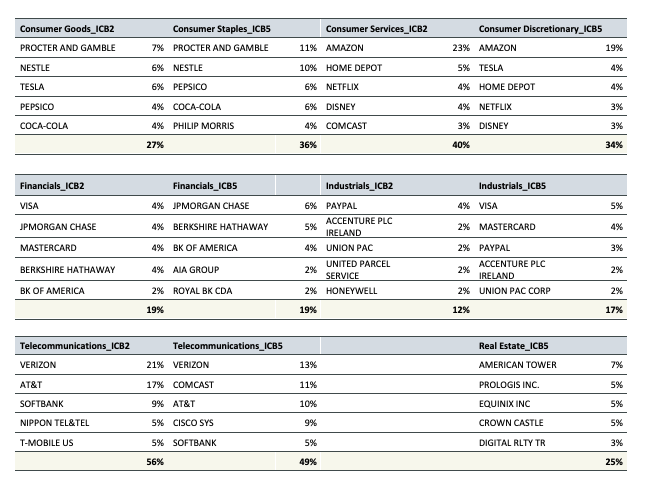

With regards to a single-stock analysis, the study uncovers some changes in the classification and weight of the top components per Industry (Exhibit 2). The concentration in the largest stocks in the two new Consumer Industries is different from that of the old groupings. Visa, MasterCard and Comcast are among stocks that shifted Industries, affecting their top five rankings.

Exhibit 2 – Five biggest stocks by weight in the most impacted Industries in STOXX Global 1800

The report runs similar reviews on Supersectors, as well as on the STOXX Europe 600.

Next, the analysis turns to the Industries’ exposure to 12 style factors. Here, again, results show that the new picture is not materially dissimilar to that under ICB2, either for global or European markets.3

A review of portfolio construction

While the risk profiles of the STOXX Global 1800 Index and STOXX Europe 600 Index have only seen slight modifications following the ICB reclassification, investors should find it useful to assess where exactly the changes have impacted portfolios. This applies, as the study’s author notes, both to users of sectorial and non-sectoral indices.

We invite you to download and read the entire the whitepaper here and learn more about the impact of the recent ICB changes.

Featured indices

STOXX® Global 1800

STOXX® Europe 600

1 Baechle, D., ‘New ICB Classification: Impact on Industries and Supersectors within the STOXX Global 1800 and STOXX Europe 600 from a Risk-Oriented Perspective,’ Qontigo, November 2020.

2 Two new Industries were created under ICB5 — Consumer Discretionary and Consumer Staples — in order to better distinguish between cyclical and defensive stocks. While the new classification is designed to reflect the cyclical division in the industry, rather than the product-focused one of the old classification, most companies in the old Consumer Services fall in the new Consumer Discretionary Industry and most stocks in the incumbent Consumer Goods transitioned to Consumer Staples.

3 All risk and style analyses are implemented using the Axioma Worldwide Fundamental Equity Factor Risk Model – Short-Horizon and the Axioma Developed Europe Fundamental Equity Factor Risk Model – Short-Horizon.