This month, Qontigo will implement announced changes to the sectorial classification structure of STOXX indices following the first major overhaul of the Industry Classification Benchmark (ICB) in years.

FTSE is updating the ICB framework to reflect the evolution of the global economy and address the changing face of industry. On Sep. 21 Qontigo will adopt the new structure on STOXX indices and in addition will maintain certain current (‘legacy’) indices to allow investors to make the transition at their own pace.

Key industry changes

The ICB is a globally recognized standard for accurately categorizing companies and securities in their respective business environments, and STOXX indices follow its categories. Each stock in the investable universe is uniquely classified into one Subsector — the lowest in a four-level hierarchy — based on the company’s primary revenue source. The new classification structure will now count:

● 11 Industries (+1 from the previous structure)

● 20 Supersectors (+1)

● 45 Sectors (+4)

● 173 Subsectors (+59)

Identifier codes will be changed throughout the structure.

- Highlight changes include:

- Two new Industries are created: Consumer Discretionary and Consumer Staples, replacing the old Consumer Goods and Consumer Services classification. The new cyclical-vs.-defensive categories are better suited to identify opportunities and manage risks at different stages of the economic cycle. Further specificity has been added to the two groups at the Supersector, Sector and Subsector levels.

- The new Personal Care, Drug and Grocery Stores Supersector is introduced within Consumer Staples.

- The old Food & Beverages Supersector will be replaced by Food, Beverage and Tobacco (falling within the Consumer Staples Industry).

- Personal & Household Goods becomes Consumer Products and Services (part of the Consumer Discretionary Industry).

- At the Industry and Supersector levels, Oil and Gas will be renamed Energy. The new framework will separate between two Sectors: Oil, Gas & Coal and Alternative Energy. The first of them will include a Coal Subsector, which was formerly part of the Basic Materials Industry.

- The new Real Estate Industry is introduced, carving out what was formerly a Supersector within Financials.

“Industries keep evolving, and a classification scheme needs to adapt to reflect those changes,” said Stephan Flaegel, Global Head of Indices and Benchmarks at Qontigo. “Going forward, STOXX indices will be aligned with the new ICB framework. On top of that we will keep several old sector indices as legacy indices to allow clients the time to adapt to the new framework.”

What the changes mean at the high level

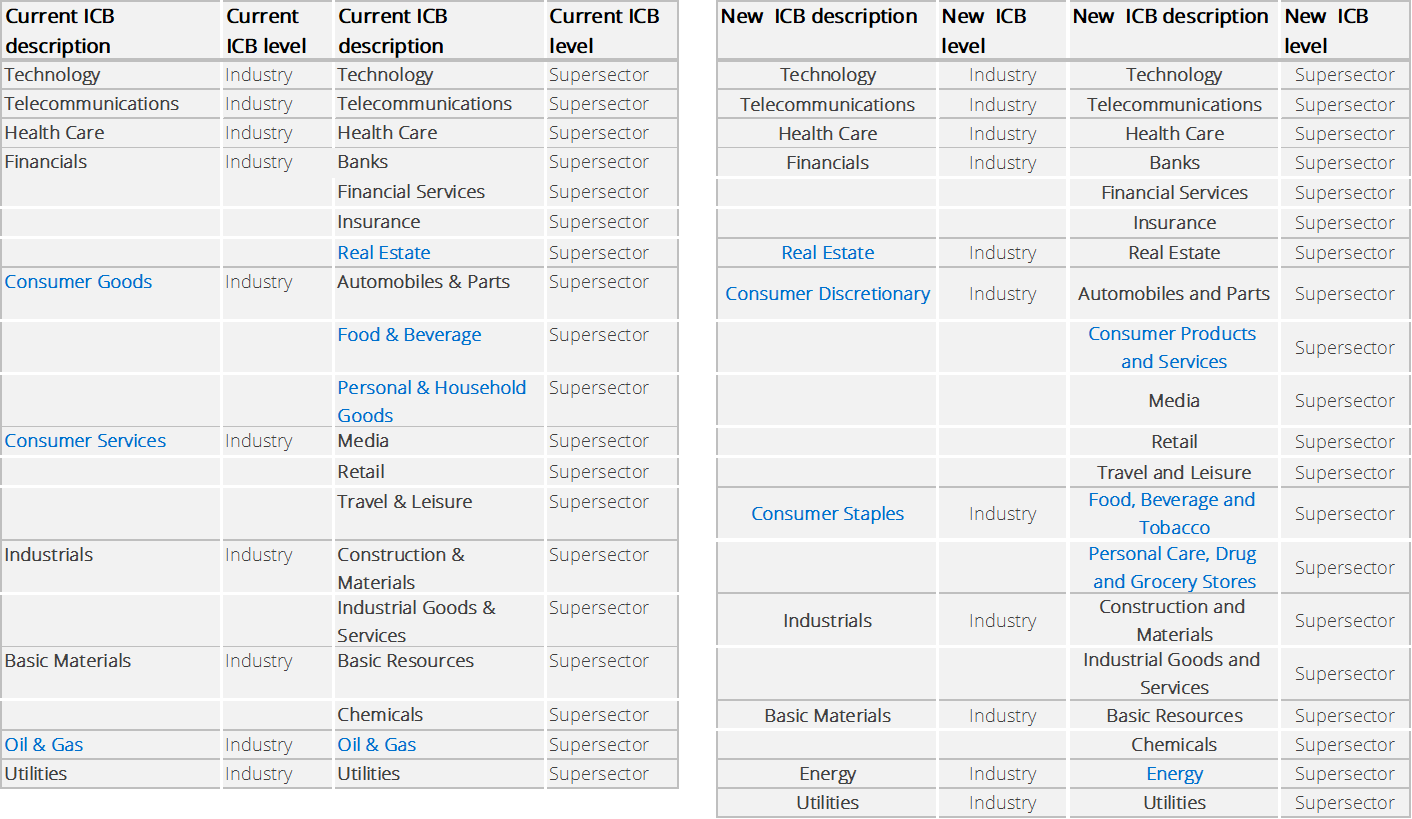

Exhibit 1 shows the current and new level 1 (Industry) and level 2 (Supersector) ICB classifications and highlights new categories in blue.

Exhibit 1 – Current and New ICB Industry and Supersector Classification

Legacy indices based on replication

Qontigo will launch STOXX Supersector indices for all four new categories — Consumer Products & Services; Energy; Food, Beverage & Tobacco; and Personal Care, Drug & Grocery Stores — across its regional indices suite.

To help with the transition, it will also maintain legacy STOXX Supersector indices within the EURO STOXX® Index and the STOXX® Europe 600 Index, which will be reconstructed by means of the new ICB structure’s categories and codes as building blocks.

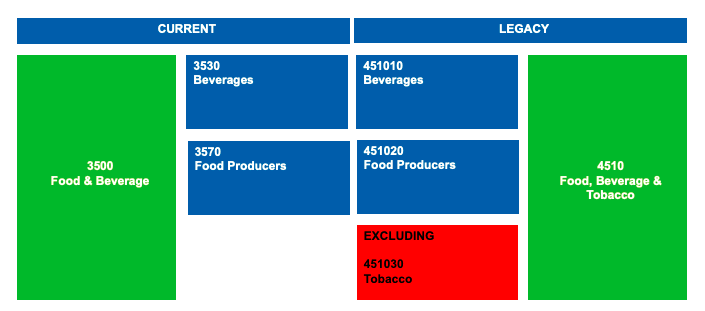

For example, the incumbent Food & Beverage STOXX Supersector Indices will be replicated with the new classification by excluding the Tobacco Sector from the new Food, Beverage and Tobacco Supersector Index (Exhibit 2).

Exhibit 2 – Incumbent (‘current’) Food & Beverage Supersector index becomes legacy index

In this way, for example, the incumbent STOXX® Europe 600 Food & Beverage Index will keep its current description and will co-exist with the soon-to-be-launched STOXX® Europe 600 Food, Beverage and Tobacco Index.

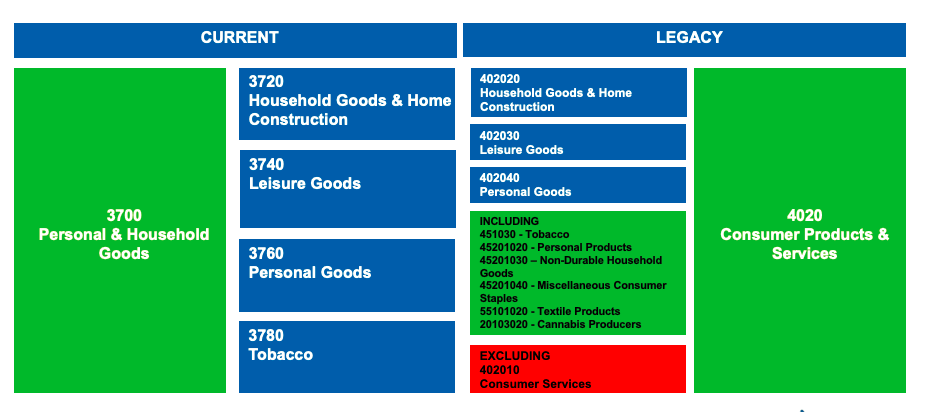

Similar replications will be implemented to keep the incumbent Oil & Gas and Personal & Household Goods Supersector indices and their current description. Exhibit 3 shows the replication process for the latter.

Exhibit 3 – Incumbent (‘current’) Personal & Household Goods Supersector index becomes legacy index

This parallel offering will facilitate the management of portfolios that rely on popular Supersector indices within the EURO STOXX and STOXX Europe 600, either as benchmarks or as underlying for listed derivatives. Qontigo will continue to disseminate legacy indices as long as there are products tied to them. Also on Sep. 21, Eurex will introduce futures and options on the new STOXX Supersector indices.

For all communication circulars around the ICB classification change, including a complete list of indices affected, please visit our methodology announcements here.

Blue-chip indices

Other indices that rely on the ICB classification to select or weight constituents will be adapted to the new framework. These include the blue-chip EURO STOXX 50® Index and STOXX® Europe 50 Index, which will now provide respective representations of 20 Supersector leaders in the Eurozone and Europe, instead of 19.

Another blue-chip index impacted will be the EURO STOXX 50® ex-Financials Index (ICB Industry Financials). As the Real Estate Supersector will move out of the Financials Industry, the EURO STOXX 50 ex-Financials Index will no longer exclude real-estate companies.

Seamless path

With these changes and their unique implementation, the STOXX indices should not only be fit for purpose and reflect current economic realities, but also offer users a practical and seamless path to adopt the new classification structure.

Visit us in coming days as we take a closer look at the effect of the new ICB structure.

Related information

The complete list of indices, including additional details on the changes, is available in Excel format under https://www.stoxx.com/documents/stoxxnet/Documents/Resources/Methodology/Sector_Classification_ICB/ICB_changes_ STOXX_indices_20200903.xlsx

For a detailed current-to-new ICB Structural Conversion Map:

https://www.ftserussell.com/files/support-document/current-new-icb-structural-conversion-map-detail